西方游戏公司该如何进军中国手机游戏市场

作者:Joseph Kim

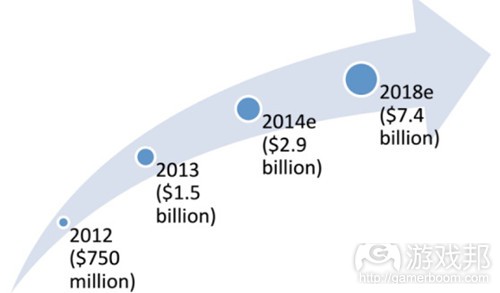

中国的手机游戏市场经历了爆炸式的发展,并且有可能在2015年赶超美国市场。根据独立研究公司Niko Partners,中国的手机游戏市场在2014年的发展达到了93%,即29亿美元,并且从2013年到2018年它将以每年37.6%的增长速度发展着。

来源:Niko Partners

今天,大多数美国游戏开发商都专注于西方和世界市场,而未真正深入了解中国市场及其潜在发展机遇。

我访问了3位中国手机游戏发行公司代表,希望能够了解中国手机游戏市场的最新视角以及西方开发商面向中国市场发行游戏的新机遇。

以下是来自中国手机游戏发行商的3位代表:

能否描述下中国手机游戏市场与美国市场的主要区别?

Eric:“我认为主要存在3个领域的区别:1.发行渠道,2.广告合作伙伴,3.市场营销和推广渠道。

在中国你至少需要覆盖前30家商店才能获得80%的覆盖率,你需要与运营公司合作去获得他们的广告代码,因为运营商的广告仍然是最有效的广告方法,特别是对于休闲游戏来说。当团队发行《神偷奶爸2》时,很大的一部分收益是来自即时刷新,而这主要是受到运营商广告的推动。

最后但也同样重要的是市场营销和推广。在西方,你可以使用Facebook,Twitter和YouTube。但是在中国所有这些服务都是被禁的,所以你只能使用新浪微博,微信和优酷等当地类似的服务。”

Greg:“从游戏自身的角度来看我将再添加3个领域。

1.美术风格—-基于中国历史和民间故事的美术与西方市场的美术是完全不同的。通常情况下亚洲玩家都喜欢一些带有可爱外观的角色,而美国玩家更喜欢一些现实的外观。

2.游戏玩法—-美国玩家喜欢带有挑战和技能的游戏玩法;中国玩家则不想花太多精力于游戏中,但是他们却有足够的耐心去刷任务。

3.盈利—-中国玩家玩免费游戏的时间久于美国玩家。所以吸引中国玩家花钱的游戏将带有复杂且深入的经济系统。”

May:“一个主要的区别是有机安装率。在中国30%是非常低的数值。常见的有机安装率是200%至300%。

在中国任何理念总是能够快速传播;人们之间的联系更加紧密。微信的影响力便很广,但主要还是因为这里的人口密度和文化。所以在中国市场分享是件很简单的事。

在这里知识产权的力量非常强大。中国人是品牌敏感型消费者。这些用户不像西方玩家那样具有冒险性,他们更加相信自己所认识的品牌。这也是《植物大战僵尸2》能够在此快速成功的原因之一。”

在中国市场什么类型的游戏更受欢迎?是否存在哪些特别的类型或机制比其它类型或机制更受欢迎?

Greg:“因为这是个巨大的市场,所以在中国很多游戏类型都能够获得成功。不过大多数成功的游戏都带有以下功能/机制:

1.RPG角色/城堡/家乡发展

2.升级系统

3.gacha机制

4.服务导向型。如果发行一款未面向中国用户的游戏,它是不可能取得成功的。”

Eric:“几年前,排行榜单一直是由当地MMORPG所占据,但这种情况已经发生了改变。在现在的畅销排行榜单上,你可以看到像《神偷奶爸2》,《水果忍者》,《滑雪大冒险》,《神庙逃亡》等西方游戏。

但前提是你需要本土化你的游戏,即你需要优化文件规格,经济模式,UI和盈利方式以确保游戏能够更加适合中国市场。”

