venturebeat:抄袭并非社交游戏未来,除非是中国社交网络

尽管抄袭国内外的作品在今日的中国社交游戏产业里相当流行,但这种做法并不能驱动整个产业前进。

千橡互动的首席运营官刘健说:“抄不能成为社交游戏开发者的未来模式,除非你是腾讯。”

如此带刺的话,罕见地在中国ChinaJoy(中国国际数码互动娱乐产品及技术应用展览会)上,引起了一阵掌声。抄袭在游戏产业历程中是一个普遍的现象,就连Zynga公司、美国艺电公司、Activision Blizzard 联合公司都多多少少遭了殃。

腾讯网——有着强势即时消息服务和广受欢迎社交网络的中国互联网巨头,正在因抄袭和排挤小公司而受到猛烈的炮火攻击。杂志《计算机世界》甚至刊出了一篇引起争议的封面文章,名曰《‘狗日’的腾讯》,配以一幅腾讯企鹅身上刺着几把刀的图。

“腾讯从来不是吃螃蟹的第一人。它在成熟的市场里寻找空间,然后挤进去。然而,它选择的手段也在引起争议:模仿,甚至有时肆无忌惮地‘山寨’抄袭。”

早在2006年,新浪的创始人王志东公开指责腾讯创始人马化腾是这个产业的“抄袭大王”,并且是肆无忌惮地抄袭。

腾讯发言人紧接着发言而没有不受注意悄悄放过此事。Qzone 社交网络产品中心的总经理郑彼得在谈及人人的设计和外观乃至它的蓝色背景明显与Facebook相似时,回应说至少腾讯并没有从Facebook复制它的整个社交网络。

中国的社交网络是在开放的平台上进行实验的,但所有人仍在开发自己的游戏,许多人仿制其他流行产品。尽管表面上努力营造一个第三方开发者的生态系统,人人网自己也已经开放人人农场和人人餐厅(Playfish’s Restaurant City的“忠实”拷贝),它们分别是网上最受欢迎游戏的第二和第四。苦恼的开发者声称网络系统以允许它们向使用者发出更多病毒通知的方式来优待自己的游戏。

中国社交网的形势意味着开发者只能赚取0或者很低的利益份额,因此都争取在国内市场生产重大收益。Calvin Ng,几家游戏公司的CEO兼顾问说,“但是你不能说社交网络不赚钱,当他们看到好的能赚钱的创意就复制,因为他们想制造一切。”

以此同时,ChinaJoy SNS 和Social Game 论坛的发言人呼吁社交游戏开发者们进行改革创新,而不是发行其他农场游戏。下载flash代码然后在两个月内重建一款游戏在中国开发人员这里是很常见的。但这种战略在国外是不行的,国外社交网络和游戏寻求的是原创内容。

即使在国内,中国社交网与开发商达成合作时,现在也正在寻求更原创和更独家的内容。如果开发商同意不将游戏发售给竞争平台的话,社交网往往会提供给他更多的收益份额。

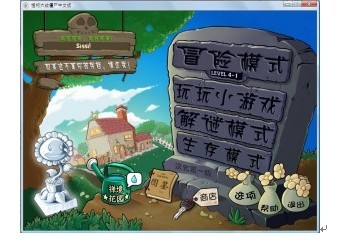

在上海有工作室的美国休闲游戏公司PopCap,新近宣布一个开创性的合作计划——它将在人人网上发行新发明的游戏,此举将检验创新游戏和外国开发者在中国的成功。PopCap的游戏,尤其是植物大战僵尸在中国广受抄袭,但公司本身还没能在中国赚到多少钱。

中国对想要介绍他们的游戏进入国内市场的外国开发商有繁琐的条款。大量的官方多人在线游戏要求有本土的合作伙伴来处理所有游戏的分派,因此有Blizzard 和网易的魔兽世界的合作。这是一个灰色地带,以致使社交网络如人人网成为社交游戏中的分配伙伴——似乎这些正成为成文规则。

除了目前的挑战外,大多数与会者者期望中国的社交网能够逐步开放。社交网开心001最近发起了一个开放平台实验(之前是完全封闭的),这将转变双方业务关系中的议价能力.据有投资Kaixin001的清明企业(Qinming Venture)的出资者之一Hans Tung所说,同样的游戏,在开心001的每用户平均收入高出人人的2—3倍。腾讯的Qzone也在继续涉足授权游戏,尽管它提供的仅是Calvin Ng 所说的“一美元里的几美分”。如果中国社交网开始寻求开发商而不是通过其他途径,开发商的收益将会有所改善。

开发人员在开发更加新颖,有针对性和难以复制的游戏方面受到禁锢。如果他们能做到这些,即使是中国的社交网络也会慢慢开放。

(译者:南奇)

Copying is not the future of social games, unless you’re a Chinese social network

Though copying of both foreign-made and Chinese-made games is rampant in China’s social games industry today, that’s not what will drive the industry forward.

