2017年游戏测试发行市场性价比适宜度比照分析

本文原作者:Yura Yashunin

想完善自己的游戏从而进行大规模发行的最佳方式就是进行一次成功的测试发行。通常情况下,游戏开发者可以通过测试发行接收用户反馈而节省下不少时间和金钱。

但是今天我们不准备聊测试发行的准备工作该怎么做,而是要聊聊测试发行的投放“地点”。这个测试发行投放的地点选择主要根据以后游戏进行全球正式发行时所要面对的市场决定的。

加拿大成为2016年占手游测试发行市场国家第一名,这个事实一点也不令人意外——因为加拿大游戏的玩法和营销模式跟美国都非常地相似。那么接下来2017年的趋势会是如何?加拿大这个市场是否对对所有开发者都适用呢?

为了寻找答案,我们对最受开发者青睐投放测试发行的前20名国家做了一次调查。它们主要来自世界的三个地理位置:EMEA(欧洲地区、中东地区、非洲地区)、NALA(北美洲地区和拉丁美洲地区)、APAC(亚太地区)。同时我们还将用到一些标准指标——以便能找出2017年对某些特定的开发者和发行商最适合的测试发行投放国家。

EMEA地区分布广而零散、相比其他地区包含了更多的国家。其文化多样性和人种多样性吸引了几乎所有开发者。英国和北欧国家被认为是EMEA地区的顶级市场。但实际上真正的顶级市场是芬兰、挪威和瑞典,像Rovio和Kabam这样的手游巨鳄喜欢在这些国家测试发行他们的游戏。但是这些国家的CPI成本似乎很贵。难道不是吗?让我们来看看我们在EMEA地区有什么发现吧。

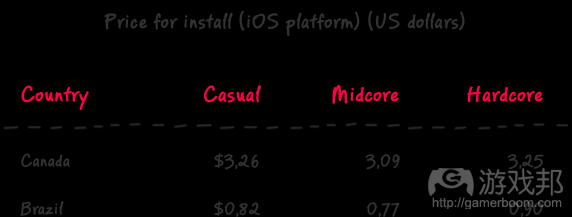

我们把所有类型的游戏分成了三大传统类型:休闲游戏(冷门小游戏类、解谜类、牌类和骰子类)、midcore游戏(冒险类、赛车类、体育类)、hardcore游戏(动作类、RPG角色扮演类、策略类)。

北美地区是世界第二大地区,其2017年的预计收入约138亿美元。要知道电子游戏这块大蛋糕中手机游戏是最大最美味的一块。这个地区有刚才提到作为测试发行市场首选的加拿大。另一方面,拉丁美洲虽说是收益最小的地区(2017年预计收入约19亿美元),但它仍旧是成长最快的区域之一。这里我们还要强调的就是巴西正被越来越多的新游戏选为测试发行的国家。

APAC现在是手游市场发展最大也是最快的地区,预计其2017年收入约为249亿美元。在收益方面,中国、日本和韩国位列前茅,但东南亚的发展之迅速也大力地推动了整个亚太地区的发展。香港(中国)和新加坡虽小,但它们属于配有具备偿付能力用户的高度创新型社会。

设备普及度

一些国家的IOS系统普及度较低,这导致那些只在IOS平台上测试发行的游戏在这些国家的接受率会较低。IOS设备按习惯来说在说英语的国家是普及度最高的(美国、澳大利亚、加拿大、新西兰、英国),对于亚洲地区来说,IOS平台使用率最高的有新加坡、日本、香港和泰国,欧洲的是挪威和瑞典。但是如果你想让自己只支持IOS系统的游戏在中国、印度和巴西进行测试发行,你最好三思。不过,从这点来讲的话,如果你仔细看泰国的IOS普及度——虽然很高(31%),但IOS的CPI成本却很低(平均0.86美元)。

