分析Facebook游戏从繁荣走向式微的收益表现

作者:joseph kim

根据Facebook和媒体,Facebook游戏仍然处于后欣欣向荣的状态。媒体报道的标题指出:

Wired:“Facebook游戏形势一片大好”

The Next Web:“前三个月的游戏收益又创纪录”

c|net:“Facebook的游戏商业比以前更强劲了”

《华尔街日报》:“Facebook的游戏收益破纪录”

Facebook首席财务官David Ebersman:“根据第一季度的表现,我们的季度收益创下历史之最。”

真的是这样吗?从硅谷的角度看,确实不是这样的。根据Zynga、Crowdstar、Digital Chocolate、Playdom、RockYou、6 Waves和EA等硅谷的游戏公司的内部人士所言,Facebook游戏已经跌落悬崖。

显著的例外当然是Kixeye;虽然Kixeye采用了一套非常不同的策略,即从非常少数的硬核玩家身上赢利,但在Facebook的11亿用户基础(2013年3月的DAU(日活跃用户)有6.6亿)中,它的受众仅占其中460万,据估计去年创造的收益已经超过1亿美元。更令人疯狂的是,Kixeye声称它的所有社交游戏的ARPDAU(日活跃用户平均收益)达到0.8美元。

但Facebook游戏世界的新领袖如King、Wooga和Social Point并不在硅谷,而是在其他地方。是硅谷的社交游戏公司竞争力不足还是有其他什么原因?

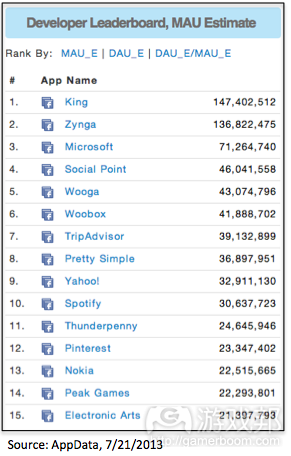

当前Facebook游戏世界的领袖是:

Facebook游戏到底怎么了?

我们再详细地看看到底发生什么事了……

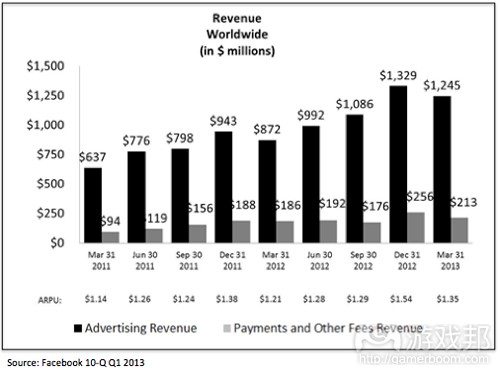

我们应该先看导出这个结论的来源:Facebook的“游戏”收益报告。如下图所示,Facebook的收益还包括灰色条表示的“付款和其他费用收益”。

乍一看,我们会觉得广告收益的增长稳健(2013年第一季度的年增长率达到42.7%),但我们把焦点放在组成游戏收益的“付款和其他费用收益”。根据上面的图表,这一项似乎稳中有增,但是我们首先要疑问:

什么是“付款和其他费用收益”?

“付款和其他费用收益。我们启用从用户到平台开发者的付款方式。我们的用户可以通过信用卡、PayPal或网站上允许的其他支付方式进行微交易和在Facebook平台上付款。当用户在我们的平台使用我们的付款方式与平台开发者进行交易时,平台开发者要付一定的费用给我们。收益扣除了给平台开发者的部分。我们已经强制用户使用我们的支付方式来购买Facebook上的游戏应用,与支付方式相关的费用几乎都是在游戏中产生的。我们的其他费用收益主要包括Promoted Post广告服务和Facebook Gift的收益,但最近一段时间这些费用收益都不大。——2013年Facebook的第一季度10-Q表格

所以,“付款和其他费用收益”“主要是”:1、来自信用卡的收益,2、Promoted Post和3、Facebook Gift。

然而,我们必须注意到,按照Facebook的“经营结果”部分下的2012年10-K表格:

