动态定价模式或助iPhone游戏获得成功

作者:Mario Alemi

你听过多少有关苹果摧毁视频游戏行业的怨言?竞争如此激烈,价格一路下滑,没有发行商愿意为仅售99美分的高质量电子游戏开发成本买单。

但是有少数发行商赚了很多钱,这些主要是新晋发行商,这意味着赚钱还是有可能的。在这篇文章中,我们将通过对市场数据的分析来理解哪些变量将成就一款成功的应用。

App Store、Android Market或诺基亚Ovi等应用市场的竞争逐渐激烈,大家的利润逐渐减少,这也在一定程度上蚕食了主机游戏市场份额。但是另一方面,它们也为发行商带来了某些有用的新鲜之物:

1、零传播成本

2、巨大的市场范围

3、新技术

4、更重要的是:数据。发行商几乎可以实时管理价格改变或在线广告产生的影响。

接下来,我们将利用可变数据,解析如何构建相对简单的模型来预测手机游戏的成功。

第一个问题:游戏如何才能对用户产生吸引力?

1、拥有优秀的质量

2、拥有良好的视觉效果

在In Numero上,我们监控将近4000个应用的用户满意度和页面访问量。我们绘制出以下图表:X轴上的数字代表总收入最高游戏的用户满意度和页面访问量排名,比如,“1”代表应用有着最棒的质量和视觉效果,Y轴应用在总收入排行榜上的排名。理想情况下,在用户满意度和页面访问量排行榜上居首的应用应该也在总收入排行榜上位于前列。以下便是图表。

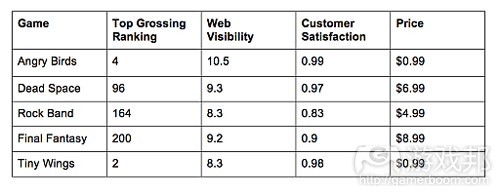

尽管这两种变量之间有某种必然的联系,但是结果并不让人十分满意。从这张图表中,我们很难预测到游戏的总收入等级。但是如果我们看看以下这个表格(游戏邦注:表格中是5款最受关注的iPhone应用,每款游戏的用户满意度都很高),我们就会看到某些奇怪的东西:

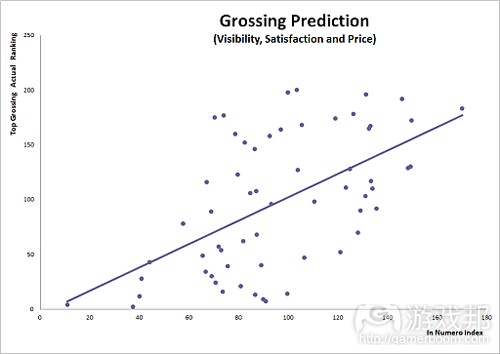

价格因素。《愤怒的小鸟》和《Tiny Wings》只售价0.99美元,是价格最低的两款游戏,但它们的总收入比定价更高的游戏要多得多。我们不应当就此得出发行商应当将游戏定价为99美分的结论,但是我们可以绘制一副与上图相似的图表,X轴上的指数换成新的因素,“惩罚”那些定价过高的应用:

以上图表的直线可以很好地预测出带有某个“指数”的游戏是否会产生盈利。它体现出来的是,在两款有着相同视觉效果和质量的游戏之间,用户会购买较便宜的那款游戏。当我9岁的侄子看到《FIFA 11》售价5美元时,他决定花30美元购买主机版本。如果iPhone游戏的售价是1美元,他说自己会把两个版本都买下来,一个用来打发假期旅行中无聊的时光,另一个放在家里玩。

动态定价

调用某天(游戏邦注:2011年3月2日)的数据时,我们发现没有著名游戏在附近几天发布。但是我们知道,《死亡空间》在1月份时很热门,当时In Numero还未关注iTunes数据。而这款游戏现在的价格是99美分。为何不持续定高价呢?因为主机版本的粉丝比较有钱,他们会在发布后2到3周内买下游戏。过了这款时间后,游戏的主要购买者就是那些偶尔玩玩游戏的用户,他们只是想要款简单的游戏,用来打发无趣的讲座时间。而这些用户只会选择最为流行游戏中最棒和最便宜的游戏。

随后我们引进了一种新的因素,根据定价来对产品进行惩罚。或者说,如果发行商以9.99美元的价格发布一款很棒的游戏,它可能会在刚刚发布的前几周热销,但随后盈利就会逐渐下滑,除非价格下降。以下便是图表:

尽管这很难直观地看出来,但预测的平均错误已经被减少了逾15%。在发布之后,游戏价格必须下调。但各个平台上的方式并非完全相同:iPhone游戏的价格必须在过段时间后调到0.99美元,而iPad游戏的定价可以更高些,因为这样用户就会认为产品有更高的价值。

结论

模型可以进一步发展,考虑到每款游戏市场的相对大小、用户给游戏赋予的价值的传播等因素,成为同种类型游戏中定价最高的游戏并非获得高盈利的最佳方案。但是应当澄清的是,永远都没有某个“合适的价格”,只有一系列合适的价格。在快速发展的数字化市场上,定价应当基于游戏价值且是动态发展的。

游戏邦注:本文发稿于2011年10月12日,所涉时间、事件和数据均以此为准。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

What successful iPhone games have in common

Mario Alemi

How many complaints have you heard about Apple destroying the video game industry? Competition is so high, prices went so down, no publisher can pay the development of a high quality video game selling at 99 cents….

But a few publishers, mainly newcomers, are making good money – which means it is possible. Here we are going to analyse market data to understand which variables make a successful application.

Application stores like App Store, Android Market or OVI have increased competition, shrunk margins, and up to a certain level cannibalised the console market. But on the other hand they have also introduced positive novelties for publishers:

* Zero distribution cost

* Huge market size

* New technologies

* More than everything: data. Publishers can monitor almost on real time the effect of price changes or, for instance, on-line ads.

Let’s then take the available data, and see how we can build a relatively simple model to forecast the success of a mobile game.

First question: when will a game appeal to customers?

1. If it’s good quality

2. If it has good visibility.

At In Numero, we monitor the Customer Satisfaction and the Web Visibility for about 4,000 applications. Let’s then plot the following chart: on the horizontal axis a number which ranks Customer Satisfaction and Web Visibility of Top Grossing games, i.e. it is “1″ for the application with highest quality and highest visibility, and on the vertical axis the Top Grossing ranking. Ideally, applications on top of the Customer Satisfaction and Web Visibility ranking should be the stars on the Top Grossing ranking. Below is the chart.

Although there is a certain correlation between the two variables, the result is not satisfactory. We could hardly predict grossing levels from this chart. But if we have a look at the table below (the five most visible iPhone applications, all with excellent customer Satisfaction) we see something strange:

The price factor. The two games with the lowest price, Angry Birds and Tiny Wings at $0.99, are grossing much more than the ones with higher price. We should not rush to the conclusion that publishers should always price their games at 99c, but we can plot a similar chart as above, where the index on the horizontal axis has a new factor, which “penalises” applications with a too high price:

The linear fit (the straight line) in the chart above can predict better when a game with a certain “index” is going to generate revenues or not. It makes sense: between two games, both with the same visibility and quality, customers are going to buy the cheaper one. When my nine-year old nephew saw FIFA 11 priced at $5, decided to invest his little money in a $30 console version. If the iPhone was $1, he told me he would have bought both –one for the boring holiday trips, one for home.

Dynamic Pricing

The particular day (2 March 2011) data are referring to, no game was very close to launch. But we know that, for instance, Dead Space was a superstar in January, when In Numero was not yet scraping iTunes data. And still its price was well above 99c. Why did not last? Because fans of the console version, with a bigger budget than my nephew, bought the game during the first two-three weeks after the launch. After that period, the game is considered for purchase mainly by the occasional customer, who wants a simple game to play during a boring lecture, or during commuting. And this customer would just download the best and cheapest game in the top most popular games.

We then introduce a new factor, which penalises products far from launch, depending from the price. Or: if a publisher launches a fantastic game at $9.99, it would sell well during the first weeks, but then revenues would go down unless the price is reduced. (For a better understanding, try this simulation). Here is the chart:

It is hardly visible by eye, but the average error on prediction has been reduced by more than 15%. After launch, prices have to go down. Not in the same way on all platform: where a game on the iPhone must approach $0.99 after a while, a game on the iPad can be priced higher, because customers recognise a higher value to the product.

Conclusions

The model can be developed further, considering the relative size of the market for each particular game, the distribution of the value given by customers to that game, and the distribution of prices for a certain segment –being the most expensive in a group of very similar games is not the best recipe for high revenues. But what should be clear, is that no “right price” exists –only a series of right prices. On the fast digital market, prices must be dynamic and value based. (Source: Bruce On Games)

闽公网安备35020302001549号

闽公网安备35020302001549号