ARPU和信用卡普及度

每用户平均收入(ARPU)——这是手游开发者用来估计游戏指数以及对手游市场状况进行更完整了解的重要指标。

ARPU会根据对象类型的不同而有较大不同,不过根据不同的国家也是如此。

日本在ARPU方面占绝对领先的地位。日本之所以能在2016年尾成为ARPU第一名要多亏了它的角色扮演游戏,因为喜欢这类游戏的玩家要比喜欢其他类别游戏的玩家花更多的钱。

根据AppAnnie在发表的ARPU报告中显示排在第二名的是中国,在曾经很长一段时间中国都被认为是在ARPU方面很弱的市场。但是在过去的3年里,中国从榜底向上超越一个又一个国家跃升至第二名——中国现在的ARPU增长速度是过去的10倍。所以如今在中国发行游戏不仅能获得更广大的用户、还能获得更多的ARPU。

从总数上来看,APRU最高的国家中来自APAC地区的占了五分之三。

不过另一方面,开发者最好不要在信用卡使用度较低的国家测试游戏的盈利水平。

就比如说,APAC中人口最密集的国家是中国、印度和印尼,在全世界没办卡的成人中有一半都是来自这三个国家的。在印度,信用卡交易率为3.40%、使用到银行账户的网上交易率同样很低只有1%。在印尼,只有5%的银行账户使用了网上交易。在菲律宾有3.50%的人口使用信用卡在网上购买商品和服务。所以如果想进行盈利水平的测试,最好选择像新加坡和香港这类城市化很早的经济体。(分别拥有28%和34%的网上交易完成率。)

选择进行测试发行的国家

现在,我们已经探索了一些让测试发行成功的主要衡量指标,现在我们来看看实例吧。

起步状况:我们现在有一只来自波兰的年轻开发团队,他们将要在IOS平台上发行他们首款解谜游戏。

ZENNA目标:从美国、加拿大、澳大利亚和英国获取新用户

结果:一开始我们有非常多适合做测试发行的国家选择。但是我们最后只选了4个国家(芬兰、丹麦、新加坡和香港)来测试这款新的解谜游戏。我们之所以选择他们是因为这些国家覆盖了大量玩家并且我们可以因此节省40%的预算(跟在加拿大进行测试发行比起来)。

我们怎么做到的:根据开始的状况,我们需要目标用户要是以英语为第一语言的、要拥有IOS系统设备、网络支付普及度要高,与此同时我们还需要游戏的CPI成本要合理。

EMEA地区,习惯上会被看作是有足够英语交流能力和IOS设备拥有率高的市场。北欧国家在这方面也有很好的表现:大部分人都说英语(大概85%)、大部分人都用IOS系统设备(丹麦是IOS系统设备普及度全世界最高的),而且欧洲大部分地方都使用信用卡和网上支付。

从安装成本方面来看,最便宜的选择是芬兰和丹麦(分别是1.17美元和1.83美元)。芬兰的ARPU为25.97美元,丹麦是30.70美元,这对于EMEA来说是相当高的指数了(举个例子,在德国是22.23美元、意大利25.42美元)。

那APAC(亚太地区)呢?新加坡现在是测试发行的新“麦加圣地”,目前有测试发行活动中有一半是在新加坡进行的。为什么呢?有几个原因:英语是新加坡的第二官方语言,因此他们说英语的人所占比例比北欧国家还要高——92.58%;相比其他东南亚国家,该国家大部分用户行为更偏西式;最后一点就是这里的每安装成本特别低:两种平台(安卓和IOS)都只要0.80至1美元。但是,习惯上说来,东南亚国家的安卓系统使用率占主导,而苹果普遍度较低:在菲律宾只有20%的用户有iphone和/或ipad。所以对于仅支持IOS平台的游戏来说这样的用户量是非常少的,加上这个国家玩家信用卡普及度和网络购买率都很低就更要命了。不过APAC还有另外两个受欢迎的市场——新加坡和香港。

