分享开发者调查评估竞争表现的方法

作者:Rocco Scandizzo

什么游戏算是获得商业上的成功?关于这个问题,我们的衡量标准已经发生变化了。我们曾经根据游戏排名和“时间+预算”的开发模式评估游戏的成功与否。

“服务型游戏”、持久型游戏、“永远在线”游戏、免费游戏和所有轻易创造了大量玩家社区的游戏都通过将消费者研究与生产相结合而获得不同程度的成功。容易获取的数据使了解消费者需求变得如此简单。所以,如果没有人购买游戏,它花了多少时间或者多少预算还有什么意义呢?

传统的游戏开发(如独立盒装产品)因为缺少消费者研究而受害,更何况即使完成了消费者研究工作,它也几乎从来没有产生“可执行的反馈”。

你现在可能在搞市场营销还是专注于生产,但如果你做游戏并且重视消费者,你就必然要寻求“可执行的反馈”。

从字面意思上看,“可执行反馈”是指你可以按照它采取行动的反馈。这就好像,你是司机,你在找一个停车位,在你找到以前(而不是之后),乘客告诉你“停那边!”。基本上,“可执行反馈”是一种具有实用价值的反馈,在及时的情况下能让你的生活和产品变得更好。

在2013年的数字时代,数据流来自消费者。游戏业在消费者的实验中获得巨大成功。如果有分析,我们就可以专注于自己的数据,看看什么方案能管用。这确实是游戏行业的伟大成就,特别是考虑到它与用户体验的关系越来越密切。现在,我们几乎是随时都能了解玩家对各款游戏设计和营销决定作何反应。

但最重要的是,得是我们自己的游戏,自己的消费者,自己的数据。

因为现在游戏通常是一种服务,所以我们要投入时间保持游戏运作、争夺大量玩家的时间(和金钱)。知己知彼,百战不殆——这就是我们从经常引用的《孙子兵法》中吸引的教训。获知对手的动向总是好战略,为此,我们可以使用玩家社区寻找游戏特点中的骑士、小兵、定时炸弹和星星。

得到数据

大多数开发者和发行商会时时监控他们的数据。这是好事!但他们几乎不会时时观察游戏的竞争格局。

但是,时时评估你自己的游戏的表现与竞争对手的并不难——我们可以使用“相对表现座标”。

当制作这种座标时,团队要执行的步骤如下:

1)决定游戏的重要特征:

1、首先,团队要坐下来头脑风暴。开发者必须回答的问题是“当玩家玩我的游戏时,他们看重的游戏特点/功能是什么?”

2、然后,可以问消费者相同的问题:“当你玩我的游戏时,你看重的游戏特点/功能是什么?”

2)做第一次调查(多项选择题):

1、根据头脑风暴的结果和消费者的反响,开发者应该做一个消费者调查来评估各个重要特点或功能的重要性,即让消费者给各个重要特点打分(一般来说是1-7分)。

2、还要询问消费者在玩哪款与你的游戏类似的游戏(你的竞争对手)。

3)分析从第一次调查中得到的数据,以及根据消费者的打分对这些特点或功能进行排名。

4)做第二次调查:

1、列出按第一次调查结果产生的“最重要的前10个”功能或特点,让消费者给它们在游戏中的表现打分。

2、让消费者也给主要竞争对手的这“最重要的前10个”功能或特点打分。

5)分析从第二次调查中获得的数据,再做一个“相对表现座标”。这个调查应该在团队有兴趣研究的各类消费者中执行,并且每一款构成竞争的游戏都要评估到。

一般来说,调查是纸质问卷。记住,去人多的餐馆,使用记分卡。为了鼓励消费者填表格,最好能承诺给予小礼物,比如把他们的名字放进抽奖箱;又或者,用虚拟奖品奖励提供有价值反馈的消费者,这个做法更简单得多(而且可以提高声誉)。