May:“来自美国且表现不错的其它游戏例子还包括《Clash of Clans》,《Boom Beach》,《Hay Day》,《Candy Crush》,迪士尼的《Frozen Freefall》,《Hearthstone》,《Injustice》,《Megapolis》和《CSR赛车》。

让我们看看这些游戏中存在的要点:

1.行动RPG游戏,在这里称为ACT,非常受欢迎。所有控制方案都很棒,不管是自动战斗还是完全移动和攻击控制。

2.SLG(城市建造)类游戏现在有点过时了,不再像它们以前在网页上获得的同样的注意,但也仍有些游戏做的不错。

3.RPG游戏非常受欢迎,现在更大的PC风格的MMORPG得到了巨大的关注。

4.像《2048》等带有创造性机制的简单游戏快速传播着。

5.带有强大社交机制的游戏通常都带有优势。

6.中国用户更喜欢3:1或4:1的身体比例,即一些不那么现实且更加可爱的角色。就像日式的可爱图像在此便很受欢迎。

7.现实风格的游戏也是可行的,但却不能吸引更加广泛的用户。当使用现实风格去吸引更加硬核的男性用户时,大多数游戏会选择使用一些性感的女性角色。

8.漫画,三国志,功夫主题在此非常受欢迎。而其它西方科幻主题很难超越《魔兽争霸》和《魔兽世界》的影响。”

相对于美国市场,开发商可以从中国手机游戏市场中赚取多少利益?

Greg:“中国手机游戏市场仍然小于美国市场。此外,开发商需要共享Android平台上的许多渠道。因此中国最畅销的游戏所赚得的收益将少于美国最畅销的游戏。”

Eric:“但从经验上来讲,当着眼于我们之前所发行的游戏,中国市场的收益仍然是基于个位数百分比。但好消息是中国市场的发展率非常高,甚至远超美国和欧洲。现在中国市场中共有3亿多手机玩家,这一数值就相当于美国的人口数了。到2018年中国手机玩家数将达到8亿。所以我会鼓励游戏开发商将中国市场作为自己的第二个战略目标。”

May:“iOS和Android上的前3至5款最棒的游戏每个月所获得的收益超过1亿人民币。有超过30款游戏每个月的收益超过1千万人民币,这个范围是非常大的。

中国市场专注于运营策略,所以每一天的收益可能会出现巨大的差别,有可能有些游戏一天就能赚到1千万人民币。”

能否聊聊中国市场的盈利和用户留存以及和美国市场的区别?

Greg:“许多最畅销的美国游戏的盈利结构仍然是基于获取内容和节约时间。频繁的内容更新将提升用户留存。而中国的盈利要求带有更多实时更新的系统以留住用户。每天都要更新,所以中国游戏公司都带有一支强大的实时更新团队。”

Eric:“我的视角可能更倾向于单人玩家休闲游戏,我发现这类型游戏的盈利在中国更具侵略性。就拿《神偷奶爸2》为例,即时刷新便是这款游戏盈利的巨大组成部分。我不敢保证西方市场能否接受这一方法。在西方市场设置一个弹出框去寻求1美元以刷新内容可能太过‘攻击性’,但在中国市场却是可行的。

我认为在中国市场,每周至少一次活动是常规,但是对于任何开发商来说可能具有一定的挑战性。此外,每天的欢迎画面或告示栏的轰炸也是再平常不过的事了。

虽然这只是我个人的观察,但我认为中国玩家比西方玩家更多动,所以游戏开发商需要更加努力去留住用户(游戏邦注:因为他们能轻松地删掉你的游戏并选择其它免费游戏)。”

在美国和中国,受欢迎游戏的游戏机制有什么不同?

Eric:“中国是免费模式的先驱,我真的对启动包,VIP包,订阅回扣等已经成为标准的游戏机制印象深刻。这非常有趣,因为这一行为对于共产主义社会来说具有资本主义特色。”

Greg:“因为主机游戏的历史,每个玩家更倾向于基于技能的游戏,他们喜欢从中获得成就感。而中国游戏机制更加被动,如果用户愿意花钱的话他们便能在游戏中做许多事。”

中国和美国的最大区别似乎是Android的优势,这里的分销渠道的优势就相当于美国的App Store。你是否能够做出进一步的描述?