尽管说英语的人口占比不同:新加坡80%、香港47%,但两个经济体都有高度数字化社会体系,智能手机/平板设备使用度和网络支付率都很高。他们俩都是东西方结合的经济体,这类市场大多不需要游戏进行本地化。与大部分东南亚地区国家不同的是,新加坡和香港有很高的IOS系统普遍度(分辨是46%和34%);然后ARPU也是如此:新加坡78.34美元、香港64.82美元(是北欧地区国家的两倍还要多)。接着最后,休闲游戏的每安装成本在新加坡是大概2美元,在香港大概是2.5美元。

我们的小伙伴提供的有关测试发行的更多技巧与提示

来自WARGAMING的高级市场主管Maria Nevoisa

在测试发行之前有个好惯例就是收集游戏竞争者的分析,这样可以知道他们进行测试发行的国家是哪些以及他们的成果如何。这类的信息你可以通过使用类似AppAnnie这样的平台来得到。记住,有一些开发者在进行全球发行之前会使用不同的账户进行测试,因此要想照搬他们的经验还是比较有难度的。

别忘了要根据不同的国家对游戏内容进行调整和优化。A/B多种测试可以帮助你找到正确的发行方法,还有像Split Metrics这类的平台可以在应用商城发行之前给你提供内容测试。

如果你只把目标面对讲英语的群体,按照传统习惯在加拿大、澳大利亚和新西兰进行测试发行,那还不如找其他讲英语人口占比高的国家来替代。这样你就可以省下资金预算并且提高游戏发行的覆盖度,因为毕竟这些国家的CPI成本还是很低的。

来自Olga Panina的市场产品总监Yulian Efremov

我们要说的也许是一些明摆的内容,不过大部分时候这些明摆的东西都被大家忽视了。

好好思考目标经济体的社会结构,并和游戏开发进程相结合;还有对游戏项目质量指标进行定义(教程完成度、用户留存等)。我要强调的是在游戏正式发行之前,目标经济体的社会结构和游戏自身进程的深度关联和整合是非常重要的;而所有的质量指标也会随着宣传活动的进展变得越发重要(重新定位目标/表现)

在测试发行之前先进行游戏的beta测试也很关键。至少要有测试人员1000名,因为我们曾经在项目里发现有大比例玩家在玩到1-3级的时候就不玩了。而早期的程序修补工作会让我们在测试发行中得到更好的结果。

对于还没有完成的游戏一定不要急着发行。就算你超过了截止期限也不能急。因为对你来说,在这个阶段的任何细节问题都能让你很伤。查看Google Play给你的结款(因为你可以在这里看到投资回报率的期望值与真实值之间的差距),把其他质量指标谨记于心——这对能够快速有效地选出最适测试发行过家非常关键。

试验你的目标用户——这可能跟你想象的有很大不同。

本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao

A successful soft-launch is the best way to optimize your game for widespread release. Generally, it allows game developers to save money and time by receiving early customer feedback and so on.

But today we are not going to talk about the way to start your soft-launch campaign. We are about to answer question is “Where?”. The principal point in your decision on where to soft-launch your app depends on the markets you going to shoot upon releasing worldwide.

The fact which is not surprising for most of people involved in the mobile game market is the dominance of Canada as the #1 soft launch country in 2016 – play and monetization patterns in Canada are very similar to US. But what about 2017 trends and does Canada works well for everyone?

In order to figure out it, we have chosen 20 the most popular countries for soft-launch and made a research. We were considering countries around the world from 3 geos: EMEA (Europe, the Middle East and Africa), NALA (North America and Latin America) and APAC (Asia-Pacific). And we have used some criterias in order to discover what country could be the best fit for specific developer or publisher in 2017.

1.Cost of CPI for Different Genres and Geos

EMEA (Europe, the Middle East and Africa).