开发者应该利用他们自己的玩家社区。玩家社区中的玩家可能已经知道在游戏中,自己觉得哪些特点或功能比较重要,以及喜欢什么功能或特点。通过对玩家社区的调查,可以得知自己的游戏在哪些方面会与同类游戏形成竞争。

持续性游戏(免费游戏、MMO、地下城游戏)的开发者在制作和执行这一种调查时有一个很大的优势——他们手上掌握了两个资源:第一个资源是beta测试玩家,他们非常乐意填写他们正在“测试”的游戏的在线调查表。第二个资源是游戏发布以后形成的在线玩家社区。

特点重要性 VS. 相对重要性

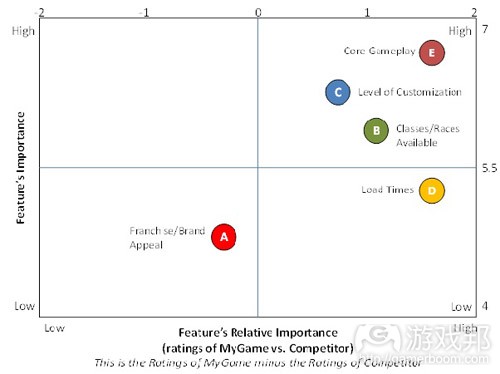

假设我们正在制作一款叫作《MyGame》的RPG游戏。这款游戏的开发者发放调查问卷,让消费者按重要性给游戏的重要特点或功能打分,然后就这几个特点给《MyGame》和它的对手游戏分别打分。

记住:

1、调查1询问消费者什么是游戏最重要的特点或功能,以及消费者在玩哪些类似游戏(竞争对手),

2、根据来自问卷1的结果1:

1)我们根据问卷1中的重要性得分选出最重要的特点(从1分到7分,分数越高,重要性越大)。

2)我们根据问卷1的玩家反馈选出游戏的主要竞争对手。

3)调查2问要求玩家就重要特点(在调查1中得分超过4的即为重要特点)分别给你的游戏和主要竞争对手打分。

数据收集完毕后,最重要的特点(>4)的得分结果可以列成下表:

根据上表,我们可以做一个座标图,反映对比各个特点,《MyGame》与竞争对手的相对表现。

Y轴上的得分是你的玩家给游戏特点/功能的打分。X轴上的值是相对表现。这个值是用《MyGame》的得分减去竞争对手在给定特点上的得分得出的结果。

先看点A——“品牌吸引力”,我们可以知道:

1)它应该算是“低重要性”,得分为4.7。这反映了消费暑对该功能/特点的看法。

2)假设《MyGame》是一款成功的游戏,即使具有不错的品牌名声,但比起竞争对手的名气还是差了一点点。因此,《MyGame》的相对表现得分是-0.2(6-6.2)。

另一方面,比较其他指标后表明《MyGame》才是胜利者。最重要的是,《MyGame》在非常重要的RPG特点或功能如玩法、角色自定义和种族/职业数量上的得分很高。不要误会,这个表现只是“相对的”。如果我们把《MyGame》与其他游戏比较,假设还存在一个“竞争对手2”,我们可能会发现竞争对手2在自定义和种族/职业数量上比《MyGame》得分更高。《MyGame》的强大品牌名声可能使“品牌吸引力”处于右下象限。

如何将以上反馈转换成“可执行反馈”

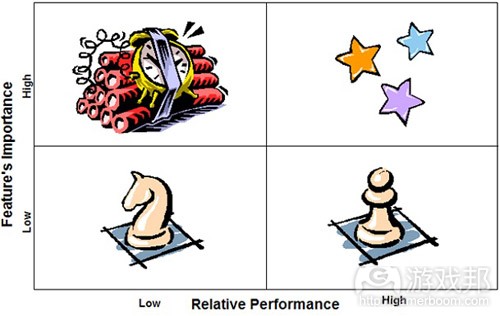

我们把四个象限分别叫作“星星”、“小兵”、“定时炸弹”和“骑士”。开发者知道他的游戏的优势和弱势,以及消费者对他们的评分以后,就可以把各个特点分别归入以下四个象限中:

1)星星:高相对表现,高重要性

2)小兵:高相对表现,低重要性

3)定时炸弹:低相对表现,高重要性

4)骑士:低相对表现,低重要性

星星是你的游戏比竞争对手表现好的特点,并且玩家觉得它确实重要。它们确定了游戏比竞争对手卓越的特点。在一款极其优秀的游戏中,所有被评估的重要特点都应该落在这个象限里。处于这个范围的特点应该“保留”,因为它们是游戏的竞争优势所在。开发者还应该记住,很成功的竞争对手的星星有时候也可能落在左边。

定时炸弹是消费者觉得重要但你的游戏表现不如竞争对手的特点。这是很严重的问题,就像定时炸弹,随时可能爆炸,一旦爆炸必定产生一定的伤害。这是竞争对手打压你的游戏的地方,特别是因为消费者不断注意到你的游戏和竞争对手之间的区别(后者更好)。定时炸弹是必须优先解决的问题。把定时炸弹当作一个戒备状态,越多特点落在这个区域,威胁越大。开发者的目标是,改进这些特点,使它们往星星象限移动。

小兵是你的游戏表现很好但消费者认为不那么重要的特点。只有当开发者成功剔除所有定时炸弹后才能考虑这些特点。小兵的问题是,即使你的游戏在这个范围表现相当好,但并没有引起消费者足够的重视。开发者的主要任务是让消费者意识到这些特点的重要性。为此,应该在社区建设和市场营销上努力。

骑士的优先级是最低的。之所以称这个象限为“骑士”是因为在解决它们时,需要“非线性策略”(游戏邦注:想象一下国际象棋中“马”的“L”形走法)。骑士在表现和重要性上都存在一些问题。开发者的首要任务是提高“骑士”们的表现,将其赶到小兵象限中。为此,开发者应该努力让消费者明白骑士特点的重要性(策略与小兵一样)。

读者可能会发问:“为什么我们不消灭小兵和骑士?它们的重要性不都很低么?”

答案是:当然不行。任何处于低重要性象限的特点仍然是重要的。因为这个座标是根据消费者的第二次调查结果做成的,使用到的特点都是消费者认为“最重要的”,所以处于这个象限的特点最多算作“重要性较低”,也就是,最重要的特点当中比较不重要的特点。因此,不能简单地把它们剔除。

总之,开发者应该在以下方面努力:

1)高优先级:拆除定时炸弹——它们导致玩家流失。

2)高优先级:保持星星——这是你的竞争优势所在。

3)次优先级:宣传小兵——让玩家明白为什么这些特点很重要。

4)低优先级:先改进后宣传骑士——改进以前不要忙着宣传。

按优先级解决这些问题,有助于在一个风云变幻的行业中建立和维持市场。社交游戏、在线社区、低准入门槛和分析技术已经使游戏的制作方式产生了革命性的变化,但同时也加剧了游戏之间的潜在竞争。使用本文提供的方法不仅可以评估你的游戏,还有助于了解当前的竞争格局。

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Knights, Pawns, Bombs and Stars: Evaluating your competition to achieve actionable feedback

by Rocco Scandizzo

There has been a shift in how many successful games come to market. We used to predict success based on gamerankings and “on-time & on-budget” development.

The new world of “games as services,” persistent games, “always on” games, F2P and all those games that create a readily accessible community of players have been enjoying the successes of marrying consumer research with production. The accessible data makes knowing what consumers want so much easier. So, why care if a game is developed on time and on budget if nobody ends up wanting it?

Traditional game development (like disconnected boxed product) suffered from a lack of consumer research, and when consumer research was done – it almost never yielded “actionable feedback.”

You might be in marketing, or you might be in production, but if you make games and give your consumers any importance whatsoever, you probably are on a constant quest for “actionable feedback.”