Eric:“是的,我认为手机游戏的大部分收益,或者至少80%的收益是来自Android商店,前30家商店的贡献便占据了Android市场的80%。我认为主要决定元素便是价格。中国仍然是一个价格敏感型市场,iPhone当前的价格还不是最吸引中国消费者的,特别是对于那些生活在第二线或第三线城市的消费者。”

Greg:“分散的中国Android市场并不像看上去的那么糟糕。一款游戏如果想在Google Play US的众多竞争者中凸显自己就需要花费大量的市场营销费用,而在中国它可以选择与Android的不同渠道合作。因为竞争激烈,所有的Android渠道都迫切需要获得更多游戏。这里的关键就在于开发商们需要创造一款真正高质量的游戏。”

中国和美国的手机游戏市场营销有什么区别?中国的主要市场营销渠道是什么?与美国又有什么不同?

Greg:“因为市场营销成本很高,所以精准营销是美国市场中最受关注的。然而,创造广告仍然是中国游戏市场营销的主要方式。这意味着提高在媒体,渠道甚至是网下的曝光率是推动游戏成功的关键。”

Eric:“在西方,你的数字市场营销=Facebook+Twitter+YouTube,但所有的这些服务在中国都是不可用的。在中国,你需要使用新浪微博,微信和Youku等类似的服务。

在中国,用户获取仍然比美国便宜,所以用户获取仍然是通过渠道营销实现。

当然了,不管你是在美国还是在中国,上述的营销方式都是受欢迎的。我们很难从投资回报率(ROI)的角度进行追踪,但如果你在这些活动中投入了市场营销费用,你就需要保持渠道的活跃。”

美国开发商是否有机会进入中国市场?他们是否该考虑面向中国发行游戏?

Greg:“是的,我认为Glu在中国的表现就很好。

在中国获得成功与进入任何较大的亚洲市场一样,需要在人员和投资方面作出贡献。如果一家中国发行商尝试着在美国发行一款基于三国志主题的游戏,并保持与中国市场一样的运营手段,它便会遭遇失败。对于美国开发商亦是如此。”

Eric:“就像我们所看到的,到2018年市场规模将会翻两番。当然了,这里也具有自身的问题与挑战,但其发展率仍是欧洲和美国开发商们不容忽视的。”

外国手机游戏开发商进入中国市场的最佳方法是什么?

Eric:“应对风险的最佳方式便是与当地公司合作。发行一或两款游戏,并从中学习什么是可行的而什么又不可行。”

Greg:“存在一些发行商致力于帮助外国开发商进入中国。一些分销渠道也一直在寻找着优秀的游戏。对于那些有着深厚的积累和耐心并且在排名前三的世界游戏市场具有品牌认知的游戏来说一定能够在此获利。”

May:“大多数开发商都不应该独自尝试着进入一个市场,除非你像Supercell/CoC那样拥有全球知名的游戏。你应该根据游戏类型选择适当的发行商。就像我们公司主要发行的是休闲,三消,纸牌战斗和SLG游戏。

至于交易结构,准备好在扣除包括市场营销预算的渠道成本后进行五五分。

在中国,发行商能够帮助你建立所有的渠道关系,即包括超过30家的应用商店以及超过300个渠道,就像预先安装在手机上,每日的免费应用以及其它UA市场营销。PR和市场营销还包括公车和的士上的广告,当地商店,海报和电梯上的视频等等。”

为了获得成功,美国公司需要投入多少本土化成本?

Greg:“为了进入一个市场,本土化需要达到最低限度。因为大多数游戏都是服务导向型,所以开发商需要确保游戏具有更多动态和深度。”

Eric:“需要投入许多本土化成本。中国是一个具有较高风险但也能带来较高报酬的市场,所以选择适当的合作伙伴非常重要。美国公司应该选择那些了解当地市场同时也尊重你们公司的设计和产品形象的合作伙伴。”

