每日观察:关注7月份Millennial智能手机广告印象(8.25)

1)微软日前宣布其手机应用商店Windows Marketplace目前应用数量已达3万款(游戏邦注:今年4月的应用数量为1万1500款)。该公司近日还向webOS应用开发者示好,鼓励后者转战WP7平台,Windows Phone Makretplace也已在本周一开始接受开发者提交的Mango应用审核申请。

2)美国手机游戏发行商Gameview日前为《Tap Fish》这款游戏添加了Android动态壁纸的功能,支持用户在无需访问游戏的情况下,直接从手机主界面查看自己的虚拟鱼缸,这一功能让该游戏晋升为Android Market游戏类动态壁纸排榜之首。

Gameview目前已并入DeNA麾下,其联合创始人Riz Virk表示,许多开发者认为Android并不像iOS那样容易创收,但Gameview游戏的盈利性却与iOS版本不相上下,《Tap Fish》目前在Android平台安装量已超过500万次,MAU也达到200万。

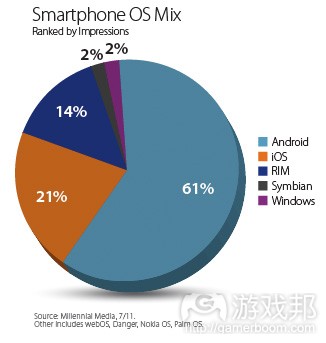

3)移动广告平台Millennial Media发布的7月份报告表明,Android以61%的广告印象连续8个月称雄智能手机操作系统,所占份额比上月增长15%(游戏邦注:以下所有数据仅适用于Millennial Media平台)。

iOS在该平台的广告印象为21%,其次是占14%比例的RIM,Symbian和Windows分别仅占2%,值得注意的是Windows Phone 7却比上个月增长了71%。

在手机应用领域的广告印象中,Android应用的广告印象占据48%份额,其次是占43%份额的iOS(同比上月增长5%)。在应用广告印象中,游戏仍是最大支柱,其广告印象月增长率达35%,占所有应用广告印象的29%。

其次是音乐和娱乐应用、社交网络。健康应用排名第7,其广告印象月增长率达13%。

从移动设备来看,苹果iPhone所占广告印象居于榜首,其次是采用Android操作系统的三星Nexus S,再次是黑莓Curve和摩托罗拉Droid。

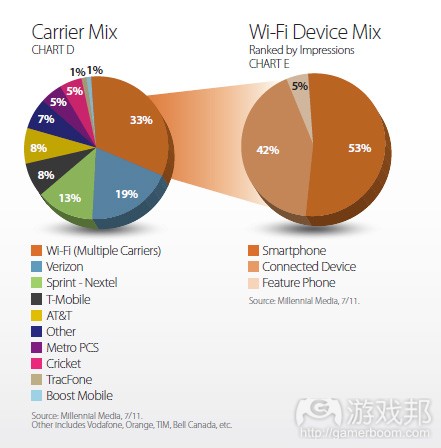

在7月份,33%的广告印象来自多家运营商供应的Wi-Fi网络,其中威瑞森占19%,Sprint-Nextel占13%。

4)手机社交游戏平台木瓜移动日前发布数据指出,木瓜移动注册用户已超过2500万,其他相关数据还包括:

·使用木瓜虚拟货币的付费交易已超过1100万笔;

·每5名用户中就有1人使用木瓜游戏引擎社交游戏中购买其虚拟货币;

·该平台的ARPPU(每付费用户平均收益)是22.6美元/月;

·所有采用木瓜游戏引擎的游戏ARPPU平均值超过10美元/月;

·该平台每款热门游戏平均收益超过2万美元/月(游戏邦注:这里指那些跻身Android平台休闲、街机&动作类游戏前100名榜单的热门游戏);

该公司开发者关系主管Paul Chen还分析了其日本竞争对手Mobage相关游戏表现,指出Mobage登陆中美市场四周后的游戏安装量并不乐观,并举例称《口袋青蛙》、《丢纸团》、《Haypi Kingdom》等多款iOS热门游戏,在Mobage平台的安装量均不足5万次。