“Actionable feedback” is – literally – feedback you can act upon. It’s like when you are looking for a spot to park your car and your passenger tells you, “One there!” before you passed the spot, and not after. Essentially, it’s the useful kind feedback, the one that, given in time, makes your life or your product better.

In the digital space, as of 2013, rivers of data stream from consumers. The industry is enjoying great successes from experimenting on consumers. If there are analytics, we can focus on our own data and see what works. This is truly the great achievement of the videogame industry since its move to more connected experiences. We now know how gamers react to each one of our game designs and marketing decisions, almost in real time.

The emphasis is, however, on one’s own games, one’s own consumers, one’s own data.

Since games are now often a service, we find we invest time in keeping them alive and fighting for an ongoing amount of consumer’s time (and wallets). This is where we can take a lesson from the over-cited Sun Tzu, and figure out that knowing our enemies is good tactics. To help in this, we can use our community to develop a Knights, Pawns, Bombs and Stars matrix.

Getting your Data

Most developers and publishers constantly monitor their own data. This is great! But fewer constantly monitor their competition.

There is however a quite simple way of constantly assessing your game’s performance versus competitors: the “Relative Performance matrix.”

In its simplest form, the steps a team has to go through when creating this kind of tool are:

1) Determine what are the game’s key features:

First the team should sit down and brainstorm. The question the developer needs to answer is “what are the game characteristics/features consumers look at when playing my kind of game?”

Then the same question can be asked to consumers. These are open questions: ”what are the game characteristics/features *you* look at when playing my game?”

2) Create a first survey (with multiple but limited choices):

With what brainstormed and with the consumers responses, the developer should create a survey for customers to rate the importance of each core feature that has been defined. Customers should be able to attribute a score (normally from 1 to 7) to each item.

Also ask consumers what other competing games they play.

3) Examine the raw data obtained from the first survey and rank the game features by consumer segment.

4) Create a second survey:

Use the “top ten” most important features that have emerged from survey #1 and have consumers rate the games performance on them.

Have consumers also rate the top ten features of the major competitors (as defined by the consumers under point 2b).

5) Analyze the data obtained from survey #2 and create a “relative performance matrix” (see below). This exercise should be repeated for every segment of consumers the team is interested in studying and for every competing game that shall be evaluated.

Traditionally, this was done with paper surveys. Remember going to a restaurant and finding a scorecard? To incentivize consumers to fill out the form, small gifts were promised. Like having their name entered in a raffle. I need not say that today, delivering virtual prizes in exchange for valuable feedback is a lot simpler (and can go a long way in creating goodwill).

Developers should use their community. They probably already know what features consumers find important in their game, and which features they prefer. It’s just an extra step to see how they shape up against the competition.

Developers of persistent games (F2P games, MMOs, MUDs) also have a great advantage in creating and implementing this kind of surveys. The first resource are beta testers. They will be more than willing to fill out online surveys on the game they are “testing.” The second resource is, once the game has launched, its online community.

Feature Importance vs. Relative Importance

For simplicity let’s consider we are making an RPG called “MyGame.” The developer of MyGame sends out his questionnaire and has the top features scored for importance. Then he asks the consumers to rate how MyGame does against his arch-enemy game, the dreaded/admired “Competitor.”

Remember:

Survey #1 Asks which are the most important game features and what competitive games do the consumers play.

Output #1: From Survey #1

We build a DB of features scored by importance (from 1 to 7, with 7 being high importance)

We build a DB of our top competitors.

Survey #2 asks consumers to score how your game scores against your top competitors on the top features (features with >4 importance) determined using Survey #1.

Once the data is collected, the results for the most important features (>4) should be plotted in a table as shown below.

From this data we can plot out a matrix that shows the importance of each feature against the relative performance of MyGame on that feature vs. Competitor.

