分析5款DAU/MAU高比值Facebook游戏运营表现

作者:James Au

人们总是习惯通过MAU或者DAU数据判断最为成功的Facebook游戏,虽然这两个数据都很重要,但DAU/MAU比值才是衡量一款社交游戏留存率和盈利性的重要参数。本文将分析DAU/MAU比值前5名的Facebook游戏运营现状。

根据Inside Virtual Goods报告所提出的标准,DAU/MAU比值不低于20%的游戏一般都有较强用户留存率和盈利性。最为成功的Facebook游戏不但拥有数百万用户,而且其DAU/MAU通常介于10%至20%之间。也有一些游戏的DAU/MAU比值较高,甚至超过了50%,但总体用户数量却较为有限。不过这并不影响这些游戏大幅创收,否则这些游戏开发商早就可以关闭这些项目以免浪费资源。从这一点上看,被列入本榜单的代表作可以算是高粘性但却较为低调的Facebook游戏。

注:这里排除了过去两个月才刚发布以及MAU不足2万的游戏,那些非游戏用途,或者用于推广其他游戏的产品也不在此列。

《Empire Avenue》——80% DAU/MAU(Empire Avenue公司)

这时一款商业模拟游戏,每个玩家在其中都是一只可以被其他玩家买卖交易的股票,其目标是让玩家通过参与游戏中的活动,或者与其他玩家相关的社交网络活动提升自己的股价。这些功能有助于鼓励玩家追随和关注自己投资的股票。

Empire Avenue副总裁Tom Ohle表示,“除了让玩家从这种投资游戏中获得乐趣,它还可以增加用户在线会面和交流的机会,新人刚来报到时,都会迅速认识其他新人,并发现与自己兴趣相一致的新内容。”

这款游戏通过虚拟货币“Eaves”创收,玩家可使用现金或通过奖励广告获得这些虚拟货币(游戏邦注:玩家还可以在Empire Avenue独立网站上体验这款游戏)。

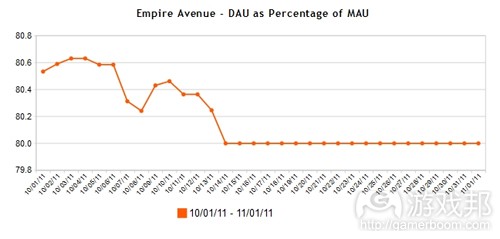

《Empire Avenue》今年初在Facebook平台呈现强劲发展势头,但后来用户数量趋于平缓,目前仅有4万DAU和5万MAU。

Ohle表示他们将为游戏推出更多新功能,今后会更关注扩大新用户规模。这些新功能将包括一个“支持玩家通过与他人的在线内容进行互动,从而赢取虚拟货币”的任务系统。

《無限德州撲克》(英文名:Chinese Poker)——55% DAU/MAU(6Waves Lolapps公司)

它是一款类似Zynga《Texas Hold ‘Em》的中文版扑克游戏,采用了回合制和计时性的多人游戏模式。虽然游戏图标和UI充满中国元素,但玩法却很容易为非中文用户所理解。

据6waves高级副总裁Jim Ying所称,这款游戏之所以收获DAU/MAU高比值,部分要归功于它是首款中文德州扑克游戏。该游戏在去年的MAU呈下滑趋势,但DAU/MAU却是有增无减。

Ying认为,高质量且有一定年龄的游戏DAU/MAU一般都会上升,因为浅尝辄止的玩家最终会退出游戏,只剩下一些更有粘性的玩家持续体验游戏。

《Fairyland》——55% DAU/MAU(Play and Connect Ltd公司)

这款园艺模拟游戏的画面质量尚可,玩法选项较为复杂,它发布于2008年,目前仍有一部分极为忠实的粉丝。玩家在游戏中可处用一系列草木个性化装饰并扩大自己的花园, 通过升级花园以及完成多种迷你任务赢取游戏虚拟货币(也可以用现金或Facebook Credits购买虚拟货币)。

《Fairyland》在2009年末的MAU达80万,但目前已降至11万。与此同时,其DAU/MAU仍在不断上升,从原来的20%涨至现在的55%。由此可见这款游戏尽管已走到其生命周期的第三年,但仍极擅长抓住铁杆用户。该游戏在11月份时添加了“限量版罂粟花”等新内容,其开发商Play and Connect并未对此发表评论。

《Lexulous – Word Game》——52% DAU/MAU(Rajat和Jayant Agarwalla)

该游戏由Rajat和ayant Agarwalla兄弟开发,发布于2007年,是最早表现出强大粘性的Facebook游戏之一。由于玩法和风格与经典桌游戏《Scrabble》极为相似,美泰公司曾要求开发者更改该游戏名称(游戏邦注:Agarwalla推出的另一款游戏《Wordscraper》与《Lexulous》风格相似,但拥有自定义的桌面,DAU/MAU比值也高达50%)。