“在2012年第四季度,我们记录了购买相关虚拟或数字产品的所有付款收益,扣除估计的退款或退单而不是30天的索赔期限结束前的延期付款收益,因为我们能够根据历史趋势估计未来的退款和退单。这些费用会导致2012年第四季度一次性增加了6600万的付款收益。

基本上,这意味着,Facebook现在对它的游戏收益的解释是,它是根据历史数据估计的退款和退单的修正值来计算游戏收益的。他们习惯于在30天后看是否发生退款或退单的情况时再解释收益。因此,这基本上导致2013年第四季度的1个月实际上有4个月的收益。

关于2012年第四季度的一些结论:

夸大了2012年第四季度:2012年第四季度的收益被夸大了是因为延期付款给这个季度增加了额外的6600万美元,推销帖子和Facebook礼品也导致这个季度增加了500万美元=1亿8500万美元的实际游戏收益。

相对平缓的增长:把调整后的2012年第四季度的1亿8500万美元与2011年第四季度的1亿8000万美元相比,可以发现不只是2011年第四季度的收益增长缓慢(甚至负增长),而且包括2013年的第一季度在内,连续6个月都是增长缓慢。

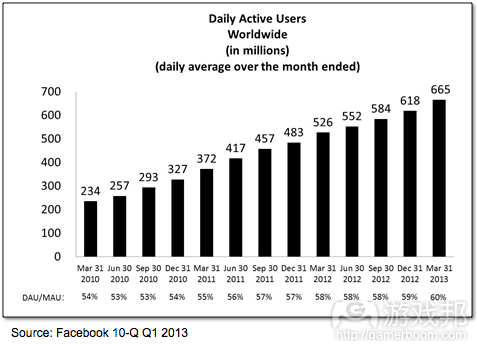

所以,Facebook游戏收益真的有那么漂亮吗?确实应该考虑一下惊人的总体用户增长的情况:

所以,事实上,在2011年第四季度和2012年第四季度之间的,28%的DAU和25%的MAU的增长,游戏收益增加是很平缓的。对我而言,这意味着Facebook游戏表现非常不佳。

所以,媒体们其实是在炒作,并没有透过数字看本质。

那么2013年第一季度又怎么样呢?

这个季度看起来好一些……但并没有好很多。2亿1300万比1亿8500万要多得多。但我发现了以下问题:

1、仍然增长平缓的收益:DAU增长了26%,广告收益增长了43%,但游戏收益只增长了6%(调整后)。

2、低ARPDAU中的用户增长:北美的每平均收益增长了21%,但在我看来,增加更多像Kixeye的游戏那样的游戏可能有困难,而且Facebook在北美市场基本上饱和了,大部分增加来自低ARPU的发展中国家。

3、解释容差系数:通过改变它的统计政策,即改变退款和退单的修正值,Facebook灵活地调整“付款和其他费用收益”。

Facebook游戏何去何从?

我们概览一下Facebook游戏收益的顺势和逆势:

顺势:1、用户持续增多-全球的Facebook玩家仍然快速增加

2、游戏发行-当然会拉动手机游戏收益,但有传闻称这也可能包括一些PC/网页游戏

3、病毒性传播渠道-PC/网页游戏仍然有大量推广的空间和潜能

逆势:1、开放网页-社交游戏发行商继续推出开放网页游戏目标站点

2、可能的硬核玩家反对-高收益的发行商如Kixeye可能会被反对,因为过分的赢利策略和缺少客户服务

3、饱和-最高收益的地区已经市饱和(如北美地区)

考虑到竞争趋势,确实很难说这两股势力以后会怎么样发展。另外,Facebook游戏平台的成功很大程度上取决于管理层想做什么。最近与前Facebook的内部人员谈话提到:

我:Facebook游戏怎么了?