EMEA is wide and fragmented region with more countries than any other region. Culturally and ethnically diverse and quite attractive almost for every developer. UK and the Nordic countries are considered as top tier markets in EMEA. But exactly Finland, Norway and Sweden – the most popular EMEA markets, where prefer to soft-launch such big sharks of mobile games, as Rovio and Kabam. But it seems like these countries are quite expensive in a subject of the cost for install. Isn’t it? Let’s find out what we discovered about EMEA region.

We have attributed every genre we were considering to 3 conventional categories: casual (trivia, puzzle, card&dice), midcore (adventure, racing, sports) and hardcore (action, RPG, strategy).

iOS EMEA CPI Cost 2017

North America is the second largest region in the world with estimated revenues of $13,8 billion in 2017. Mobile segment is the biggest and tasty part of video games cake. Here we have Canada, which was mentioned above as a leader on the soft-launch market. On the other hand, Latin America, which is the smallest region in terms of revenues ($1.9 billion of revenues in 2017), but remains one of the fastest growing. And here we should emphasize Brazil as a country, which become more and more popular for testing new games.

APAC now is the biggest and the fastest growing mobile games market with revenues of $24.9 billion in 2017. China, Japan and South Korea are leaders in terms of revenues, but Southeast Asia is growing so rapidly and urge growth of the whole region. Hong Kong and Singapore – very small, but extremely innovative societies with solvent audience.

2. Device penetration.

Some countries have relatively low iOS penetration and soft launching an iOS-only game in them would negatively affect acceptance rates. iOS traditionally the most populated in the English-speaking countries (USA, Australia, Canada, New Zealand, the UK), as for Asian countries, leader by iOS owners are Singapore, Japan, Hong Kong and Thailand, in Europe – Norway and Sweden. But you better to think twice if you considering your iOS-only game for soft launch in China, India or Brazil. But, on the hand, it seems interesting to look closer at Thailand with really high (31%) percentage of iOS penetration and quite low price for one iOS install (0,86$ average).

3. ARPU and Credit Card penetration.

Average revenue per user (ARPU) – one of the most important metrics, widely used by mobile games developers for estimating game indexes and making more complete picture of mobile market conditions.

ARPU varies hugely across genres, but it also depends on a country.

Japan is full-fledged leader in terms of ARPU. As for the end of 2016 Japan took the first place, thanks to role-playing games, which gives more money to developers from each specific user than any other genre.

Second place due to the AppAnnie report on

Average Revenue Per User goes to China, which long time was considering as quite lean market in terms of ARPU. But over the past three years, China has moved from the bottom of the list of ARPU by country to the second place, increasing its ARPU by a factor of 10. So now you can get not only bigger audience, but also bigger ARPUs from releasing your game in China.

In the total number, 3 from 5 the most rich for APRU countries, are from APAC region.

But on the other hand is the fact that you cannot properly test the game’s monetization in a country with low credit-card penetration.

For instance, three the most populated APAC countries— China, India, and Indonesia— account for almost half of the world’s unbanked adult population. For India credit card transaction rate is at 3.40%, online transactions involving bank accounts is likewise low at a rate of 1%. Only 5% of bank accounts are involved in online transactions in Indonesia. In Philippines 3.50% of population use credit cards to pay goods and services purchased online. So for proper game monetization testing is better to choose such premiere urban countries as Singapore and Hong Kong. (28% and 36% of accounts involved in the completion of online transactions, respectively).

But, you can, however, test other metrics such as retention and engagement which resonate better across the globe.

4. Choosing the country for soft-launch.

Now, as we have explored few of the main criteria for successful start of soft-launch campaign, let’s look on a real case.

Start Conditions: We have young team of developers from Poland, going to release their first puzzle game for iOS platform.

Goal for ZENNA: To acquire new users from US, Canada, Australia and the UK.

Result: We’ve started from wide range of different countries, which were seemed quite suitable for soft-launch campaign. But we’ve chosen only 4 countries (Finland, Denmark, Singapore and Hong Kong) for testing new puzzle game. Our choice was justifying due to broad covering of players and saving about 40% of our budget (in comparison with Canada).

