评2011年移动领域十大现象对行业的影响

作者:Jon Jordan

本文主要回顾2011年移动领域十大重要现象,这些现象或预示一个行业走向,或对整个行业的变革产生了不容忽视的影响。

1.亚马逊199美元平板电脑Kindle Fire

在iPad、Xoom、PlayBook、Kindle Fire这四款平板电脑中,亚马逊产品最为平价,售价仅是其他产品的一半左右。

Kindle Fire在美国发售头两个月的收获表明,功能够齐全(足以上网、玩游戏、看视频、听音乐和阅读内容)、价格公道的平板电脑也有极大的市场发展潜力。

令人困惑的是,为何其他平板电脑制造商现在才明白这个道理,他们为何要不遗余力地说服大众以超过iPad的价格,购买性能不及iPad的摩托罗拉、RIM、惠普、索尼、华硕等平板电脑产品。

很显然,包括苹果在内的公司将在2012年瞄准300美元以下的平板电脑市场,为大众用户推出更多此类物美价廉的产品。

与此同时,亚马逊能否顺利与开发者打交道,为其平板电脑提供更多数字内容,这一点值得人们关注。

2.苹果“限制”奖励安装下载行为

尽管苹果在4月份推出的这一举措影响犹存,但苹果却从未发布官方声明,旗帜鲜明地指出公司禁止以奖励手段推高应用下载量的行为。

用“禁止”一词似乎也并不妥当,因为有不少使用该策略但并未更新内容的iOS应用及游戏仍未被App Store移除,而“苹果不推荐使用奖励下载模式”似乎也未必是合适的说法,因为苹果确实采取了相应举措控制这种行为。

这个事件如此瞩目的原因在于,它打击了Tapjoy、Flurry、W3i、Fiksu等依此模式创收的服务供应商,导致后者不得不另辟蹊径,以免触犯iOS的限制政策;它也让那些非付费(通过奖励安装模式获得虚拟货币)游戏玩家、希望开辟更多创收渠道的开发者,以及拥有足够资金“收买”用户的发行商因此而受挫。

Tapjoy为应对苹果政策而率先推出自己的解决方案App Marketplace(游戏邦注:该服务支持用户通过观看广告或与广告内容进行互动而赢取虚拟货币),Fiksu也效法推出了自己的对策FreeMyApps。

其他公司也相继调整了自己的奖励下载模式,例如Flurry、AdColony就通过让玩家观看广告视频等途径,下载自己想要的应用程序。

许多开发商也采纳了这种机制,鼓励玩家通过在iTunes为游戏发表评论,在Facebook“赞”一下游戏,或者上Tweet“推”一下游戏以赢取虚拟货币。

值得一提的是,我们从中可以看出即使是强大如苹果的公司,也无法与人们渴求“免费”产品的心理相抗衡。

3.Rovio公司影响力持续高涨

《愤怒的小鸟》在2011年11月突破了5亿次下载大关,在圣诞节当天就创造了650万次下载量。

对于一家在两年半以前曾濒临破产的公司来说,Rovio仅靠《愤怒的小鸟》就能一网打尽的经历的确是一个神话。

当然也有人质疑《愤怒的小鸟》现象只是一时的热潮,但这并不意味着Rovio无法推出可持续发展的运营模式。

更重要的是,有许多公司也开始走Rovio路线,Storm8在2011年下载量也突破了2亿次,Outfit 7的Talking Friends系列应用同样如此,Backflip Studios现在下载量超过1.5亿次,而Halfbrick仅《水果忍者》一款游戏就超过了1亿次下载量。

《愤怒的小鸟》和Rovio现象均表明,移动领域打破了传统游戏产业格局。

4.《蓝精灵村庄》促使iTunes调整IAP交易设置

尽管免费增值模式问世已有多年,但该模式进入隐私安全漏洞频现的移动设备领域,总会带来不少问题。

由于许多孩子使用家长的iTunes帐户在《蓝精灵村庄》购买大量游戏虚拟货币,导致家长投诉并退款的事件频频发生,游戏发行商Capcom因这款游戏而备受谴责,而苹果则调整了其IAP支付机制,导致现在的用户在下载应用和执行IAP交易时都需要分别输入密码。

5.Zynga终于落实IPO

在2011年5月业内就已盛传Zynga将进行IPO的说法。但比较令人意外的是,尽管当前世界经济不景气,Zynga仍在2011年底前实现了这一计划(其目前股价低于原先的10美元定价)。

Zynga上市成为焦点的原因如下:

首先,作为上市企业的Zynga今后每隔三个月就得公布财报数据,而这些信息有助于人们预测Facebook平台免费游戏的发展前景,并观察Zynga在移动领域的扩张策略。

其次,Zynga上市后拥有更多资金开拓市场并扩大影响力,据称该公司之前曾有意收购PopCap和Rovio,这种情况不禁令人联想,谁会成为下一个Zynga收购对象?

