分析Facebook App Center游戏类型分布情况

作者:Hassan Baig

Appdata等提供单款Facebook游戏应用数据的服务问世已经有些年头了,但分析Facebook App Center顶级排名游戏的服务却并未出现。因此我们就需要一种跨领域的研究方法,以便让游戏开发商,或身处这一领域的投资者得知Facebook游戏生态圈的宏观情况。

关于我的数据集合

我的数据集合囊括了Facebook App Center中855款顶级游戏应用。这里的“世界排名”表明这一结果适用于全球范围的工作室,但由于Facebook App Center并非移动领域的先锋,所以在此仅考虑网页版游戏的情况(游戏邦注:这里显示的是2013年3月1日的世界排名结果)。

研究发现

以下是Facebook App Center的主要游戏类型及其领先者,该平台游戏可划分为12种类型:

Zynga游戏主导了半数游戏类型,其余游戏类型领先者分别是King.com(2款游戏),Social Point(2款游戏),Geewa(1款游戏),Peak Games(1款游戏)和Playdom(1款游戏)。虽然Wooga和EA并非某类游戏的佼佼者,但都针对上述游戏类型推出不少作品。而6waves并未跻身这一排行榜,该公司在过去一年中的MAU(月活跃用户)已经缩水3倍。

竞争最激烈的类型:在这12种类型中,特别值得一提的是模拟游戏。Zynga有超过半数的MAU集中于这类游戏。这类游戏中的玩家行为和品味深受Zynga游戏设计和产品价值的影响,所以实际上可以说,这些游戏用户就是Zynga 在Facebook游戏网络的支柱,并且是Zynga的主要收益来源(例如,Zynga经常发布的Ville游戏)。因此,我们可以得出结论,由于Zynga塑造并称霸这一游戏类型,它对其他工作室而言仍是最具挑战性的题材。

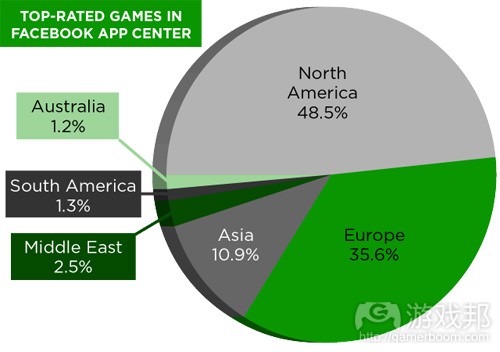

地理分布:Facebook App Center顶级游戏的工作室地理分布情况如下:北美(占比48.5%),欧洲(35.6%),亚洲(10.9%),中亚(2.5%),南美(1.3%),澳大利亚(1.2%)。

亚洲工作室:北美和欧洲工作室占据主流的情况并不令人意外,但亚洲工作室在这一列表中所占比例甚少的情况却很值得关注。这一地区在全球人口中占半数以上比例,并且存在一些极为庞大、著名的游戏公司,但亚洲开发商却并没有真正在社交游戏领域施展手脚。

在来自亚洲的前25款社交游戏中,排名最靠前的分别是韩国公司Cookapps推出的《Buggle》和《Pengle》,以及另一家韩国公司Syntasia,Inc作品《Baseball Heroes》。中国社交游戏占据11个席位,而日本却仅有一款游戏进入前25名榜单。

南亚工作室:南亚工作室的游戏在Facebook App Center所占比例更低,这一地区的主要国家包括印度、孟加拉国、巴基斯坦和斯里兰卡(人口达16亿),但在855款顶级游戏排行榜中却仅占9个席位。这与南亚国家的技术发展水平极不相称,并且表明该地区极为缺乏游戏设计氛围。

但我们也可以看到一些变化的迹象。传统上以服务为主的南亚科技领域一直投身于革新大潮,并且涌现许多基于产品的初创公司。我预测到2020年南亚终将追赶上世界其他地区的水平,并且形成产值至少达10亿美元的游戏公司。

中东工作室:在这855款Facebook游戏中,来自中东工作室的游戏仅占比2.5%,而这一小部分比例则主要来自一个小小的中东国家——以色列。尽管中东最小的国家之一,以色列反差一直是该地区的科技和游戏开发中心。Facebook平台上几乎所有的中东应用都是出自以色列工作室之手,Facebook App Center中几乎所有的游戏类型,都有一款排名前列的以色列工作室游戏。这种现象表明以色列在过去四年中在游戏开发领域迈进了不容小觑的一大步。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

The Facebook Gaming Ecosystem: A Cross-Sectional Study Of The Top-Rated Apps

Hassan Baig

Services like Appdata have been providing individual stats about gaming apps for a long time, but snapshot-like analyses of top-rated games on Facebook’s App Center have not yet been done. What follows is a cross-sectional study of top-rated gaming apps in the Facebook App Center. Such a study could be useful for game developers or strategic investors who have a stake in Facebook games and want a macro picture of where the ecosystem stands at the moment.

