Niko Partners总经理谈中国游戏市场发展情况

作者:Dean Takahashi

中国已经成为了世界上最有活力且最独特的一大游戏市场。从10年前那个还不存在虚拟理念的时代开始崛起,又经历了盗版磁盘肆虐时期,最终中国游戏市场成为了在线游戏市场一股不可小觑的强大力量。Niko Partners总经理Lisa Cosmas Hanson见证了中国在线游戏市场长达10年的发展。她目睹了一些公开上市公司(如腾讯)的崛起,一些大受欢迎的西方多人在线游戏(如《魔兽世界》)在此的发行以及社交网络游戏的出现。在数百个Android应用商店中,手机游戏也出现了爆炸式发展。现在的中国游戏市场还迎来了一个好消息,即中国政府将允许掌机游戏的发行,特别是那些具有教育意义的掌机游戏。今天我们将与Cosmas Hanson共同谈论中国这个不断发展的市场。

在中国哪些游戏更受欢迎?玩家对于《魔兽世界》的需求是否发生了改变?

我认为对于《魔兽世界》的需求改变是来自于全球范围,并不只在于中国市场——虽然我没有明确的数据点能够证明这一点。今天,那些原本受欢迎的游戏还是很受欢迎。就像《梦幻西游》虽然是一款老游戏,但是它却仍然是许多网吧中最受欢迎的游戏;它同样也还处在主流大型多人在线角色扮演游戏榜单中的前列。现在,Riot Games的《英雄联盟》引起巨大轰动,我们将其归为“高级休闲游戏”,这又是另外一种类型。《英雄联盟》比《梦幻西游》的游戏时间更长,可以说这是一款新型游戏,玩家都颇受吸引,且愿意在游戏中投入时间和金钱。我相信,若要罗列出集家庭、网吧、办公室及学校休闲娱乐为一体的10大最受欢迎高级休闲游戏,这款游戏必将位于榜首。而如果单从网吧的受欢迎程度来看,它的成绩已经非常好了!

中国游戏市场有多大?

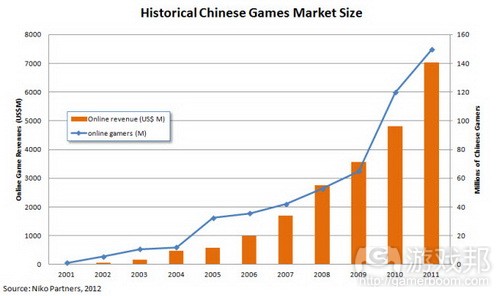

这是一个很难回答的问题,尽管社交网站服务(SNS)的游戏收益(游戏邦注:基本上是指一些社交网站或微博上的社交游戏)2009年才开始出现,但其发展非常快。但从绝对值来看,大型多人在线游戏(MMOG)仍然处于支配地位。SNS游戏收益每年增长率为31.2%,而MMOG收益的增长率仅为22%,但是如果从绝对值来看,后者显然更胜一筹。总体看来,今年的收益是70亿美元,而到2016年中国游戏市场的总收益有望达到200亿美元。

能否提供给我们一些具体范畴的数据。

2011年的SNS游戏收益是7.53亿美元。而我们估计在2016年这一数值将变成29亿美元。MMOG的收益也将是2011年的6倍。到2016年,若发展势头依旧的话,比例将有所放缓,降为13%;然而MMOG在2016年仍然可以创造出120亿美元的收益。

在此需要阐明的一点是,基于大数定律(游戏邦注:是指在随机试验中,每次出现的结果不同,但是大量重复试验出现的结果的平均值却几乎总是接近于某个确定的值),我们知道增长率终会呈现出下降趋势并且会变得无法继续维持。我们一直想着这应该就是顶峰了吧,但是直至今年,总游戏收益依然比2010年高出46%。

2016年的数据包含了那些内容?

包含了MMOG、SNS以及休闲游戏。我们会想增长率应该会开始出现下降。投资团体们可能会开始抛售这些中国在线运营商的股票,而中国运营商们也将会开始转向国际市场寻求进一步发展。尽管如此,国内市场也将继续发展。且更让人费解的是发展速度依旧非常迅速。(根据对比,美国的掌机市场收益在4月份下降了42%)。当着眼于所谓的网络用户以及他们使用在线游戏的频率,还有不同城市等级间的游戏行为变化(从上海北京等大城市到一些小城市甚至是偏远城市),我们从中发现增长势头。事实上人们所拥有的娱乐选择并不多。我们可以发现,虽然游戏非常重要,但是仍然存在一些其它选择。在中国,在线视频非常受欢迎(特别是现在)。作为一种网络应用,它甚至赶超在线游戏的使用频率。基于某些因素我们可以说“在不久的将来会出现能够压制在线游戏增长率的内容。”除此之外,我们还发现玩家们仍然持续为游戏花钱,且潜在游戏玩家将乐意为游戏掏腰包,这样游戏的收益就会持续上升。

能否谈谈将中国游戏市场同西方游戏市场,或者具体点,同美国市场进行比较的情况?

