每日观察:关注Zynga估值降为70亿美元等消息(12.3)

1)东京社交游戏开发商gloops最近宣布将于本月在美国旧金山、越南胡志明市成立新工作室,该公司目前共有200名成员,不久前刚向Facebook平台智能手机版本投放英文社交游戏《Legend Cards》。

2)据Fusible报道,从时代华纳在11月29日注册的一系列域名可以推测该公司可能已投入开发一款根据卡通题材改制的在线游戏《Looney Tunes Cartoon Universe》。

该公司注册的域名包括CartoonUniversegame.com,Playtheuniverse.com和Looneytunescu.com,本周注册的其他域名包括Toontokens.com和Wbcash.com,由此可推测这款游戏可能会采用类似于Toon Tokens的游戏内置付费功能。

观察者称目前尚无法得知这款游戏将投放到哪个平台,但《Looney Tunes》动画片系列锁定的是成人用户,而Facebook玩家主力军也正是成人群体,再加上时代华纳竞争对手迪士尼早已通过Playdom进军Facebook游戏市场,因此不排除这款游戏登陆Facebook的可能。

3)gumi公司(日本最大的第三方社交游戏开发商之一)近日在公司网站公布其虚拟道具销售情况,指出公司最近在一天内就通过虚拟商品交易创收1亿日元(约合130万美元)。GREE公司是gumi投资者,后者有数款游戏居于GREE热门游戏前20名榜单。

4)Lazard Capital Markets最近发布的一份报告显示,Facebook游戏领域的竞争压力并没有减少,而是比以往更为激烈。

报告指出EA、Zynga等早有建树的大型开发商仍然占有优势,该平台用户获取成本上升只会让这类已坐拥庞大用户群体的公司受益,新兴开发商将面临更严峻的挑战。

Lazard报告主要内容包括:

*Facebook游戏用户获取成本上升,该平台病毒传播效能下降;

*由于用户对游戏认知度的提高,逐渐开始适应虚拟商品交易,Facebook游戏盈利性正在提高;

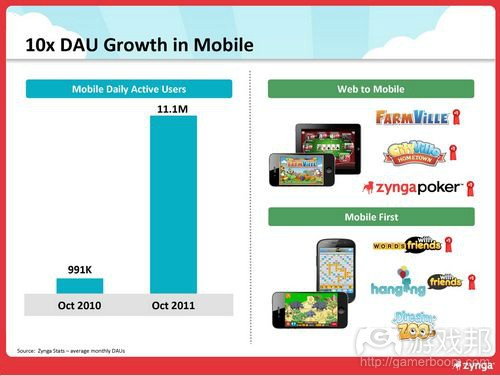

*由于这个平台竞争加剧,开发商已发现找到细分市场(例如锁定女性玩家或硬核游戏群体),或者拓展手机等其他平台的市场才是发展出路;

*由于用户终身价值较高,加上竞争对手相对较少,Facebook硬核游戏利润比较高;

*手机社交游戏由于发展相对迅速,粘性和盈利性较为可观,所以目前利润也较为理想;

*移动设备上的游戏曝光度仍然很成问题,这或许可为移动游戏平台创造发展机会;

*跨平台游戏才有可能实现长远发展。

5)日本社交游戏平台GREE创始人及首席执行官Yoshikazu Tanaka在最近的媒体采访中表示,GREE多数营收来自日本用户,他们希望以任天堂为榜样,收获大规模的全球用户。

但他并不满足于效仿任天堂,他预计未来5年内,GREE在西方营收将是在亚洲市场的4-5倍,并希望GREE品牌至少能够赶超任天堂。

6)数字商品营销技术公司Ifeelgoods最近根据其客户的Credits使用情况,列出了Facebook Credits用户最喜欢的电影、电视、音乐、美食、零售商、产品和服务、游戏等内容的排行榜单(游戏邦注:Ifeelgoods的女性用户比例高达69%,而整个Facebook平台的女性用户比例为49%)。

在游戏这个类型中,排名第一的是《FarmVille》,第二名为《FrontierVille》,第三名《Family Feud》、第四名《CityVille》、第五名《Games》、第六名《PetVille》、第七名《YoVille》、第八名《Café World》、第九名《Treasure Isle》、第十名《The Price Is Right Game》。

7)据Zynga最新修订的SEC文件显示,该公司将通过IPO筹资11.5亿美元(将比原先计划的100亿美元多1500万美元),公司估值介于59-70亿美元,将于12月12日进行IPO。

