每日观察:关注全球游戏市场投资及并购交易情况(4.3)

1)Digi-Capital最新报告预测,2017年全球市场市场(包括软件和硬件)规模将超过1200亿美元。主机和PC游戏市场仍然较为稳定,而手机和网络游戏则发展迅速。

Digi-Capital称手机和网络游戏市场在2011年产值约150亿美元,预计2017年将增长至600亿美元,复合年增长率达24%。其中中国、日本和韩国市场发展最为醒目。

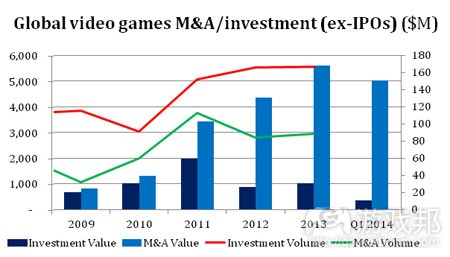

从2014年1月至3月,游戏行业中的合并及收购交易额达到了50亿美元,而2013全年的这一交易额也仅为56亿美元。

其中手机游戏领域发生了7笔并购交易,价值约15亿美元;投资交易(通常是VC向初创企业投资)产值约3.46亿美元,2013全年则是10亿美元。

手机游戏在此占据最大比例,在价值2亿美元的投资中占据了16笔交易。

2012年有7家游戏公司完成了IPO(主要分布于中国和日本),2013年有4家公司(均为中国公司),而2014年第一季度仅有King一家公司完成IPO,但目前所知还有数家中国公司正考虑进行IPO。

但从2011年开始算起,在Digi-Capital所观察到游戏领域中,仅有MMO游戏领域的公司上市后在股价方面获得了长期的成功。

2)据venturebeat报道,社交游戏发行商King目前正大力招兵买马,吸引开发者、制作人加入团队,以便创造更多类似《Candy Crush Saga》和《Pet Rescue Saga》的新产品。

该公司计划将其成员增加25%,目前在北美、欧洲和亚洲挂出了165个招聘岗位。King目前市值约63.1亿美元,股票售价为20美元左右。

3)据pocketgamer报道,就在越南开发者Dong Nguyen表示有意重新发布《Flappy Bird》之后,苹果App Store日前又出现了一款名称上貌似其续作的游戏《Flappy Bird:A New Season》,但它实际上只是又一款克隆产品。

值得注意的是,该游戏本身并没有任何创新,其玩法和机制几乎与原作如出一辙。更重要的是,该游戏也并非Nguyen现存的App Store帐户发布。尽管如此,这款游戏还是晋升App Store免费应用榜单之首。

除了App Store充斥大量这种克隆游戏之外,就连竞争较不激烈的Windows Store也可以搜索到179个关于该克隆游戏的结果。

4)据gamasutra报道,King去年夏天起诉开发商6Waves,声称后者剽窃了自己的两款游戏,最近又向美国加州北部地区法院提起新诉讼 。

King之前称6Waves的《Treasure Epic》和《Farm Epic》抄袭了自己的两款游戏,6Waves曾请求将该案提交至中国北京的法院审理,而King反对称6Waves些举另有意图(该案可能不被中国当地法院受理,并且中国地区的裁决可能会减少其损失)。美国法院称鉴于6Waves这一案件的多项因素否决了6Waves所提出的申请。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Japanese, Korean and Chinese mobile market growth will drive total games industry to $120 billion by 2017

by Jon Jordan

The rise of mobile and online games, particularly in Asia, will be the industry’s engine for growth over the coming years.

That’s the headline from the quarterly report from games investment outfit Digi-Capital.

It predicts the global games market – both hardware and software – will be worth over $120 billion in 2017. That’s up from around $70 million in 2011.

But while the console and PC segments remain steady, mobile and online gaming are growing fast.

Digi-Capital reckons that from around $15 billion in 2011, this market will be worth almost $60 billion by 2017; that’s compound annual growth of 24 percent.

Mobile first

In terms of where that growth is happening, the report is clear.

The Chinese, Japanese and Korean markets are exploding, particularly as they move from big PC client games to highly profitable – and much cheaper to produce – mobile games.

Digi-Capital points to operating margins of over 50 percent for the most successful companies.

And this growth is being reflected in mergers and acquisition activity between companies.

Between January and March 2014, the value of M&A activity in the games sector was $5 billion: that compares with $5.6 billion for the whole of 2013.

Mobile games were the most active sector with 7 deals, worth around $1.5 billion.

Investment activity – that’s generally VC companies investing in start-ups – was worth $346 million, compared to $1 billion for 2013.

Again, mobile games took the biggest share: 16 deals worth a total of $200 million.

You can see the sort of deals that have been occurring in our handy Deals section.

Floating a boat

IPO activity is more complex, however, partly because this is typically the only exit option for the largest companies and as King is proving, highly dependent on market and public confidence.

There were 7 game company IPOs in 2012 (mainly in China and Japan), compared to 4 in 2013 (all Chinese companies), and only one (King in the US) so far in 2014, although several Chinese companies are known to be considering the opportunity, despite warnings that they only have a six month window.