中国PC游戏市场是全球游戏市场的重要组成部分。这个市场的规模甚至超越人们的想象。一些美国和欧洲公司甚至会感觉到自己被阻隔在中国市场之外,即他们只能通过合作方式进入这个市场。虽然市场准入门槛过高,但是如果你拥有一款热门的MMOG,你便能够在此夺取市场份额。但问题是,你必须先拥有特许经营权,然后获得政府的批准,最后才能使用游戏内容。而经历这些层层关卡真的不是件易事。不过如果你最终能够进入这个市场,那么之前的一切付出也算有了回报。同时你需要仔细思考玩家真正想要的以及政府愿意接受的内容是什么,哪家公司能够成为你真正的合作伙伴,且为你带来利益,以及你的开发团队是否如你所愿足够优秀等。

Trion最近便凭借在线游戏《Rift》成功地做到了这点。

的确如此,他们与盛大展开紧密合作(游戏邦注:盛大获得《Rift》在中国的代理权)。《Rift》属于中国玩家喜欢的游戏类型。所以如果说连这款游戏都无法取得成功,那也只能说开发公司不懂得如何保护玩家数据。我觉得如果一款游戏营销做得很成功,发行日期刚好配合玩家的休闲时间,那么它应该会取得成功。但是我们同样也看到另外一款来自韩国(游戏在韩国市场大获成功)的游戏《Aion》因出现了许多帐号被盗请款而无法达到预期的成绩。所以很多操作方面的因素还是值得开发者重视。我也真心希望不会再看到类似问题。虽然这种情况甚少发生,但是一旦出现在AAA级游戏身上,对于这些游戏的打击也将是致命的。

听说最近很多bots侵入iPhone下载领域?

不只是iPhone,还有Android平台。在中国,人们获得游戏的方式有所不同。这个市场共有上百个应用商店,我听到的一个数据是共有400个可供合法下载的应用商店。加之,现在很多商店还提供手机的越狱服务,所以你可以在各种应用商店非法取得各种你想要的内容。我们在6月份发行了一份手机游戏报告,但一直到我们完成这项研究,仍然不能理解为什么玩家要在能够以非法手段免费获得的情况下继续通过正规渠道购买游戏。所以我们决定弄清楚这个问题。

我想bots不再只是针对于PC游戏,这是整个游戏领域都很常见的现象。

我觉得这种非法行为已盛行于整个中国市场,这是指编写一些具有破坏性的代码。但关于这种情况对手机游戏的影响,我不是很清楚。

中国市场的主要优势在于增长率,尽管有所放缓,但是仍然高于西方市场及整个掌机市场。

的确如此。但我不认为这是个区域发展问题,而应该是平台的发展。现在我们能够从在线游戏中看到掌机的特性,这些游戏具有破坏性,将变得越来越普及,而且发行成本较低。当然了操作成本非常高。你会发现在全球范围内,PC平台比掌机平台更易于搭载。掌机有可能不再是倍受青睐的游戏平台。但是谁也说不准这种可能性。

除此之外,游戏还有一个容身之处,自2010年中国政府承认掌机的合法性以来,这一设备便大量涌现。但用户更多通过掌机体验简单的游戏。例如联想在中国发行了两款不一样的掌机,一款是之前的爱塞克(iSec),另一款是不久前新闻说到的绿动CT510搭载游戏掌机。CT510虽然具有与Kinect类似的功能,但是它却不是Kinect的复制品。这是联想旗下的一个衍生产品,而开发这款衍生产品的公司就是绿动。这款运动机的发行一再被延迟,并最终于4月29日在中国大陆问世,售价6百美元。我们将继续观察中国掌机游戏市场的发展,不管这里是否容得下西方掌机制造者,或者也许这些西方制造者的游戏能够夺取中国在线游戏的部分市场份额也说不准。

