如何打破App Store榜单固定不变的格局?

作者:Keith Andrew

App Store和Google Play榜单这是怎么了?

148App的Carter Dotson曾指出,虽然《Clash of Clans》和《Candy Crush》总能出现在业内媒体的头条,给开发者带来正能量,但它长踞榜单前列的现象实则有损行业的创造性。

Carter表示,“2008年App Store问世之后,移动行业如此令人兴奋的部分原因就在于各个工作室不断创新,并从中得到了不少收获。”

“这些工作室并没有像正在停滞发展的主机平台一样,不断推出续作以期保证收益,而是冒险尝试,另辟蹊径,创造了更可能创收的作品。”

“简而言之,正是这些创新推动手机行业的进步。但是到了2013年,榜单前列的游戏种类相当少,新理念总是被挤兑,甚至是彻底被驱逐出整个市场。”

所以,我们这次的问题是:

手机游戏行业的创造性真的停滞不前了吗?

像Supercell和King这种小型工作室是否将成为新的EA和动视,挤压更小型团队的成功机率和生存空间?或者说是我们反应过度了,手机游戏行业仍然像两三年前一样充满生机和活力?

Jani Kahrama(Secret Exit)

*免费是手机游戏定价的主流趋势。

*在免费榜单的曝光度是任何手机游戏下载量的唯一决定因素。没有曝光度就没有下载量。

*免费榜单已经被付费用户获取手段所控制。采用独立营销手段实现所需下载量难度极大。

*有财力购买用户的总是大型F2P游戏公司。

根据Chartboos CPI发布的热图数据粗略统计一下用户获取成本,你每天需要投入4万美元左右才能跻身名费榜单前50名并保持这一名次,其总额也就是1.67美元*23000次日常下载量。

唯一出现在收益榜单前50名的付费游戏是《Minecraft Pocket Edition》,其售价高达6.99美元,排名与其最为接近的其他付费游戏则跌至第79和80名。

在付费榜单较劲似乎成了小型工作室唯一的选择,但哪种开发者社区能够在这种市场中幸存仍然有待观望。

目前来看,进入榜单前列所需的下载量仍是开发者的游戏在相关网站上获得积极评价的一个必要因素。

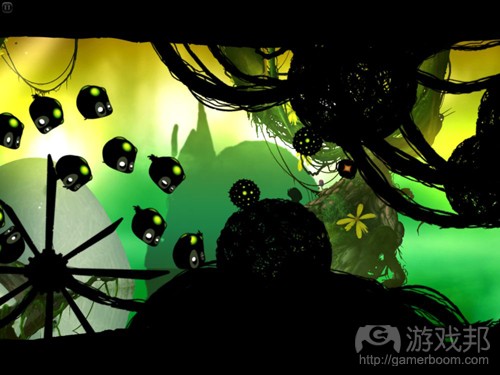

像《Badland》这种独立游戏的成功故事仍然有可能再诞生,但小型工作室能否依靠频频被平台运营者所推荐而成功却仍然有待探讨。

看看美国付费游戏前50名榜单,就可以看到多数榜单似乎已被大型工作室和大品牌受主宰。仅有廖廖数款游戏不在此列(游戏邦注:这类游戏似乎深受《Minecraft》启发)。

在我看来,除非App Store更改其曝光机率,否则小型独立工作室就只能去寻找其他平台的机会来维系自己的长期发展战略了。

或者,孤注一掷地将所有鸡蛋放到同一个篮子里,投入一切资源创造出华丽的应用,寄希望于它能够同《实况赛车》和《无尽之剑》等游戏竞争,获得平台所有者的关注。

Jared Steffes(Furywing)

我认为美国榜单几乎没有变化与美国政府关门停摆的事情直接相关……开个玩笑。

现在,让我们原归正状。F2P游戏需要大量营销资金,才能获得足够的眼求。新开发团队和工作室如果都是元老级的人物,那就有可能筹集到足够的资金以执行自己的F2P战略。这种情况确实存在。