最后,这次IPO为Zynga投资者及拥有期权的员工再度筹到巨款,有利于他们向外部初创企业投资,或参与大型公司的融资活动。

这三个因素将给2012年的手机游戏行业带来广泛影响。

6.乔布斯病逝

得益于现代医学技术,乔布斯才能够坚持与病魔抗争多年直到2011年才倒下。这位将苹果培养成全球最有价值和最受尊重企业的伟人谢世,将对整个行业造成长期影响,至少对苹果来说是如此。

7.任天堂3DS设备降价40%

任天堂于2011年春季推出的3DS设备在发售首月市场行情尚且可观,但由于缺少能够与之匹配的软件内容,加上网页及手机平台的低价竞争压力,3DS随后开始持续失势。

尽管其竞争对手索尼一直致力于抓住新的便携式游戏发展机遇,但任天堂却依然故我,始终与手机游戏领域绝缘。

该公司CEO岩田聪在2011年的多个场合中表现出了这种抵触立场,一方面宣称Facebook或GREE游戏用户同时也是DS游戏玩家,另一方面又声称开发智能手机游戏是有违任天堂原则的做法。

从该公司首个财报亏损,以及3DS削价出售的情况来看,任天堂在2012年还将遭遇投资者进一步施压。

8.Storm8游戏单天IAP营收达100万美元

单天就创造100万美元IAP营收无疑是游戏高下载量的结果,数以千万的用户在玩智能手机游戏,当然也就容易为游戏创造大量收益。

不过像Storm8这种成立不足两年,就敢于公开自己在促销下载高峰期实现100万美元IAP营收的公司并不多见,这种迹象也显示了免费增值模式在2011年惊人的爆发力。

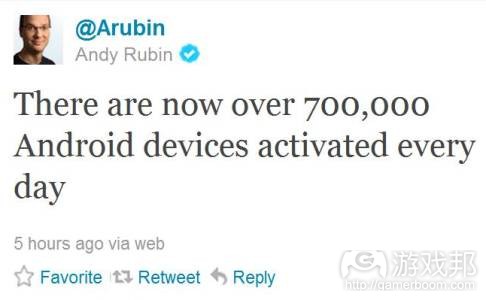

9.Android设备每日激活量达70万次

这是谷歌高管Andy Rubin通过Twitter发布的消息,分析师也许可利用这个不甚准确的数据预测Android设备未来趋势和发展潜力。2011年无疑是Android运势高涨的年份,该平台不但在移动设备数量上打败苹果iOS,甚至是每日应用下载量也超越了iOS。

谷歌和苹果这两大巨头已将其他竞争者远远甩在后头,这两者的激烈角逐甚至足以令人忽略在此领域排名第三的公司。

10.webOS、摩托罗拉、RIM在平板电脑市场失势

惠普原本打算在2011年靠基于webOS操作系统(游戏邦注:这是该公司以12亿美元收购Palm时所获资产)的智能手机及平板电脑在移动领域施展拳脚,RIM也有意以其首款平板电脑设备实现抱负,Motorola Mobility则寄希望于摆脱母公司Motorola Solutions这个累赘之后能够更有作为,并推出有望打败iPad的平板电脑。

但随后的结果却与预期截然相反,这三者在2011年运势不济,甚至可以说是今不如昔。

惠普就是最明显的典型,它不得不在2011年甩掉智能手机业务,使webOS沦为一个开源项目,而且很难在平板电脑市场复兴。

摩托罗拉的情况略好,至少能够以125亿美元出售给谷歌,但其中期发展前途仍未明朗,它的手机和Xoom平板电脑也并没有获得商业上的成功。

RIM的处境则明显不容乐观,它究竟将走向何方仍然有待观望。

当然也有其他公司在2011年也是如履薄冰,例如戴尔、LG和宏碁,即使是成功推出Transformer平板电脑的华硕也不例外。

从移动设备市场来看,苹果和三星才是2011年最大赢家,其他公司在2012年若不迎头赶上,就有可能步此后尘。诺基亚和HTC需提高警惕。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

The 10 most significant events of 2011

by Jon Jordan

In an environment of 24 hour news channels, websites, blogs and RSS feeds, it’s a truism to say there’s always news.

The truth, however, is that while there’s plenty happening, fewer events change the things we do and the way we view the world.

For example, during 2011, we wrote a lot about iPhone 5 rumours and tied ourselves into knots trying to understand myriad lawsuits, ranging from feuding OEMs to pure play patent trolling. Was anything of substance concluded from those cases?

So, instead, let’s take a look back at 10 of the most significant events from the past 12 months; events that either highlighted a key trend or that themselves changed the industry.

