开发者谈2018日本手机游戏市场的5个发展趋势

开发者谈2018日本手机游戏市场的5个发展趋势

原作者:Johannes Heinze 译者:Willow Wu

对于很多想进行全球扩张的游戏开发者来说,日本通常是他们的首选目标之一,这是有原因的。

根据App Annie的研究,日本手游市场收益在2017年增长了35%,超越美国成为了手游收益第一大市场。

主要原因之一就是日本玩家对手游的投入程度相对高很多。

同一篇研究还发现了日本玩家打开手游的频率是美国玩家的两倍之多。2016年6月至2017年6月,在日本手游的总下载量中,RPG游戏和休闲游戏的比例超过了半数。

RPG游戏的沉浸度高,内购商品多,自然也就成为了盈利最多的游戏类别。

然而,在2018这些趋势或许会因为多种因素而产生转变,我们将在下文进行一一分析。如果你算进入日本市场,那么以下就是你在2018年需要留心的趋势。

1.App Store和Google Play收入几乎平分

在日本,安卓和iOS的市场份额其实是不相上下的。截止2017年十月,安卓在日本的市场份额达到55%,iOS约为44.8%。虽然iPhone X在日本十分畅销,但iOS的市场份额却下滑了6.9%。

在美国,安卓的市场份额达到了66.2%,而iOS是32.9%。虽然安卓占得更多,但大部分游戏公司还是把iOS看作是优先考虑的目标平台。所以在日本,平台选择对收益的影响并没有美国那么明显。

2.有越来越多来自中国、韩国手游进入日本市场,但本土游戏依然占据优势。

日本玩家历来偏爱本地团队制作的手游,但这种情况可能会在将来发生改变。

自2016年7月至2018年6月,日本手游市场有80%的收益都来自本土游戏。相较之下,同一时期的美国仅有50%的收益是来自本土游戏。

这是由于日本玩家的独特性,比如说他们对RPG游戏的偏爱以及高沉浸度。对于非本土游戏开发者们来说,这就意味着优质的游戏本地化是必不可少的。

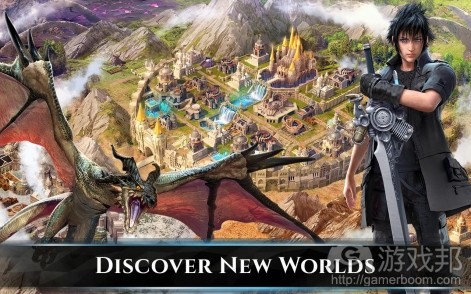

举个例子,《最终幻想:新帝国》是由MZ这个美国公司开发的,但是它在日本也十分火爆,这要归功于游戏的本土IP以及高质量翻译。

但是,我们也发现在过去几年有越来越多中国以及韩国开发的游戏成功进入日本市场。

原因之一就是这两个国家的游戏公司在初期非常重视用户获取,通常会在这上面投入一大笔钱,这有助于他们实现迅速扩张。虽然广告支出回报率(ROAS)在用户获取前期会比较低,但这些投入能够将竞争对手的玩家转化为自己的玩家,长期来看是有益的。

另一个主要原因就是这两个国家的开发者原先就考虑到了日本玩家的特性,有针对性地设计了游戏,而不是到最后阶段在国际版的基础上进行微调。这就意味着开发者会在角色设计、关卡设计以及语言等方面花费更多精力。

尽管外国游戏能在日本市场挣得份额是件好事,但它们之中的绝大部分还是RPG以及策略游戏,表示着日本玩家对这类游戏依然是热情不减。

这就是为什么RPG以及策略游戏能为日本游戏开发者带来最多的收益。游戏机制比如收集道具、武器、强化、gacha和其它可购买的物品为开发者们带来了丰厚的利润。

3.休闲和超休闲游戏崛起

长久以来,midcore和hardcore手游在日本一直处于主导地位。但是现在这个风向要变了,休闲和超休闲游戏开始受广大到玩家的喜爱。

一般是迪士尼和LINE这样的大公司会发行休闲游戏,现在独立开发者们也把目光转向了它。比如说《一笔画》(1LINE)和Human Tower都是出自小型工作室之手的热门游戏。