这还只是一个新兴行业,所以何谓元老级的人物确实值得推敲。

我曾建议年轻的工作室开发付费游戏,因为他们打造的是一个基于自身社交媒体的品牌。他们需要一直将自己推销成有趣的人,尽量让自己的作品显得很酷。

我认为榜单的情况与流行音乐领域相似。

乐坛总会有人推出引起大众共鸣的歌曲,过不了一个月又会有大量类似的音乐涌现。游戏行业也同此理。

这是否会抑制创新?我想这确实不利于纯粹的创新。但以创新方式重新演绎原作的精髓,仍然不失为一种创新。这正是为何这么多人仍在制作不同类型的四轮汽车的原因。

Scott Foe(Big Head Mode)

想阻止独立开发者好比是想用电吹风把海水烤干。这个行业总会出现智慧、前所未有,并且能够通过口头传播登上报纸头条和实现创收致富的独特游戏。

也就是说,开发成本与营销投入并不成正比。已经站稳脚跟的发行商在用户获取方面总会占有优势。

有效的每用户获取成本(eCPA)是开发者推出具有盈利性的游戏产品的最大挑战。如果你想成立独立工作室并推出全新产品,那就没有什么可以阻止你的步伐。

如果你想成立重复而可扩展的公司,那么你就得更有策略更为明智地砍削有效用户获取成本,尽可能将其降为零。

将eCPA降至能够让项目盈利的水平并非不可能之事:所有开发者可以齐心协力将eCPA降至大家都可把握的水平。

如果所有独立开发者都接受互惠的交叉推广系统,获得平等的玩家流,那么蹩脚游戏终会半途夭折,而优秀的游戏则会获得更多曝光度。

Oliver Heins(Goodgame Studios)

应用商店被冻结了吗?不是,但独立游戏要跻身榜单前列难度十分之大。

记得数年前许多人告诉我“我们不会在移动平台上浪费功夫,这个市场并不赚钱。”但看看现在,《Candy Crush》和《Clash of Clans》问世之后,大家都争先涌向移动平台。

有些应用是由并不缺钱的大公司开发的,但他们却并不知道有效的营销方式。如果你无法获得玩家,就不能够获得收益。

如果你想打败Supercell或King,光有资金还是不够的,你还要掌握营销手段。

但这是另一个话题了。《Candy Crush》和《Clash of Clans》并不只是大,它们还是很棒的游戏。这意味着要拿下这两者——假如你并没有足够的营销预算,那就要制作出更棒的游戏。

这很困难,但我相信还是有可能的。我们现在就在朝这个方向努力。

John Griffin(Game Sparks)

创意的重要性已经超过以往,我认为在这一点上,独立开发者对行业的贡献不容小觑。

正如你所言,移动平台已经被许多游戏公司视为战略重心,而这也是智能手机和平板电脑未来数年的增长趋势的必然结果。

现在我们看到《Candy Crush》等热作的月活跃用户就已经超过1亿,再加上智能手机用户数量的快速增长,过不了多久这一数据就会突破10亿了吧?

人人都想从这个庞大的市场分一杯羹,其中有许多人携带大量营销预算以及许多独立开发者不具备的经验来到这个行业。

在当前的生态圈中,热门榜单在短期内仍将被相同的公司所占据。但是,我认为我们将来会看到更多伏动的情况,这一趋势可能将延伸到第101-1000名之间。

开发者有可能创造占据这些榜单位置的成功项目。位于第1000名的游戏很可能拥有数百万玩家基础。有些工作室会上升到榜单前列,有些会被收购,不幸的是,有些则会被大型公司所模仿。

一家工作室的创新和创意是决定其结果的关键要素。

最后,我同意Jani的说法,也认同Scott提出的砍削用户获取成本的观点。必须更改整个曝光机制。市场上很可能有更多应用商店前仆后继(至少在发展最快的Android平台上是如此),并出现更多新曝光渠道。

独立工作室所需的创意并不仅局限于游戏设计——他们在市场营销方面也必须极具创意。

Harry Holmwood(MAQL Europe)

