每日观察:关注用户安装应用数量与IAP消费比例(8.21)

1)StatCounter最新数据预测,微软手机平台Windows Phone在美国市场份额将于2012年11月底超过黑莓。但这主要是因为黑莓市场行情不济所致。Windows Phone目前在美国智能手机中仅占比2%,但未来其比例将高于黑莓。

StatCounter从今年初开始观察其网络使用率相关数据并发现,Windows Phone在美国使用率将超过黑莓。Windows Phone超越黑莓的情况可能很快就会出现,因为Windows 8及微软新移动设备预计于10月份发布,而BB 10平台亮相时间却推迟到了2013年。

2)据Techcrunch报道,苹果公司目前市值已达6230亿美元,创下美国上市公司的历史新纪录。之前最高纪录保持者是微软,该公司在1999年12月30日时的市值达6189亿美元(与通货膨胀有关),但微软目前市值已缩水至2570亿美元。

思科市值曾排名世界第三,当时身价超过3500亿美元,但现在则降至1000亿美元左右;诺基亚当时世界排名第九,市值为2000亿美元,但现在却接近于80亿美元。AOL曾经身价与诺基亚不相上下,当时市值也是2000亿美元,但现在接近30亿美元。

雅虎在1999年底市值曾高达1000亿美元,当时排在世界第39名,但现在仅180亿美元左右;戴尔在1999年排在第30名,市值为1220亿美元(1997年苹果市值降至23亿美元左右,在1999年上升至90亿美元,仅为戴尔的十分之一,微软的六十分之一),但现在戴尔市值不足220亿美元,缩水1000亿美元,而苹果在此期间却增值6100亿美元。

在2010年5月26日,苹果和微软市值均为2270亿美元,但从那时起苹果市值增长了4000亿美元,而微软仅增长了300亿美元。

苹果市值是艾克森石油(Exxon)及谷歌市值(2200亿美元,排名第二)的总和,或者微软、谷歌和英特尔三者相加的总和,其身价是戴尔的28倍。

3)Arxan Technologies最新报告指出,90%以上位居前100名的热门手机应用已被破解,其中灾情最严重的是Android平台。

该报告调查了230款热门手机应用,其中包括Android和iOS平台前100名热门付费应用,发现92%的iOS应用已被破解,而Android平台这一比例高达100%。

Arxan报告发现免费应用也不例外,40%热门免费iOS应用已被破解,Android免费应用的这一比例则高达80%。

所有手机应用类型都难逃此劫(包括商务及办公应用),这些破解方式多种多样,包括瘫痪安全系统、解琐和修改应用功能,盗窃代码/IP并推出植入恶意插件的盗版应用。

Arxan Technologies指出开发者需加固代码以防御反向工程行为,并制作更具抗干扰性和自我防护型的应用。

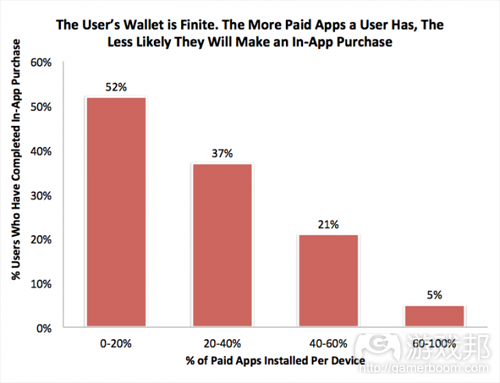

4)移动分析公司Apsalar最近报告指出,用户购买的付费应用越多,他们在免费应用中购买的IAP内容就越少(游戏邦注:其数据取自Apsalar网络对2.5亿部独立移动设备,以及1000多亿次用户操作行为的观察)。这有可能与用户预算有关,他们若主要消费付费应用,就不会频繁购买IAP。