About My Data Set

Those interested can access the entire data set here. It is comprised of 855 top-rated apps from the game categories available in the Facebook App Center. “World rankings” have been used to make the study globally applicable; only web games are counted because the platform is not a leader in mobile; and a cut-off is imposed on top-rated lists that swell beyond 100 games. So, for example, whereas Zynga’s FarmVille makes the cut, Treasure Isle doesn’t.

Also note that the data represents a snapshot of the world rankings as they appeared on the March 1, 2013 and hence are fresh results. In case anyone wants to rectify a datapoint, feel free to drop me an email.

Findings

Categories and leaders. The Facebook App Center is divided into 12 categories:

Almost half of the categories are dominated by Zynga, while the rest are led by King.com (2), Social Point (2), Geewa (1), Peak Games (1) and Playdom (1). Though Wooga and EA do not show up as category leaders, they nevertheless have a sizable presence in these genres. Other usual suspects also figure high in these lists, except perhaps for 6waves, which seems to have shrunk by more than three times its MAU on Facebook within the last year.

Most competitive category. Among the 12 genres, Simulation deserves special mention. More than half of Zynga’s MAU in top-rated games reside in this category. Players in this category have had their tastes and behaviors molded by Zynga’s game design and production values more than any other genre on Facebook. So in effect these users form the backbone of the Zynga network on Facebook and drive the cash cow of the company (i.e. ‘Ville’ games, which Zynga continues to churn out with regularity). Thus, it can be logically surmised that given the way the Zynga juggernaut has shaped and ultimately owned the Simulation category, it remains the most challenging genre for any studio to break into.

Geographical distribution. The geographical distribution of the studios that have developed top-rated games in the Facebook App Center is as follows: North American (48.5%); European studios (35.6%); Asian studio (10.9%); Middle Eastern studios (2.5%); South American studios (1.3%); Australian studios (1.2%).

Asian studios. The dominance by North American and European studios is unsurprising news, but Asia’s relatively small representation among top-rated games is notable. Housing more than half of the world’s population and some extremely large, storied gaming companies, it seems game developers from Asia have not been able to fully grasp social gaming.

Among the top-25 social games from Asia, the biggest three are Buggle and Pengle by Cookapps (Korea), and Baseball Heroes by Syntasia, Inc (Korea again). Moreover Chinese social games figure 11 times among this top 25, and Japan only once. A complete list of the top 25 is here.

South Asian studios. Social games by South Asian studios make up an even smaller proportion of top rated apps on the Facebook App Center. Major South Asian countries include India, Bangladesh, Pakistan and Sri Lanka – a population of 1.6 billion – yet only nine games by South Asian studios are represented among the 855 top-rated apps. This is quite low for the kind of tech muscle South Asia has, and is indicative of a larger lack of game design smarts in the region.

But one can see signs of change. The traditionally services-centric South Asian tech industry is in the midst of discovering an innovative streak with lots of product-based startups cropping up all over the region. In fact many success stories have been covered on TechCrunch. My prediction is that South Asia will catch up to the rest of the world and will be home to at least one $1 billion+ gaming company by 2020.

Middle Eastern studios. Only 2.5 percent of the top-rated social games on Facebook are from Middle Eastern studios, but this small percentage masks the big contributions of a tiny Middle Eastern country to the social gaming industry: Israel. One of the smallest countries in the Middle East, Israel is a hub of tech and game development in the region. Almost all Middle Eastern apps on the Facebook platform originate from Israeli studios, and almost all categories in the Facebook App Center have at least one Israeli studio game in their top ratings. This is testimony to the great strides Israel has taken in the game development space in the last four years.(source:techcrunch)

上一篇:关于游戏开发者生活质量的调查结果

下一篇:关于游戏开发者生活质量的调查结果

闽公网安备35020302001549号

闽公网安备35020302001549号