前内部人员:Zuck讨厌游戏。他对游戏的关注度可能降至0点(意思是Zuck并不在乎游戏的死活)。这就是平台的危险所在。

然而,根据最近的收入调用,似乎暗示着Facebook管理层仍然支持平台的PC游戏。

为了更好的理解这个情况,以下是一些可以说明一些事的市场情况:

1、Facebook游戏发行:正如广泛报道的那样,Facebook将启动一项游戏发行业务。这个商业的庞大图景似乎在商业模式(类似Kakao Talk和Line)方面是很清楚的,但至于会不会影响PC游戏,就不是很明朗了。我听说一些东西有可能带动PC游戏一端的增长。

2、硬核社交:显然,根据报道,Kixeye狠狠地踹了巨头们一脚。与平常一样,Zynga并不介意复制别人成功的策略,也发布了一款《Clash of Clans》的跟风之作《Dojo Mojo for》。PC硬核受众有多少并不清楚,但肯定是有潜力的。这一点要密切关注,因为有可能增加PC游戏的收益。

3、新的市场进入者:有些手机游戏公司最近宣布进军Facebook游戏市场……我猜这可能跟第一条有关系。保持密切关注,因为这些新的市场开拓者可能预示着转机。

那么结论是什么?

1、Facebook游戏的情况没有那么火爆:与那些普遍的报道相反,Facebook游戏并不火红,甚至增长情况也不乐观……至少目前是这样的。

2、可能的转机:Facebook似乎有支持Facebook游戏的努力,且业界谣传Facebook最终会做付出一些拉动游戏收益的努力。

3、Zynga继续衰弱:在Facebook的PC休闲游戏方面,Zynga正在被King、Wooga和Social Point赶超,并且这个趋势似乎不会停止,毕竟硅谷的手机游戏公司竞争仍然激烈。Zynga现在正努力向Kixeye的方向转型,但缺少真正专注于产品的管理层(相反地,Kixeye首席执行官Will Harbin每天都会玩自己公司的游戏若干小时),我很怀疑他们能否成功。尽管在短中期内我们可能看到Zynga有一些假动作,但整体趋势不会有什么积极变化(至少在真钱赌博之外的范围)。

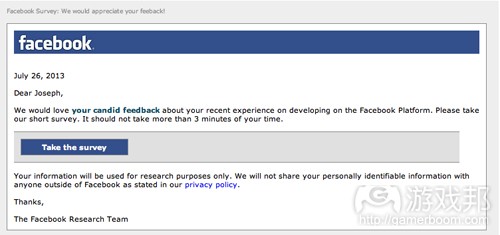

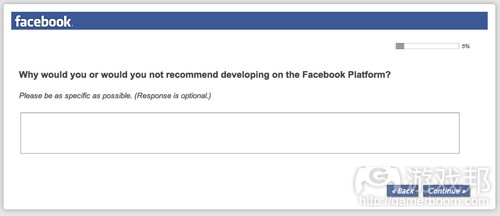

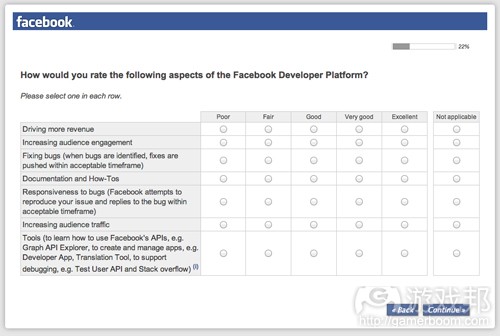

更新:Facebook于7月24日公布了收入情况。我们再次看到游戏收益的减少趋势。管理层没有算入销售帖子和礼品的收益,但我猜那部分应该是上涨的。有趣的是,在7月26日,Facebook给开发者发送了一个关于网页应用开发的调查问卷:

因此,我认为他们至少正在努力改进,并且在讨好独立开发者,希望他们能回归Facebook:

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

What’s really going on with Facebook gaming?

by joseph kim

According to Facebook and the press, Facebook gaming is booming. Headlines from the media indicate:

Wired: “Facebook gaming thrives”

The Next Web: “last three months of game revenue are a record”

c|net: “Facebook’s games business stronger than ever”

Wall Street Journal: “Facebook Racks Up Record Games Revenue“

Facebook CFO David Ebersman: “Q1 represented our largest three-month quarter of games revenue to-date“

Is this really the case? From a Silicon Valley perspective it certainly doesn’t seem so. Most gaming people here in Silicon Valley have friends somewhere at Zynga, Crowdstar, Digital Chocolate, Playdom, RockYou, 6 Waves, EA, etc. etc., folks from those companies often claim that Facebook gaming (Facebook games accessed via Facebook.com PC/canvas) has fallen off a cliff.