这一调查结果意味着,开发者最好不要在付费游戏中交叉推广免费游戏,因为玩家在免费游戏中购买IAP的可能性并不高。

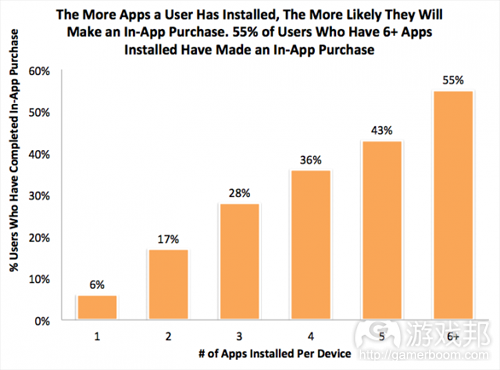

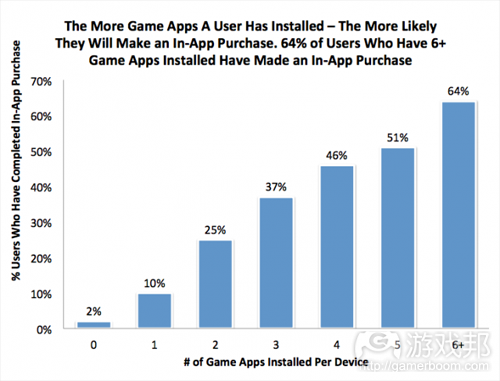

该报告同时还显示,用户拥有的应用数量越多,他们就越可能在其中消费。约有半数以上至少安装了6款应用的用户会购买IAP,而仅安装一款应用的用户这一比例仅为6%(当然,智能手机上安装不足5款应用的用户也较为少见)。同理,用户安装的游戏越多,他们就越可能消费IAP。

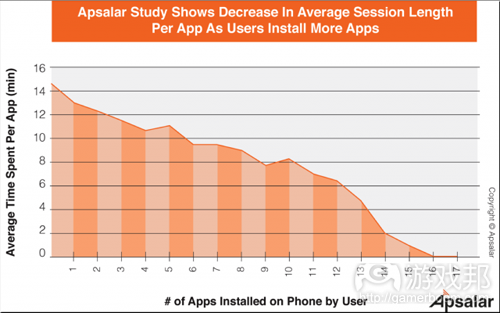

但值得注意的是,用户安装的应用越多,他们在每款应用中的投入时间就越少。因为他们时间有限,无法在所有应用中都投入足够多的精力。

5)据joystiq报道,Konami最近财报显示其2012财年前9个月的社交游戏收益达3.48亿美元,比2011年增长1.27亿美元;Konami已成为这一市场上收益仅次于Zynga的第二大社交游戏公司。

Zynga在2011年社交游戏总收益为11.4亿美元,其中微交易收益为10.7亿美元,净亏损为4.043亿美元。

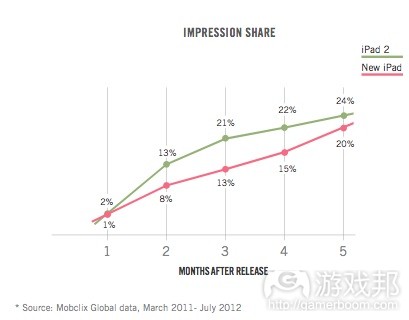

6)移动营销公司Velti最近发布的7月份报告显示,苹果新iPad在Velti网络广告印象正缩小与iPad 2的差距,iPad 2在该网络所有平板电脑广告印象中占比24%,而新iPad则占比20%。

