从经济角度预测社交游戏收益情况(上)

作者:Brian Poel

我深受GDC大会启发再次修正我的财务预测模型数据表,并在此与大家一同分享我的处理方法。根据各种幻灯片、文章、综述和blog提供的数值,我将对模型中出现的重要参数进行一次概述,然后做一个使参数变化最显著的变量的敏感性分析。现在让我们看看这些数值是如何计算的吧!以下是本文上部内容,下部内容请参阅读:从经济角度预测社交游戏收益情况(下)

一般流程

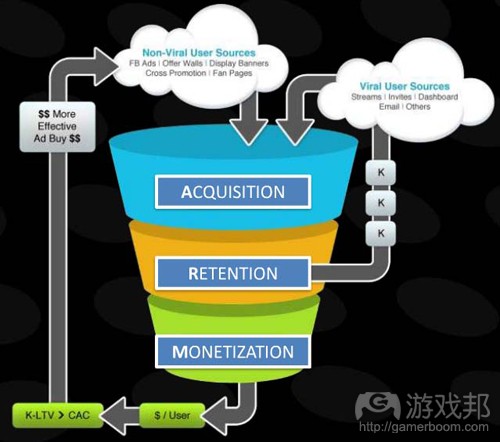

我所阅读到的分析皆来源于网络,以下是比较常用的社交应用分析结构:用户获取->输入->用户留存率->加入病毒传播和盈利方案->反馈用户获取情况。这个循环结构紧密,且没有太多干扰数据点。

变量

我所扩建的模型利用了以下概念和预测变量:

玩家群体:我将玩家分为三类赋予各种变量值的群体。这三类群体分别是“新玩家”、“一周玩家”、“留存玩家”。

新玩家:这类玩家是游戏刚刚获取的用户,还未被赋予任何流失率和留存率。

一周玩家:这类玩家由新玩家转化而来。在这个模型的其他版本里,我也将这类群体扩充为二周玩家、三周玩家和四周玩家,当然,此时他们还未转变为留存玩家。如何详细化分类的时间点取决于你判定他们成为游戏忠实粉丝所需的时间,以及他们的扩散性和消费行为的充分改变。

留存玩家:一周玩家长期玩某款游戏后,将转变为留存玩家。与每一周都建立独立群体类别相比,我认为把所有留存玩家归入同一类的这种做法更为简单。然后,你可以把单一持续流失率、病毒扩散性及消费行为应用于这类群体。

用户获取(有成本):例如,通过在Facebook付费广告而获取的玩家。

用户获取(无成本):从其他游戏的交叉推广中导入的玩家。注:这与病毒性传播有区别,虽然这是你有意识的行为,但仍然不需支付任何费用。

1周后的流失情况:试玩一周后流失的新玩家(游戏邦注:通过所有获取方式得到的玩家)的人数。

留存玩家的持续性流失情况:游戏每一周流失的留存玩家。

一周玩家的病毒性:对各个一周玩家群体成员,通过病毒性邀请而产生的新玩家人数。

留存玩家的病毒性:对各个留存玩家群体成员,通过病毒性邀请而产生的新玩家人数。

新玩家的病毒性:我的假设是只有决定追随某款游戏的新玩家(一周玩家过渡中)才会不厌其烦地发出邀请。不过针对新玩家群体增加病毒性行为并不十分困难。

粘性:各个群体的日活跃用户(DAU)和月活跃用户(MAU)的比值。这个参数可以反映各个群体中每天玩游戏的实际人数。该参数的重要性体现在DAU通常更能反映玩家的消费行为。

玩家消费:各个群体每天的消费金额,主要根据每个DAU来衡量。这里显然包括了“鲸鱼”玩家(游戏邦注:他们每天的游戏开支不少于100美元,每月不少于1000美元)和“小鱼”玩家(整个月的游戏开支可能只有几美元)的消费总和。