5)中国iOS开发者社区及游戏开发商CocoaChina在日前的第二轮融资中筹得1400万美元,其支持者包括红杉资本中国、迪士尼的Steamboat Ventures、北极光创投(游戏邦注:CocoaChinaA轮融资数额为120万美元,支持者是北极光创投)。

该公司代表作是《Fishing Joy》,在Android和iOS平台发布4月个共收获1000万用户,跻身中国手机游戏营收前50名排行榜,且是美国排名前50的免费游戏。

6)手机游戏公司Pocket Gems宣布《Tap Petshop》成为公司第三个跻身美国营收前15名游戏榜单的作品(游戏邦注:该公司之前有三款游戏位列前10名,但《Tap Zoo》、《Tao Petshop》近日排名有所下滑)。

该公司团队今年创立之初仅有10名成员,但目前已超过60人。据称排在营收榜单前15名的游戏,每月营收一般都超过100万美元,甚至可能高达300万美元,由此可以推测Pocket Gems这三款游戏已为其创造不少收益。该公司游戏上月下载量已达4000万次。

7)休闲游戏公司PopCap Games日前宣布向iPad平台推出《Peggle》高清版本。这款游戏在2007年3月发布后,已在PC平台实现3000万次下载量,现将以2.99美元售价登陆App Store。该版本支持Game Center功能,在促销期间,玩家可以花费0.99美元购买游戏中的拓展内容Peggle Nights,促销结束后该拓展内容将恢复4.99和1.99美元售价。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

1)Windows Marketplace hits 30,000 apps

by Tim Green

Microsoft will be pleased with the hike, but aware that its a long old way from iOS and Android, which count 425,000 and 250,000 respectively.

These are interesting times for the WinPho 7 platform, which has struggled to establish itself in the face of competition from the aforementioned OSs, and from RIM.

However, it’s currently wooing cast-adrift webOS developers, looking ahead to the first Nokia WinPho and preparing for its souped-up Mango upgrade and devices.

Indeed, on Monday, Microsoft opened up Windows Phone Marketplace to accept developers’ Mango app submissions.(source:mobile-ent)

2)Gameview turns Tap Fish game into chart-topping Android live wallpaper

by Stuart Dredge

Lets users check their virtual fish tanks without starting up the game itself.

US mobile games publisher Gameview is topping the Android charts, but not in the category you might expect.

The company has added a new feature to its Tap Fish game that supports Android’s live wallpaper feature. Users can check their virtual fish tanks from their phone’s homescreen, without having to load the actual game. The introduction of the new feature rocketed Tap Fish to top spot in the Live Wallpaper category in Android Market’s games section.

Gameview – now owned by Japanese mobile social games giant DeNA – is one of the more positive developers when it comes to Google-powered smartphones. “Android as a platform is chock full of really innovative features for developers to integrate into their apps, and live wallpaper is a perfect example,” says co-founder Riz Virk.

“Many developers complain that Android only monetizes at a small fraction of their games on iOS, but that’s not what we see. Our Android games monetize almost on par with our iOS games, and as we focus on building out cool new features like live wallpaper, we expect usage, engagement and revenues on the Android platform to continue to climb.”

Tap Fish has so far notched up more than five million installs on Android, with two million monthly active users.(source:mobile-ent)

3)Report: Android Impressions Grow 15% Month-Over-Month, Games Increase 35%

By Christopher Mack

Though the Apple iPhone remains the top device, based on impressions, the iOS is second, once again, to Android. Mobile ad network Millennial Media released its July Mobile Mix Report, and the Android operating system grew 15 percent month-over-month in terms of smartphone impressions with 61 percent. This is the eighth month in a row that Android has been on top.

According to Millennial, iOS held 21 percent of smartphone impressions, followed by RIM at 14 percent. Behind them were Symbian and Windows at 2 percent each. Interestingly enough, however, Windows Phone 7 actually grew significantly this past month with a global month-over-month growth of 71 percent.

Despite Android holding significantly more OS impressions than iOS, the ad spend difference from applications between the two was not as great. While Android was still highest, with 48 percent coming from Android apps, iOS was just behind it with 43 percent (a 5 percent month-over-month growth).

Of all app impressions, games continue to be the highest contributors and have been so for the past year. They continue to grow and actually increased in impressions, month-over-month, by 35 percent to make up 29 percent of total application impressions. Behind games was music and entertainment followed by mobile social networking. Health and fitness apps were also highlighted with a 13 percent month-over-month growth, though they are ranked at #7.