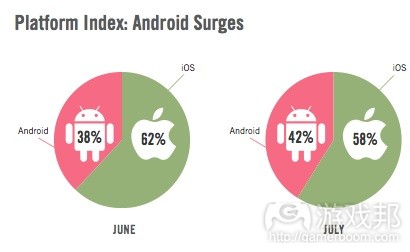

该报告还指出,Android广告印象开始追赶iOS,7月份iOS和Android两者所占份额分别是58%和42%,而6月份这一比例则是62:38。

但6月至7月间的广告eCPM有所下降,这有可能是广告商有意结束第二季度预算,因此在6月份广告投入高于7月份。

7)据venturebeat报道,PopCap Games日前宣布公司已投入开发《植物大战僵尸2》。该游戏原作发布于2009年5月,发售首天销量超过30万份。

这个续集游戏将包含“一系列新功能和场景”,但该公司并未透露更多详情,仅表示该续集预计于2013年春季发布。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Windows Phone to overtake BlackBerry in the US

by Mike Shaw

Data by StatCounter suggests Microsoft’s platform will be more common than BB by late 2012.

Windows Phone isn’t a particularly fast-growing platform, but new figures suggest it is set to overtake BlackBerry in the US by the end of November.

This isn’t due to any great step forwards by the Microsoft platform, but more because of BlackBerry’s terrifying decline.

The projection is based on extrapolating StatCounter web usage data from the beginning of the year, and would mean there would be more Windows Phones in use in the USA than BlackBerries.

The reality is, this increase is probably going to happen even sooner, considering Windows 8 and new devices are expected for October, while BB10 is delayed until 2013.

With fewer than two per cent of US smartphones being Windows Phones, they’ll still be be rare in the US; just not as rare as BlackBerries.(source:mobile-ent)

2)Apple’s Market Run: Amazing! Magical! Boom! Superlative!

Mg Siegler

Joking aside, this is remarkable. Apple’s market cap now stands at $623 billion. That’s a new all-time high for a publicly-traded stock in the U.S. The previous record was $618.9 billion, which Microsoft hit on December 30, 1999.

Yes, adjusted for inflation, Microsoft’s tally is far higher (about $850 billion), but you should also consider another inflation: that was the height of the tech bubble. The real one, not the fake one that people keep saying we’re in now.

At the time, Microsoft’s market cap was more than double Exxon’s. Cisco was the third most valuable company in the world at that point, with a market cap of over $350 billion. Today, their market cap is about $100 billion. Nokia was the ninth most valuable company in the world at $200 billion. Today, they’re closer to $8 billion — and quickly approaching $0.

AOL (which owns this site) was 12th, also right around $200 billion. They were just weeks away from buying Time Warner for $162 billion. Today, AOL’s market cap is closer to $3 billion, having long since been spun off from the company they acquired.

Back then, Oracle and Sun Microsystems were roughly equal — Oracle at $137 billion, Sun at $116 billion. Less than ten years later, Oracle bought Sun for $7.4 billion.

Yahoo was also at the peak of their fiscal power, with a market cap of $100 billion at the end of 1999. They were the 39th most valuable company in the world. Today, that market cap is right around $18 billion. I wouldn’t rule out Apple making that much in profit in the upcoming holiday quarter.

And then there’s Dell. They were the 30th most valuable company in 1999, with a market cap of $122 billion. In 1997, when asked what he would do if he were in charge of Apple, Michael Dell famously said, “What would I do? I’d shut it down and give the money back to the shareholders.”

At that time, Apple’s market cap had fallen to about $2.3 billion. By 1999, it had risen to $9 billion — still just a 10th the size of Dell. And a 60th the size of Microsoft. Today, Dell’s market cap stands at just under $22 billion. They’ve lost $100 billion in market value while Apple has gained about $610 billion.

While Apple’s long-term surge is obviously massive, short-term is just as impressive. Consider that it was only a little over two years ago that Apple passed Microsoft in market cap for the first time since the early days of both companies. On May 26, 2010, both had a market cap of $227 billion. Apple’s market cap has grown $400 billion since then. Microsoft’s has grown “just” $30 billion in the same timeframe.

A year ago, I wrote a post wondering if Apple may be able to overtake Exxon in the fall to become the most valuable company in terms of market cap? Some people thought I was insane. Then it happened. Three weeks later.