运营和内容成本:这是指一些普遍的成本数值,包括服务器维护、客户服务、社区建设、新内容设计和编程等所需的费用。根据游戏规模来计算这个成本的一个简单方法是:收益乘以百分比或人数乘以百分比,再除以最小成本(即收益%(或人数%)/最小成本)。

下面我们将深入探究社交游戏财政预测模式的参数变量。

成熟游戏Vs.新游戏

虽然我赞同某数据分析公司提出的提出的获取-留存-营收模式,但将其引用数据套入此模式有些令人沮丧。我随后发现一段GDC座谈会讨论视频,这给数据提供实际背景。开发商称其中数据反映的是成熟游戏,但这些参数多数在游戏发行初期呈不同态势。下文将多次提到。

一个关键问题是如何界定“新”和“成熟”以及其中的层次变化。这或许同时间或玩家临界规模相关。但其实更多取决于游戏性质、预期稳定群体以及相关营销预算。一款具有广泛吸引力的游戏通常瞄准1千万、1亿甚至几亿用户,而一款细分游戏只要有上百万高度投入的玩家,就算是大获成功。你的Facebook广告预算有多少?

这里我建议采取双重办法。首先,将游戏生命周期分作3段(游戏邦注:早期、中期和末期),给每个阶段分配一定时间(例如1个月或2个月)。然后根据所处阶段,赋予每个关键参数不同价值(游戏邦注:或采用逐步转换,或设定分界线)。

关键参数价值范围的重要性

建模过程中,我发现给每个关键参数设定预期范围非常重要(而非采用既定价值标准),建立游戏参数运作“欠佳”、“中等”和“优秀”3大基准。这样一来,你就能获悉有多少参数达到平均水平以上,游戏才能取得成功。若有某些参数处在平均水平以下,其他参数要达到什么标准方能弥补。

用户获取(有成本):

* 有公司在GDC演讲资料称用户获取成本介于1-3美元之间。这个成本价值不菲,多半是针对成熟游戏。

* 另有广告公司首席执行官称,用户获取成本与日俱增,但初期支出将更有效用,因为能够从中获得更高点击率。

* 在GDC座谈会中,开发商们支持该广告公司的观点:他们认为初期吸引先驱玩家更加简单,且玩家留存率至关重要。

* 年轻VS.成熟:在新阶段瞄准优质标准,后面阶段逐步向欠佳水平靠拢。

* 变量范围:

–欠佳:3美元

–中等:1美元

–优秀:0.5美元

用户获取(无成本):

* 若你有多款游戏,在自身玩家中进行交叉推广是件轻而易举之事。玩家通常一次会同时玩几款游戏,所以无需担心会转移某款游戏的玩家。若玩家放弃某游戏,提供新作品会好过失去他们。

* 只有一款游戏的开发商只有借助链接交换服务或同其他开发商/发行商合作。

* 在GDC座谈会中,开发商也谈及交叉推广。有趣的是,他们讨论的是为何最佳目标通常是你的直接竞争对手,因为他们有最多目标玩家,双方通常会事先达成“物物交换”协议。

* 在一篇有关Applifier的文章中,作者引用“最佳应用”1.5mm点击量例子。我建议将此数据延长一段时间(游戏邦注:3个月刚好是生命周期的初始阶段),回到周新用户获取率,把时间细化成以周为单位,然后再套入低/中/高转换率。

* 年轻Vs.成熟:通过把免费促销效应集中在发展初期阶段,你能够有效预测项目寿命。

* 变量范围:

–欠佳: 0.5mm > 10% CTR(点击率) > 50%安装量,3个多月=2500次/周。

–中等:1.0mm > 15% CTR > 60%安装量,3个多月=9000次/周。

–优秀:1.5mm > 20% CTR > 70%安装量,3个多月=2.1万次/周。

–你可以“混合搭配”这些价值,在价值间创造更多层次,适用于考察最坏打算和最佳状态之间的表现。

1周后的流失量:

* 该数据分析公司演讲中呈现的数据是介于85%至90%之间。

* 如上所述,在GDC座谈会中,开发商表示此流失量是针对成熟游戏而言,而且是在最初发行阶段,若第1日留存率没有超过50%,那么就无法实现目标。当然这不过是第1日留存率,但这个观点仍然有效。在游戏生命周期最初阶段,其留存率会更高。

* 年轻Vs.成熟:把优秀标准应用至最初阶段,或把欠佳标准应用至成熟阶段,抑或者在每个阶段建立欠佳、中等和优秀标准范围。我偏好后者,但模式越精确,所要调整的变量也越多。

* 注意:此变量是推动整个模式获得成功的关键因素。若游戏是个漏水木桶,玩家流失速度高于玩家获取速度,那么就需要重新设计游戏,降低损失。若是重视获取用户而无视玩家终身价值,那就是得不偿失的做法。

* 年轻阶段(1个月)变量范围:

–欠佳:60%流失率

–中等:45%流失率

–优秀:30%流失率

* 中间阶段(2-3个月)变量范围:

–欠佳:75%流失率

–中等:60%流失率

–优秀:45%流失率

* 成熟阶段变量范围:

–欠佳:90%流失率

–中等:80%流失率

–优秀:70%流失率

留存玩家持续流失:

* 我的模式不是分别追踪单个玩家群体,而是将1周内没有流失的新玩家纳入留存玩家的范围,对其采用静态流失率的考察方法。

* 分析公司Mixpanel的Tim Trefren表示,继初期玩家数量下滑后,所有游戏的持续流失率都大同小异,介于5%-20%之间。这同时也说明最初留存率的重要性(游戏邦注:若后面几周都处在相同范围内)。

* 变量范围:

–欠佳:30%流失率

–中等:20%流失率

–优秀:10%流失率

(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Financial Forecasting for Social Games (pt 1)

Brian Poel

With GDC happening this past week, I’ve been inspired to revisit and revise my financial modeling spreadsheet and share my approach here. Based on data from a variety of slideshows, articles, interviews and blogs, I’ll summarize the key metrics that go into the model, and show the sensitivity analysis of which variables move the meter the most. Let’s see how the numbers add up! (Note: this will be a multi-post series.)

The General Flow

Of all the analysis I’ve read online, I really like Kontagent’s approach the best. They’re a company that provides social game analytics tools (http://www.kontagent.com/), and with the breadth of clients they service, their aggregated view of ‘typical’ data points seems the most useful (compared to any numbers quoted by a single developer, which would be biased by their own games).

The presentation they deliver at conferences like GDC has a really nice workflow in it for how customer acquisition, retention and spending connect together. (On SlideShare, you can see previous presentations from them, and their slides have gotten much tighter over time with a great informatics diagram too.)

Here’s the general shape of it: Customer Acquisition -> feeds into -> Customer Retention –> feeds into Virality and Monetization –> feeds back into Customer Acquisition. It’s a nice, tight little loop without too many distracting data points.

The Variables

The model I’ve built out uses the following concepts and variables for forecasting:

Player Populations: I’ve divided the players into three populations, who can then have different variable values assigned to them. These are New Players, One Week Players, and Retained Players.

New Players: players who have only just been acquired, but have not yet had any attrition/retention assigned to them.

One Week Players: the population pool resulting from attrition of the New Player pool. In some versions of the model, I’ve extended this group into Weeks 2, 3, and 4 before transitioning the population to Retained Players. Whether or not you think that’s overkill may depend on how long you think it takes for a player to become firmly entrenched in your game and whether their virality and monetization behavior changes sufficiently during this transition period.

Retained Players: the population pool of One Week Players who continue playing the game long term. Rather than create individual population cohorts for every single week and track them until they reach zero population, I think it’s simpler to put all Retained Players into the same population pool. Then you can apply a single ongoing attrition rate to them, and the same ongoing virality and monetization behavior.

Customer Acquisition (paid): players acquired from paid Facebook ads, for example.