与此同时联想还在本月发行了一款带有网络连接功能的智能电视。设备内部还设有了上集成系统,旨在充当掌机平台,共能够运行30款掌机游戏。我想其中应该有6款是免费的,而其余则是付费游戏(虽然我还不清楚其完整模式)。为了运行这款电视,你同时需要购买一台控制器,或者你也可以在中国应用商店中购买免费iPhone应用,将你的iPhone变成这台电视的控制器,然后运行游戏。这些游戏更像是Wii游戏。查看这些游戏是否自动获得认可,或者查看它们是否需要经历特定过程,或者玩家是否愿意在除PC以外的电视上玩游戏,是一个有趣的过程。

所以我们会密切关注着这两种不同产品的发行,查看管理者的看法,同时也会关注《Rift》这类游戏在市场中的表现。这些游戏有可能唤醒市场上许多不同类型的玩家,但也有可能遭到打击而只能乖乖撤回休闲和掌机游戏领域,在那里所有玩家能够彼此进行交流,甚至能够在现实生活中与好友谈论他们自己在玩的游戏。

如今中国社交游戏共获得7.53亿美元的收益。如此看来中国社交游戏市场规模还远远小于美国,因为在美国单Zynga就挣得10亿美元。你能否跟我们说说美国社交市场与中国社交市场的区别所在?

我认为中国的一些游戏其实本身并不能赚钱。这里的PC游戏出现众多游戏玩法,但玩家习惯于体验手头的游戏作品。不过我们也不能忽视其中的发展,据估算,2009年中国的社交游戏市场的盈利额为8000万美元;而在短短的两年后,也就是2011年,其盈利额已达到8亿美元!如此快速的增长真心让人感到惊讶。社交游戏的发展不仅能够吸引更多传统PC在线游戏玩家的注意,同时也能给予玩家更多不同的游戏选择。我想Zynga可能正从中获得巨大收益。

美国一些主要的社交游戏开发者甚至还通过手机平台赚取收益,但中国的智能手机和平板电脑的兴起只有不到一年的时间。所以我们有信心迎来销售额和销量的增长,且从苹果在中国市场所获得的巨大收益增长来看,我们便知道这里充满潜力。我们需要留给市场更多时间去推动智能手机和平板电脑的普及,而且因为这些平台上的社交游戏对于全世界玩家来说都非常简单,所以我们有信心迎来比PC游戏多出10倍的增长率。

在中国,网吧仍然是一股强劲力量吗?

的确是这样的。直到现在我们也仍然在收集网吧的每月数据。有趣的是,玩家在网吧里玩游戏的行为与他们在自家玩游戏有所不同,更别说那些从未去过网吧的玩家。我们会发现,玩家在网吧里选出的最受欢迎的游戏通常与在家里选出的游戏不同。我想玩家到网吧都会选择基于服务器的游戏,有时候也会玩网页游戏;而且他们绝不会花时间耗在网吧里玩社交游戏,除非他们家里没有电脑。

对于那些较短暂的游戏,玩家可以选择在办公室或者在店里没什么客人的时候玩。而如果玩家想要在网吧玩会儿社交游戏,那么这时候的社交游戏更像是他们体验其它游戏的插曲,而不是他们到网吧的主要原因。

网吧仍然是一种非常重要的渠道。尽管它所创造的利益不如家庭用户来得多,但是我们却不能忽视它的作用;尤其是在互联网普及率渗透到一些偏远的小城市时——因为在这些较为落后的地区,人们上网的主要方式便是去网吧。这些地区的人们甚至没钱为自家购置一台电脑。

尽管对于一线、二线城市来说,网吧不再是他们访问网络的主要渠道,但是对于那些小城市来说(游戏邦注:游戏公司会在此派遣地区推广负责人宣传游戏作品),网吧仍然是不可替代的存在。

我很好奇的是为什么网吧没有在美国兴盛起来?

我想这多半会以一种不同的方式存在,如游戏中心。人们总是希望聚集在一起玩游戏,就像是一种流动的局域网派对。所以如果我们能够提供给玩家一些配有较快访问速度和高端电脑的席位,呈现聚会或比赛氛围,玩家们肯定会喜欢上这种玩游戏的方式。

但是如果你的国家拥有极高的家庭PC渗透率,网吧也的确没有什么存在必要。但不论你询问的是中国哪个城市的居民,他们都会说一旦有了家庭PC也就不会再到网吧玩游戏。因为网吧毕竟是一个噪杂的公共场所。而那些来自一线、二线城市,仍愿意去网吧的居民会说,他们喜欢与好友在一起玩游戏,就像在进行体育运动或郊游,他们喜欢到网吧尝试一些新游戏,他们也会受到在线游戏运营商的推动而到网吧玩游戏。甚至,他们有可能只是为了逃离束缚的居家空间,才选择到网吧去。

你在之前提到过,游戏公司在股票市场中的待遇将发生变化。能否跟我们详细说说这种变化会持续多久,以及在这个市场中实际发生了些什么变化?