Since then, Exxon has added about $70 billion to their market cap — a hugely impressive run. But in the same amount of time, Apple has added almost $300 billion to their market cap. No, that’s not a typo. Apple has added nearly $300 billion to their market cap in the past year. As a result, today Apple is worth nearly $220 billion more than Exxon — in other words, the market cap of Google — which is still the second-most valuable company in the world, by the way.

So what’s next for Apple? Well, they hit this peak just weeks after a “disappointing” third quarter. They could miss (from Wall Street’s perspective) in the fourth quarter as well, as everyone will be waiting for the new iPhone. But there’s little question that Q1 (the holiday quarter) is going to be insane. At that point, the race may be on to the $1 trillion market cap.

It sounds crazy to think they could hit that mark. But again, they added $300 billion to their market cap in the past year. If there is in fact an “iPad mini” this fall and some sort of Apple television product next year… And a $1 trillion value isn’t completely unprecedented. PetroChina actually hit that mark back in 2007, on its first day of trading. That made it worth more than Exxon and General Electric combined. Amazingly, it had a greater market value than the entire Russian stock market, as Bloomberg pointed out.

Right now, Apple has to settle for being worth what Exxon and Google are combined. Or worth more than Microsoft, Google, and Intel combined. Or maybe they’re just content to be worth 28x what Dell is worth. Someone alert the stockholders.(source:techcrunch)

3)Developers, Your Android App Will Be Cracked [STUDY]

by Doug Drinkwater

A damning new study finds that more than 90% of the Top 100 mobile apps have been hacked, with Android the most susceptible platform.

The report from security vendor Arxan Technologies tackles how the prevalence of “cracked” mobile apps can compromise brands and affect revenues.

The report studied 230 top apps — including the Top 100 Paid apps on Android and iOS — and found that 92% of iOS apps have been hacked, with this rising to an incredible 100% on the Android platform.

Free apps weren’t immune from attacks either, as Arxan found that 40% of popular free iOS apps had been hacked, with this rising to 80% for apps running Google’s operating system.

Researchers found hacking to be prevalent across all mobile apps irrespective of category (including business and productivity), and indicated that hacking presides in a number of forms, from disabling security to unlocking and modifying app features. Hackers also resort to code/IP theft and pushing illegal malware-infested versions.

To counter this, Arxan Technologies says developers should harden the code against reverse engineering (reproducing the app based on how it is built) and make their apps tamper-proof and self-defending.

“We envision a thriving App Economy with freedom and confidence to innovate and distribute new apps,” said Jukka Alanen, vice president at Arxan and the lead author of the new study.

“However, this potential is being threatened by hackers, and most enterprises, security teams and app developers are not prepared for these attacks.”(source:mashable)

4)Predictors of In-App Purchases? Not Having Paid Apps And Playing Lots of Games, Apsalar Finds

Kim-Mai Cutler

In-app purchases have become the predominant way that mobile developers monetize their work, with the bulk of iOS’s top 25 grossing apps being free-to-play. One company, the U.K.’s NaturalMotion, even made $12 million through in-app purchases on iOS in a single month for CSR Racing, so these microtransactions are starting to add up in a big way for venture-backed mobile startups.

Analytics company Apsalar took a deeper look into factors that predict spending inside mobile apps and more specifically, how the quantity of apps a user has affects their spending habits.

Somewhat counter-intuitively, users with a greater percentage of paid apps tend to spend less inside free ones. Apsalar speculates this is because consumers have a limited budget and paid apps serve as an economic substitute for in-app purchases.

Now while it might be hard for an individual developer to know how exactly many apps a customer has, developers can decide where and how to cross-promote their work in other games or apps.

So a game developer might choose not to cross-promote their free app in another paid game if it means that there’s a lower chance that the end-user will pay for virtual currency.

