每日观察:关注Kodable称儿童应学习编程的理由(10.16)

1)《Puzzle & Dragons》开发商GungHo Online Entertainment日前与日本电信巨头软银联合收购了芬兰开发商Supercell公司51%的股份,其成交额为15亿美元;其中GungHo的支出占20%,软银占比31%(游戏邦注:Supercell原先估值为7.7亿美元,这项交易相当于其身价上涨至30亿美元)。

在此之前,Supercell和GungHo旗下两款热门游戏曾展开交叉推广活动,Supercell首席执行官Ilkka Paananen表示,这项交易有助于推进公司的全球化发展战略,他们的目标是将Supercell打造成一个30年后驰名全球,并且推出了众多出色游戏,能够对人们的生活产生影响的公司。

2)据Venturebeat报道,土耳其开发商Peak Games日前宣布公司成立3年的日活跃玩家超过1180万,其手机社交游戏已经主导了土耳其、中东和北非市场。

该公司成立于2010年11月,每年销售增长300%,目前员工达150人左右,月活跃玩家超过2500万。

Peak Games最初在Facebook起步,18个月前进军了移动领域,目前Facebook仍是其最大的游戏平台,但来自移动平台的收益正在迅速增长。

3)据Technode报道,腾讯旗下的微信游戏平台最近发布的《天天酷跑》日常收益超过700万人民币(约100万美元),该游戏发布首月收益超过1亿人民币(约1600万美元)。

这款2D横向卷轴的跑酷游戏类似于WeMade旗下的《Wind Runner》或DevSisters的《Cookie Run》(这两者在韩国的KakaoTalk平台也极受欢迎),绑定了腾讯的微信和手机QQ服务。

4)据Eilers Research报告显示,Caesar’s Interactive Entertainment仍是今年第三季度市场排名第一的社交博彩游戏发行商,但其该季度的Facebook/手机平台收益却并没有增长,甚至略有下滑。

该公司目前在社交博彩游戏市场份额为15%,排名第二的是International Game Technology(占比13.6%),第三名则是占比11.5%的Zynga。

Big Fish Games旗下的《Big Fish Casino》目前仍是移动平台最大的独立社交博彩应用,在该季度收益达3510万美元,Big Fish Games在该市场份额为7.4%。

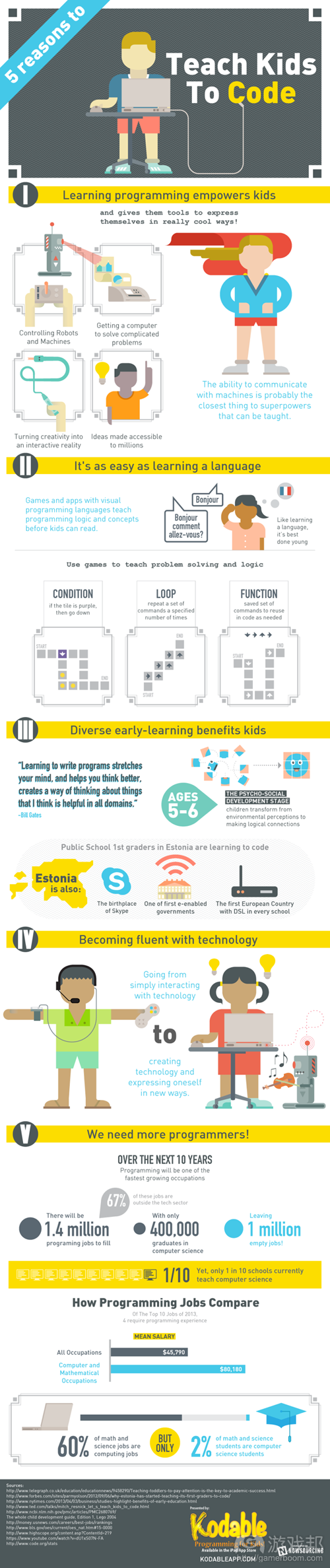

5)Kodable最近发布信息图表列出了提前让儿童接触编程的5个理由,其中包括:

*学习编程可以让孩子获得一种有趣的自我表达方式;

*编程就像学习语言一样简单,可以用游戏来教孩子解决问题,了解逻辑性;

*多元化的早期教育具有拓展孩子的思维等多项益处(爱沙尼亚的公立小学1年级就开始传授编码课程,该国还是Skype应用的诞生地);

*有助于让孩子熟悉运用科技,由接触科技转向创造科技;

*目前市场上的程序员供不应求(在未来十年,编程将成为需求增长最快的工作之一,岗位缺口达140万,但目前每十所学校中才有一所传授计算机科学,而该专业每年仅提供40万名毕业生,市场上还存在100万岗位缺口)。

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Super sale: GungHo and SoftBank buy 51% stake in Supercell

by Keith Andrew

Puzzle & Dragons developer GungHo Online Entertainment has partnered with Japanese telecommunications specialist SoftBank to buy a 51 percent stake in Supercell.

