数字化复兴CCG 卡牌游戏发展潜力无限

作者:Joost Van Dreunen

收集卡片游戏(游戏邦注:即collectible card games,简称为CCG。)原本作为“休闲”游戏,用于竞赛时的不同角色扮演环节之间的娱乐形式,但今天却成了在线游戏中发展最快的一类。2011年,CCG的全球销售额达到21亿美元,自经济萧条后快速恢复,其增长率从2010年的7%增至2011年的9%。在其他游戏正经历大衰退之际,这显著的增长应归功于向数字CCG销售的转变。2008年,数字CCG还说不上存在,而至2010年,其销售额增至1.91亿美元(在全球销售额约占比9%),到2014年初,我们估计数字CCG的销售额将达到7.14亿美元。

如此乐观的预测基于几个原因。首先,面临着实体CCG市场的大衰退,大发行商被迫探索CCG的新形式和平台。

传统的大发行商如口袋妖怪(任天堂)、科乐美和Wizards of the Coast(WotC)占领着实体CCG的市场。《游戏王》发行商科乐美CCG年销售额大约是3.32亿美元,旗下游戏《Dragon Collection》成为手机社交平台GREE上的头号游戏,玩家达到400万。另一款科乐美游戏《战国大乱斗》在Mobage平台的玩家有200万。与此类似,2011年底,以《七龙珠Z》和《火影忍者》CCG闻名的发行商Bandai同DeNA合作开发手机卡牌游戏。自《Gundam Royale》在短短6天内累计达到100万玩家后,Bandai开始对手机平台产生兴趣。欧美方面,WotC携《Magic the Gathering: Tactics and Duels of the Planeswalkers》强势闯入数字CCG市场。WotC看到该作著名的改编数字版仅在Xbox Live平台就卖出了50万份的好成绩,随后便在PC和PS3平台发行。

这三家公司都凭借自身实力成为行业中的佼佼者。另外,更重要的是,这些公司有了必要的资金和经验进入数字CCG领域,并且征服它。

小型开发商重新洗牌

尽管付出努力,但大公司在发展速度上从来快不过小公司。所以涌现了新平台与新一代小型创新开发商携手并进的局面。当前,大公司留下的空间比较小,但有经验的公司仍然可以迅速积累自己的名气。Playdek是一家发源于Incinerator工作室的小发行商,具有数十年的主机游戏开发经验,它的《Ascension》目前是iOS上最热门的CCG之一。《口袋妖怪》在苹果平台的缺席在很大程度上,为小型开发商创造了在智能手机市场的发展机遇。

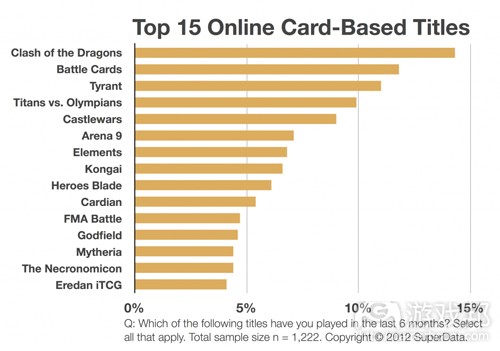

无独有偶,开发商5th Planet Games也凭借卡牌游戏《Clash of the Dragons》成为Kongregate平台上的最大赢家。据称,其月活跃用户的消费额平均大约是55美元。趁热打铁,该公司最近又收获了纽约开发商To Be Continued。另外,据称目标受众为7-12岁男性玩家的《Fight My Monsters》的用户已达110万。经过相对稳定的而漫长的时间后,从整体的竞争格局上看,CCG市场正经历着一场结构性调整。

“记帐”

数字化使游戏省掉了这个类型所固有的“记帐”特点。就像纸笔RPG成为主流游戏类型是因为不再需要记录得分和点数,CCG的数字化使游戏更容易进行。因此,玩家可以将注意力放在研究策略和构想自己的玩法。与此同时,社交游戏玩家越来越青睐更复杂的游戏玩法。我们最近发现中级硬核玩家与主流社交游戏玩家的开支比为2:1。CCG的深度和复杂度使之能够更好地利用这个趋势。

证据当然还是在开销上

一般的实体CCG玩家每年的游戏消费额是300美元。而对于数字化CCG,这个数字更高:在过去6个月,我们得到的记录,每个CCG玩家每个月的最低消费是是33.37美元,最高是52.68美元(在跨平台的社交游戏中,每月付费CCG玩家平均收益)。根据我们的数据得出的结果与公开发布的数字一致。比今年GDC更早以前,Kongregate声称它最流行的两款游戏《Tyrant》 (Synapse Games)每月付费玩家的平均收益是33.08美元,而《Clash of the Dragons》(5th Planet Games)则是59.65美元。相比之下,一般的主流社交游戏玩家,即玩模拟城市和农场类游戏的玩家这一数字介于20美元至30美元。