据venturebeat报道,其竞争对手EA目前市值为77亿美元,大型发行商动视暴雪身价为140亿美元。

Zynga首席执行官Mark Pincus并不打算出售自己的股份,在公司IPO之后,他将享有公司36%的表决权。

根据AppData数据,Zynga目前的MAU为2.15亿,而7月份时的这一数据则是2.32亿。

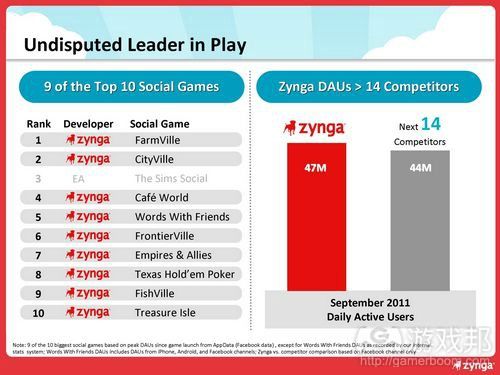

Zynga称公司旗下游戏的每日活跃用户超过排在其后的14家社交游戏开发商的总和,截止今年9月30日,Zynga第三季度净收益为1250万美元,比去年同期的2700万减少54%。其第三季度总营收为3.07亿美元,同比去年的1.706亿美元增长80%。

8)针对Zynga估值从原来的200亿美元缩减为不足100亿美元的现象,venturebeat日前分析称这主要是受到6个原因的影响:

*金融环境:目前的世界经济形势,以及欧洲的经济恐慌表明,现在并非进行大规模IPO的最佳时机;

*用户及利润下滑:Zynga游戏MAU已从7月份的2.32亿下滑至目前的2.15亿,尽管营收大幅增长,但用于用户获取成本上升,以及社交游戏市场竞争加剧,Zynga利润已经出现下滑趋势;

*核心人员离职:Zynga前首席商务官Own Van Natta最近已离岗(但仍是Zynga董事会成员),核心成员走出的现象会影响投资者对Zynga的信心;

*竞争加剧:例如EA于8月份发布的《模拟人生社交版》就在短时间内迅速聚集人气,直逼Zynga头牌游戏《FarmVille》。尽管Zynga仍是Facebook最有影响力的游戏开发商,但已难恢复《模拟人生社交版》问世前的光芒;

*不良口碑:Zynga在上市之前的媒体公关工作不到位,频频传出公司的负面消息。其中最具危害性的是《纽约时报》最近针对Zynga将收回员工期权的报道,此外,Zynga未能如愿收购PopCap和Rovio的传闻也给公司带来了消极影响。

*Zynga从来就“不值”200亿美元:观察者称,假如Zynga市值果真达到200亿美元,那么它就会成为华尔街身价最高的前200名公司之一,堪比食品行业巨头Kellogg。而这个估值几乎是Zynga今年夏天收益的46倍,远超过其他大型电子游戏公司的市值,例如动视暴雪(超过6倍)、EA(超过11倍)和Take-Two(超过8倍)。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)gloops Opens Offices In The US And Vietnam [Social Games]

by Dr. Serkan Toto

Major Tokyo-based social game provider (and DeNA partner) gloops has announced the establishment of two offices outside Japan. The company is currently operating some very successful mobile social games on Mobage in Japan.

gloops International is located in San Francisco, while the Vietnam office will be opened in Ho Chi Minh City within this month. gloops proper is currently employing 200 people.

The company just published their first mobile social game in English, Legend Cards, on Facebook for smartphones.(source:serkantoto)

2)Bugs Bunny, Daffy Duck and that red thing just might get a social game

by Joe Osborne

You know, that thing that looks like a walking, furry Valentine? Wait, that thing has a name, and it’s “Gossamer?” (What kind of name is that?) Anyway, Fusible has tracked down a lengthy list of domain names registered by Warner Bros. Entertainment on Nov. 29, nearly all of which seeming to refer to an online game that could be in the works: Looney Tunes Cartoon Universe.

Of course, the game could be named anything. But it’s a safe guess for now that domains like “CartoonUniversegame.com”, “Playtheuniverse.com” and “Looneytunescu.com,” refer to a game titled at least similarly to that. There are other domains that WB registered this week, like “Toontokens.com” and “Wbcash.com”, that suggest the game would be supported by in-game purchases using a currency like Toon Tokens.

A Looney Tunes Cartoon Universe game would make a whole lot of sense both on Facebook and elsewhere. Disney is arguably WB’s biggest competitor, and the company has already stated plans for its cast of characters to enter Facebook games through developer Playdom. The company has even release a console game titled “Disney Universe.” Perhaps WB is eying up a piece of the same pie.