我认为不妨退一步看待这个问题。

我们看到特定游戏长踞榜首的原因并非是其开发者财力雄厚,而是因为开发者制作了出色而有趣,留存率和盈利性极佳的游戏。

从而得到了很好的收益回报,拥有足够的资金获取更多用户,这样他们就可以进入一个投入、获取、利润的良性循环,这样又会产生更多理想的数据。

你可以为多数游戏花5000万美元来获取用户,这样你就流失了每一分钱。

对我来说,这主要取决于游戏。如果一家开发商拥有一款极为有趣,令人们爱不释手的游戏,那么从一定程度上可以说,他们已经完成了最困难的部分。

如果你的游戏是一款经济上可行的产品,那就有可能从发行商或VC投资者那里获得营销资金。如果不是,那么就算有大把营销资金也无济于事。

这种情况下你需要将更多资金投入开发环节,以便争取到足够的时间和人才,优化游戏直到完善为止。

当然,有效获取用户也需要投入大量的专业知识,但在我看来,即使制作了成功的产品也还是离不开市场营销。

Oscar Clark(Applifier)

麻烦在于我们整合了错误的问题。

首先,让我们谈谈基于整体下载量/销量的榜单。虽然作为开发者我们很清楚自己做得有多好,但却并不一定了解用户。停滞不变的榜单总偏爱那些长期名列前茅的游戏。

我个人只会关注一个榜单,即谷歌的趋势榜单。因为该榜单可以显示人们最近感兴趣的内容。

在3UK,我拒绝设置基于销量的榜单。不要误会,我们的确有十大热门榜单、最新热门游戏以及最新租赁游戏,以及售价最高的3大游戏等榜单。但这些只是最新发布中更新内容的编辑选择列表。这种摆布听起来像作弊,但它意味着用户能够找到新内容,我们事先也已经知道了这是编辑选择的结果。

我曾经去度一个长假,回来后发现有位经理强迫团队进入前十大热门销售榜单,而结果却导致销量急剧下滑,而我们依然可得的销量却主要来自那些原本就热销的游戏。

这不禁让我去思考Jani关于免费榜单究竟有多拥挤的观点。他说得对,这些榜单竞争太激烈了,但当前的应用商店已经不同于过去了。

App Store并非人们获得游戏消息的唯一渠道,但它确实很强大,极具影响力。不过在榜单前100名之外的开发者还是能够赚到一些钱。

Flurry报告普显示App Store总收益中,不到70%是来自前100名榜单之外的应用。

开发者进入和保持在前100名榜单所需的成本极高——例如每用户获取费用就可能高达9美元。

也许有人会说,你应该去竞争较不激烈的付费榜单碰碰运气。

预付费的价格标签也许能够说明游戏质量不差,也为玩家提供了一个继续玩游戏的理由,甚至还会有一些出售额外内容的空间。

但是,付费模式也会让你失去更多不想冒险花钱的玩家,也失去了让玩家为游戏长期掏钱的机会。

也有一些例外情况,但预先付费可以先同玩家建立起一种信任感。

John Ozimek曾引用Flurry数据指出,付费玩家在美国一款免费游戏的平均投入是14美元,而来自Flurry的Richard Firminger却在另一天告诉我,这并非玩家对免费游戏的终身投入。

14美元只是2011年玩家在游戏中平均每笔交易的消费额!我并没有关于免费游戏终身价值的相关数据,但由此可见这里的情形远比多数人想象的更乐观。

我并不是说所有免费游戏都能获得平均每位玩家每月投入14美元的收益,或者每款游戏3%的付费玩家每人每月都会投入14美元,但这种转变模式意味着奉行“游戏即服务”理念的免费游戏即便是对小型独立开发者来说依然极具盈利潜力。

App Store榜单好比是荷马史诗《奥德赛》中的塞任一样,如果我们去听她的音乐,我们就会发疯并自取灭亡。当然,榜单排名也很重要,它们确实能够推动下载量,但进入榜单前列需要开发者投入大量资金,不然我们就要另辟蹊径。

为何《Badlands》等游戏能够进入榜单前列?它们质量过硬,能够促使用户口头传播游戏。我们并不需要依赖榜单获得曝光度。

在Applifier调查中,我们发现35.1%的受访者表示自己会受到App Store中的推荐、搜索和热门榜单的影响而决定是否购买/下载应用。

其中有12.4%受访者会受到广告影响,37.2%会受到口头传播和社交媒体的影响,其余15.3%则会因电视、YouTube或其他媒体而决定是否购买/下载。

广告确实很重要,但我们要平衡自己的精力,全力打造成功的产品。榜单并非唯一决定因素!(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Candy crusher: How to beat the App Store’s frozen charts and win

by Keith Andrew

Are the App Store and Google Play charts frozen?

