社交游戏用户与老虎机玩家具有重叠性

作者:Tyler York

似乎在一夜之间,社交游戏成为价值20亿美元的行业,在全球拥有数亿玩家。正如我们之前在所发表的博文中提到的那样,社交游戏利用类似老虎机的游戏机制和心理暗示来吸引玩家。因而对我们来说,当我们发现社交游戏的玩家群体同老虎机极为相似时,并不感到十分惊讶。

看看现代社交游戏所吸引的用户群体。流行社交游戏所获得的庞大玩家群体并非视频游戏玩家。InsideNetwork研究总结表示,社交游戏70%的玩家是女性:这部分群体并非典型的“玩家”,但与典型的老虎机玩家却极为相似。在Harrah对女性的调查中发现,81%的女性喜欢玩老虎机和电子游戏。这表明,虽然赌徒中绝大部分并非女性,但是当她们若赌博时更易于选择老虎机。当你观察社交游戏玩家的年龄分布时,这两者间的关联就更加明显了。

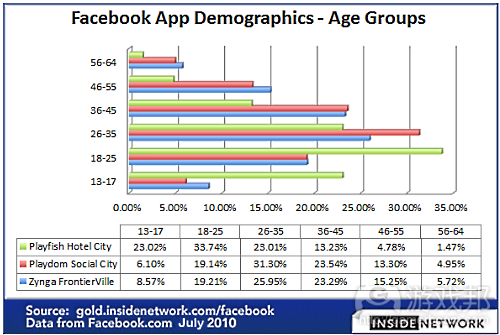

虽然这项研究的样本大小有限,但其数据却呈现出令人信服的图表:《Social City》和《FrontierVille》的半数玩家年龄为26到45岁。随后,许多公布的数据都表明这些发现的准确性,比如GigaOm报告称社交游戏玩家以女性居多,平均年龄为43岁。滑铁卢大学的研究显示,老虎机玩家的平均年龄为39到45岁。比较这两项数据,你会发现赌老虎玩家年龄分布与社交游戏玩家年龄分布显然存在重叠的部分。

在社交游戏出现之前,女性游戏市场并未被充分开发。Zynga和其他社交游戏公司意识到了潜在的机遇,于是开始发掘这个新兴市场。Zynga的首席游戏设计师Brian Reynolds声称,公司的目标是制作“人人都可以玩的大众化娱乐形式”。CrowdStar推出的《It Girl》等女性题材游戏获得的巨大成功,进一步增强了这种趋势。

社交游戏利用赌博机制来吸引和留存用户,打开了巨大的女性玩家市场。因为这两个行业间的用户群组如此相似,所以这些机制能够产生效果,这不足为奇。而现在,随着女性玩手机游戏的频率逐渐超过男性,我们认为这些机制会蔓延到无数的游戏公司,他们会努力在手机平台上复制社交游戏的成功。

但是,为什么社交游戏公司要使用老虎机模式呢?最简单的答案是:这种机制有效。超过60%的社交游戏玩家表示,他们每次玩游戏的时间超过半个小时,28%的玩家曾用真实货币购买游戏中的虚拟货币。但是,这也意味着从未购买虚拟货币的社交游戏玩家比例高达72%。

这并不奇怪:社交游戏与老虎机不同,当用户购买虚拟货币时,他们知道自己再也拿不回这些钱。虽然社交游戏20亿美元的市场规模的确很可观,但是全国老虎机每天的产值就高达10亿美元。如果玩家在玩自己最喜欢的游戏时有机会赢取现实金钱,那么非付费玩家的比例会不会减少呢?

这就是玩真钱极为适合用于社交游戏的原因所在(游戏邦注:美国相关法案最近刚放松对在线博彩业的限制)。社交游戏市场有着同老虎机相同的玩家群体,而且50%的社交游戏玩家并非美国本土玩家。社交游戏公司和玩家或许能够实现双赢:社交游戏公司可以利用现有的游戏和玩家群体,同时玩家在体验自己喜欢的游戏的时候还能赢得金钱。玩真钱或许是值得社交游戏领域考虑的创新之路,可能使盈利大幅提升。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Social Gamers are Gamblers

Tyler York

It almost seems like overnight, social gaming became a $2 billion industry with hundreds of millions of players worldwide. As we mentioned in our blog post, Exposing Social Gaming’s Hidden Lever, social gaming leverages the same game mechanics and psychological cues as slot machines to hook players. To us, it was no surprise when we found that social gaming is popular with the same demographics as slot machines.

Take a look at the audience that modern social games attracts. Much of the gigantic player base that the most popular social games has acquired was gained from demographics far outside the typical video gamer. An InsideNetwork study concluded that on average, almost 70% of social gamers were female:

This flies in the face of the typical “gamer”, but it’s quite similar to the typical slot machine player. Among women polled in a Harrah’s survey, 81% of women favored slots and electronic gaming. This shows that while women are not necessarily the majority of gamblers, when they do gamble they prefer slot machines. The correlation becomes even more apparent when you see social gaming’s demographics by age:

While the sample size is limited in this study, the data paints a convincing picture: both Social City and FrontierVille see half of their player base come from players aged 26-45. More data was released supporting these findings when GigaOm reported that the average social gamer is a 43 year old woman. When you compare this with slot machine players surveyed in a University of Waterloo study, whose average age was found to be 39-45 years old, you see a clear overlap between slot machine players and social game players.

Before social gaming, women young and old were a relatively untapped gaming market, and one that had both time and money to spend on games that could capture their interest. Once they realized the potential opportunity, Zynga and other social game companies openly pursued this new market, with Zynga’s chief game designer Brian Reynolds’ stated goal being to make “mass-market entertainment everyone can play”. Reinforcing these demographic trends is the fact that female focused games like It Girl have become massive successes.

Social gaming’s use of gambling mechanics to engage and retain users also helped unlock a massive new market of female players. It’s no surprise to us that these mechanics are effective with a similar group of users across different industries. And with women now playing more mobile games than men, we expect these mechanics to cross over as countless game companies try to recreate social gaming’s success on mobile.

But why do social game companies use gambling mechanics? Short answer: they work. Over 60 percent of social gamers say that they play for over half an hour at a time, and 28 percent of them have purchased virtual currency with real-world currency. However, this means that 72 percent of social game players have never purchased virtual currency.

This is no surprise: unlike in a slot machine, when users purchase virtual currency they know that they are never getting their money out. While social gaming’s $2 billion market is nothing to scoff at, slot machines nationwide pull down $1 billion a day. Could more of those 72 percent never-purchasers be converted into paying customers if they had a chance to win cash playing their favorite games?

This is why real-money play is such a great fit for social games. The social gaming market has the same demographics as slot machine players, and over 50% of social game players are outside of the US. This would be a win-win for social game companies and their players: social game companies could leverage their existing games and player base, while players would get the option to win cash when playing their favorite games. Real-money play is a compelling opportunity to innovate in the social game space in a way that boosts revenues. Social game companies should take note. (Source: Gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号