Then somewhat unsurprisingly, the more apps a consumer has, the more likely they’ll spend inside one. If they are invested enough in downloading tons of apps, they might be likely to spend more inside of them as well. More than half of users who have more than six apps will go on to make an in-app purchase, compared to 6 percent of those who only have one app. (Of course, it’s kind of hard to imagine someone with fewer than five apps on their smartphone.)

Similarly, the more games they have, the more likely they are to make an in-app purchase.

There’s a flipside to this trend though. The more apps a user has, the less time they spend on average in each individual app. Logically, it makes sense if a user has dozens of apps, they’re not going to have enough free time to spend above a certain amount in each of them.

The stats above are from 250 million unique mobile devices on and over 100 billion user actions in Apsalar’s network. The company, which is backed by more than $5.8 million in funding from Thomvest and Battery Ventures, recently launched an engagement service for app developers who want to target users with promotions based on their previous behavior.(source:techcrunch)

5)Konami is No. 2 social games publisher behind Zyngaby

Jessica Conditt

Konami has recently received a massive bump to its financial report from its social gaming division: In the first nine months of fiscal 2012, Konami reported its year-on-year gain was driven by social gaming, which generated $348 million in revenue, up $127 million from 2011. Without context, these numbers can seem impressive, but meaningless.

Fortunately, Careen Yapp provided a background for Konami’s finances during an “ask these publishers anything” panel at Gamescom: Last year estimates put Konami as the second-most-prolific social games publisher behind Zynga.

Zynga, the market giant, posted $1.14 billion in revenue for 2011 from social gaming, with $1.07 billion of that in microtransactions alone. This actually translated to a net loss of $404.3 million for Zynga, and its stock continues to remain far below original estimates, along with public perception of the company.

Being No. 2 to Zynga and being in a position to create products other than social games isn’t such a bad spot for Konami to be in. (source:joystiq)

6)The New iPad Is Finally Catching Up In Ad Impressions (According To Velti)

Anthony Ha

Yes, it’s a big day for mobile ad reports, at least at TechCrunch — mobile marketing company Velti just released its report for July.

One of the themes in recent reports has been the relatively slow growth of the new iPad when it comes to ad impression front. In July, however, Apple’s new tablet started to close its gap with the iPad 2 — the older device now accounts for 24 percent of the total tablet impressions tracked, compared to 20 percent for the new iPad. Apple also released the new iPad in China last month, and in the week following, ad impressions from the device increased 150 percent.

Despite that growth, the report also says that for the first time this year, Android took ad marketshare from iOS. The breakdown last month was 58 percent iOS and 42 percent Android, compared to 62-38 in June.

As for ad pricing, Velti says eCPMs fell between June and July, perhaps because of more spending in June as advertisers tried to finish their Q2 budgets. Weather is still the most highly-priced category — the report suggests this may be because of a high frequency of geotargeted ads.

The report is based on data from Velti’s Mobclix Exchange, which supposedly serves ads to more than 33,500 apps. You can read the full report here.(source:techcrunch)

7)Plants vs. Zombies sequel coming in 2013

Stefanie Fogel

Add a Comment TweetShare on printShare on emailShare on diggShare on stumbleuponShare on redditMore Sharing Services The zombies are back! I hope you have a trowel and watering can handy.

Casual video game publisher PopCap Games announced today that it’s working on a sequel to its popular tower defense title Plants vs. Zombies. The original game, which features comic zombie characters attacking a house defended by plants, was a smash hit when it debuted in May 2009. It sold more than 300,000 copies in its first nine days, setting a record for Apple App Store launches.

The sequel will include “a bevy of new features, settings, and situations.” PopCap released no other details about the game at this time, although it did offer up this amusing quote from an unidentified “spokesperson.”

“Spring is crullest curlie ungood time, and plantz grow dull roots. So, we are meating you for brainz at yore house. No worry to skedule schedlue plan… we’re freee anytime. We’ll find you.”

Plants vs. Zombies 2 is expected to launch by late spring.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号