In our Stateside column last week, 148Apps’ Carter Dotson suggested that, while the success of Clash of Clans and Candy Crush delivers positive headlines for the mobile industry, their run at the top of the charts is harming creativity.

“Part of what made mobile such an exciting space to be in after the launch of the App Store in 2008 was the fact that studios were constantly innovating and being rewarded for that endeavour,” detailed Carter.

“Rather that sequels being guaranteed bankers – stagnating the market as they do on consoles – developers learned that, taking a risk and doing something different was more likely to pay off.

“In short, this innovation drove mobile forward. Fast forward to 2013, and the variety of titles at the top of the charts is very low. New ideas are being shut out, or driven away from mobile entirely.”

So, we asked out Mavens:

Has creativity in mobile really stagnated?

Have formally small studios like Supercell and King become the new EA and Activision, squeezing out the smaller outfits and making their chances of success slimmer and slimmer? Or is this an overreaction, and mobile remains the vibrant sector it was two to three years ago?

Jani Kahrama, Secret Exit

Well if anyone would care to shoot down this chain of logic, I’m all ears:

Free is the dominant trend in mobile games pricing

Visibility on the free charts is the single deciding factor for any download volumes. No visibility, no downloads

Free charts are controlled by paid user acquisition. Indie marketing methods have very little ability to reach the required numbers

Those who can afford to buy users are the big F2P companies

As a gross estimation of the user acquisition costs (according to Chartboost CPI heat map) you’ need a budget of around $40,000 per day to get to top 50 free and sustain the position – that’s $1.67 x 23,000 daily downloads.

The only paid game in the top 50 grossing is Minecraft Pocket Edition, with its bold price point of $6.99. The next paid games are at ranks 79 and 80.

Competing in the paid charts seems to be the only option for smaller studios, but it remains to be seen what kind of a developer community that segment of the market will sustain.

At least the download numbers required to break into the charts seem to be such that positive buzz on the relevant websites might still make a difference.

Opportunities for indie success stories like Badland certainly still exist, but it can be debated whether or not a small studio can (or should) rely on being repeatedly featured by the platform holder.

Looking at the top 50 paid games in the US, the majority of the charts seem to be ruled by big studios and big brands. There are few exceptions (and the exceptions seem to be heavily Minecraft-inspired).

It seems to me that unless the App Store brings in changes to its discovery mechanisms, small independent studios should investigate alternative platform opportunities for their long-term strategy.

Or, alternatively, put all eggs in one basket and invest everything in creating showcase apps, hoping to compete with the likes of Real Racing (which has gone F2P) and Infinity Blade for some platform holder attention.

Jared Steffes, Furywing

I believe the US charts not moving is actually directly tied to the US Government shutdown…

Okay, back to reality. F2P requires a lot of money to acquire eyeballs to make it work. New dev teams and studios in this realm are able to raise a decent amount of money to execute on the F2P strategy if they are proven veterans. I see the deals happening.

It’s funny to consider people veterans when the industry is so young, but that’s the wordage.

I personally consult young studios to go the paid route because they are building a brand based off their own social media. They need to always be selling themselves as interesting people and their titles as cool must haves.

I have been saying for a while that the charts are similar to the pop music industry.

Someone comes out with something that resonates and a hundred people show up a month later with songs – games in this matter – that are considered clones of the genre leader.

Clash of Clans

Does it stifle innovation? Pure and new innovation I’d say yes. Innovative ways to use the core of what made the original title great are still innovative. That’s why we can have so many people building different types of four wheeled cars.

