每日观察:关注《Puzzle & Dragons》收益情况(2.19)

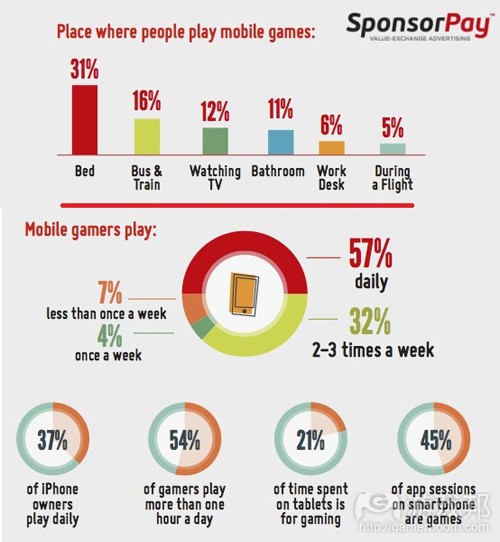

1)盈利解决方案平台SponsorPay最近发布的手机游戏信息图表显示,有45%的移动应用访问量来自游戏,54%玩家每天玩手机游戏的时间超过一个小时。

最后,用户在平板电脑上的投入时间有21%流向了游戏,这意味着平板电脑是一个潜力无限的游戏平台。

有31%用户在床上玩手机游戏,16%在巴士和火车上玩游戏,12%在看电视过程中玩手机游戏,11%在洗手间玩游戏。

57%用户每天都玩手机游戏,32%每周玩2-3次手机游戏,4%每周玩一次游戏,7%每周玩游戏不足一次。

2)据serkantoto报道,日本头号智能手机游戏《Puzzle & Dragons》目前在iOS和Android平台注册用户达800万,该游戏于2012年2月在日本App Store上线,2012年9月在Android平台发布,通过电视广告渠道以及有趣而富有创意的玩法,迅速成为日本收益排名第一的iOS和Android应用(游戏邦注:这款游戏并未绑定Mobage、GREE或LINE等社交平台,并且没有推出功能性手机和智能手机浏览器版本,目前在日本每月收益达5400万-7500万美元)。

该游戏开发商GungHo在大阪证券交易所股票一路上扬,目前市值已达23亿美元,逼近日本社交游戏巨头GREE(27亿美元)。

GungHo最近发布的2012财报(2012年1月至12月)显示,公司销售额同比上年增长168.8%,达到2.8亿美元,营业利润增长690.1%,达到9900万美元。

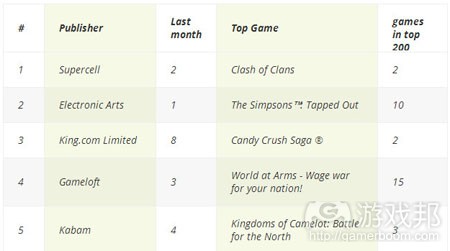

3)Distimo最近数据表明,2012年12月份,EA凭借位居前200名的9款游戏,在收益上超过Supercell,但在2013年1月份则让位给Supercell,屈居第二位。

Supercell热门游戏《Clash of Clans》在1月份位居热门游戏榜单第一名,排名第二的是King.com游戏《Candy Crush Saga》,Supercell游戏《Hay Day》,EA游戏《The Simpsons:Tapped Out》则排名第四(它在12月份是位居第二)。

King.com和Kabam均跻身开发商榜单前5名,Gameloft则意外挤进前4名(它有15款游戏进入前200名热门游戏榜单)。

GungHo凭借在日本大受欢迎的《Puzzle and Dragons》而在榜单登顶,DeNA旗下的Mobage位列第三,其竞争对手排名第五,其他进入榜单前列的公司还包括韩国门户网站Naver、日本地理定位服务供应商Colopl(专注于日本国内市场,因此在西方影响力有限)。