The notable exception of course is Kixeye; although understood that Kixeye employs a differentiated strategy of owning a very small hardcore audience and monetizing the shit out of it. In this case, their audience of only 4.6M users relative to the overall Facebook user base of over 1.1B (665M DAU in March 2013) users was predicted to have generated over $100M in revenue last year. Even crazier is Kixeye’s claims of a mind blowing $0.80 ARPDAU all on social.

But the new leaders in Facebook gaming such as King, Wooga, and Social Point are not in Silicon Valley they are elsewhere. Is it just that Silicon Valley social gaming companies aren’t competitive (perhaps like SV mobile game companies)or is there something else going on?

Current Leaders on Facebook:

How Is Facebook Gaming Actually Doing?

Let’s take a closer look at what’s actually going on…

We should start by looking at the source upon which the conclusions are being drawn: Facebook’s reporting of it’s “games” revenue. In the chart below Facebook games revenue is accounted for by “Payments and Other Fees Revenue” in grey.

On the face of it we can see a very healthy increase in Advertising Revenue (42.7% YOY for Q1 2013) but lets focus on “Payments and Other Fees Revenue” where games revenue is accounted for. Judging by the graph above it certainly seems to be growing but let’s take a closer look.

First of all, what is “Payments and Other Fees Revenue”?:

Payments and other fees. We enable Payments from our users to our Platform developers. Our users can transact and make payments on the Facebook Platform by using credit cards, PayPal or other payment methods available on our website. We receive a fee from our Platform developers when users make purchases from our Platform developers using our Payments infrastructure. We recognize revenue net of amounts remitted to our Platform developers. We have mandated the use of our Payments infrastructure for game apps on Facebook, and fees related to Payments are generated almost exclusively from games. Our other fees revenue consists primarily of user Promoted Posts and, to a lesser extent, Facebook Gifts revenue, and has been immaterial in recent periods.

- Source Facebook 10-Q Q1 2013

So, “Payments and Other Fees Revenue” = 1. Revenue from Credits, 2. Promoted Posts, and 3. Facebook Gifts. “Primarily”.

However, we need to take care to note that as per Facebook’s 2012 10-K under “Results of Operations” section:

In the fourth quarter of 2012, we recorded all Payments revenue at the time of purchase of the related virtual or digital goods, net of estimated refunds or chargebacks, instead of deferring Payment revenue until the expiration of the 30-day claim period, as we are able to estimate future refunds and chargebacks based on historical trends. This charge resulted in a one-time increase in Payment revenue of $66 million in the fourth quarter of 2012.

Basically, what this means is that Facebook now is accounting for games revenue as it is charged and making an allowance for refunds and chargebacks based on their historical data. They used to account for this after 30 days to see whether refunds or chargebacks occurred. Hence, this basically made Q4 of 2013 a month in which there were effectively 4 months of revenue recognized.

Some conclusions about Q4 2012:

Overstated Q4 2012: Q4 2012 is overstated due to deferred payment issue adding an additional $66M to the quarter, Promoted Posts and Facebook Gifts also accounted for $5M in that quarter = $185M of true game revenue.

Relatively Flat Growth: Comparing an adjusted $185M for Q4 2012 to $188M for Q4 2011 suggests flat (perhaps even negative) growth not only for Q4 2011 but relatively flat growth for 6 straight quarters including Q1 2013

So, is Facebook games revenue really booming? Well, it really should be given the tremendous overall user growth:

So, in reality, amidst user growth of 28% DAU and 25% MAU between Q4 2011 and Q4 2012 we have flat to negative games revenue. To me this means that Facebook gaming is significantly underperforming.