其实也就是投资者购买这些游戏股份的动力会显著降低;游戏公司的股票价格和市场价值逐渐下跌。在询问一些股票分析家后,我们发现若干重要原因,即“中国市场的发展是来得猛,去得也快,许多在线游戏运营商开始转向其它国家的市场。”也就是这些运营商认为本国的游戏市场已不足以支撑他们自身的发展。但是我却认为事情不是这样。根据我们的数据,我发现中国游戏市场的发展局势还是非常乐观的,不仅依然有大量在线游戏运营商坚守于此,这里还存在大量公开交易以及无数出色游戏。

尽管这个市场的游戏过于饱和,但是这里有众多游戏玩家,所以我认为中国数字娱乐市场最有趣,也最吸引人的一点是,许多在线游戏运营商(过去只是关注于游戏的开发和运营或是在线游戏授权和运营)开始转向手机游戏,社交游戏,甚至是在线视频内容。而所有这些不同切入点让那些能够连接网络且希望体验基于社交或病毒式传播形式电子游戏的玩家拥有更多选择。如果能够有效地结合所有这些元素,不管你开发的是否是一款热门游戏都不重要,只要你能够明确一个合适的渠道,且拥有一定野心(渴求获得中国当前的游戏用户),你就有可能取得成功。

我发现许多游戏公司总会两边下注,观看不同局势的发展和收益。所以这些游戏公司正在观察着社交游戏的发展。同时他们发现手机游戏和在线视频在一个官方互联网应用使用率榜单中的排行超越了在线游戏。所以现在的他们需要回答的问题是“我们到底该做些什么?”我想说的是,现在你们唯一可以做的便是发行一款像《英雄联盟》一样热门的游戏,真正去把握市场,找到合适的发行伙伴,尝试在这个已充斥各类型游戏的市场满足用户需求。就像我们从一些研究数据中看到的那样,中国市场中的游戏仍在有序运作着。

如果市场价值发生改变,你是否认为中国公司会前往美国市场并购一些美国公司或初创企业?虽然已出现这类情况的相关实例,但我们想知道的是中国股票市场的转变是否会促使这种情况变得更明显?

我不认为现在的中国游戏市场出现现金短缺情况。这些游戏公司们仍然拥有足够的资本能够购买他们所需要的内容。而关于“移民”理念更重要的一点是,就像在美国,外国公司并不需要与本土公司共享收益,他们可以通过美国本土公司所提供的本土服务器而运行自己的游戏。我们让游戏公司能够轻松地在此设立商店,运营他们自己的游戏。

有趣的是,在中国获得巨大成功的游戏有可能无法在国外市场取得同样优秀的成绩;反之亦然。主要是因为外国公司本身就不会受到很大的欢迎,同时中国政府所设定的条条框框也是一大阻碍因素。除此之外,这主要是因为很多美国游戏巨头一直都关注于开发掌机游戏,但是在中国市场这些游戏却还不甚普及。

我们还发现许多中国游戏公司已经发展成大型企业,即使是在自己的地盘上,他们也不与世界上其它公司竞争。他们只与自己进行竞争。所以当这些公司进军海外市场,如美国时,他们将会认为“哇,我们好像是校园里的风云人物!”这种情况就像是他们本来在一所普通高中就读,但最终却毕业于著名的斯坦福大学一样。也就是你只有努力成为校园里的风云人物你才有可能来到斯坦福大学。

所以为了进一步研究当地市场,这些中国公司将收购一些美国运行或美国管理的公司,将他们当成是情报站,以此理解当地市场玩家的需求,系统的运行,并弄清楚自己需要何种合作伙伴。这里你需要采取与你在拓宽其它国际市场时有所不同的做法。因为你在自己的国家拥有一款大受欢迎的游戏,但是不管这是怎样的一款游戏都不重要,你真正需要做的是理解你所选择的市场,搞清楚如何进入这个市场,及如何在此赚取利益。这些道理对于那些想要进入中国的外国公司也同样适用。