May:“对于角色是游戏核心的游戏来说,角色设计的改变非常重要,特别是将游戏角色变得更加可爱或添加更多中国特色。

首先,用户体验和游戏控制非常重要。中国的新用户希望在自己的早前游戏阶段获得更高级别的手控感,并且说明需要足够简单清晰。

关于盈利,中国用户习惯于与西方玩家不同的盈利方式。所以美国公司通常都需要设定新价格。

最后,还有许多软件开发工具包集成。就像如果开发商选择从Android平台开始,他们就需要整合大约10种不同的收费系统。”

总结:

多谢Eric,Greg和May。如果你真的对中国手机游戏市场感兴趣,我强烈建议你能够请求一家适当的发行公司的帮助。我敢保证他们真的很棒。

联系信息:

以下是他们三人的联系信息。

Eric Tan:

Fifth Journey的首席执行官。GameLoft的前发行经理。

电子邮件:eric.tan@fifthjourney.com

Greg Chang:

Glu Mobile亚洲副总裁

电子邮件:greg.chang@glu.com

May Zhang:

White Orange首席执行官

电子邮件:gaowanli@baijuzi.com

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转功,如需转载请联系:游戏邦)

China Mobile Game Market: What You Need to Know!

by Joseph Kim

China’s mobile gaming market has been experiencing explosive growth and is projected to soon overtake the US market by as early as next year in 2015. Independent research firm Niko Partners estimates China’s mobile game market to grow 93% to $2.9B in 2014 with compound annual growth of 37.6% from 2013 to 2018.

Source: Niko Partners

Today, most US game developers focus on Western and “World-wide” markets without having a deep enough understanding of China and the potential opportunities there.

I spoke with three Chinese mobile game publishing companies to get the latest perspective on the Chinese mobile game market and the opportunity for Western developers to publish in China.

Following are excerpts from interviews with key representatives from three Chinese mobile game publishers:

How would you describe the main differences between the Chinese mobile gaming market and the U.S. market?

Eric: “I think there are 3 areas that stand out right away and that is: 1. Distribution channels, 2. Billing partners, and 3. Marketing & promotion channels.

In China you have to cover at least the Top 30 stores to give you 80% coverage and on top, you need to work with the carriers to get hold of their billing codes as carrier billing is still the most efficient solution of billing especially with casual type of games. When the team published Despicable Me 2, a large chunk of the revenue came from instant revive, which was powered by carrier billing.

Last but not least is the marketing & promotions. In the West you can use Facebook, Twitter, and YouTube. All of these services are banned in China so you need to use the local equivalent services such as Sina Weibo, WeChat and Youku.”

Greg: “From the perspective of the game itself I would add another 3 areas.

1.Art Style – Art based on Chinese history and folk tale is obviously different. Asian gamers, in general, like cute looking character features while US gamers like tough and realistic looks.

2.Game Play – US gamers like to be challenged and skills are heavily involved; Chinese gamers do not want to spend as much effort in the game but have patience to grind endlessly.

3.Monetization – Chinese gamers have been playing free-to-play games a lot longer than US gamers. Games that make Chinese gamers pay have very complex and deep economic systems.”

May: “One other key difference is the rate of organic installs. Here in China 30% is very small. It’s common to see 200-300% organics per install.

Ideas in China spread very quickly; people are more interconnected. WeChat moments is a powerful influence in this, but so is population density and culture. It’s really easy to share here.

The power of IP is very strong. Chinese are very brand sensitive consumers. Users are not as adventurous as western gamers, and are less trusting of brands they do not know. Plants vs. Zombies 2 became an instant hit in China.”

What kinds of games do well in the Chinese market? Are there specific genres or mechanics that are more popular than others?

Greg: “Since the market is so big, multiple genres can be successful in China. Nevertheless, most of them have the following functions/mechanics:

1.RPG character/castle/home growth

2.Upgrade system

3.Gacha fusion

4.Service oriented is a must. Just launching the game without talking to the Chinese customers will not generate big success.”

Eric: “A few year’s back, the charts were dominated by local MMORPG but that has changed. On the top grossing charts now, you can see more Western products such as Despicable Me 2, Fruit Ninja, Ski Safari, Temple Run, etc.

But the caveat is that you need to localize & culturalize your game and that means optimizing the file size, the economy, the UI and monetization to make it more suitable for the Chinese market.”