So much for all of the media hype and the media’s inability to take 1 extra step and actually look through the numbers.

What about Q1 2013?

Well, this quarter looks better… but not by much. $213M is much higher than $185M. But, here’s what I don’t like about Q1 2013:

Continued Flat Revenue: DAU was up 26% and ad revenue was up 43% year over year but game revenue was only up 6% (after adjustments)

User Growth in Low ARPDAU Countries: ARPU increased by 21% for North America but in my view having a lot more games like Kixeye’s may be difficult, further Facebook has largely saturated North America and most of the growth will come from developing countries with lower ARPU.

Accounting Fudge Factor: By changing it’s accounting policy, Facebook has the flexibility to tweak “Payments and Other Revenue Fees” by changing the allowance for refunds and chargebacks however it wants to.

Where Will Facebook Gaming Go From Here?

Let’s consider an overview of Headwinds and Tailwinds for Facebook gaming revenue:

Given the competing trends, it’s really hard to tell how this category will do in the future. Further, much of the success of the Facebook gaming platform on PC/canvas depends on what management wants to do. A recent abbreviated conversation with an ex-Facebook insider:

Me: What happened to gaming on Facebook?

ex-FB Insider: Zuck hates games. Games could go to zero [Meaning Zuck doesn't care if it goes to zero]. That’s what platform risk is.

However, the current indication by Facebook management based on recent earnings calls seems to indicate support for PC/canvas gaming.

To get a better idea of this category there are some market events/hints that bear close watching. Here’s what to watch for:

Facebook Game Publishing: As has been fairly widely reported and as I’ve announced ahead of the media in my Rumors section, Facebook will launch a Games Publishing business. The big picture of the business seems pretty clear as far as business model (similar to Kakao Talk and Line) but what’s less clear are the ties to the canvas page and whether there will be an impact on PC/canvas games. I’m hearing a few things that may indicate there is potential to drive growth on the PC/canvas side as well.

Hardcore Social: Obviously Kixeye has been reportedly kicking major ass. As usual Zynga is not far behind in copying anyone’s successful strategy and has launched it’s rip ”fast follow” of Clash of Clans called Dojo Mojo for PC/canvas. It’s not clear how big the hard-core audience on PC/canvas is but certainly lots of potential upside here. Keep an eye out on this space as it may expand PC/canvas games revenue.

New Entrants: Some mobile game companies have recently announced launching Facebook games… My suspicion is that this may be related to #1 above. Keep an eye on additional new entrants as this may portend movement ahead.

So what are the conclusions?

Facebook Gaming Not Booming Yet!: Contrary to popular reports Facebook gaming is not booming nor is it even growing on a relative basis… at least not yet.

Likely Movement Ahead: There seems to be an effort by Facebook to prop up the Facebook gaming numbers and industry rumors indicate Facebook will actually make some efforts to push revenue here.

Continued Downfall for Zynga: Zynga is getting their asses handed to them by King, Wooga, and Social Point in Facebook PC/canvas casual gaming and that trend doesn’t look like it will stop for many of the same reasons I point out about competitiveness of mobile gaming companies in Silicon Valley. Zynga is now trying to shift to be more like Kixeye but given Zynga doesn’t have product driven management (Will Harbin on the other hand plays his games for hours every day) I doubt they will be successful here as well. Although we may see some upward head fakes in the short to medium term the overall trend should be negative for Zynga (at least outside of real money gaming) on PC/canvas.

Update (7/26/’13): Facebook announced earnings on July 24th. We again saw flat to down revenue for canvas gaming. Management did not break out Promoted Posts & Gifts revenue but I suspect that portion should be up and growing. Interestingly, On July 26, Facebook sent out a developer survey focused on canvas app development:

Hence, I assume they are at least trying to improve canvas and courting independent developers back to Facebook:(source:quarterview)

闽公网安备35020302001549号

闽公网安备35020302001549号