这里只为你开启的是一扇小小的门和一道狭窄的门槛,并且你所需要面对的失败风险也非常巨大。所以如果你希望能够在中国市场取得比美国更好的成绩,你就需要做好万全准备。就像我们所看到的,中国公司也开始进军美国市场,并在此购买工作室,同时他们也会前往其它地区,如菲律宾或其它东南亚国家或俄罗斯。不管他们的目标是哪里,我们都可以注意到中国政府正在鼓励这种国际性扩张。如果他们能够在这种国际扩张中取得好成绩,对于他们在国内的发展也非常有帮助——不过我却不知道他们的扩张速度及所采取的具体步骤是什么。但我们可以确定的是,这些公司,至少是上市公司将在今年或往后几年里向其它国家扩张。

你能否谈谈中国何时能够成为最大的游戏市场——我们是否能够看到这一发展,或者你能否明确我们何时才能看到这一结果?

我希望我们能够了解全球在线游戏市场的收益情况,但是这是不可能的事。不过我认为现在的中国PC在线游戏市场已占领一半的全球在线游戏市场份额。所以不可否认的是,这就是全球最大的在线游戏市场!(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Why China’s game business will hit $20B by 2016 (exclusive interview)

Dean Takahashi

China has one of the most dynamic and unique game markets in the world. Rising from virtual non-existence a decade ago, and surviving a stage when every disk was pirated, the nation has become a force to be reckoned with in online games. Lisa Cosmas Hanson, managing director of Niko Partners, has watched the Chinese online game market for more than a decade. She has seen the rise of publicly traded companies such as Tencent, the launch of popular Western massively multiplayer online games such as World of Warcraft, and the emergence of social networking games. Mobile gaming has exploded with hundreds of Android app stores. And now there’s even a glimmer of hope that the Chinese government will allow the launch of game consoles, particularly if they are education focused. We talked with Cosmas Hanson about this ever-changing market. Here’s an edited transcript of the conversation.

GamesBeat: What kind of games are popular in China? Has the demand for World of Warcraft changed at all?

Hanson: I think World of Warcraft demand has changed slightly on a global scale. I don’t think it’s any more dramatic in China than it is anywhere else in the world. But I don’t have their exact data points. Now, the games that have been popular remain popular. Fantasy Westward Journey is so old now, but it’s still the leading game in the internet cafes. It’s among the leading games on the MMORPG list as well. Riot Games’ League of Legends is a smash success right now. We call that “advanced casual,” so it’s a different list. It has far more hours than Fantasy Westward Journey. It’s a new game. Gamers are attracted to it, and they’ll spend their time and money playing it. I’m sure it’ll be catapulted up towards the top of our advanced casual list when we come up with our top 10 list for home, internet cafe, office, and school use combined. But out of the internet cafes specifically, it’s doing quite well.

GamesBeat: How big is the Chinese game market?

Cosmas Hanson: It’s a harder question to answer than you’d think, because while social network service (SNS) game revenue, which is basically social games just through SNS sites or microblogging sites, started at next to nothing in 2009, it’s rising pretty quickly. But in absolute value, the massively multiplayer online games (MMOGs) still totally dominate. So the SNS game revenue compound annual growth rate is 31.2 percent, and the MMOG rate is only 22 percent, but at the same time, in absolute value it’s so much greater. Overall, it will hit $20 billion by 2016 from $7 billion this year.

GamesBeat: Tell us some of the category numbers.

Cosmas Hanson: The SNS game revenue for 2011 is $753 million US dollars. And in 2016 we think it’ll be $2.9 billion. And then MMOG revenue may be six times that for 2011. In 2016, if the growth rates continue, we will see the total growth rate slowing to only 13 percent from 2016 over 2015, yet MMOGs will still generate $12 billion in 2016.

One thing to say about these numbers is that we always have declining growth because of the law of large numbers and the growth just becomes unsustainable. We keep thinking that it’s got to peak, but then this year, total games revenue was still 46 percent higher than in 2010.

GamesBeat: What does the 2016 figure include?