May: “Other examples of games that have come from the US and done well here include the Supercell games like Clash of Clans, Boom Beach, and Hay Day, Candy Crush, Disney’s Frozen Freefall, Hearthstone, Injustice,Megapolis, and CSR Racing.

A quick list of things that seem to work here:

1.Action RPG games, called ACT here, are very popular. All control schemes have been doing well, from auto-battle to full movement and attack control.

2.SLG (city builder) style games are a bit out of style right now, and never gained the same popularity as they did on the web, but they are still a few doing very well.

3.RPG games are very popular and now larger more PC style MMORPGs are gaining popularity

4.Simple games with an innovative mechanic like 2048 spread like wildfire

5.Games with strong social mechanics will have a general advantage

6.Chinese users prefer body ratios of 3:1 or 4:1, less realistic and cuter. Japanese style cute graphics are more widely accepted.

7.Realistic style games can and do work, but will not appeal to a wider audience. When appealing to the more hardcore male audience with a realistic style most games tend to use many over-the-top sexy female characters.

8.Manga, 3 Kingdoms, Kung-fu themes work the best here. Western fantasy is not very popular outside of the influence of DOTA and WOW IPs.”

How much money can a developer expect to make from the Chinese mobile market relative to the US market?

Greg: “Chinese mobile gaming market is still slightly smaller than the US market. In addition, developers need to share a hefty percentage to channels on Android. Therefore, a top grossing game in China will make less money net than a top grossing game in the US.”

Eric: “Purely speaking from experience, China revenues are still in the single digit % when we looked at the titles that we had published before. The good news is that the growth rate of the China market is still going very strong, ahead of the U.S and Europe. There are about 300 million mobile gamers now which is equivalent to the U.S. population already. That is destined to grow to about 800 million by 2018. I would definitely encourage game developers to at least have China as its #2 strategy.”

May: “The top 3-5 best games on IOS + Android are making revenues of over 100 million RMB [~$16.5M USD] per month. There are over 30 games making over 10 million RMB [~$1.65M USD] per month, and the range is quite large.

The Chinese market focuses on operations strategy, so daily revenue varies greatly from day to day, with some games making 10 million RMB on single days.”

Can you talk about Chinese monetization and retention and how it differs from the US?

Greg: “A lot of top grossing US games still structure monetization based on content acquisition and saving time. Frequent content updates would satisfy retention. Chinese monetization require multiple systems with heavy live ops to keep users. Events need to happen every day and Chinese game companies all have a sizable live ops team.”

Eric: “My viewpoint maybe skewed towards more single player casual games but I find that the monetization tends to be more aggressive here in China. In the case of Despicable Me 2 again, instant revive was a big portion of the revenues. I’m not sure how this method would be received in the West. Having a pop up and asking for $1 to revive may come across as “offensive” in the West but it is acceptable here.

Retention wise, I feel that having an event at least every week seems to be the norm here in China but operationally this would for sure be challenging for any developers. Furthermore, I feel that being bombarded by the welcoming screen or noticeboard everyday here is also quite the norm.

This is only a personal observation but I think Chinese gamer are generally more ADD when compared to their western counterparts and hence game developers need to do everything that they can to keep users (because they can just easily delete your game and go to the next free-to-play game).”

What about differences in game mechanics of popular games in the US vs. China?

Eric: China has been the pioneer of the free to play model and I’m really impressed that mechanics such as starter packs, VIP packs, subscription rebates are already quite the norm here in China. That is interesting because this behavior is actually quite capitalistic for a communist society. It’s really competitive!

Greg: “Because of the console game history, US gamers lean towards more of a skill based game play for a sense of achievement. Chinese game play is more passive and a lot of things can be done in the game if users pay.”

One of the biggest differences between China and US seems to be the strength of Android and the power of distribution channels here relative to App Stores in the U.S. Can you talk a little bit more about this?

Eric: “Yes I believe the main bulk or at least 80% or so of the mobile gaming revenues come from the Android stores and of this, the Top 30 stores should contribute to 80% of the Android market. I think a main factor is price. China is still a price sensitive market and the current price of the iPhone is just not enticing enough for the Chinese consumers especially for the ones who live in 2nd tier or 3rd tier cities.”