4)GREE最近发布财报显示,公司2013财年第二季度销售额为394.07亿日元(4.22亿美元),降幅为5%;营业利润下挫37%,降至142.85亿日元(1.53亿美元)。据GREE所称,这一情况应归结于公司总体运营成本上升(同比上年增长32%)。

其竞争对手DeNA上个季度收益增长52%,达到523亿日元(5.67亿美元),营业利润则增长54%,达到199亿日元(2.16亿美元)。

5)Flurry曾在去年11月份指出,中国Android设备安装量即将超过美国,其最近数据则显示中国将在月底成为全球Android和iOS智能手机、平板电脑安装量最高的市场。

截止今年1月,中美两国在活跃智能设备安装量上已经不相上下,分别为2.21亿部和2.22亿部,预计2月底美国这一数据是2.3亿,而中国则是2.46亿(印度仅为1900万)。

更重要的是,自此之后美国将不再是世界第一大智能设备市场。目前来看,中国美两的设备活跃安装量均超过第三大市场的5倍,这两者设备安装量均快速发展。美国从2012年1月至2013年1月,增加了5500万部设备;中国在此期间则增加了1.5亿部。

巴西、俄罗斯、印度和中国虽然并非增幅最高的国家,但在过去一年中增加的新设备数量惊人,巴西增加1150万部,俄罗斯1200万部,印度1240万部,中国1.495亿部。

6)据Venturebeat报道,分析师Sameer Singh最近表示,目前平板电脑每季度销量已达5500万至6000万部,PC销量则仅不足8000万部,预计今年第三或第四季度平板电脑销量将超过PC。

Singh预测,由于发展中国家的平价平板电脑市场发展迅速,今年底就有可能迎来平板电脑替代PC的时代。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Chart of the Week: Where and when we play mobile games

by James Nouch

Monetisation platform SponsorPay has published an infographic that charts the rise of mobile gaming – as well as outlining where we play games and how often.

SponsorPay’s figures show that public transport is a popular venue for mobile play, second only to the comfort of bed-based gaming.

Daily cycle

And when it comes to frequency, SponsorPay notes that a whopping 45 percent of mobile app sessions are games and 54 percent of mobile gamers play for more than one hour each day.

Finally, 21 percent of all time spend on tablets is engaged in gaming, underlining the device’s potential as a gaming platform.(source:pocketgamer)

2)Who Is Supercell? Puzzle & Dragons Estimated To Make US$54-75 Million Per Month In Japan.

by Dr. Serkan Toto

Puzzle & Dragons, Japan’s top smartphone game with 8 million registered users across iOS and Android, is buzzing again in Japan.

And what a buzz it is this time: I think it’s safe to say that the title is “making history” at the moment – on a global level.

To recap, the puzzle/RPG hybrid was released on the Japanese App Store in February 2012 and on Android in September 2012. Fueled by the social nature of the game, TV advertising, and quite simply the fun and innovative gameplay, it has been the country’s No. 1 money making app on both platforms since, with very few breaks.

Side note: Puzzle & Dragons isn’t using Mobage, GREE, LINE or any other kind of platform for distribution- and there is no feature phone or smartphone browser version.

So no wonder the share price of maker GungHo at the stock exchange in Osaka has been going through the roof as of late: last month, I highlighted that the company’s market cap topped that of Zynga. (And in fact, GungHo’s market cap (US$2.3 billion) is getting dangerously close to that of juggernaut GREE (US$2.7 billion)).

The Puzzle & Dragons Effect: GungHo’s Financial Report For 2012

Now over the weekend, GungHo released its financial report for fiscal 2012 (January – December 2012, available in JP only).

I don’t want to get into all details here, but the company saw sales growing 168.8% year-on-year to US$280 million, while operating profit shot up a staggering 690.1% to US$99 million.

There is absolutely no doubt in the industry over here that one game only – Puzzle & Dragons – is the main driver behind this growth.

January 2013 Sales And Growth Revealed In Separate Document

What is especially interesting is a second financial document the company provided to investors (that document, too, is available in JP only).