Scott Foe, Big Head Mode

Trying to stop the indies would be like trying to parch an ocean with a hairdryer: There will always be cool, clever, never-seen-it-before games being released into to market and word-of-mouth will carry some of them to headlines and to riches.

That said, development costs are in no way proportional to marketing costs; entrenched publishers will always have the upper-hand when it comes to user acquisition. And, if you think user acquisition costs are bad now, ask yourself if the ceiling on acquiring a player can reach $9?

Effective Cost per Acquisition (eCPA) is the biggest challenge to launching profitable new game product. If you want to be an indie studio and release cool new product, business-be-damned, absolutely nothing is stopping you.

If you want to achieve repeatable, scalable business, well, you have to get smarter about growth hacking.

Growth Hacking, verb, the act of driving the effective cost of user acquisition down toward zero

Bringing eCPA down to levels that make business sense is actually not an unachievable prospect: Bringing eCPA down to manageable levels could be achieved through concerted effort on the part of all indies everywhere.

If all indies adopted a system for tit-for-tat cross promotion, a machine learning arbitrage of equitable player flow, yes, crappy titles would still die on the vine, but worthy titles would gain much more exposure.

If BitCoin can decentralise currency, why can’t somebody decentralise Chartboost?

Oliver Heins, Goodgame Studios

Are the app stores are frozen? No, but it is very hard to reach the top positions.

I remember some years ago many people told me “we won’t do mobile – there are no revenues .” Now, after Candy Crush and Clash of Clans, everybody wants to do mobile.

There are apps developed by companies that have big fountains of money, but they don’t know how to do marketing well. If you can’t get the players, you can’t get the revenue either.

If you want to beat Supercell or King, it’s simply not enough to have a lot of money – you also have to master marketing.

But there’s another problem. Candy Crush and Clash of Clans are not just big, they’re also great games. That means taking them down – if you don’t have the money to spend on masses of marketing – is a case of making a game that, simply speaking, is even better.

It’s hard, but I’m sure it’s possible. We’re working on it. Give us a month.

John Griffin, Game Sparks

Creativity is more important than ever and I think we rely hugely on the indies for that.

As you point out, mobile is being adopted by many (if not most) games companies as the strategic focus and this, as we all know, is driven by the anticipated huge uptake of smartphones and tablets over coming years.

Right now we see these blockbuster titles such as Candy Crush reaching staggering player volumes of over 100 million monthly active users (MAUs). On the back of mass smartphone uptake, how long is it before we see that number top 1 billion?

Candy Crush Saga

So, for sure, the playing field has changed because of the potential sums involved. Everyone is trying to have a bite and many of them are bringing large marketing budgets and know-how that the indies don’t have.

It’s likely, in the current ecosystem, that the ‘top charts’ will remain dominated in the short term by the same companies. However, I think we will continue to see a lot of movement further down the charts in positions 101-1,000, perhaps.

It’s going to be possible to build a very successful business occupying these chart positions. A game at position 1,000 is likely to have a player base of several million going forward. Some of these studios will rise up the charts and some will be acquired and, unfortunately, some will be copied by the bigger guys.

A studio’s innovation and creativity will be critical in determining which outcome lies ahead for it.

Finally, I agree with Jani and like Scott’s growth hacking points. The whole discovery process must and hopefully will change. There is likely to be a lot more stores going forward (at least on Android – the fastest growing platform) and new ways to get discovered.

The creativity required from studios is not limited to game design alone – they also need to get very creative when it comes to marketing.

Harry Holmwood, MAQL Europe

I think there’s a tendency to look at this issue backwards.

The reason we see certain titles dominate the charts is not because the creators have a lot of money. It’s because the creators made a great, fun game which has excellent retention and monetisation.

That, in turn, gives them a good return on investment on user acquisition, so they can get into the cycle of spend, acquire, profit, which spirals up into the big numbers those games enjoy.

You could spend $50 million acquiring users for most games, and you’d lose every penny.

For me, it’s all about the game. If a developer has a F2P game which is demonstrably fun, which makes people want to keep playing and, in enough cases, playing, they’ve done the difficult bit.