How we did it: According to starting conditions, we need mostly English-speaking audience with decent iOS-devices and online payments penetration and appropriate cost for install in the same time.

EMEA region, traditionally, was considering as a market with sufficient number of English-speaking players and iOS-devices. Nordic countries could show the best results in this case: exceptional number of people, who speak English (about 85%), high percent of people, owing iOS-devices (Denmark – world leading country by iOS-devices penetration), and prevailing place in Europe on the use of credit cards and completing online payments.

In terms of the cost for install, the cheapest options are Finland and Denmark (1,17 and 1,83$ relatively). ARPU in these countries are 25,97$ in Finland and 30,70$ in Denmark, which is quite high index for EMEA (for instance, in Germany – 22,23$ ,Italy – 25,42$).

What about APAC? New soft-launch “Mecca” is Philippines, which now used in half of all soft-launch campaigns. Why so? There are different causes. English is the second official language in country and the percent of people, who speak English even higher than in Nordic countries: 92,58%. Users are more close to Western-style behavior than most of other Southeast countries and, finally, cost of install quite low: about 0,80-1$ for both platforms. But, traditionally, in Southeast countries dominates Android and penetration of iOS-devices keeps low: in Philippines only 20% of users own iPhone and/or iPad. So for iOS-only game it’s quite small percent, especially with low percent of card penetration and online purchases among players. Another popular markets for soft-launch in APAC are Singapore and Hong Kong.

Though percent of people, who speak English is different: 80% in Singapore to 47% in Hong Kong, both countries have truly digital society with high percent of smartphone / tablets usage and online payments. These countries are quintessence of West and East, so a lot of games could hit the market with no localization required. As opposed to the majority of Southeast, Singapore and Hong Kong should be mentioned for high percent of iOS penetration (46% and 34% relatively). ARPU is following: 78,34$ in Singapore and 64,82$ in Hong Kong (which is more than twice higher than in Nordic countries). And, finally, cost for install of casual game would be around 2$ in Singapore and 2,5$ in Hong Kong.

More soft-launch tips and hints from our partners

The good practice before soft-launch is to collect game-competitor’s analytics, to find out in what countries they were soft-launching and what results they’ve got. You can get this kind of information, using AppAnnie, for example. Keep in mind, some developers using different accounts for testing before global launch, so in this case it will be harder to replicate their experience.

Don’t forget about content adaptation and optimization for different countries. A/B testing can help you in searching of right approach, and services like Split Metrics giving the opportunity to test the content even before app store release.

If you are aimed for English-speaking segment only, traditional soft-launch campaigns in Canada, Australia and New Zealand, you may replace or dilute by countries with high penetration of English. In this way, you can save your budgets and increase coverage due to the fact that prices in these countries are still lower.

Maria Nevoisa, Senior Marketing Manager at Wargaming

Probably, we going to talk about obvious, but, as it turned out, these moments often staying neglected.

Think through social mechanics properly and include it into game process. Define quality project metrics (tutorial completing, retention and so on).

I should emphasize importance of deep links and their integration prior launching. All the metrics also will be important during further promotion campaigns (retargeting / lookalike).

Beta-tests prior soft-launch also important. At least, for 1000 players. We have discovered during one of our projects that big percentage of users dropping out the game during 1-3 levels. Early fixing work gave us much better results on the stage of soft-launch campaign.

Do not release your unfinished game. Even if you miss all your deadlines. Every raw, at your opinion, detail on this stage might cost you really much. Check the payment returns from Google Play (since there you could find the difference between expected and real ROI), and keep in mind all other metrics – it’s your key for fast and efficient optimization.

Experiment with your goal audience – it might be much diverse, than you think.(source:gamasutra.com )

下一篇:the only way to move forward is to move forward together

闽公网安备35020302001549号

闽公网安备35020302001549号