1 $199 Kindle Fire

Of my four tablets – iPad, Xoom, PlayBook – Amazon’s Kindle Fire is far-and-away the least nice and least used. But that’s fine because it’s the cheapest, being less than half the price of the others.

And as the massive success of the device in the two months since it’s been available in the US demonstrates, price and ‘good enough’ functionality are sufficient to enthuse a large market that’s interested in a cheap tablet which is okay at web browsing, games, video playable, music and reading.

Quite why it took tablet makers so long to realise this is something of a mystery; one that’s put into focus by their numerous attempts to persuade the public to spend more than the cost of an iPad for less than an iPad’s functionality – Motorola, RIM, HP, Sony, Asus etc please note.

Clearly 2012 will see everyone – perhaps even Apple – focusing on the sub-$300 price point for tablets, with – no doubt – some very interesting results.

Meanwhile, we await to see how Amazon deals with developer relations and the retailing of digital content, as it also continues to expand its family of devices.

2. Apple ‘bans’ incentivised downloads; industry works around it

Considering it’s the story that keeps on giving, it’s remarkable that Apple hasn’t made any official statement about its decision in April to start rejecting app updates that used offerwalls to exchange in-game currency for downloads.

Indeed, even use of the word ‘ban’ isn’t strictly correct as iOS apps and games that used the model but weren’t updated continued to be available on the App Store; a lucrative source of income for their developers for months. ‘Apple deprecated incentivised downloads’ isn’t such as good headline, though.

Still, the reason this story is so significant is the way companies such as Tapjoy, Flurry, W3i and Fiksu have worked throughout the year to get around the restriction on iOS [Android is open of course], so important are incentivised downloads to players who can’t or don’t want to pay, developers who want to generate revenue, and publisher who have the cash to buy users.

Tapjoy – which was the prime mover of the original scheme – has done this most elegantly with what it calls the Tapjoy Personal App Marketplace, something Fiksu has mirrored with its FreeMyApps.

Other companies have tweaked the action that’s incentivised, with Flurry, AdColony and others employing it to get players to watch video, also giving them the opportunity to download apps if they so desire.

More generally, many developers have incorporate the mechanism, encouraging their players to review the game on iTunes, like it on Facebook or tweet – all actions rewarded with in-game currency.

Bottomline is that even Apple can’t fight against the desire to get something for ‘free’, especially if it’s ‘money’.

3. The rise and rise of Rovio

Hard to recall now, but it wasn’t until March that Angry Birds notched up 100 million downloads, with the pace accelerating past the 500 million mark by November. On Christmas Day 2011, 6.5 million Angry Birds games were downloaded.

It’s a remarkable story, particularly for a company that was going bust two and a half years ago, and since then has released just three titles, all within the same franchise.

Of course, there are elements of a fad, but that doesn’t mean that a sustainable business won’t emerge – and be acquired by one of the big media outfits once Rovio’s insane valuation bubble pops.

More significant, however, is that many companies have followed Rovio’s path, if without such headlines and to such heights.

As already discussed, Storm8 passed the 200 million game download mark in 2011, as did Outfit 7 with its Talking Friends apps. Backflip Studios is now over 150 million downloads, while Halfbrick has done over 100 million downloads of Fruit Ninja alone.

So while many journalists and developers now struggle to muster much enthusiasm for Rovio or Angry Birds, we should remember its success is a reflection of the entire mobile industry’s disruptive march over traditional gaming.

4. Smurfberries and Apple’s iTunes IAP tweak

While the free-to-play model has been around for years, bringing it to devices that open personal security loopholes due to their portability – notably parents handling them to their children – was always going to cause problems.

Perhaps Capcom was unlucky it took much of the flack via its Smurfs’ Village game when there were many other well documented cases of children unwittingly spending large sums on in-game virtual goods through their parents’ iTunes accounts.

Equally, as a very popular game using a child-friendly licence, it wasn’t a surprise Capcom was fingered when news broke that Apple was considering tweaking its in-app purchase mechanism because of the number of refunds being demanded by parents.

The result was logical; users now have to enter their password separately for app downloads and in-app purchases, although the 15 minute time-out window between password prompts remains in place.

It remains to be seen how forces outside the industry – notably governmental or financial – will deal with other issues, such as the regulating the amount of money that can be spent in single transactions and/or periods of time.

5. Zynga finally IPOs

Given its tremendous growth, it was hardly a surprise when rumours started to leak in May that Facebook gaming giant Zynga was considering filing for IPO.

Given the declining world economic conditions, it was more of a surprise that it managed to complete its plan before the end of the year, even if the shares currently remain worth less than their $10 float price.

Put this way, it doesn’t sound very significant, but there are good reasons why this is the case.