Customer Acquisition (free): players acquired from cross-promoting from your other games, for example. Note: this isn’t the same as viral acquisition (see below), but is something you’re intentionally doing, but still doesn’t cost you anything out-of-pocket.

Attrition after 1 week: how many of your New Players (paid, free or viral) leave after their first week of play.

Ongoing Attrition of Retained Players: how many of your Retained Players leave each week.

Virality of 1 Week Players: for each 1 Week Player in the population, how many New Players are generated from viral invitations.

Virality of Retained Players: for each member of the Retained Player population, how many New Players are generated from viral inviations.

Virality of New Player: my assumption here is that only New Players that decide to keep playing the game (becoming One Week players) are going to bother sending out Invites. It’s easy enough to add Virality behavior to the New Player population, though.

Engagement: for each population group, assign Daily Active User (DAU) as % of Monthly Active User (MAU). This will take the overall population of a group, and represent how many of them are actually playing daily. This is important because spending data is often measured in relation to DAU.

Player Spending: For each population group, how much real money are they spending per day, measured per DAU. This is clearly an aggregate number that encompasses the Whales, who spend $100s and $1,000s of dollars, and the Minnows who might spend a couple of dollars for the whole month.

Operations & Content Cost: Some generalized number representing costs for such things as: servers, customer service, community, new content design, programming, etc. One simple way to have this scale with the size of the game is to measure it as a % of Revenue or as a % of Population, and then apply a minimum spend underneath it.

Next Week

So that’s an overview of the variables at play in the model. Next week, I’ll look at some of the values to these variables that are being publicly discussed on the interwebs, and look at a sensitivity analysis of which variables affect bottom-line revenue the most.(source:plotluckgames)

Financial Forecasting for Social Games (pt 2)

By Brian Poel

Last week, I looked at the variables that go into my social games financial forecasting model, introduced a great slideshow from Kontagent on the subject, and also provided some additional research links. This week, I’ll dig into some of the variables a bit more and provide ranges for those metrics, with supporting links where appropriate.

Mature Games vs. New Games

Although I love Kontagent’s Acquisition-Retention-Monetization model, the numbers quoted in their slideshow are a bit discouraging when you plug them into the model. Then I found a video from a GDC panel discussion (hosted by Kontagent) that gives some real-world context to the numbers. These developers point out that Kontagent’s numbers reflect a mature game, but that many of these metrics are much different at the very beginning of a game launch. I’ll reference this observation several times in the rest of this blog post.

One key question to address then is where to draw the line between “New” and “Mature”, and gradations in between. It could be a measure of time or based on thresholds of player population. It really depends on the nature of your game, expected stable population, and your marketing budget to get there. A broad-appeal game may be aiming for 10s to 100s or millions, while a niche game may be happy with a highly invested several million players. And how much money do you have for Facebook ads?

I recommend a dual approach here. First, break your game lifecycle into 3 pieces (early, middle, late) and assign a length of time to each (1 month, 2 months, remaining 9 months of a year long forecast). Then assign different values for the key metrics depending on which phase you’re in (either gradually shift values to the new goal or switch at the dividing line).

Importance of Value Ranges for the Key Metrics

When modeling, I find it invaluable to define expected ranges for each of the key variables, rather than some set value, establishing baselines for “Poor”, “Middling” and “Good” performance of your game in each metric. This way, you’re being realistic about how far above average you’ll need to be in how many metrics in order to be successful — and if you’re below average in some metrics, how exceptional you’ll need to be in the rest.

Customer Acquisition (paid):

* Kontagent’s presentation quotes a $1 to $3 cost of acquisition. Based on other discussions, this seems high and likely represents the cost for mature games.

* In this article from InsideSocial, Hussein Fazal is CEO of AdParlor puts forward that your cost of acquisition increases over time, but your initial spending will be more efficient because you’re getting high click-throughs from the low-hanging fruit.

* In the GDC panel discussion (at the 23:50 minute mark) the developers back up AdParlor’s theories: they discuss how much easier it is at the beginning to attract early adopters to the game, and how critical it is to be successful with the retention of this population.