In it, GungHo reveals that in January 2013, sales hit an almost unbelievable 8.5 billion yen, which currently translates to US$92 million (+ 1,022.4% year-on-year).

GungHo is neither providing a platform nor having particularly successful console games in its portfolio: the company does run Ragnarok in Japan (and a few fairly successful mobile games), but again, this has written Puzzle & Dragons all over it.

But how much exactly is Puzzle & Dragons making it on its own?

The company doesn’t break down the game’s exact contribution, but several Japanese sources have published estimates.

Here is a short list:

•“Inside Games”: 7 billion yen (US$75.5 million0)

•“Projetista”: 6 billion yen (US$64.6 million)

•“Popular Social App And Game Analysis Blog”: 5 billion yen (US$54 million)

Yes, this is for one game, in one month, and in one country only.*

No matter which number you believe, Puzzle & Dragons is testament that the smartphone game market, at least in Japan, has reached a new level of maturity.

I usually hesitate to use big words, but I have to say it again: these are numbers never seen before in this industry.

Who is Supercell?**

Notes:

*Puzzle & Dragons is out in English since late last year, but it’s safe to say that close to 100% of the revenue last month came from Japanese users.

**Just for the record, this is pure snark – I am personally a big Supercell fan.(source:serkantoto)

3)Supercell overcomes EA to gain #1 top grossing game and company status on iOS

by Jon Jordan

In the app store information battle now raging between App Annie and Distimo, it’s the Dutch outfit that sneaks out on top – this week at least.

Its data has been contextualised in an excellent report from fellow Dutch outfit Newzoo, which has been released to promote its market breakdown on the US and Northern European mobile sector.

Clash of giants

One aspect of this is Distimo’s estimate of how Google Play and iOS are monetising, and the games and companies that are making the most cash.

Detailed for January 2013, across 44 tracked countries, on iOS the competition between Supercell and EA continues apace.

In December, EA was ahead of Supercell, thanks to the 9 games it then had in the top 200 (now 10), but in January, the Finnish outfit bounced back gaining the top spot.

Clash of Clans remains the top grossing individual title in January, while King.com’s Candy Crush Saga was #2, Supercell’s Hay Day was #3, leaving The Simpsons: Tapped Out at #4. It was #2 in December.

King.com and Kabam featured in the company-wise top 5, although Gameloft’s position at #4 is a surprise, given its failure to have a headline global success in terms of free-to-play games. Instead, its volume approach gives it rank; it has 15 games in the top 200.

Mysteries of the east

When it comes to Google Play, however, the picture changes radically.

With Korea and Japan the two most valuable Android markets, it’s Japanese and Korea companies who lead the charge.

GungHo ranks #1 thanks to the massive success of Puzzle and Dragons in Japan.

While DeNA’s Mobage is #3, while arch-rival GREE is #5, although they do have very different publishing strategies.

Other high raking companies are Korean web portal Naver and Japanese location-based specialist Colopl, are focused on their own internal markets, and hence not well known in the west.(source:pocketgamer)

4)GREE’s Results For Q2 FY2013: Sales And Profit Are Down Year-On-Year

by Dr. Serkan Toto

GREE released its financial report for the second quarter of fiscal 2013, and in a nutshell, things aren’t looking too well.

Year-on-year, the company saw sales dropping 5% to 39.407 billion yen (US$422 million) while operating profit plunged a brutal 37% to 14.285 billion yen (US$153 million):

So GREE is still very profitable, but the numbers are shrinking, even quarter-on-quarter.

Looking at the last quarter of big rival DeNA, the Mobage operator’s revenue grew 52% to 52.3 billion yen (US$567 million) year-on-year, while operating profit increased by 54% to 19.9 billion yen (US$216 million).

GREE says that rising overall costs (a whopping 32% plus year-on-year) contributed to these new numbers.(source:serkantoto)

5)China Passes U.S. As World’s Top Smart Device Market

Sarah Perez

In November, mobile app services company Flurry announced that China was on track to top the U.S. and Android install base at some point in the first quarter of 2013. Today, Flurry says that has happened. China has passed the U.S. to become the world’s top country for active Android and iOS smartphones and tablets, a year after the country became the fastest-growing smart device market in the world.

