移动领域竞争加剧 Android平台势头强劲

作者:Matthäus Krzykowski

据我们在应用搜索初创公司Xyologic所做的调查显示,问鼎美国苹果App Store Top Free 100榜单的iPhone应用数量减少35%。2011年4月,有422款应用出现于Top 100 Free iPhone应用榜单中,而到2012年4月,应用数量减少为277款。

入驻榜单的新应用数量由58减少至33款。这是相比2011年4月问世的6497款免费新iPhone应用及2012年4月的1万1545款免费新iPhone应用而言。在同一时间里,问鼎美国Google Play商店前100热门免费应用排行榜的应用数量保持不变,虽然规模有所减小。

下表显示调查结果——入驻苹果App Store及美国Google Play前100热门免费应用榜单的应用数量及其各自期限(2011年4月 vs 2012年4月)。

2011年4月——前100热门免费应用榜单的应用数量及其期限

2012年4月——前100热门免费应用榜单的应用数量及其期限

我们可以通过数据得出什么结论?我们的调查结果进一步说明,平台呈现饱和状态,就如Kim-Mai Cutler最近所指出的。

由于苹果应用商店的设计方式,只要应用入驻热门榜单(游戏邦注:在此应用能够面向真正的用户),它的日下载量就会出现显著提高。关于苹果在此机制中的角色大家说法不一。

苹果是否有责任让更少的新(独立)应用/开发者进入热门免费应用榜单?苹果是否该向“较小”开发者提供曝光度?苹果过去12个月在行业中的干涉是否对“大人物”更偏心?

或者只有“大人物”才能够充分利用应用商店的机制?入驻这些榜单对于发行商来说是否“过于”困难,导致发行商“必须”通过购买手段,方能获取用户?

在我看来,这些问题虽然合理,但对整个行业来说无关紧要。苹果应用商店当前的曝光度和用户获取模式依然是发行商在移动行业历史中得到的最佳交易。

自我2007年担任Admob旗下手机社交网络Peperonity的产品经理以来,用户获取经历若干独特新时期。在各新时期,竞争平衡关系、关键成功要素及市场机会都出现转变,颠覆当时的情况。

在我看来,自2008年围绕运营商的商业模式土崩瓦解以来,行业历史可以简单分成3个“时期”:首先,出现开放移动网络;其次,应用公司的出现;第三,付费推广模式&分析方法的出现。

2007年前,运营商生态系统时代的用户获取

虽然移动平台随iOS和Android的兴起而越来越受关注,但二者直到2007年才出现。在那以前,运营商是移动领域的主导者:移动内容领域和其他领域的供应商会在贸易展览中排成一排,积极向运营商主管展示自己的产品。当美国手机用户想要访问移动互联网时,多数都采用手机运营商门户/平台。因此移动内容初创公司会参加各种会议,以确保获得“Verizon协议”或“Vodafone协议”,而且通常会让用户提前付费购买移动内容,让运营商获得大多数业务。

2008年开放移动领域的出现

2008年,这一机制开始出现问题。受移动领域Myspace和Facebook问世的推动,越来越多手机用户通过浏览器访问移动互联网。

2008年4月,TC Mike Arrington报道了Loopt,在Valley就移动领域展开初期宣传。越来越多创业者开始思考如何利用这一发展趋势。随着这些创业者开始创建自己的初创公司,他们开始寻求跳过运营商,直接面向用户的宣传策略。“开放移动平台”用户获取理念开始出现在移动领域中,Admob是这一趋势的接受者。随着众多VC移动内容初创公司参与竞争,2008年公司的收益出现显著增长。行业似乎开始朝此竞争趋势迈进。

应用经济形态的出现

我们很容易忘记,当2008年美国出现金融危机时,行业谣传移动广告领域会停滞不前。很多移动内容广告商退出移动网络广告领域,很多风投资本家暂停投资移动领域。

直到iPhone问世,大家才再次从移动领域看到新的创收机会。

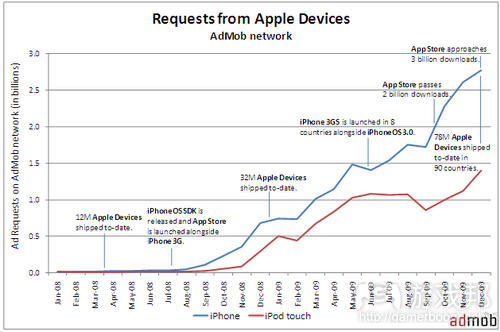

就如Admob网络的广告需求所示,待到App Store问世后,移动开发者、VC支持的初创公司及广告商才转投苹果平台。

Groupon移动营销主管Iryna Newman表示:“应用创收获得优化的一个主要原因是,应用最终解决了用户认证、交易记录及付费问题。例如,在一个应用中,你只需登录一次,提供你的信用卡信息。随后你就能够轻松返回,你的所有交易记录都会无缝隙接合。