* Young vs Mature: consider assigning the Good value for the New phase and shift towards Poor in the later phases.

* Variable Ranges:

–Poor: $3

–Middling: $1

–Good: $0.50

Customer Acquisition (free):

* If you have more than one game, cross-promoting to your own players is a no-brainer. Because players often juggle several games at once, you shouldn’t be afraid of cannibalizing one game for another. And if a player is losing steam on one of your games, reinvesting them into a new game of yours is better than losing them.

* As a new developer, with only one game, your only real choice is partnering with link exchange services or with other developers/publishers. Applifier is a good example (http://www.applifier.com) of an easily accessible (and free) cross-promotion.

* In the GDC panel (at the 26:30 minute mark), the developers discuss cross-promotion. Interestingly (at 29:35), they discuss how the best target is often the game(s) that represent your direct competition, as they’re the most qualified players and both developers can come out ahead on such a ‘barter’ arrangement.

* In this SocialTimes article about Applifier, the author quotes an example of 1.5mm clicks for a “best performing app”. I suggest backing into a weekly rate of new customers by stretching this number over some length of time (3 months covers the early phases of the lifecycle), chop it into weeks, and apply some low/middle/good conversion rates.

* Young vs Mature: by limiting the effect of this free promotion to the early phases of growth, I think that’s a more realistic expectation of how long you can expect to pull water from this particular well.

* Variable Ranges:

–Poor: 0.5mm > 10% CTR > 50% install, over 3 months = 2.5k per week

–Middling: 1.0mm > 15% CTR > 60% install, over 3 months = 9k per week

–Good: 1.5mm > 20% CTR > 70% install, over 3 months = 21k per week

–You can always ‘mix and match’ these values for more gradation between values, but this gives you a range of worst-case to best-case.

Attrition after 1 week:

* Kontagent’s presentation, puts this at 90% to 85%. Ouch.

* As mentioned above, in the GDC panel (at the 35:45 minute mark), the developers point out that this kind of attrition is for mature games, and that at initial launch if you don’t see Day 1 Retention of better than 50%, then you’ve likely missed the mark. Of course that’s just Day 1 (not Week 1) retention, but the point is still valid. During the Early phase of the game lifecyle, you can expect (and you need) for retention to be much higher.

* Young vs Mature: consider either applying the Good attrition to the Early phase and the Poor to the Mature phase, or creating 3 ranges of Poor, Middling and Good for each of the phases. I prefer the latter, but the model just gets more fiddly the more variables there are to tweak.

* Note: this variable is one of the most critical factors driving overall success of the model. If your game is a leaky bucket that loses players faster than you can pour in new ones, it’s time to do some major redesigning or cut your losses. Spending more on customer acquisition than the Lifetime Value of your players is a losing game.

* Young Phase (1 month) Variable Ranges:

–Poor: 60% attrition

–Middling: 45% attrition

–Good: 30% attrition

* Middle Phase (months 2 and 3) Variable Ranges:

–Poor: 75% attrition

–Middling: 60% attrition

–Good: 45% attrition

* Mature Phase Variable Ranges:

–Poor: 90% attrition

–Middling: 80% attrition

–Good: 70% attrition

Ongoing Attrition of Retained Players:

* In my model, rather than track every individual population cohort individually, I take all of the New Players who survive attrition into the One Week pool and put them into a single pool of Retained Players, and then apply a static ongoing attrition rate to that population.

* In this blog post from InsideSocialGames, Tim Trefren, from the analytics company Mixpanel, shows that after the initial population drop-off, most games have similar ongoing attrition, ranging from only 20% to 5%. This also serves to highlight how critical initial retention rates are, if later weeks settle into the same range regardless.

* Variable Ranges:

–Poor: 30% attrition

–Middling: 20% attrition

–Good: 10% attrition (Source:plotluckgames)

闽公网安备35020302001549号

闽公网安备35020302001549号