While this game–if it even is a game–could appear on any platform, it’s also important to consider the audience. Looney Tunes have always been the more mature cartoon troupe, and the majority of Facebook gamers are adults. Who knows, maybe Bugs, Daffy (and Gossamer) can beat Mickey and crew to the punch.(source:games)

3)Social Gaming Company gumi Just Made US$1.3 Million In Revenue – On A Single Day [Social Games]

by Dr. Serkan Toto

One of the biggest third-party social gaming companies in Japan (along Konami, gloops, Klab, etc.) is Tokyo-based gumi. The startup has just posted a pretty unusual and “open” announcement on its website.

According to the release, gumi generated a whopping 100 million Yen in virtual item sales across all its games – on a single day (100 million yen currently translates to US$1.3 million).

GREE is an investor in gumi, which boasts several titles in GREE’s top 20 ranking of the most popular games.(source:serkantoto)

4)Facebook Gaming Market Favors Biggest Players: Report

by David Cohen

Just when you thought the Facebook gaming sector couldn’t get any more competitive, another report comes out saying things have tightened even further.

Lazard Capital Markets released a report based on meetings with a half-dozen privately held social and mobile gaming companies: CrowdStar, Digital Chocolate, Funzio, HeyZap, IGG, and Tapjoy.

The company’s conclusion on established players, such as Zynga and Electronic Arts is:

A toughening landscape bodes well (relatively) for established category leaders (such as Zynga and Electronic Arts) that have built large user bases and seem to enjoy network effects.

We acknowledge that toughening competition on Facebook could constrain margins and is generally negative for the space; however, we believe that rising user acquisition costs could be relatively positive for companies like Zynga and Electronic Arts that have already built large user bases on Facebook and disproportionately benefit from network effect and, therefore, may have an advantage over the newer companies in the space.

Other takeaways from the Lazard report are:

•The competitive landscape for Facebook games seems to be getting tougher, with rising customer acquisition costs and declining virality of the platform.

•Monetization on Facebook games seems to be improving, driven by growing awareness and growing comfort level of users with spending on virtual items.

•Given the tougher competition on Facebook, companies note that they have to either find a niche market (such as female audience, hardcore gaming audience) on Facebook, or look for opportunities to expand on other platforms such as mobile.

•Opportunity for the hardcore games seems lucrative, given a meaningfully higher lifetime value and relatively limited competition in the segment.

•Social-mobile games opportunity also seems lucrative given relatively faster growth, better engagement and monetization metrics, and a relatively level playing field on social-mobile compared with Facebook.

•Discovery remains one of the biggest challenges for games on mobile devices, suggesting opportunity for a game-centric platform on mobile.

•The biggest opportunity for long-term growth is cross-platform games.(source:allfacebook)

5)Watch your back, Nintendo: GREE doesn’t want just a piece of your pie

by Joe Osborne

The Japan-based mobile social games company wants all of it. That’s essentially what the company’s founder and CEO, Yoshikazu Tanaka, told TechCrunch during its Disrupt event in Tokyo recently. The GREE chief told TechCrunch that most of the company’s revenue comes from its Japanese audience, but that it hopes to follow Nintendo’s example in creating a massive global audience.

But Tanaka isn’t happy with just following Nintendo, he looks to displace the veteran games maker. He told the news outlet that he wouldn’t surprised to see GREE’s revenue in the West jump to four to five times of what it is in Asian within the next five years. “We definitely feel positive, and our goal is to make sure our brand is just as successful, if not better than Nintendo.”

Nintendo is infamous for its unwillingness to enter the mobile games market through iOS or Android. While the company does plan to release an iOS version of its eShop (the downloadable games store on the 3DS), it simply refuses to create games for mobile phones. This is despite numerous studies suggesting otherwise and even investors clamoring for Nintendo games on iPhone.

Nintendo did, however, manage to sell more 3DS consoles in its first eight months on the market than the original DS system sold in one year. Perhaps there’s still interest in a handheld device dedicated to gaming, but you could also chalk these immense sales up to the devices’ price cut over the summer and a terribly strong Black Friday. Regardless, the mobile gaming world is after Nintendo, which leaves us wondering whether its stern strategy can withstand the onslaught.(source:games)

6)What Some Facebook Credits Users Like Most

by Jackie Cohen

Clicking like doesn’t cost anything, but money talks, which ought to make a ranking of the preferences of people using Facebook Credits more valuable than tallies of fans.

With that in mind, digital goods marketing technology firm Ifeelgoods ranked its clientele’s Credits usage.

Note that Ifeelgoods’ users skew more female — 69 percent — than what the social network overall has, 49 percent female. This makes a big difference in the rankings, which is why we say “some users” in the headline. That said, read on for some interesting lists.