Getting marketing money – whether from a publisher or VC investor – is perfectly achievable if your game is a viable financial proposition. If it’s not, marketing money won’t help.

What you need in that instance is more money to spend on development, to buy you the time and expertise to refine the game until it does work.

Of course, there’s huge expertise and value in doing that user acquisition as effectively as possible, but nobody is closed out of making a successful product in my opinion.

Oscar Clark, Applifier

The trouble is that we are conflating the wrong issues.

First, lets start with charts based on total downloads/sales. Whilst these are great for us as developers to see how well we are doing, they are terrible for users because they become a self-fulfilling prophecy. Stagnant charts lead to an undue focus only on those games at the top of the chart.

There is only one chart I pay any attention to personally; Google’s Trending chart. It’s brilliant and always show the latest interesting content.

At 3UK, I refused to have sales-based charts. Don’t get me wrong – we had top 10′s. Top New Games, Top £3 Games, Top Rent Games, etc. But these were editorial lists of newly released or updated content. hat might sound like cheating, but it meant that users could find new content; oh! and we were upfront that this was editorial too.

I went on a long holiday and came back to find one of the managers had forced the team to put in a Top 10 sales chart and the net result was that we’d had a massive drop in sales and those sales we still got were overly focused on just the titles thst had already been selling.

That takes me onto Jani’s point about how flooded the free charts are. He is right they are flooded; but there is an important difference between life on app stores now and in the past, when 3UK ruled the mobile waves (I know that sounds egotistical; but 68 percent of UK mobile games purchases in 2005 is a pretty solid stat).

The App Store isn’t the only place to get information about games, but boy is it powerful; sure it’s incredibly influential; but its still possible to make money without being in the top 100.

I don’t think Flurry has updated this stat in a while, but it has shown that just under 70 percent of all revenue on the App Store comes outside the top 100.

The costs of getting (and staying) in the top 100 are extraordinary and, as Scott has said, it can reach extraordinary heights – e.g. $9 Cost of Acquisition.

Logic, then, says that you should go for the less competitive paid chart.

A price upfront says something about the quality of the game (provided you live up to that and be very wary if you don’t!). It also provides a utility for the player to sustain their interest in the game after they have started playing. There is even some scope for selling additional content.

However, you are cutting off a vastly larger audience who simply won’t take the risk on paying upfront. You also cap the long term willingness for the players you get to spend money (in most cases).

There are exceptions, but paying up front and then again in the game does breach a level of trust that players have come to expect.

Then I need to correct a wrongly quoted stat from the last Mavens question. John Ozimek quoted a Flurry stat which talked about $14 being the average spend in the US for a freemium game. I met up with Richard Firminger from Flurry the other day and he reminded me that this is not, as quoted, the lifetime spend for freemium games.

Instead, $14 was the average US transaction value in 2011! I don’t have any stats on the average lifetime value sadly, but its vastly greater than most people realise.

I’m not suggesting we can all get $14 per month for every player of course; or even $14 per month from 3 percent of players for every game, but this changed model means that economically freemium games delivered as services have extraordinary potential even for small indie developers; long after the paid chart becomes as clogged up as the free chart have become.

The App Store charts are like the Sirens in Homer’s Odyssey. If we listen to their music, we will go mad and crash on the rocks. Of course the charts matter. Of course they drive downloads, but getting to the top of those charts either takes a huge amount of money or instead we can focus on other things.

Why do titles like Badlands make it into the charts? They have qualities which inspire and compel an audience to talk about them. We aren’t just tied to the charts to be discovered.

Indeed, in a Applifier survey we found that participants stated that the App Store, including features, search and top charts, represented 35.1 percent of the influences on their decision to make a purchase/download.

Advertising represented 12.4 percent of that influence, but 37.2 percent came from word of mouth and social media. The remaining 15.3 percent was other media, such as TV, YouTube or other media.

Advertising is extremely important, but we need to balance our efforts so we create the context for success. There is life outside the charts!(source:pocketgamer)

闽公网安备35020302001549号

闽公网安备35020302001549号