在移动网络,cookies软件依然不可靠,用户通常会在登陆、消费或完成日常活动时遇到障碍,他们必须记住自己的密码,经常重新输入信用卡信息。在很大程度上,移动网络用户获得的是令人沮丧的体验。”

回到2008年11月,iPhone问世1年多后,Jason Spero(游戏邦注:Admob营销副总裁)告诉我们:“iPhone市场正急剧膨胀,Inventory迅速发展,广告商如饥似渴。”两个推动因素促使广告网络的收益明显提高——即AdMob和Quattro Wireless。首先,基于用户获取的应用非常合拍:当用户通过点击广告下载应用时,新移动应用的发行商就会付费给其他发行商。其次,品牌广告商设法获取iPhone用户,因为他们更频繁地浏览他们的应用。Quattro在此表现得尤其突出。

在这1年里,一个新兴移动平台在AdMob网络中获得更多关注:Android。在2010年3月,Android在广告市场的可用库存首次超过iPhone平台,在美国获得更高的智能手机广告份额。

目前,多数美国移动广告开支都集中在原生手机应用上,而非移动网络。令网络纯化者惊讶的是,开发者每月继续推出众多原生手机应用。但随着美国广告商继续着眼于应用领域的广告,而非网络领域,应用将成为美国“免费”移动内容的创收来源。

移动领域的病毒式传播

近年来,移动领域开发者的一个常见错误观念体现在,他们关于“病毒式传播策略”可行性的观念。在网络领域取得成功的传统病毒式传播策略注定会在移动领域惨遭失败。

有人表示,Kik的早期成功属于病毒式传播。但这其实归功于他们巧妙运用通讯簿和邀请机制,而非严格意义上的病毒式传播。不足为奇的是,这一策略被广泛借鉴,直到1年多后,Path的Addressbookgate结束了这一切。

“病毒式传播并不适合移动平台”观点的例外情况体现在应用的内在机制,尤其是游戏。

付费推广模式&分析方法的出现

出现付费推广模式的关键是,发现多数成功应用,尤其是顶级手机游戏都以较高速度创收。既有经济形态包含重要启示意义。开发者如今持有这样的应用:通过付费渠道的用户获取成本低于所获取用户的预计终身价值。这些应用的收益用于支撑发行商其他作品的开发和营销工作。他们可以通过分析方案持续完善他们的应用。

虽然这种方法就是众所周知的社交游戏,但这在移动平台依然非常新鲜。

在这背后,系列移动创收和推广公司开始浮出水面,值得一提的是Tapjoy和Flurry。

目前相关实践的全盛时期大概是在2011年3月。据众多消息表示,当月,Tapjoy赚取比Admob更多的收益。

我如何诠释调查数据——这一趋势包含明确成功者和失败者

这意味着(这是我对于调查结果的诠释),过去几个月来,目标市场选择和营销开支在iOS平台已变得缺乏效率。移动创收公司Adeven CEO Christian Henschel表示,“获取(有价值)新用户对于开发者和发行商来说依然非常有挑战性。随着用户获取成本(尤其是下载成本)的提高,旗帜广告显然缺乏可行性。”

移动分析公司Apsalar CEO Michael Oiknine补充表示,“随着应用数量的增多,应用开发者和营销面临的挑战不仅在于获得推荐,还包括提高用户粘性、留存率和创收水平。”

日本游戏巨头GREE的商业情报总监Alex Rosen表示同意:“发现真实用户族群依然非常困难,因此给直接的营销支出带来更多挑战性。更好把握用户基础,挖掘最佳分析工具,以实现这一目标是行业的未来走向。分析工具的完善将给开发者、平台和广告公司带来更多机会。”

2011年4月,苹果开始打击奖励付费安装举措,在此开发者于其他游戏中呈现自己的应用,当用户安装他们的产品时,就给予他们虚拟货币。今年初,苹果坚决打击这一被开发者运用1年多的漏洞方式,开发者旨在通过这一手段让自己入驻热门榜单,进而接触到真正的用户。

据Fiksu表示,上个月随着广告网络及其他渠道争相寻找UDID的替代品,移动应用领域的获取成本有所下滑。Fiksu营销总监Viki Zabala表示,“过去几个月我们已深入谈到,苹果逐步淘汰UDID的计划给iOS应用社区带来极大困惑。在此不确定阶段,有些营销者更加关注Google Play,以促进他们在移动领域的持续发展。虽然我们从未表示,iOS领域将遭受忽略,但Android的Google Play给应用带来新的有利条件。”