The score on the Y axis is the rating your segment gives to a game characteristic/feature. The value on the X axis is the relative performance. It is obtained by subtracting the Competitor’s performance score on a given feature from MyGame’s score.

By examining point A, “franchise/brand appeal,” one can understand that:

1) it qualifies as “low importance,” with a score of 4.7. This yields the consumers point of view on the feature/characteristic.

2) MyGame, even if it possesses a good brand name due to its hypothetical success, suffers the brand strength that Competitor possesses (maybe its a long lasting franchise). Thus, MyGame’s relative performance is a -0.2 (= 6 – 6.2).

On the other hand, all the rest of the dimensions compared see MyGame as a winner. Most importantly, MyGame scores high ratings on very important RPG features such as gameplay, level of customization and number of classes/races available. Do not be misled, the performance is only “relative.” If we plot MyGame against yet another game, imagine a “Competitor2,” we could find out that Competitor2 largely outperforms MyGame both on customization and number of classes/races available. On the other hand, MyGame’s strong brand name could result in the “franchise appeal” dot in the lower right quadrant.

How to turn this feedback into “Actionable Feedback”

Once the developer knows his game’s strengths and weaknesses and how consumers rate them, he will be able to define all items as one of the following:

1) Stars: High relative performance, High importance

2) Pawns: High relative performance, Low importance

3) Time bombs: Low relative performance, High importance

4) Knights: Low relative performance, Low importance

Stars are features where your game is better than competition and that customers find really important. They define features where the game is on the cutting edge respect to its competitor. In a perfect world all of the items evaluated should be clustered in this zone. Items in this area should be “maintained” in order to keep the competitive advantage. Developers should also keep in mind that it’s probable that at some point a competitor with a great hit will kick their star to the left.

Time bombs are features that customers find really important but where your game is worse than competition. They are immediate problems, they are about the blow up and might have already done some damage. This is where competitors are giving your game a hard time, especially because consumers constantly notice the difference between the product and the competitors’ product (the latter being better). Time bombs are high priority and are the first situation that should be assessed and defused. Think of Time Bomb’s as a Def Con situation, the higher the number of items in this area, the higher is the Def Con number (try not to get to DefCon 5). The objective is to fix them so that they shift laterally into your star quadrant.

Pawns are features where you perform really well but to which consumers attach low importance. They should be assessed only after a developer has successfully defused all time bombs. The problem with pawns is that even if one’s product performs well with them, consumers don’t seem to appreciate them enough. The main task here is to convince consumers how these features, as a matter of fact, are important. Community building and marketing efforts should be the main course of action.

Knights have last priority. They are defined as knights since they need a “non linear tactic” in order to be assessed (the classic chess piece L jump). Knights show some problems both on performance and in perceived importance. The first task is to improve their performance, shifting them into the pawn quadrant. At that point one should work on making consumers understand how much the knight feature is important (see the Pawns paragraph).

The existence of Knights begs the question: “Why aren’t we just killing the Pawns and Knights features? Aren’t they low importance?”

The answer is no. Any feature that qualifies in the low importance quadrant should still be deemed as important. Since the matrix is built based on consumers’ second survey, thus using only the feature they deemed as most important, these features should only be considered less important. Or even just the least important of the most important. Hence, they are probably too important to kill.

To summarize, efforts should be focused in the following way.

1) High Priority – Fix the Bombs: they leak consumers.

2) High Priority – Maintain your Stars: you don’t want to lose your competitive edge.

3) Secondary Priority – Evangelize your Pawns: you want players to understand why this feature is so great.

4) Low Priority – Fix then Evangelize: don’t make the mistake of marketing a feature before fixing it.

Prioritizing actionable items can help establish and maintain a market in a world of constant change. Social gaming, online communities, lowered barriers to entry and analytics have evolved the way games are made and increased potential competition. It just takes an extra step to use all the tools that such connected experiences offer in order to evaluate, not only the game you are making, but also the competitive landscape.(source:gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号