Cosmas Hanson: That includes MMOG, SNS, and casual games. And so we keep thinking, well, this rate of growth has to come down. The investment community has kind of written off these Chinese online operator stocks, and Chinese operators themselves are looking to international markets for their growth. Yet their domestic market is still growing so much. It’s perplexing that it continues at such a great pace. (By comparison, the U.S. console market fell 42 percent in April.) When we look at what we see for internet users and the rate of usage for online games for internet users, and then behavioral changes between the city tiers, from the big cities of Shanghai and Beijing to some smaller cities further afield, we find the growth. People don’t have a whole lot of entertainment choices. We can see that the usage of games is important. But there are a lot of other choices too. Online video is a very popular thing in China, especially now. It actually outpaced the use of online games as an internet application. We look at all these factors and we try to say, ‘Well, maybe something else is going to come along and knock down the growth rate of online games.’ But we still find that the gamers who are playing continue to spend money, and the gamers who will enter will spend some money in the games, and the revenue just keeps coming.

GamesBeat: What do you see when you compare this to the West or, specifically, to the U.S. market?

Cosmas Hanson: I know that the Chinese PC game market is absolutely critical as a segment of the global market. It’s just so much bigger than people are willing to understand. These U.S.-based and Europe-based companies feel like they’re locked out of the Chinese market, where they can only enter the market with a partner. It is quite difficult to enter, but if you have a hot MMOG, then you can take share away. The problem is you have to get a licensing deal. Then you have to get content approved by the government. You have to jump through lots of hoops and it’s not easy. But it’s worth the payoff once you’re there. It’s definitely worth figuring out what the gamers want and what the government would accept and who the right companies are to partner with in order to have the opportunity, should your development team be as top-notch as you’d hope they are.

GamesBeat: Trion recently succeeded in doing that with its Rift online game?

Cosmas Hanson: Yeah, they did quite a deal with Shanda, and I’m quite hopeful for that game. It’s a type of game that Chinese gamers should like. The only thing that could screw it up is if the companies somehow don’t protect the data. I think that the game itself, assuming that it’s marketed well, and assuming that it hits at a time when gamers are willing to take a few days to try it out, it should be successful. But we saw another game that should have been successful from Korea, Aion. It really was not as successful as it could have been. Some people say there was a lot of hacking and account theft within the game. A lot of operational things didn’t go smoothly. Hopefully that type of thing won’t happen again. It’s rare that it does, but when it does on an AAA title it’s just devastating.

GamesBeat: Speaking of bots, I heard lately that a lot of them have moved into the iPhone downloads business?

Cosmas Hanson: Not just iPhone but Android too. The way people get their games in China is different from here. There are hundreds of stores. I heard a figure of 400 app stores, for legitimate downloads. Plus, phones are jailbroken on purchase. There are all kinds of app stores that you can use, or just places to get illegally downloaded content. So we don’t yet know. We’re publishing a report on mobile games in June. But until we finish the research for that report, we won’t really understand why the gamers are continuing to buy games legally for their phones if they can get almost all of their games illegally. So we’re trying to understand that as well.

GamesBeat: I guess the bots are not just a problem for PC games anymore, then? They’re probably across all of gaming.

Cosmas Hanson: It feels like it’s almost a sport in China, to write some code that will be destructive. But I don’t know any specifics about that occurring in mobile phone games.

GamesBeat: The good thing for China seems to be that the growth rate, even though it’s slowing, is still a lot better than the West and the main console market.

Cosmas Hanson: Yeah, I don’t think it’s a regional growth problem. I think it’s a platform growth problem. Now that you can see console quality in online games, these games are disruptive and are becoming far more pervasive and the distribution costs are lower. The operating costs are of course high. I think you’re finding that the platform of PC is so much easier to serve on a global basis than the platforms of consoles. And so maybe consoles are on their way down as a platform. Maybe they’re not.

There’s still a place for them, it seems, and we’re even seeing consoles spring up in China, where they’ve been illegal since 2010. But they’re more playing these for the simple games. So for example there are two separate Lenovo products being launched right now in China for consoles. One is what they call the iSec, and now Eedoo CT510 motion-gaming console. It was just in the news this past week. It supposedly was launched on April 29, with the Kinect-like capability. It’s not quite a clone, but is similar to Kinect. That is a spin-off of Lenovo and the spin-off company is called Eedoo. Their product had been delayed and delayed and it was finally announced that it would launch on April 29 in mainland China for $600. We’ll have to see what’s going on with the regulation of consoles, whether or not the western console makers can enter, and perhaps then with their theatrical-quality games take some share away from the online games.

But at the same time, Lenovo is launching a smart TV with internet connectivity. That’s this month. And within it will be a system-on-chip that works as a console, fully capable of playing 30 console games. I think six are offered for free and then somehow you have to pay for the other ones. I don’t know the full model quite yet. You have to buy a controller to go with the TV, or there’s a free iPhone app available on the Chinese app store that turns your iPhone into a controller for that TV so that you can play those games. And those games are more like a Wii game. It’ll be interesting to see if those games just automatically are approved, or if they have to go through some sort of process, and if gamers are eager to play on their TVs in addition to on their PCs.