The two parties have paid out $1.5 billion for the majority share in the Finnish mobile powerhouse – known for Clash of Clans and Hay Day – effectively representing a quadrupling in Supercell’s value during the last seven months.

Details release by SoftBank suggest GungHo paid out for 20 percent of the company, with SoftBank making up the remaining 31 percent.

Next steps

The deal builds on an existing relationship between GungHo and Supercell, which had seen the two developers cross-promote each other’s titles in-game, helping the Finnish studio make a mark in the Japanese mobile market.

Indeed, in a blog post by Ilkka Paananen, the Supercell CEO claims the firm’s decision to sell the majority share – referred to as a “strategic investment” by Paananen – was motivated by a desire to “accelerate Supercell towards our goal of being the first truly global games company.”

Clash of Clans

“The combination of tablets, mobile and the free-to-play business model has created a new market for games, one that will be accessible to billions of consumers, more people than ever before in the history of games,” details Paananen.

“At Supercell, one of our greatest aspirations is to become the first truly global games company, one that has a strong foothold in both the West and the East, including Japan, Korea and China.

“We want to build a company that people all over the globe will look back in 30 years and talk about all the great games that we developed and the impact they had on people’s lives.

“This is a lofty goal and getting there takes persistence, passion, and luck – but just as importantly, it takes time, and requires a lot of patience. Even if we have had a pretty good start on our journey, it is still very early days. Creating history takes time.”

Global game

The investment, therefore, will provide Supercell both with the resources and the security Supercell needs to cements its position in the global market.

“SoftBank is all about the long term,” adds Paananen. “In fact, I have never met anyone who thinks as long term as its founder, Masayoshi Son, does.

“When we first met, he told me he has a 300-year vision, and I thought he was joking until the following day when he ran me through what it actually looks like and it is indeed very real and extremely inspirational.(source:pocketgamer)

2)Peak Games dominates mobile social games in the Middle East and Turkey

Dean Takahashi

While other digital game companies have had rocky growth, Turkey’s Peak Games has had a remarkable run in the past three years. The mobile, social, and online game publisher has more than 11.8 million daily active players, and it dominates the markets for such titles in Turkey, the Middle East, and North Africa.

That regional audience is so big that Peak Games has become one of the world’s biggest social-and-mobile game companies. Peak has done that by tailoring content to players in the Middle East, with titles such as Okey, an online version of a traditional board game that is popular in the region.

And while other social game companies like Zynga have faltered, Peak Games has made the leap into mobile and scored a hit with its mid-core, cross-platform title (or a hardcore game that can you can play in short mobile sessions), War Mercenaries. With these games, Peak is one of the new companies competing on a global stage with the likes of Electronic Arts, Disney, and King. War Mercenaries, for instance, has a following in the U.S., Western Europe, and East Asia.

“Three years ago, we said we were going to dominate this region. We are very much focused on the Turkish and Arabic regions because we believe there is a lot of untapped opportunity here with the hyper growth of mobile,” said Rina Onur, co-founder and chief strategy officer at Peak Games, in an interview with GamesBeat. “We started to invest in mobile not for short-term profit but because we knew it was the future. We began investing when there were only 2 million mobile devices in the region, and we had 10 million customers on Facebook. That strategy is paying off.”

The 300-percent sales growth per year is remarkable for a free-to-play gaming company that started in Nov., 2010. Peak Games now has 150 employees across multiple offices, and it has more than 25 million monthly active players.

Key to the firm’s growth is the Plus franchise, which are digital renditions of popular board, card, and tabletop games. People have played these games offline for generations, and the plus versions encourage multiple players to sit at virtual tables for long sessions with their friends. Six titles are available in the genre: Okey, Okey Plus, 101 Plus, Tavla Plus, Batak, and Pool Plus. The Okey Plus and 101 Plus titles are consistently in top-grossing lists, generating half their revenues from mobile.

“Our business is sustainable and profitable,” Onur said. “That’s a blessing these days. We were lucky in some sense. Not all mouse-clicking games translated well to mobile. But our multiplayer, synchronous titles (with simultaneous play) worked well on mobile. It’s like four people sitting at a table, playing cards or tiles.”

The Istanbul-based startup has more than 300,000 concurrent users, compared to 128,000 in June, 2012. It started with parlor games that are appropriate for the region. Now, it has expanded so that more than 50 percent of its revenue comes from mobile. The company focuses on community-driven multiplayer and synchronous releases. Peak Games tries to turn its offerings into staples of everyday life, and it services repeat players.

Peak started out on Facebook, but as that channel slowed, the developer began investing in mobile games about 18 months ago. Now, all of its flagship titles have launched on mobile. Apple’s iOS generated more revenue in the past, but Android has now surpassed iOS growth in terms of players. The iOS revenue metrics are better than Android. Facebook is still the largest platform, but mobile is growing rapidly.