For its report, Flurry sourced from its entire data set of over 2.4 billion anonymous, aggregated app session daily across over 275,000 applications around the world. The company says it reliably measures activity in over 90 percent of the world’s smart devices.

In January of this year, the U.S. and China were neck-and-neck in terms of their active smart device installed base, at 222 million and 221 million, respectively. By the end of this month, Flurry estimates that will change to 230 million in the U.S. and 246 million in China.

More importantly, the U.S. will not regain the lead after this shift occurs, due the size of China’s population (over 1.3 billion people vs. 310 million in the U.S.). In fact, the report notes, the only other country that could eventually challenge China is India, which has just over 1.2 billion people. But China’s smart device installed base is significantly larger than India’s, where today there are only 19 million active devices.

Of the top 10 countries leading in terms of active iOS and Android devices, the U.S. and China are by far in the lead – each has over 5 times more the active installed base than the third largest market, the U.K. Both also continue to see rapid active device adoption, says Flurry. The U.S. adding 55 million devices from January 2012 to January 2013. But during that time, China added 150 million. If it wasn’t for the holidays, which generally brings a surge of new activations to the U.S. market, China would have actually passed the U.S. sooner.

Flurry also revealed an updated look at the fastest-growing smart devices markets, year-over-year from January 2012 to last month. China’s 209 percent growth rate on top of a base of 71 devices last January is no longer the leader in terms of growth.

Countries now growing faster than China this past year included Columbia, Vietnam, Turkey, Ukraine and Egypt.

While Brazil, Russia, India and China may not be the fastest-growing, they have still added a significant number of new devices year-over-year: Brazil +11.5 million, Russia +12.0 million, India +12.4 million, China +149.5 million.

China’s growing significance has the potential to really shake up the mobile industry. Apple notably broke out China as a standalone region on its balance sheet after years of lumping it in the “

Asia-Pacific” group. China’s revenues were up 67 percent over the previous quarter, Apple said in January, having contributed $6.8 billion in revenue last quarter. That’s more than the $4.4 billion Japan did. But Android is leading over iOS in China, in terms of sales. According to some reports, it has nearly three-quarters of the market by smartphone sales, 23 percent of which can be attributed to Samsung.(source:techcrunch)

6)Tablet sales will surpass PC sales by late 2012 or early 2013

John Koetsier

Global tablet sales are still well below PC shipments. But one analyst is predicting that they will overtake PCs by the fourth quarter of this year, or the first quarter of 2013.

Tablet sales are currently about 55-60 million per quarter, while PC sales are in the low 80 million range. But according to analyst Sameer Singh, the tablet market is very similar to the modern smartphone market (Android and iOS phones, as opposed to Windows Mobile, Palm, Symbian, and BlackBerry smartphones) … which allows him to compare 16 quarters of phone sales to 11 quarters of tablet sales, and make some inferences about when more tablets will be sold than PCs.

The result?

Singh says that the crossover point is coming early in 2013, or possibly even earlier:

“The substitution rate patterns between the two markets are remarkably similar, showing a correlation of nearly 93% over the first 11 quarters,” Singh writes. “It is also interesting to note that tablet/PC substitution seems to be happening at a faster pace.”

That faster pace is what makes Singh predict that the switchover point of sales could occur as early as the end of this year, driven by accelerating adoption of cheap tablets in emerging markets. (Which, by the way, sounds a lot like Android, and not much like iPad.)

One thing to note: while phone penetration was fairly limited in the early days of smartphones, the PC market is saturated. Which means that overall growth in the combined PC/tablet market will be in the low single digits, says Singh.

That’s bad news for traditional PC vendors who are getting eaten at the high end by tough competition in a declining market, and beaten at the low end by more nimble new competitors in the tablet market.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号