随着竞争格局的转变,资金充裕的开发商的涌现,以及第一代数字CCG玩家呈现的乐观消费情况证明,未来可能就在于卡牌游戏。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

DIGITAL CARD GAMES REVIVE STAGNANT RETAIL BUSINESS, REACHING $714MM BY 2014E

By Joost Van Dreunen

Originally invented as a ‘casual’ game to play in between role-playing sessions at tournaments, collectible card games (CCGs) today are one of the fastest growing segments among online games. In 2011 worldwide sales totaled $2.1 billion, after a quick recovery from the recession, and grew 7% in 2010 and 9% in 2011. This remarkable growth, in a time when other categories suffer from a steep decline, can be attributed to the transition to digital CCG sales. Practically non-existent in 2008, digital CCGs had grown to $191MM by 2010 (about 9% of worldwide sales), and by 2014E we expect digital sales to grow to $714MM.

There are several reasons behind this rosy forecast. For starters, large publishers face declining growth of the physical CCG market, forcing them to explore new formats and platforms.

Traditionally major publishers like Pokémon (Nintendo), Konami and Wizards of the Coast dominated especially the physical CCG business. Konami, the company behind Yu-Gi-Oh! and an estimated $332MM in annual CCG sales, saw its Dragon Collection become the number one app on mobile social platform GREE, reaching 4 million users. Another Konami title,Sengoku Collection, counts 2 million users on the Mobage platform. Similarly, in late 2011 Bandai, known for its Dragonball Z and Naruto CCGs, teamed up with DeNA and together invested $1.3MM in, among others, mobile card games. Bandai found itself motivated to pursue the mobile platform after Gundam Royale accumulated one million players within only six days. In the West, Wizards of the Coast (WotC) made a strong push into digital CCGs with Magic the Gathering: Tactics and Duels of the Planeswalkers. WotC saw the digital version of its well-known franchise sell 500,000 copies on Xbox Live alone, and has since released its games on both PC and PS3.

All three companies are industry juggernauts in their own right. And, more importantly, have the necessary dollars and experience to not just enter the digital CCG space, but conquer it.

Small developers shuffle the deck

Despite their efforts, however, large companies never move as fast as small ones do. And so the emergence of new platforms goes hand-in-hand with the coming of a new generation of small, innovative developers. In the current vacuum left by the incumbents, relatively small, but experienced companies have been able to quickly build a name for themselves. Playdek, a small publisher originating from Incinerator studios, houses several decades of console development experience. Its Ascension is currently one of the most popular CCGs on iOS, and convinced the company to publish a sequel and other card-based mobile games. To an important extent, Pokémon’s absence from the Apple platform has allowed smaller developers to capitalize on the momentum of the smartphone market.

Similarly, 5th Planet Games, with its card-based Clash of the Dragons, is one of the biggest earners on Kongregate, claiming around $55 per paying user every month (Source: Kongregate). To further expand on its success the company recently acquired New York-based developer To Be Continued. And finally, Fight My Monsters, which targets a 7 to 12 year old male demographic, claims 1.1 million users and received a financial boost in the form of a $2.4MM funding round led by Greycroft Partners. After a long period of a relative stability the CCG market is experiencing structural changes in the overall competitive landscape.

Bookkeeping

In terms of game play, digitalization makes it possible to dispense with the laborious bookkeeping inherent to the genre. Just as pencil-and-paper RPGs became a more mainstream genre because there no longer was a need to keep score and role dice, so too will CCG become more accessible. This allows players to focus on developing strategies and building their decks. At the same time, social gamers increasingly seem to move toward more complex game play. We recently found that mid-core social gamers outspend mainstream social gamers two to one. The depth and sophistication of CCGs put the genre in a good place to capitalize on this trend.

The proof, of course, is in the spending

The average physical CCG player spends about $300 a year. For digital CCGs this number is higher: in the last six months we recorded a low of $33.37 and a high of $52.68 per paying CCG player per month (monthly ARPPU for CCG-type social games across platforms). Findings based on our data are consistent with publicly released numbers. Earlier this year at GDC, Kongregate claimed two of its most popular titles earned monthly ARRPUs of $33.08 for Tyrant (Synapse Games) and $59.65 for Clash of the Dragons (5th Planet Games). By comparison, the average mainstream social gamer, who plays city building and farm-type games, spends between $20 and $30 a month.

With a shifting competitive landscape, the emergence of well-funded developers with something to prove, and healthy spending among the first generation of digital CCG players, the future may just be in the cards.(source:gamesbrief)

闽公网安备35020302001549号

闽公网安备35020302001549号