In terms of device breakdown, and following the Apple iPhone, Millennial Media reports that the #2 handset is the Android-powered Samsung Nexus S (Samsung as a manufacturer actually grew 28 percent as a whole), followed by the BlackBerry Curve and the Motorola Droid.

Millennial also added a new set of metrics, reporting on Wi-Fi impressions. In July, the majority — 33 percent — of impressions came from Wi-Fi (multiple carriers) connections. Regarding carriers, however, Verizon held 19 percent followed by Sprint – Nextel at 13 percent.(source:insidemobileapps)

4)PapayaMobile Reaches 25M Registered Users, Takes Jabs At DeNA’s Mobage

By Kim-Mai Cutler

PapayaMobile, the Android-focused mobile-social gaming network, said today that it passed 25 million registered users and released a host of statistics to show developers that it can help them monetize and distribute their titles.

As Android’s momentum in activations and recently launched in-app billing system make it a more financially viable platform for developers, we’re in a landgrab period where PapayaMobile, DeNA’s Mobage, GREE’s OpenFeint and others are trying to sign up gaming companies as quickly as possible to create network effects.

More games means more power to drive installs, sell virtual currency and earn more revenue. But there are also giants lurking in the background too. It’s not clear how Google intends to integrate Google+ into Android or how well Facebook’s HTML5 platform efforts will fare.

Here’s the simple rundown of statistics Papaya released today. Our extra notes are italicized. We still have a few questions so we’ll update as we get more detail:

More than 11 million paid transactions have occurred using Papaya’s virtual currency.

On average, 1 in 5 users purchase Papaya’s virtual currency in social games that use Papaya’s Game Engine.

ARPPU (average revenue per paying user) on the Papaya network is $22.60/month.

ARPPU across all Papaya Game Engine games is more than $10.00 per month.

Popular titles earn on average over $20,000/month. “Popular” means the game is in the top 100 in gaming categories like Casual or Arcade & Action on Android.

The most spent by a single user on the Papaya network is $4,440.

93 million pMails have been sent to users across the Papaya network.

Users have engaged in over 874 million game sessions.

Regionally, the fastest growing market for Papaya is China which has experienced over 500% growth since January 2011. Europe is close behind at 224% and then the United States at 222%.

Papaya didn’t break out how ARPPU, ARPU or the paid conversion rate differs in China from the rest of the world.

PapayaMobile also pointed out an example of how it drove installs for a developer. It said it launched X-City from Aidi and was able to get it into sixth place in Android Market’s casual games category without use of any other paid channels. The game received 90 percent of its traffic from the Papaya Social Network.

The Mobage-Papaya Rivalry Heats Up in The U.S. and China

The company’s head of developer relations Paul Chen also took an unusually pointed jab at rival DeNA, which recently launched its competing Mobage platform in Papaya’s core markets of China and the U.S. He said that four weeks after launch, Mobage wasn’t driving meaningful numbers of installs for developers on its network. He said that Mobage has poor design, requiring users to install the network’s app before installing the game they want.

He pointed out that apps like NimbleBit’s Pocket Frogs, Backflip’s Paper Toss and Haypi Kingdom — which are all hits on iOS — are not seeing more than 50,000 installs from the Mobage network, as evidenced by Android Market’s public statistics. Some of the apps he sampled include:

Pocket Frogs for Mobage: 10,000-50,000 installs with rating of 3.6 stars

We Rule for Mobage: 5,000-10,000 installs with rating of 3.7 stars

Paper Toss for Mobage: 1,000-5,000 installs with rating of 2.4 stars

Ninja Royale for Mobage: 1,000-5,000 installs with rating of 3.7 stars

Haypi Kingdom for Mobage: 1,000-5,000 installs with rating of 3.2 stars

Paradise Island for Mobage: 1,000-5,000 installs with rating of 3.5 stars

The thing to point out though is that DeNA has the ability to spend capital in a way that a venture-backed company like PapayaMobile, which recently closed an $18 million round, does not.