Groupon手机营销主管Iryna Newman表示:“假设百货商店的前排货架只有50个位置。若你能够获得前排位置,你每天就将获得数以万计的高质量‘有机’买家。这里有个显而易见的目标实现渠道:获取尽可能多的下载量,超越竞争对手。这一算法的简单性、排名位置的激烈竞争性及其所带来的强大推动性促使整个移动领域变得非常富有创造性:从奖励下载到bot-farms。App Store排名变成iOS开发者最强大的营销工具,在排名位置的竞争压力下,开发者迫切希望能够提高他们的排名位置。”

某初创公司联合创始人Deng-Kai Cheng表示,“虽然供给日益提高,但相比用户增长趋势,整体付费推广数量处于停滞状态,价格依然维持较高水平,可能会继续上涨。就需求方面来说,这主要受两类广告商的推动:能够证明较高CPA合理性的游戏开发者,大品牌或VC支持的初创公司,他们资金雄厚,愿意接受较高价位。随着付费推广模式在iOS平台变得越发困难,曝光度将日益变得一种成败游戏。因此这对大型开发者来说是个自我实现过程。他们具备交叉推广新应用的庞大安装基础,他们资金雄厚,能够负担高成本的推广方式。”

GREE商业情报总监Alex Rosen则更加乐观:“在我看来,这不再围绕获取更多用户,而更多着眼于找到目标用户,虽然这具有可行性,但依然不是个简单过程。这通过分析方案能够完成,但依然需要持续完善,方能满足变更市场的需求。”

移动平台的竞争有利于发行商

据Flurry及EA Popcap之类主流开发商的分析数据显示,就表面来看,相比Android或Facebook,iOS的人均用户收益依然更突出。iOS平台的收益持续提高。

但少数从中收益的开发者和苹果存在密切关系。

就单纯的用户覆盖面而言(游戏邦注:基于月应用下载量),Android明显赶超iOS。

在推广效率日益缩减、推广成本日益提高的发行商世界,苹果的生态系统出现缺陷,希望这一缺陷不会持续扩大。

无论如何,发行商应继续制作手机内容。他们首次能够以平台间的竞争作为刺激玩家的主要因素,进而提高自身作品的曝光度和推广程度。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Apple’s App Discovery Lead On Google Is Shrinking, But Mobile Publishers Shouldn’t Be Too Worried

by Matthäus Krzykowski

The number of iPhone apps that hit the Top Free 100 rankings in the U.S. Apple App Store has decreased by 35%, according to a study we’ve completed at app search startup Xyologic. In April 2011, 422 apps got into the Top 100 Free iPhone apps, while in April 2012, just 277 apps made the cut.

The number of new apps that hit this ranking sank from 58 to 33. This compares with 6,497 new free iPhone apps in April 2011 and 11,545 new free iPhone apps in April 2012. During the same time, the number of apps that hit the top 100 free rankings in the U.S. Google Play store stayed about the same, albeit at a smaller scale.

The table below shows the summary of the study – the number of apps within the top 100 free apps and their respective ages year over year (April 2011 vs April 2012) for both the Apple App Store as well as Google Play U.S.

Number of Apps and Their Age in the Top Free 100 – April 2011

Number of Apps and Their Age in The Top Free 100 – April 2012

What can be concluded from the data? Our findings can be seen as a further signal of the maturation of the platform, just as Kim-Mai Cutler recently pointed out.

Because of the way Apple’s app store is designed, once an app breaks into the top charts where it can be seen by real users, it gets a huge increase in downloads per day. There are different arguments to made about Apple’s role in this system.

Is Apple responsible for fewer new (indie) apps/developers getting into the top free rankings? Is it Apple’s role to provide exposure for the “small” guys? Have Apple’s well-documented interventions in the market in the last 12 months favoured the “big” guys?

Or were the “big guys” just able to use the app store’s dynamics to their advantage? Is getting onto these charts for publishers “too” hard, causing publishers “have to” buy their way onto them to acquire users?

In my view these questions, while valid, are not important for the overall industry. The current model of content discovery and user acquisition in the Apple app store is still the best deal publishers have gotten in the history of the mobile industry.

Mobile user acquisition has gone through a number of distinct epochs since I was a product manager at Admob’s largest publisher in 2007, mobile-only social network Peperonity. In each of the epochs, the competitive balance, key success factors, and market opportunity shifted and upset the status quo.