Liu Jian, chief operating officer of Oak Pacific Interactive, owners of the popular RenRen social network, stated, “Copying cannot be the future model for social game developers, unless you’re Tencent.”

That barb, rare at a Chinese conference like the recent ChinaJoy event, prompted a round of applause. The issue of copying is a common one in game industry history, with the likes of Zynga, Electronic Arts, and Activision Blizzard being blasted for it at some point or other.

Tencent, a Chinese internet giant with a dominant instant messaging service and popular social network, has come under heavy fire for copying and pushing out smaller players. The magazine China Computerworld went so far as to publish a controversial cover story called “F**king Tencent,” with a picture of the Tencent Penguin stabbed with knives, writing:

Tencent is never the first to “eat crab” [to try out new things]. It looks for a space in a mature markets to shove its way in. However, the methods it chooses also invite controversy: imitation, sometimes unscrupulous “shanzhai” copying.

As early as 2006, Sina founder Wang Zhidong openly accused [Tencent founder] Ma Huateng of being the industry’s “plagiarism king,” and of brazen plagiarism at that.

Tencent’s speaker was up next and did not let slight pass unnoticed. Peter Zheng, General Manager of the Qzone Social Network Product Center, responded that at least Tencent did not copy its entire social network from Facebook, referring to the fact that RenRen’s design and features, down to the shade of blue, are remarkably “similar” to Facebook.

China’s social networks are experimenting with open platforms, but all still produce their own games, many of them knockoffs of other popular titles. Despite ostensibly striving to create an ecosystem of third party developers, RenRen itself has released RenRen Farm and RenRen Restaurant (a ‘faithful’ copy of Playfish’s Restaurant City), the second and fourth most popular games on the network, respectively. Upset developers allege that the network privileges its own games by allowing them to send out more viral notifications to users.

The power of Chinese social networks means that developers earn zero or low revenue share and therefore struggle to generate significant revenues in the domestic market. Calvin Ng, a CEO and advisor to several gaming companies, says, “But you can’t say that social networks are not making money, when they see a good idea that’s making money they just copy it because they want to make everything.”

At the same time, speakers at the ChinaJoy SNS & Social Game Forum urged social game developers to innovate, rather than release another farm game. It’s common for Chinese developers to download the flash code and then reconstruct a game within two months. But this strategy may not work abroad, where social networks and gamers are seeking original content.

Even domestically, Chinese social networks, when they do cooperate with developers, are now looking for more original and exclusive content. Chinese social networks often offer higher revenue share if developers agree not to release games on competitor’s platforms.

PopCap, a U.S. casual games company with a studio in Shanghai, just announced a pioneering cooperation to release innovative games on RenRen, which will test the success of both original games and foreign developers in China. PopCap’s games, especially Plants vs. Zombies, are widely pirated in China, but the company has not yet been able to make much money in China.

China has onerous rules for foreign developers who seek to introduce their games into the market. Massive multiplayer online games officially require a local partner to handle the distribution of all games, hence Blizzard’s cooperation with NetEase on World of Warcraft. It’s a gray area as to whether a social network like RenRen qualifies as a distribution partner in the case of social games—it seems the rules are still being written.

Despite the current challenges, most of the attendees expect China’s social network to gradually open up more. The social network Kaixin001 recently launched an open platform experiment (it was previously completely closed), which may shift the bargaining power in the relationship. For the same game, average revenue per user is 2-3 times higher on Kaixin001 than on RenRen, according to Hans Tung, a partner at Qinming Venture, which invested in Kaixin001. Tencent’s Qzone also continues to dabble in licensing games, though it offers only “a few cents on the dollar” according to Calvin Ng. If Chinese social networks start chasing developers rather than the other way around, revenue share will surely improve for developers.

Developers are being challenged to create games that are more innovative, targeted, and difficult to copy. If they are able to achieve that, even Chinese social networks should slowly open up.

闽公网安备35020302001549号

闽公网安备35020302001549号