Jayant Agarwalla称这款游戏DAU/MAU比值较高的原因包括:它支持用户同一时间参与多个挑战,同时还支持异步玩法。另外,游戏还会对很长时间才作出回应的玩家进行惩罚,所以玩家经常会回访游戏继续完成挑战。《Lexulous》还融入了聊天/信息交流功能,有许多Facebook好友将该游戏作为通用的社交联络工具。

该游戏目前通过广告创造,Agarwalla表示游戏的DAU较为稳定,所以能够保证较为可观的每日广告印象,他们计划增加Facebook Credits这个营收渠道。

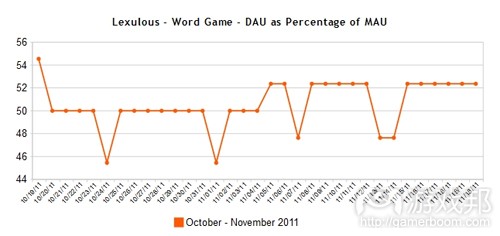

《Lexulous》在过去几个月中的MAU总量正在下降,但DAU/MAU比值仍在上升。Agarwalla有意重新调整游戏以更好地保证新用户留存率。

《Legacy of a Thousand Suns》—— 50% DAU/MAU(5th Planet Games公司)

这款回合制角色扮演游戏拥有极富深度的故事元素,以及高质量的游戏画面,虽然MAU仅为4万,但DAU/MAU比值却很高。5th Planet Games公司首席商务官Braden Moulton表示,由于DAU/MAU比值和游戏社区的玩家粘性都很高,这款游戏为公司创造了大量收益。也正是这因为如此,这款游戏开发团队需考虑新设计方案对玩家社区的影响,才能执行最终决策。

Moulton称这款游戏的DAU平均收益也甚为可观,补充能量/精力以及Expeditions功能(它是一个博弈机制,可助玩家获取梦寐以求的道具)是主要的盈利渠道,并且这些玩家为公会花钱的意愿甚至高于为自己消费。

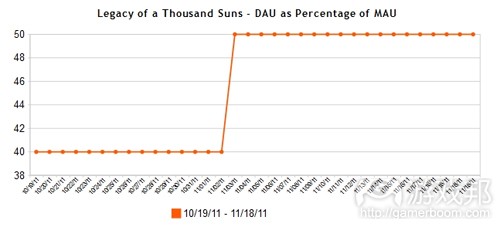

这款游戏在过去6个月中的MAU和DAU均有所下降,但DAU/MAU比值仍在上升。Moulton认为出现这一现象的原因是,游戏刚发布时仅收获6位数的MAU,而非数百万的MAU。他们将在未来的更新内容中,为PVE玩家添加新的游戏区域,为游戏公会添加PvP模式,并希望借此增加总体用户数量。除此之外,该公司还计划在12月份将游戏推向其他主流网站,扩大用户基础。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Facebook’s Top 5 Games by DAU as a Percentage of MAU

James Au

When judging which Facebook games are the most successful, many people look at total monthly active users or daily active users. While both metrics are important, daily active users as a percentage of monthly active users is another relevant metric for ballpark-estimating the retention and monetization rates in social games. Let’s look at the top five games on Facebook by DAU as a percentage of MAU.

As supported by data from Inside Virtual Goods, games with a DAU/MAU of 20% or higher have strong user retention and monetization rates. The most successful Facebook games tend to maintain a DAU/MAU somewhere between 10% and 20%, while also enjoying a large total userbase in the millions. There are a number of games with a far higher DAU/MAU percentage, some even exceeding 50%, but do not enjoy large audiences. Even so, these games are likely still performing well in terms of monetization — otherwise we can assume a developer would eventually sunset the game to save on resources. From that perspective, apps like those on our list could be called Facebook gaming’s hidden gems of high engagement.

[Editor's Note: Games which launched in the last couple months or had fewer than 20,000 monthly active users were excluded. This list also excludes game apps that are actually non-game utilities, extensions, or promotions for other games.]

Empire Avenue – by Empire Avenue: 80% DAU/MAU

A business simulation in which each player becomes a stock that can be bought and sold by other players on a trading exchange, the goal of Empire Avenue is to drive up your Share Price with in-game activity, and activity on social media sites that other players are connected to. This latter feature encourages players to follow and engage with the stocks (i.e. other players) they are invested in.

“So aside from having fun by playing the investment game, it actually enhances how you meet and engage with people online,” says Empire Avenue VP Tom Ohle. “As new people arrive on the site, they’re introduced them to new people quickly, and discover new content that lines up with their own interests.”

The game is monetized with the sale of the in-game currency “Eaves,” which can be purchased with cash or offers. (Empire Avenue is also playable on a standalone website.)