In my view, the history of the space can roughly be broken down into 3 “eras” since its carrier-centric model broke in 2008: First, the emergence of the open mobile web; second, the emergence of the app economy, third the rise of the paid distribution model & analytics.

User Acquisition In The Operator Ecosystem Era Until 2007

While mobile has never been hotter with the rise of iOS and Android, you would have never expected it to happen until 2007. Until then mobile operators were the kings of the mobile industry: The mobile content industry and other industry other vendors would line up at trade shows to try to show their wares to any operator executive who would listen. Phone users in the U.S. were mostly using mobile operator portals/decks when they wanted to access the mobile Internet. Hence mobile content startups would attend meeting after meeting to make sure they “get that Verizon deal” or “that Vodafone deal” & usually ask consumers to pay up front for mobile content and give carriers a large chunk of the business.

The Emergence Of Open Mobile In 2008

In 2008 the creaks of this system began to appear. Increasingly, U.S. phone users were accessing the mobile Internet using browsers, pushed by the emergence of Myspace and Facebook in mobile.

In April 2008, TC’s Mike Arrington covered Loopt and set off an early hype around mobile in the Valley. An increasing amount of entrepreneurs wondered how to benefit from the trend. As these entrepreneurs launched their startups they, in turn, were looking to find marketing strategies going directly to the consumer, bypassing the operator. The notion of “open mobile” user acquisition entered the mobile realm and above all, Admob was at the receiving end of this trend. A very significant percentage of its revenue growth in 2008 came out new, with many VC-driven mobile content startups entering the fray. The industry was off to the races it seemed.

The Rise Of The App Economy

It is easy to forget that as the financial crisis hit the U.S. economy in Autumn of 2008 and rumors of stagnation in mobile advertising abounded. A lot of mobile content advertisers pulled out of the mobile web-based advertising market and many VCs put their mobile consumer investments on hold.

It wasn’t until the launch of the iPhone that anyone saw dollar signs in mobile.

Mobile developers, VC-backed startups and advertisers only jumped on Apple’s platform once the App Store launched, as the ad requests on Admob network show.

Iryna Newman, Head of Mobile Marketing at Groupon: “A big reason for optimized monetazation in apps is that apps finally solved the problem of user authentication, transaction history and payments. For example, within an app, you only have to log in once and provide your credit card information… you’re then stress-free every time you come back and all your transactions will be seamless.

With mobile web, cookies are still unreliable and users often face obstacles as they try to sign up, purchase or complete everyday actions, having to remember their passwords and constantly re-enter credit card information. For the most part, mobile web users are having a frustrating experience.”

Back in November 2008, more than a year after the iPhone launch, Jason Spero (then the VP of Marketing at Admob) told me: “The iPhone market is exploding, Inventory is growing and advertisers are hungry for it.” Two drivers pushed revenues up at some ad networks that were tuned into the changes — specifically AdMob and Quattro Wireless. Above all, user acquisition based apps hit it off: Publishers of new mobile applications started paying other publishers every time a user clicked on their ad to download their applications. Second, brand advertisers sought to reach iPhone users as they surfed more frequently on their applications. Quattro was particularly good with these.

As the year unfolded, a new mobile platform gained traction on AdMob’s network: Android. By March 2010, Android surpassed the iPhone in terms of available inventory in the advertising market, accounting for a greater share of smartphone-served ads in the United States.

These days, the vast majority of U.S. mobile ad spend is in native mobile apps and not the mobile web. To web purists it may be surprising that developers continue to release thousands of native mobile apps each month. However, as U.S. advertisers continue to focus on advertising in apps and not the web and apps is where the monetisation of “free” mobile content in the U.S. is at.

A Note On Virality in mobile

One of the most common misconceptions of developers who entered mobile in recent years was their notions around the viability of “viral strategies” in mobile. Traditionally viral strategies that are successful on the web had been destined to fail in mobile.

Some have argued that Kik’s early success was viral. However it was actually due to a clever use of the address book and invites and not viral in the strictest sense of the word. Not surprisingly this strategy got copied a lot, that it is until Path’s Addressbookgate more than a year later put an end to that.

An exception to the argument that “viral does not work in mobile” can be made around in-game mechanics in apps, specifically games.

The Rise Of The Paid Distribution Model & Analytics

The key ingredient for the emergence of the paid distribution model is the discovery that the most successful apps and especially some of the top mobile games were monetizing at impressive rates. Known economics has important implications. Developers now had apps where the cost of acquiring users through paid channels was less than the projected lifetime value of those acquired users. The revenue from these apps was used to subsidize the development and marketing of other titles in those publishers’ portfolios. They could continuously improve their apps using analytics.