DeNA is trying to grow outside of the saturated Japanese market and has pledged to investors that it will become the biggest mobile social gaming platform in the world. With its high-rolling Japanese consumer base (which produces an ARPU of $12.06 on Mobage), the company had 50.9 billion yen ($665 million) in cash and cash equivalents on its balance sheet at the end of the last quarter.

That said, PapayaMobile has early mover advantage on Android with its 25 million registered users and know-how in the Chinese market where chief executive Si Shen was a product manager at Google for four years in Mountain View and China. DeNA has had to buy, rather than build, to enter the U.S. market where it bought ngmoco:) for up to $403 million last year. It also has historically held a dual role as a game developer and platform provider, which isn’t the predominant model in English-speaking markets.(source:insidemobileapps)

5)CocoaChina Raises $14M From Sequoia China, Steamboat to Foster Local iOS Developer Community

By Kim-Mai Cutler

CocoaChina, a game developer that also hosts one of the largest iOS developer communities in China, has raised $14 million in a second round of funding from Sequoia Capital China, Disney’s Steamboat Ventures and Northern Light Venture Capital.

Known locally as Chukong, the company is behind Fishing Joy, a game that has accumulated 10 million users on Android and iOS since it launched four months ago. It’s consistently ranked as one of China’s top 50 grossing games and it’s broken into the U.S.’s top 50 free apps, although it’s usually not among the top grossing there.

While that may not be eyebrow-raising considering that some game developers are breaking into the hundred million range or higher in terms of downloads, CocoaChina also happens to host the most active local iOS developer community in the country. It ends up like being like a cross between iPhoneDevSDK and a gaming company. The company’s co-founder Gary Liu was an early employee at RenRen who experimented with iOS development when the iPhone first came out. He created CocoaChina as a hobby on the side, until it eventually grew into a business that raised a $1.2 million Series A from Northern Light.(source:insidemobileapps)

6)With Tap Petshop Launch, Pocket Gems Nabs Three of the Top 15 Grossing Apps on iOS

By Kim-Mai Cutler

Pocket Gems, a Sequoia Capital-backed gaming company that made its name on casual sim titles with lots of animals, has put a third app into the U.S.’s top-grossing 15 this week with the launch of Tap Petshop. (The company had three in the top 10 earlier, but both Tap Zoo and Tap Petshop have slipped a little this morning.)

Android versions of Pocket Gems’ apps will be coming soon, along with several brand-new titles before the end of the year.

“Our goal is be the leader in mobile entertainment,” said Ben Liu, who came on as Pocket Gems’ chief operating officer from Playdom. He added that the company will broaden out beyond Tamagotchi-like, animal care-taking games too. “We’re working on new kinds of game mechanics and genres which will come out in the next couple of months. It’s safe to assume we’ll have a bunch of releases soon.”

The company’s staffed up from around 10 people at the start of the year to more than 60 now, so it certainly has the capacity to step up the pace. Tap Petshop is Pocket Gems’ second launch this year after Tap Pet Hotel.

Considering that iOS titles with a top 15 ranking in the platform’s biggest markets often make more than $1 million a month, and north of $3 million at the very highest echelons, all three apps represent a fair amount of revenue for the company. (Unfortunately though, Liu was not really specific about anything concerning revenue.)

That said, given that Pocket Gems already had two top-grossing titles, it’s not surprising that the company has the marketing muscle to push a third game to the top. The company said last month that it’s seen 40 million downloads.(source:insidemobileapps)

7)PopCap looks to cure its Extreme Fever with Peggle HD for iPad

by Joe Osborne

Still waiting with bated breath for PopCap to bring Peggle to Facebook? (Keep holding it, then.) So are we, but until then, perhaps Peggle in HD will hold you over. The creator of Bejeweled announced that its mega hit pachinko-meets-Breakout game is now available for the iPad under the title–what else?–Peggle HD.

The game, which has already been downloaded 30 million times since its original release on the PC in March 2007, is available now in the App Store for an introductory price of $2.99. Once in the game, players can purchase Peggle Nights, the full-blown expansion to the original, for $.99. Of course, the prices will hike up once this promotion ends (which we imagine will be soon) to $4.99 and $1.99, respectively.

While this is essentially the same Peggle about 30 million of you have played before, this version comes with Game Center support at launch. And yes, that means this “HD” edition of the ultimate pachinko also features Achievements–29 of them, to be exact.(source:games)