Earlier this year, the game enjoyed strong growth on Facebook, which then plateaued to around its current level of user activity, with 40,000 DAU and 50,000 MAU.

“[W]e’re starting to roll out some more features, which will see us start to focus once more on new-user acquisition,” Ohle says. “It’s just something we haven’t spent a ton of time on lately.” These new features include a mission system “which allows users to earn virtual currency by engaging with other players’ online content.” With additions like that, the company hopes to see user growth return.

無限德州撲克 (Chinese Poker) – by 6Waves Lolapps: 55% DAU/MAU

As the title suggests, Chinese Poker is a Chinese-language poker app similar to such successful apps as Zynga’s Texas Hold ‘Em, with turn-based, timer-driven multiplayer games of poker played around a casino table. While the game icons and UI are in Chinese characters, the gameplay is similar enough to other poker games for non-Chinese users to understand and play

According to Jim Ying, Senior Vice President at 6waves, the game’s high DAU/MAU is due in great part to being among the first poker games in Chinese. In the last year, the game’s total number of MAU has been dropping, as DAU/MAU has risen.

Ying attributes this to the game’s life cycle: “DAU/MAU will naturally rise for high-quality, older games as the people who just try out the game stop playing and you’re left with the ‘stickier’ people who keep playing the game.”

Fairyland – by Play and Connect Ltd: 55% DAU/MAU

A gardening sim with modest graphics and complex gameplay options, Fairyland was launched in 2008 and still maintains a relatively small but very engaged following. Players customize and expand their gardens with a wide array of plants and flower types, and earn in-game gold by leveling up their garden and through various mini-quests. (Gold can also be purchased for cash and Facebook Credits, the game’s most evident monetization channel.)

Fairyland enjoyed a high of 800,000 MAU in late 2009, but has steadily dropped to its present-day traffic of just 110,000 MAU. At the same time, its DAU/MAU rate has risen, going from a low point of under 20%, to nearly 55% now. This is indicative of a game that’s managed to retain a core userbase of very active players, even three years into its life cycle. The game is still being refreshed with new content, such as “Limited Edition Poppies” added to the game’s store in early November. (The developer, Play and Connect, did not respond to request for comment as of press time.)

Lexulous – Word Game – by Rajat and Jayant Agarwalla: 52% DAU/MAU

Created by Rajat and Jayant Agarwalla of Calcutta, Lexulous is a variation of the Agarwalla’s Scrabulous, which was launched in 2007. This was one of the very first Facebook games to show strong engagement rates. Strikingly similar to the classic boardgame Scrabble, a lawsuit from copyright holder Mattel forced the brothers to change the game’s name. (Wordscraper, another Agarwalla game similar to Lexulous, but with customizable playing boards, also has a very high DAU/MAU rate of 50%.)

Jayant Agarwalla says that the game enjoys high engagement for several reasons: Users can play many matches simultaneously, and also play matches asynchronously. At the same time, there is a time penalty for taking too long to make a turn, so players tend to return to the app on a regular basis, to finish ongoing games. In addition, Lexulous has a chat/messaging feature, and Agarwalla says Facebook friends use the game as a context for general socialization.

At the moment, Lexulous is monetized with display ads. “Our DAU count has been pretty consistent, so it’s easier to predict daily ad impressions and thus strike deals with ad networks,” Agarwalla says, adding that they plan to add Facebook Credits as a revenue stream soon.

Over the last few months, the total MAU of Lexulous has been trending down, while DAU/MAU has risen. In the next few weeks, Agarwalla says they will overhaul the game to better attract and retain new users.

Legacy of a Thousand Suns – by 5th Planet Games: 50% DAU/MAU

A turn-based role-playing game with a deep story and high quality game assets, Legacy of a Thousand Suns see a very high DAU/MAU rate with just 40,000 MAU. Even so, 5th Planet Games’ Chief Business Officer Braden Moulton says that the game is very cash flow positive for the company, attributing this and the game’s high engagement levels to the game’s passionate community of users. For this reason, he says any new design decision is weighed against how it will impact this community.

As a consequence, says Moulton, the game has strong ARPDAUs. Stamina/energy refills and Expeditions (a gambling mechanic players use to acquire coveted in-game items) enjoy high monetization rates. However, Moulton says players are more likely to spend money helping their in-game guild, than themselves.

In the last six months, MAU and DAU for Legacy have been dropping slowly while DAU/MAU has been rising. Moulton attributes this to the game’s relatively modest launch numbers in the six figures, as opposed to millions. In future upgrades, the game will add new zones for PVE players, and a PvP mode for the game’s guilds, called “Alliance vs. Alliance.” This may increase total users. In addition, the company plans to deploy the game on other major networks in December, which may boost Legacy of a Thousand Suns’ overall userbase.(source:insidesocialgames)

下一篇:社交游戏并非传统游戏时代的终结者

闽公网安备35020302001549号

闽公网安备35020302001549号