While this approach has been known to social gaming, it’s been new to mobile.

Behind this a new set of mobile monetization and offer companies rose to the fore, particularly Tapjoy and Flurry.

The heyday of the associated practices so far was, probably, March 2011. In that month, Tapjoy was making more revenue than Admob, according to various sources I talked to.

How I Interpret The Data Of Our Study – This Trend Has Clear Winners And Losers

What that has meant is – and this is how I interpret the findings of our study – targeting and marketing spending has become far less efficient on iOS over the past few months. Says Christian Henschel, CEO of mobile monetisation company Adeven: “It is still very challenging for app developers and publishers to generate new (valuable) users. Banner advertising is not really working as costumer acquisition costs – specifically cost per downloads – have become very cost intensive.”

Michael Oiknine, CEO of mobile analytics company Apsalar, adds: “With the increasing number of apps in the market, the challenge for app developers and marketers is to not only get discovered, but also to drive engagement, retention, and monetization from their users.”

Alex Rosen, Director of Business Intelligence at Japanese gaming giant GREE, agrees: “It’s still very hard to uncover actual user demographics and therefore more challenging to direct marketing spend. The ability to better understand user bases and figure out the best analytical tools to make that happen is where the industry is going. There are great opportunities for developers, platforms, and advertising companies as analytic tools improve.”

In April 2011 Apple cracked down on the practice of incentivized pay-per-install, where developers offer their apps in other games and pay for downloads when players install their titles for virtual currency. Earlier this year Apple went against bots that have been used for well over a year to download apps until they reach the top of the charts where they can be seen by real users.

Then the cost to acquire users for mobile apps declined last month as ad networks and other channels scrambled to find a replacement for UDIDs, according to Fiksu. “As we’ve discussed in depth over the past several months, Apple’s planned phase-out of the UDID has resulted in significant confusion across the iOS app community. During this time of uncertainty, some marketers are looking more closely at Google Play to fuel their continued growth in mobile. And while we’d never suggest that the iOS market be ignored, Android’s Google Play offers a very compelling opportunity that can benefit app businesses in exceptional new ways” says Viki Zabala, Director of Marketing at Fiksu.

Iryna Newman, Head of Mobile Marketing at Groupon: “Imagine that there are only 50 spots on the front shelf at a department store. If you manage to get on that front shelf, you are guaranteed tens of thousands of high-quality “organic” buyers per day. And there is a clear path of getting there: get as many downloads as possible and get more than the next guy. The simplicity of this algorithm, fierce competition for the same rank spots and the powerful lift it provides, forced the whole mobile space to become very creative: from incentivized downloads to bot-farms. Rank in the App Store became the single most powerful marketing tool for all iOS developers, and under pressure of everyone competing for the same spots, developers became desperate for ways to boost their rank.”

Says Deng-Kai Cheng, Co-founder of a productivity stealth startup: “While supply is up, overall paid distribution volume has been flat relative to user growth, and prices have stayed consistently high and will likely continue to go up. This is driven on the demand side mainly by two advertiser sources: game developers that can usually justify the high CPA, and big brands or VC backed startups that are flush with capital and are willing to pay the high prices. As paid distribution becomes more and more difficult on iOS, discovery will continue to increasingly become a game of winners and losers. It thus becomes a self fulfilling cycle for large developers. They have a large install base to cross promote new apps from and they have the cash flow to pay the high prices for distribution.“

Alex Rosen, Director of Business Intelligence at GREE, is more optimistic: “I think it’s becoming less about driving the most users and more about finding the right users and although it’s doable, it is still not an easy process. The analytics are getting there but still need to evolve to meet the needs of the changing market. “

Mobile Platform Competition Is Good For Mobile Publishers

On the face of it iOS is still – by a wide margin – more lucrative per user than Android or Facebook, according to data from analytics provider Flurry and top-tier developers like EA Popcap. Revenues on iOS have grown considerably year over year.

But a smaller amount of developers benefiting from it must be concern for Apple.

In sheer reach for user – measured in monthly app downloads – Android is already considerably outpacing iOS.

In a publisher world of reduced efficiency of distribution and raised costs, Apple is creating a flaw in its ecosystem that hopefully will not grow with time.

Publishers, either way, should continue to be bullish about creating mobile content. For the first time in history they can truly rely on competition between platforms – especially from Android and Amazon – to be a major incentive for all players that drives discovery and marketing of their content forward.(Source:techcrunch)

闽公网安备35020302001549号

闽公网安备35020302001549号