The first is Zynga now has to release its financial figures every three months, providing transparency of freemium gaming trends on Facebook and, more interestingly for us, mobile – onto which Zynga is aggressively expanding.

Secondly, the company has another massive pile of cash to add to its existing $1 billion-odd warchest. Given it’s already attempted to buy PopCap and Rovio, we wonder who will be next?

Finally, the IPO also refinances the company’s corporate investors as well as funding individual employees (dependant on option price), enabling them to go out and reinvest in new start ups or participate in large funding rounds for existing companies.

All three are excellent for the mobile games industry in 2012.

6. Steve Jobs dies at 56

Depending on your point of view, the death of a billionaire who had been seriously ill for a number of years might be better viewed as a demonstration of the power of medical science rather than a shock that turned the technology business upside down.

There’s little doubt, however, that the loss of the key figure behind the transformation of Apple into the most valuable and most highly regarded company in the world will have longterm significance, at least for Apple.

Perhaps, in time, it will view games in a more positive light.

7. Nintendo slashes 3DS price by 40 percent

While start ups such as Storm8 are ringing the sales bell, veteran game company Nintendo is getting its first taste of the bitter dregs of failure for years.

Launched in the spring, the 3DS did okay for the first month but then stalled due to a lack of software, concerns over its 3DS graphics, and wider pressure from cheap gaming on web and mobile platforms, as sort-of demonstrated by research from companies such as Flurry.

Yet, while rival Sony – for all its problems – is at least attempting to get to grips with the new world order in portable gaming, Nintendo remains steadfast against mobile gaming.

On numerous occasions during 2011, CEO Satoru Iwata took defensive positions, on one hand claiming people who play on Facebook or GREE also play more on DS, while conversely arguing that ‘Nintendo would cease to be Nintendo’ if it started to develop games for smartphones.

Still, with the company posted its first financial losses ever, and having to cut the price of the just launched 3DS to kickstart unit sales (plus the cost of launching the Wii U in 2012), it’s likely that Nintendo will come under more pressure from investors in 2012.

8. Storm8′s $1 million revenue day

On one level, generating $1 million in a single day through in-app purchases is just another result of the law of big numbers.

There are hundreds of millions of people playing games on their smartphones, meaning the daily revenue through the various billing mechanisms will be tens of millions of dollars.

Still, the fact that a fairly unknown company less than two years old was the first to publicly announce the landmark – even admitting it was a manipulated peak because of pricing promotion – was significant, at least in terms of highlighting the wider explosion in the freemium business in 2011.

9. Google’s Rubin reveals daily Android activations up to 700,000

What does it mean that Google is activating 700,000 Android devices per day?

In abstract terms, it’s useful as analysts take such imprecise figures (it’s from a tweet!) and construct graphs of activations over time and discuss platform momentum and the like. But in absolute terms, it’s just a massive install base number that accumulates to an even bigger number each day.

In that regard, 2011 was certainly the year of Android, with the platform overcoming iOS’ lead in terms of number of devices, and more importantly, overtaking iOS in terms of daily app downloads as well.

Together, these two companies are so far ahead of the rest in terms of consumer market share that you have to wonder whether third place is actually worth bothering about.

10. 20 months from its $1.2 billion deal, webOS was dead open sourced (and other stories of corporate malaise)

HP entered 2011 raring to release its smartphones and tablets based on the webOS platform it had acquired via its $1.2 billion acquisition of Palm.

Similarly, RIM had posted record numbers in terms of its financials, shipped devices and subscribers, and was planning for success with its first tablet device. Motorola Mobility was looking forward to life separate from the drag of its enterprise parent, again with plans for an iPad-beating tablet.

But demonstrating how quickly things can turn and bite you in the ass in the mobile world if you’re not laser focused, all three ended the year in much reduced circumstances.

HP was the clearest example, even if webOS eventually proved to be a minor part of its troubles as CEO Léo Apotheker contrived to thoroughly confuse investors and analysts with his strategic plan for the company. It ended the year having dropped its smartphone business, kicking webOS into the long grass as an open source project, and very unlikely to be a force in the tablet market anytime soon.

Motorola is in a better situation, following its $12.5 billion acquisition by Google, but its medium term future remains uncertain, following the relative commercial failure of its phones and Xoom tablets.

Then there’s RIM, about which we can only wait and see. It surely can’t get any worse, can it?

Of course, there were plenty of other companies that bumped along the bottom, notably Dell, LG and Acer. Even Asus, which gained headlines with its Transformer line of tablets, gained little real traction.

The bottomline was that Apple, and to some degree Samsung, chewed up the competition in 2011, and unless companies get very serious, it’s likely to happen again in 2012. Nokia and HTC take note.(source:pocketgamer)

闽公网安备35020302001549号

闽公网安备35020302001549号