Yet looking at the longterm success in terms of the share price of companies that have floated, when indexed to back 2011, the only sector that has been successful – at least in terms of outranking Digi-Capital’s All Games Index – is the MMOG sector.(source:pocketgamer)

2)Candy Crush Saga publisher pegs IPO riches for hiring-spree bender

Jeffrey Grubb

Don’t let cyber attacks kill your game! Join GamesBeat’s Dean Takahashi for a free webinar on April 18 that will explore the DDoS risks facing the game industry. Sign up here.

Social-game publisher King is looking to hire a number of developers, producers, and more to help it build a number of new products to follow up games like Candy Crush Saga and Pet Rescue Saga.

The company plans to increase its employee headcount by 25 percent. It has 165 job openings currently listed for its development locations in North America, Europe, and Asia. This bolstering of its human resources is part of King’s plan for the future, which will have the publisher working to produce and release several new mobile and social games to ensure future growth. King is currently valued at around $6.31 billion and is trading at around $20. That’s primarily due to Candy Crush Saga, which is a free-to-play puzzler game that made more money than any other iOS app in 2013. Last year, mobile gaming generated around $16 billion in spending.

This boost in hiring comes after King raised $500 million in its March 26 initial public offering, which introduced its shares for trading at $22.50 on the New York Stock Exchange. That price immediately took a dive, and it has since hit a low of $17.66 a share. Investors worry that King is deriving the bulk of its value from Candy Crush Saga, and that could turn sour if the game’s players start abandoning it. The company’s chief executive officer, Riccardo Zacconi, isn’t worried about that because he claims King’s strength is its multitude of other, smaller titles.

“I wouldn’t be here if I was not confident,” Zacconi told GamesBeat last week. “The company has a great future.”

He explained that King’s current strategy is to build a portfolio of successful games and that he doesn’t want his teams struggling to re-create another megahit like Candy Crush Saga.

That’s likely what the new round of hiring is about — finding employees that can build on King’s current success.

“What are we working on now? Leveraging the network we’ve built with Candy Crush to build our portfolio,” said Zacconi. “The No. 1 target for us is the retention of players. The number of players in our network is constantly growing.”

King has around 150 million monthly active users (MAUs), the mobile gaming industry’s metric for measuring players. Feeding them new experiences on mobile and social will play a key role in maintaining revenues and keeping shareholders happy.

As of the time of this posting, King’s shares are trading at around $20. It has never reached its introductory price of $22.50.(source:venturebeat)

3)Flappy Bird ‘sequel’ soars to the top of the App Store

by Keith Andrew

A game purporting to be an official follow up to the wildly successful (but still absent) Flappy Bird has hit the top of the free charts of the App Store, illustrating the continued demand for Dong Nguyen’s runaway hit.

With Nguyen himself having recently talked up the possibility of relaunching Flappy Bird in a fresh, retooled form in an interview with Rolling Stone, the appearance of Flappy Bird: A New Season would appear to be a timely one.

As The Guardian reports, however, it appears this second crack of the whip is, in reality, just another clone.

What’s in a clone?

The game itself offers no new take on Flappy Bird’s intentionally simplistic gameplay – to all intents and purposes, it’s identical to the original title.

More importantly, however, the game hasn’t been released via Nguyen’s existing App Store account and the Twitter account being used to promote it is, likewise, a new addition.

The ‘new’ Flappy Bird is currently ahead of Supercell’s Boom Beach

Nevertheless, the rise of Flappy Bird: A New Season both proves that consumer want for Nguyen’s game remains high, almost two months after the game was pulled from sale.

In a flap

It also raises questions about Apple’s ability to keep on top of the continued flood of Flappy Bird clones onto its marketplace.

As previously detailed on PocketGamer.biz, the App Store is by no means the only marketplace to play host to clones of the game or, indeed, games claiming to stand as Flappy Bird sequels.

A quick search for Flappy Bird games on the Windows Store – hardly the most packed of app markets – brings up 179 results.

Attention has more recently been diverted to clones of puzzle game Threes, however, which co-creator Asher Vollmer recently claimed risks being “lost in the underbrush of copycats, me-toos and iterators.”

“We do believe imitation is the greatest form of flattery,” added Vollmer, “but ideally the imitation happens after we’ve had time to descend slowly from the peak – not the moment we plant the flag.”(source:pocketgamer)

4)King vs. 6Waves lawsuit will go ahead in San Francisco

By Mike Rose

Last summer, mobile behemoth King filed a lawsuit against developer 6Waves, alleging that the company has blatantly copied two of its titles. That case will now go ahead, following a new ruling from the U.S. District Court for the Northern District of California.

King previously suggested that two games from 6Waves, Treasure Epic and Farm Epic, infringed on King’s own similar titles. You can take a look at the visual comparisons here.

6Waves had originally requested that jurisdiction of the suit be submitted in Beijing, China, rather than the U.S. King argued that 6waves was making this move for various reasons, including the suggestions that it’s more likely the case would be thrown out in China, and also because damages would be reduced through a Chinese ruling.

While the U.S. court found that the Chinese judical system was “an adequate alternative forum” for the lawsuit, it ruled that numerous factors weighed 6Waves’ dismissal of the case, and therefore 6Waves’ motion was denied.

In a ruling on March 31 as sent to Gamasutra, District Judge Maxine M. Chesney said that the lawsuit will now go ahead as originally planned in San Francisco at a later date.

This isn’t the first time that 6Waves has found itself in a spot of bother with other mobile developers. Back in 2012, Triple Town studio Spry Fox sued the company, claiming it had copied its game for Yeti Town.(source:gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号