So we’ll watch these two different products launch and then we’ll see what the regulators have to say, and meanwhile watch games like Rift enter the market. It could perhaps awaken a whole different segment of gamer. Or, at the same time, they just might get overwhelmed and retreat back to the sanctuary of casual and social games that all the people they know are playing, and have become really popular, just so they can be able to communicate in real life with people that they know about games that they’re all playing.

GamesBeat: China’s social games are $753 million now. It seems like the market is quite a bit smaller there than it is in the U.S., where Zynga alone is a billion-dollar company. What explains that difference between the U.S. social market and the Chinese social market?

Cosmas Hanson: I think some of the games in China don’t all generate revenue. I think that there is so much gameplay already on PC that they are used to playing they way that they’ve been playing over time. We can look at the growth, where in 2009 I think our estimate was that social game market in China was $80 million. And in 2011, two years later, it was approaching $800 million. It’s just really speedy growth. It’s serving to diffuse the attention away from the traditional PC online games and give the gamers something else to play. Also, I think Zynga is probably getting a lot of revenue.

But some of the American major social game developers have to be generating a lot of their revenue from the mobile platform, and in China smartphones and tablets have really only been there about a year. So we’re watching huge growth in the sales, unit sales rates, and you can see Apple’s revenue growing so much just based on the China presence alone. And so I think we need to give the market a little bit of time to have penetration of smartphones and tablets, where these social games are so readily played in the rest of the world, and meanwhile recognize that this tenfold growth has happened just on PC.

GamesBeat: The internet cafes are still going strong over there?

Cosmas Hanson: Yeah, the internet cafes are going strong. We’re collecting monthly data now in internet cafes. What’s interesting about that is, the behavior of the gamer who plays in an internet cafe is different from even that same gamer playing at home. Or quite different from the gamers who would never go to an internet cafe. We see different games emerging as popular from within the internet cafes than in the home. I think gamers who go to internet cafes are playing client-based games. Sometimes web-based games. But they’re not spending a lot of their time in the internet cafes playing social games, unless they don’t have a PC at home. And then they need to go there to play those things.

But those are such short games that they can often play them in an office or a store where there are no customers and things of that nature. You sit down in an I-cafe to play for an extended period of time, and so the social game becomes a kind of interlude rather than a reason to be there.

The internet cafes are still quite important as a channel. They might not generate as much revenue as the home user segment. In fact they don’t, but they cannot be dismissed. Especially as the internet penetration extends to the smaller cities farther away from the great metropolis. The main way for those Chinese citizens to get online is to go to an internet cafe. Many of them could never afford to have a PC at home.

The internet cafe might be losing its luster as a channel in the tier one and tier two cities, or as a primary point of access, but in the smaller cities where the game companies are more frequently sending their field marketing agents to promote games, those internet cafes are still quite important.

GamesBeat: I wonder why they haven’t taken off in the U.S.?

Cosmas Hanson: If there were to be one, it would be marketed as something different. It would be a gaming center. Somebody told me today that for her 10-year-old son, she’s hiring a truck to come to their house and it’s loaded up with game consoles or whatever it is. People just like to congregate to play together, it’s like a roving LAN party. Maybe in that sense, if you could just have a collection of seats with high-speed access and high-end computers and make it more of a party or a tournament or something. In that case I think they could be popular.

But you don’t need an internet cafe when you have such high rates of home PC penetration. No matter where you go in China, people say that they don’t ever need to go to an internet cafe again once they get a home PC. Because the I-cafes can be pretty disgusting. But the people who do continue to go in the tier one or tier two cities, they go, like I said, for different reasons. They go to play different games with their friends, more like a sport or a social outing, and they go to try out new games, they’re being promoted there by the online game operators. Or they go because they just want to escape from, perhaps, a cramped house situation.

GamesBeat: You mentioned that the stock market reception for game companies has changed. How long has that been going on, and what actually has been happening there?

Cosmas Hanson: It just feels like the pulse of investment and buying these shares has slowed down significantly. And the stock prices and the market caps have fallen for these companies. The reasons we’ve found, when asking some of the stock analysts what’s going on, is that they say, ‘Well, the growth in China is going to dry up soon and the online game operators are looking to other countries.’ So for some reason they just think that their primary market is not going to be able to sustain their growth levels. I just think that’s not the case. Maybe I misheard, maybe I don’t understand. But from our data, it shows that things are very rosy there, and that there are plenty of online game operators, there are plenty of publicly traded ones, there are plenty of games.