要说为什么休闲游戏很难在日本占据自己的一席之地,其中原因之一就是midcore、hardcore和RPG游戏的盈利空间非常可观,对于日本开发者来说,他们没有什么特别的理由要放弃这些摇钱树而去做休闲游戏。

然而,随着视频广告被大众所接受,而且事实也证明了它具备盈利能力,日本手游开发者做休闲游戏的前景也变得明朗起来。

4.主流IP地位依然不可撼动

主流IP游戏依然是吸金能力最强的,很大程度上受是因为日本的动漫文化的影响。日本人从小就看动画、漫画,了解他们喜爱的角色,而现在这些故事搬上了移动平台,他们自然也会继续消费下去。

任天堂就是一个非常典型例子。任天堂是近几年才进入手游领域的,但它凭借旗下的热门IP大获成功——比如Pokémon Go、《火焰纹章:英雄》以及《动物之森:口袋露营》(《超级马里奥酷跑》有争议)。任天堂也宣布了Mario Kart Tour将会在2019年登陆移动平台。

5.日本开发者迎合女性玩家

另一个明显的趋势就是“浪漫类”游戏依然很受欢迎,它们是针对女性玩家群体。这些让人上瘾的游戏需要随着剧情一步一步深入,跟虚拟情人发展关系。

这些游戏为何如此成功?其中一个说法是它们能帮助玩家减轻压力,缓解了在拥挤的城市环境中普遍存在的疏离感。这类恋爱游戏目前在中国也十分受欢迎。

此外,“偶像养成”类游戏也非常受日本女性玩家的青睐。玩家要在游戏中挖掘、培养角色的才艺技能,把他培养成下一个国际巨星。在竞争如此激烈的日本游戏市场中,这类游戏给玩家提供以了一种更为休闲的玩法。

而美国的情况则完全相反,面向女性玩家的游戏非常少,熟为人知的只有Kim Kardashian:Hollywood、High School Story和Covet Fashion。

总结

对于手游开发者们来说,日本是一个盈利空间极大的市场。

尽管日本的人口只有美国的五分之二,但在过去的三年里,它的手游市场规模已经超过了美国。换句话说,日本玩家对手游有很大的需求,而且他们的沉浸度高,愿意花钱购买游戏以及游戏内的商品。

虽然日本对国外的手游开发公司来说无疑是一个颇具吸引力的地方,但它也带来了独特的挑战。在日本最受欢迎的游戏通常是IP改编的RPG游戏,如果独立开发者们想在这个领域获得突破,那将会非常难。

然而,这也意味着休闲游戏和超休闲游戏的机会还有很多,毕竟世界各地的玩家都很喜欢这类游戏。除此之外,越来越多的中韩游戏进入日本市场,这也是一个激励人心的好现象。

本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao

For many mobile games developers looking to expand globally, Japan is usually one of the first markets they seek out, and for good reason.

According to an App Annie study, Japan’s mobile game revenues rose 35 per cent in 2017, outpacing the United States, making the country the number one market for mobile game revenue.

One of the biggest reasons why Japan leads in mobile game revenues is because its players are far more engaged.

The same App Annie study found that Japanese players opened mobile games more than twice as much as those in the United States. This makes sense, as RPG and casual game categories made up over 55 per cent of mobile game downloads between June 2016 and June 2017.

Unsurprisingly, RPGs made the most mobile game revenue because of in-app purchases and high engagement.

However, these trends may change in 2018 due to a number of factors which we’ll go over in this article. If you’re looking to expand into Japan, these are the mobile game trends you need to watch in 2018.

App Store and Google Play revenues are nearly evenly split

App Store and Google Play revenues are evenly split in Japan, which is not the case in the US. In the US, iOS dominates mobile games revenues making it the “premium” platform for mobile game devs to target.

In Japan, however, Android and iOS market share is neck and neck. As of October 2017, Android made up 55 per cent of mobile market share in Japan compared to iOS’s 44.8 per cent. Although iPhone X sales were strong in Japan, iOS market share managed to slip 6.9 per cent.

Compared to the US, Android makes up 66.2 per cent of mobile market share while iOS holds 32.9 per cent. So it appears that in Japan, choosing a platform to maximize revenue doesn’t matter quite as much as in the United States.

More Chinese and Korean games are making it to Japan, but local games still perform better

Japan has historically preferred locally-produced mobile games, but that could be changing over the next year.