Greg: “The fragmented China Android market is not as bad as it seems. While a game needs to spend large sum of marketing dollars to stand out from competitors on Google Play US, it can partner with the Android channels in China and do well. Due to intense competition, all the Android channels are hungry for games. The key is still down to making a quality game.”

How does marketing of mobile games differ between China and the US? What are the primary marketing channels for China? How does it differ from the US?

Greg: “Precision marketing is now big in the US since marketing costs are so high. However, creating the hype is still the dominant way to do game marketing in China. This means maximum coverage in media, channels, and even offline is required to make the game successful.”

Eric: “In the West, your digital marketing mix = Facebook + Twitter + YouTube but all of these services are banned in China. In China, you need to use the local equivalent of Sina Weibo, WeChat and Youku.

User acquisition wise, it is still cheaper here in China than in the U.S. so users are mainly still acquired through channel marketing.

Above the line marketing of course will be welcomed regardless of whether you’re in U.S. or China. It’s hard to track eyeballs from an ROI perspective, but it keeps the channels warm & fuzzy if you invest your marketing dollars into these activities.”

Do US developers have a chance in the Chinese market? Should they think about publishing in China?

Greg: “Yes, I think Glu is doing OK in China.

Becoming very successful in China, just like going into any large Asian markets, requires significant commitment in terms of personnel and investment. If a Chinese publisher tries to launch a Three Kingdoms game in the US while having the whole operation in China, the publisher will fail. Same mentality applies to publishing in China.”

Eric: “As we can see, the market is going to double in size by 2018 so yes the pie is still getting bigger. Sure there are its own set of problems and challenges but the growth rate is still ahead of Europe and the U.S.”

What is the best way for a foreign mobile game developer to enter the Chinese market?

Eric: “The best way to hedge the risks is to work with a local partner. Published one or two titles, learn what works, what doesn’t and go from there.”

Greg: “There are several publishers that specialize in helping developers enter China. Channels are also aggressively seeking games directly as well. For those with a deep war-chest and patience, having brand recognition in the top 3 gaming markets in the world will definitely be beneficial.”

May: “Most developers should not try to enter the market by themselves unless you have a global brand name game like Supercell/CoC. Choose the right publisher based on the type of game they have experience with.For my company, we publish mostly casual, match-3, card battle, and SLG games.

As far as deal structure, be prepared for a 50/50 rev share after channel costs which includes marketing budget to push the game.

In China, the publisher will help you set up all of the channel relationships which may include 30+ App Stores and over 300+ channels like getting pre-installed on phones, free daily apps, and other types of UA marketing. PR and marketing can also often involve buses and taxis, local stores, posters and video in elevators and more.”

How much should US companies expect to localize for the Chinese market in order to be successful?

Greg: “Localization should be the minimum to enter the market. Since most successful games are service oriented, making the game more dynamic and deep is required.”

Eric: “A lot! China is a high risk, high reward market so choosing the right partner is important. Find someone who knows the local market but at the same time have respect for the design and product identity of your company.”

May: “For games where characters are central to the game, changes in character design will be important, especially making the characters cuter, or including more Chinese features.

First time user experience and game controls are also critical. Chinese new users require a high level of hand-holding in the early stages of their games, and instructions must be simple and clear. Many western games do a decent job, but Chinese users need longer before letting them go.

Also with monetization, Chinese users are used to different (and often more) monetization than western gamers. New prices will need to be set.

Finally, there will be a lot of SDK Integration. Just to start on Android, developers will need to integrate around 10 different billing systems.”

Summary:

Many thanks to Eric, Greg, and May for the great insights. If you are interested in the China mobile gaming market I strongly recommend talking to one of their companies for publishing. Knowing each personally I can attest that they are all really great.

Contact Information:

If you would like to follow up for more information about an opportunity in China. Contact information is provided below.

Eric Tan:

CEO, Fifth Journey. Former GM Publishing, GameLoft.

For Further Inquiry, Email: eric.tan at fifthjourney.com

Greg Chang:

VP of Asia, Glu Mobile

For Further Inquiry, Email: greg.chang at glu.com

May Zhang:

CEO, White Orange

For Further Inquiry, Email: gaowanli at baijuzi.com(source:gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号