“Now, we’re bringing our games out on iOS, Android, and Facebook simultaneously,” Onur said.

The company remains platform agnostic, and it has only just started to reach a global audience for its releases like War Mercenaries, which resembles Supercell’s Clash of Clans. The company plans to take War Mercenaries to mobile soon. Some of Peak’s games, such as Okey Plus, come embedded on the home screens of Middle Eastern wireless phone carriers.

“That is where the industry is going,” Onur said.

Peak Games will launch a series of new mobile and online titles in the fourth quarter. Over time, the company might move into other emerging markets. In-app purchases generate about 95 percent of revenue now, and ads account for 5 percent.(source:venturebeat)

3)Tencent generates $1 million a day from its WeChat-fuelled ‘Wind Runner’

by Jon Jordan

The big news when it comes to Chinese app distribution remains the expected impact of Tencent’s WeChat Games Platform.

We’re still waiting for the doors to be widely opened – notably for the release of western-developed titles such as Temple Run 2 and Plants vs Zombies 2.

But, in the meantime, Tencent has been making the most of its monopolistic position.

According to Technode, its most recent release Tian Tian Ku Pao (or Cool Running Everyday) has peaked at over 7 million RMB ($1 million) daily.

During its first month, it’s reportedly generated over 100 million RMB (around $16 million).

Running better than you

In terms of gameplay, it’s a 2D side-scrolling high score-based runner much like WeMade’s Wind Runner or DevSisters’ Cookie Run; both of which have been massively successful in Korea thanks to their integration of the KakaoTalk messaging service.

In terms of Tian Tian Ku Pa, it’s been released as a standalone game, with integration into Tencent’s two mobile messaging services WeChat and Mobile QQ.(source:pocketgamer)

4)Caesar’s Interactive rules social casino games again in Q3 — but its revenue doesn’t grow

Dean Takahashi

Caesar’s Interactive Entertainment held its position as the No. 1 social casino gaming publisher in the third quarter, according to market research firm Eilers Research. But overall revenue in the sector was flat in quarter.

Growth in the mobile and tablet sector wasn’t able to offset a 7 percent decline in Facebook social casino game revenues. During the quarter, Caesar’s launched Caesar’s Slots and World Series of Poker (previously licensed to Electronic Arts). Slotmania, the marquee title for Caesar’s, saw its revenue fall during the quarter. It’s not clear if this was a result of a shift in marketing spending to the new titles or fatigue with the mainstay game. Overall, Caesar’s has 15 percent of the market.

The data captures the top-grossing social casino games on Facebook, iOS, and Google Play, with revenue estimated for each major title and publisher. Social casino games include free-to-play poker, slots, table games, and bingo.

Eilers said a significant amount of growth has occurred on Facebook and mobile, with numerous high-profile merger and acquisition deals. That interest has been stoked since 2011 at the prospect of the U.S. permiting real-money online gambling on a state-by-state basis.

International Game Technology, operator of DoubleDown Casino, surpassed Zynga during the quarter to become the second-largest social casino game publisher with 13.6 percent market share.

DoubleDown increased revenues 5 percent thanks to growth on both Facebook and mobile apps.

Zynga saw another quarter of double-digit revenue declines as Texas Hold’Em Poker (both Facebook and mobile version) continued to lose market share. Zynga also ceased operation of Zynga Slingo in late August after Real Networks bought Slingo. Meanwhile, Zynga’s Rich! Casino Slots, developed by Zynga’s Spooky Cool Labs, saw a promising start on Facebook. Zynga now has 11.5 percent of the market.

Big Fish Games’ Big Fish Casino is still the largest stand-alone social casino app on mobile and it generated an estimated $35.1 million in revenues in the quarter. Big Fish has 7.4 percent of the market.

WMS’ Jackpot Party Casino was one of the fastest-growing social casino games this quarter. WMS has 4.9 percent. Smaller firms account for the rest of the market.(source:venturebeat)

5)INFOGRAPHIC: Five reasons to teach kids to code

by Phil Tottman

The ability to communicate with machines is probably the closest thing to superpowers that can be taught.

Teaching kids computer programming from a young age can help learning development and better prepare them for a world that is becoming increasingly connected.

Over the next ten years, programming will be one of the fastest growing occupations, with 1.4 million jobs to be filled.

However only one in ten schools currently teach computer science, and there are only 400,000 graduates in the subject, leaving one million empty jobs.

Kids are becoming tech savvy at an increasingly younger age, with 26 per cent of kids under three knowing how to use a tablet.

Bill Gates, chief executive and chairman of Microsoft, previously said: “Learning to write programs stretches your mind, and helps you think better, creates a way of thinking about things that I think is helpful in all domains.”

Not only will teaching our young ones the art of coding be beneficial to their future career prospects and general development, it will also give them the opportunity to earn big bucks, as computer and mathematical jobs can earn almost double that of other occupations.(source:mobile-ent)

闽公网安备35020302001549号

闽公网安备35020302001549号