Between July 2016 and June 2018, 80 per cent of Japan’s mobile game revenues came from games which were produced in Japan. In comparison, only 50 per cent of mobile game revenues in the US came from US-made games during the same period.

This is because Japanese players have very specific tastes, like their love for RPGs and high engagement rates. For devs, this means quality localisation is a must for games developed outside of Japan.

For example, Final Fantasy: A New Empire was developed by Machine Zone, an American company, but has found success in Japan thanks to its Japanese IP and good translation.

This trend appears to be changing, as we’ve noticed that more Chinese and Korean-made games are entering the Japanese market over the past year.

One reason is that Chinese and Korean game studios are investing heavily in user acquisition from the very beginning. This allows them to scale their businesses quickly. Although ROAS can be low at the beginning of a user acquisition campaign, it can divert mobile gamers from competitors’ games and will pay off in the long run.

Another big reason we see Chinese and Korean games breaking into Japan is the fact that developers have begun creating games specifically for the Japanese market, instead of trying to localise a global version. This means more attention is paid to things like character design, level design, language and more.

While it’s nice to see games from outside of Japan gaining traction, they are still predominantly RPG and strategy games, meaning Japan’s predilection for these games remains strong.

This is why RPG and strategy games provide the most revenue for Japanese game developers. These games provide developers with a lucrative monetisation cycle that utilises gaming mechanics like collectibles, weapons, boosts, gacha and other in-game items available for purchase.

Casual and hyper-casual games are rising

For the longest time, midcore and hardcore mobile games have dominated in Japan. But now the tides are beginning to turn and casual and hyper-casual games are starting to become popularised.

In addition to big companies like Disney and LINE creating more casual games, indie devs are jumping on the trend as well. For example, 1LINE and Kumitaisou are very popular and made by small development studios.

One of the reasons why casual games have had trouble gaining traction in Japan is the fact that midcore, hardcore and RPG perform so well that there hasn’t been much incentive for Japanese developers to create casual games.

However, as video ads become more accepted and are proven to monetise well, Japanese mobile games developers are more able to scale their casual games globally.

Established IPs still rule

Established IPs bring in the most money, largely because there’s a huge culture of anime and manga in Japan. As kids grow up watching and reading stories about their favorite characters, it’s natural that they will continue consuming them as they transition to mobile.

One company that shows the success of strong IPs is Nintendo. The company only got into the mobile games space a couple of years ago, but is already seeing great success because of their strong IP. While some may argue that Super Mario Run was a failure, there was considerable hype surrounding the game.

Other Nintendo games like Pokémon Go, Fire Emblem Heroes, and Animal Crossing: Pocket Camp are all doing very well for the company. It also announced that Mario Kart Tour will be coming to mobile sometime in 2019.

Japanese developers actually cater to women’s tastes

Another trend in Japan that remains strong is the “romance” genre, which is targeted towards women. These addictive games let players progress through a story, letting them meet virtual lovers.

One speculation about why these games are so successful is that they provide stress relief and mitigate the sense of alienation that’s common in crowded urban environments. These romance games are so popular now that they’re gaining traction in China as well.

Alternatively, the “idol raising” genre is also quite popular among Japanese women. These games let you scout new talent to create the next big international superstar. In an exceedingly competitive games marketplace for Japanese men, these types of games offer more relaxed gameplay.

In contrast, the US only has few popular games targeted toward women, including games like Kim Kardashian: Hollywood, High School Story and Covet Fashion.

Wrap-up

For mobile games developers, Japan is an incredible country due to its voracious appetite for mobile games.

Although Japan’s population is two-fifths of the United States, its mobile games market has outgrown the US for the last three years running. This means Japanese players have a huge appetite for mobile games, have high engagement and spend tonnes of money on games and in-game items.

While Japan is undoubtedly an attractive place for mobiles developers outside of the country, it brings unique challenges. The fact that the most profitable mobile games are usually RGPs with established IPs will be difficult for indie developers creating games in the genre.

However, this also means that there’s ample opportunity for casual and hyper-casual games since these games provide global appeal. It’s heartening to see more competition from China and Korea break into the Japanese market and to see casual and hyper-casual games beginning to take hold.(source:pocketgamer.biz )

闽公网安备35020302001549号

闽公网安备35020302001549号