The market is probably too game-saturated, if anything else. And there are plenty of gamers. I think one of the very interesting and compelling points about the Chinese digital entertainment market in general is that even the online game operators, who had been solely focused on development of and operation of, or in some cases just licensing of and operation of, online games, are now diversifying into mobile games, social games, even online video. All these different entry points for people who have internet access and want to have some digital entertainment on a social level or even a viral video kind of level. At some point these things are all going to merge, there’s going to be this cohesive moment where it doesn’t really matter whether you are developing a hit game or not, so long as whatever you developed is going through the right channel and being right in front of the voracious appetite of the Chinese current gamer audience. It’s probably going to succeed.

And I think that the game companies are trying to hedge their bets and see where all the different avenues of growth might be. They’re watching what happened with social games. They’re seeing the emergence of mobile games. They’re seeing the online video out-seeding online games in one of the government rankings of internet application usage. They’re wondering, ‘Wow, what can we do?’ Well, one thing you can do is put out a hit game like League of Legends and really understand the market and find the right distribution partner and really try to serve a need in a segment where there are lots of games that have been around for just too long. As you can see by some of the data, that game is doing quite well.

GamesBeat: If there is some change in the market cap, do you think the Chinese companies would all come to the U.S. and start buying a lot of the U.S. companies or startups? That’s happened to some degree, but do you think the change in the Chinese stock market will make it more pronounced?

Cosmas Hanson: I don’t think they have any shortage of cash balance. I think they still have enough money to go buy things if they want to. But the more important emigration kind of concept is that, in America, we don’t require foreign companies to share revenue with a domestic company and operate games through a domestic company with domestic-owned servers. We allow companies to just come here, set up shop, and start operating their own games.

On the telecom infrastructure side, I believe that there’s some sort of national security thing that dictates who owns the telecom companies. I don’t get into all of that. But I think that it’s a lot easier for a company to come here and just say, ‘We’re here!’ and try to operate a game. The interesting part of that is that the games that have been just tremendous successes in China may not become tremendous successes here. And that is because the foreign companies have been less welcome, because of the rules and regulations and hoops to jump through to launch their games in China. And also because, historically, a lot of the American game giants have been focusing most of their development efforts on console-based games, and those just haven’t been there in China.

What we see is these Chinese companies have developed into massive companies without any of the opportunity to compete on a global scale, even on their own turf. They are not competing against global giants on their own turf. They’re just competing against themselves. So when they come overseas, they come to America for example, and they think, ‘Wow, we’re the big man on campus.’ They get there and it’s sort of like being in high school and then suddenly you end up at Stanford. You’d better well be a big man on campus or you won’t be anymore at Stanford.

So to watch the whole entry and exposure here, it does sometimes take acquisition of studios that are American-run and American-managed, just so you can have a listening post and understand what gamers are going to want, how the system works, what partnerships you need. All the different steps it takes for any kind of international market expansion effort. Because you have a hit product in your home country, no matter what it is, it might be a toaster oven, it doesn’t matter, you have to understand the market where you’re going, the ways to get in, the methods of access, and the availability for you to make a profit. And all of that is a truth even for foreign companies going to China.

It’s just that the door is smaller, the pathway is narrower, and your margin for failure is bigger. So you need to be more prepared to enter China if you have a hope of succeeding than you do if you’re coming to the US and you have the luxury of maybe throwing spaghetti at the wall. So you see that the Chinese companies are coming here, they are buying studios, and they’re going to other places too, like the Philippines or southeast Asia or Russia. Wherever. There’s a great deal of international expansion and the Chinese government is promoting those companies to develop internationally, expand internationally. I think it’s in their best interest for their domestic success, if they do get this international exposure, but I don’t know what the pace will be for that, or what exact steps they will take for that. But you can be sure that each and every one of those, at least the publicly traded companies, will be making a march to another country, or to more than one, in this year and the years forward.

GamesBeat: Do you see some intersection point where China becomes the biggest game market at some point — and, if so, is it visible yet, as far as which year that might happen?

Cosmas Hanson: I wish I knew the total global online game market revenue. I don’t. But I think that the Chinese PC online game market already makes up at least 50 percent of the global online gaming market. It is the biggest online gaming market. (source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号