Games

1. FarmVille

2. FrontierVille

3. Family Feud

4. CityVille

5. Games

6. PetVille

7. YoVille

8. Café World

9. Treasure Isle

10. The Price Is Right Game(source:allfacebook)

7)Zynga confirms plans to raise up to $1.15B at $8.9B valuation and start IPO roadshow

Dean Takahashi

Zynga plans to raise around $850 million to $1.15 billion at a $5.9 billion to $6.99 billion valuation in an initial public offering that will be priced on Dec. 15 and begin trading the next day. Counting options, the value would be $7.6 billion to $8.9 billion.

Finally setting its long-awaited initial public offering in motion, social game maker Zynga has named a price range for its offering and unveiled its investor roadshow pitch for why company executives think it is a good investment. Zynga originally filed to go public in July 1.

Moments ago, Zynga filed new papers with the Securities and Exchange Commission that set the price range for its IPO at $8.50 to $10 a share. The company is reportedly planning to issue 100 million shares (about 14.3 percent of its shares) and go public on Dec. 16. Total shares outstanding after the offering will be 699.3 million. Zynga may issue 15 million more shares than it indicated it would raise when it filed its original papers.

[Update: Zynga has 200 million or so options issued as well, which means that the fully diluted valuation is higher, at $7.6 billion to $8.9 billion. If you add $2 billion in cash, from the $1 billion in the bank and the $1 billion to be raised, then Zynga's value would be more like $9.6 billion to $10.9 billion in terms of the total enterprise value.]

The valuation is much lower than the $15 billion to $20 billion that was rumored as Zynga’s expected valuation when it first filed. By comparison, rival Electronic Arts is valued at $7.7 billion today. And Activision Blizzard is valued at $14 billion. The pricing shows just how volatile market valuations have been.

Mark Pincus, chief executive, isn’t planning on selling any of his own shares. Pincus will control about 36 percent of the voting power of Zynga after the offering is complete.

The price of the offering is subject to change, given that Zynga will now begin a nine-day roadshow to pitch investors about why it is valuable. Still, the expected valuation is below previous estimates. Zynga’s profit growth has slowed and its user numbers have declined. AppData reports that Zynga’s monthly active users are about 215 million, compared with 232 million in July.

Zynga will trade under the stock symbol ZNGA on the Nasdaq stock market. In its offering statement, Zynga said it has 227 million monthly active users and 54 million daily active users. The company’s social games such as CityVille are played 2 billion minutes per day.

Just two weeks ago, the company said a third-party analysis had valued Zynga at $14.05 billion, which is about the same as Activision Blizzard, the largest video game publisher, with four times Zynga’s revenues.

But Zynga is still on top of the Facebook charts. CityVille, which is a year old today, still has 49.7 million monthly active users. And the newly launched CastleVille has more than 20.8 million users, making it one of the fastest, if not the very fastest, growing games in all of history. CastleVille launched just 17 days ago. Zynga said its games are played by more daily users than the next 14 social game developers combined.

Zynga was founded in 2007 and has been riding the wave of Facebook’s growth and the popularity of lightweight social games, which are free to play. In those games, such as FarmVille and CityVille, users play for free and pay real money for virtual goods.

Zynga has made money this year, but its growth slowed in the September quarter. Zynga has already waited a long time for its IPO, but the market window hasn’t been right. Companies such as Groupon and Angie’s List have gone public, but the market has been volatile due to uncertainty in Europe.

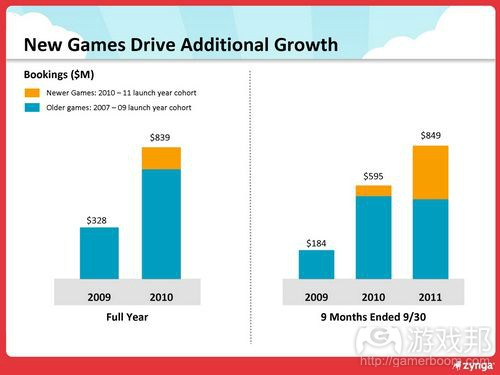

The company reported net income of $12.5 million in the third quarter ended Sept. 30, down 54 percent from $27 million a year ago, according to an updated S1 filing with the Securities and Exchange Commission. The performance isn’t stellar, but it’s not so bad as to suggest Zynga’s planned initial public offering is in trouble.

Revenue was $307 million in the quarter, up 80 percent from $170.6 million a year ago. In other words, Zynga is working harder for the profits it gets by generating a lot more revenue compared to the past.

In the second quarter, Zynga reported only $1.4 million in profits on $280 million in revenue, so the third quarter report is an improvement on a quarter-to-quarter basis.

Pincus closed the video by saying that Zynga is launching more new games than at any time in its history.

“We’re excited and we hope you are too,” he said in closing.(source:venturebeat)