每日观察:关注Zynga等游戏公司第四季度财报(2.6)

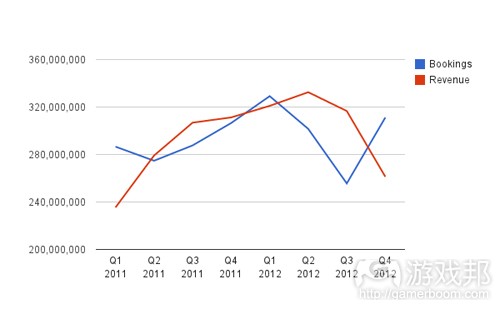

1)据venturebeat报道,Zynga日前宣布2012年第四季度收益为3.11亿美元,基于GAAP的季度亏损为4860万美元,EBITDA(未计利息、税项、折旧及摊销前的利润)为4500万美元;2012全年收益为12.8亿美元,同比上年增长12%。全年净亏损为2.09亿美元,EBITDA为2.13亿美元。

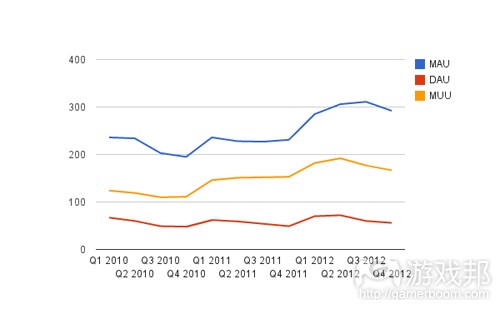

该季度Zynga日活跃用户(DAU)增长至5600万,比去年同期(5400万)增长3%,但比第三季度(6000万)有所下降;与此同时,月活跃用户(MAU)为2.98亿,同比去年(2.4亿)增长24%,但比第三季度(3.11亿)下降了4%。

Zynga月独立用户为1.67亿,同比去年(1.53亿)增长9%,但比第三季度(1.77亿)下降6%。

每DAU日均收益为51美分,低于去年时的61美分,但比第三季度时的47美分增长8%;月独立付费用户为290万,比一年前下降1%,比第三季度下降2%。

第四季度Zynga向网页平台发布了6款新游戏:《Bubble Safari Ocean》、《CityVille 2》、《CoasterVille》、《the Friend Game》,以及两款移动游戏《Ayakashi》、《Party Place》,并推出了《Bubble Safari》和《Ruby Blast》的移动版本(游戏邦注:但Zynga也在同一天宣布将关闭《CityVille 2》、《the Friend Game》和《Party Place》这三款表现欠佳的游戏)。

截止2012年12月31日,Zynga有5款游戏跻身Facebook十大热门游戏DAU榜单;在12月份,Zynga美国移动游戏玩家在Zynga游戏中的投入,超过了其他五大游戏公司的总和。

Zynga目前在移动平台已有7200万MAU(游戏邦注:据gamezebo报道,其首席执行官Mark Pincus宣布Zynga未来将采取“移动优先”战略,并准备将《FarmVille 2》等热作推向移动平台,但并未透露《FarmVille 2》移动版的具体情况);该公司第四季度广告收益为3680万美元,同比上年增长35%,比第三季度增长19%。预计2013年第一季度收益将达2.55-2.65亿美元,亏损为1200-3200万美元。

2)NPD最近报告显示,2012年美国用户在电子游戏中的总投入达148亿美元(游戏邦注:这里包括实体与数字游戏、新游戏与二手游戏、完整游戏与附加内容,但并不包括游戏硬件及配件的收益),但比2011年时的163.4亿美元下降了9%。

实体盒装游戏在2012年收益为88.8亿美元,而2011年时的这一数据为112.5亿美元(降幅为21%),而数字游戏销售额却从原来的50.9亿美元增长至59.2亿美元(增幅为16%)

3)据venturebeat报道,游戏评价网站Metacritic最近公布的用户投票结果显示,EA同时当选为2012年“美国最糟糕的公司”,以及发布了“最受好评游戏的公司”。

2012年EA游戏在Metacritic的平均得分为75.2,超过了微软、索尼、任天堂,其口碑最佳的游戏包括《质量效应3》(得分为93),最佳原创发行游戏是《Kingdoms of Amalur:Reckoning》(得分为81),最差评的游戏则是《Medal of Honor:Warfighter》(得分仅为53)。

有趣的是,EA的最大竞争对手动视仅跻身前十大发行商之列,平均得分仅为64.4,其代表作《暗黑破坏神3》平均得分为88。

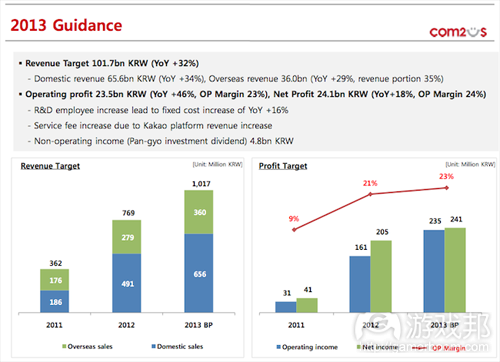

4)据insidemobileapps报道,手机游戏开发商及发行商Com2uS最近财报显示,公司在2012年第四季度收益为212亿韩元(1950万美元),利润为30亿韩元(280万美元);收益同比上一季度下降5%,利润则下降60%(第三季度收益为2050万美元,利润为680万美元),但收益同比上季度增长89%,利润比上季度增长145%。

Com2uS第四季度智能手机游戏收益为198亿韩元(1820万美元),比2011年同期的760万美元增长138%,但比上一季度下降6.2%。智能手机游戏销售额在该公司总体收益中占比93%,上一季度的这一比例为94%。

2012年该公司韩国市场销售额为491亿韩元(4510万美元),占比64%,同比2011年时的1710万美元增长163%。海外销售额为67亿韩元(610万美元),同比上一季度下降17%,但比上年增长18%。

Com2uS预计公司在2013年收益将达1017亿韩元(9330万美元),比2012年时的769亿韩元(7060万美元)增长32%;利润将达241亿韩元(2210万美元),比2012年时的205亿韩元(1880万美元)增长18%。

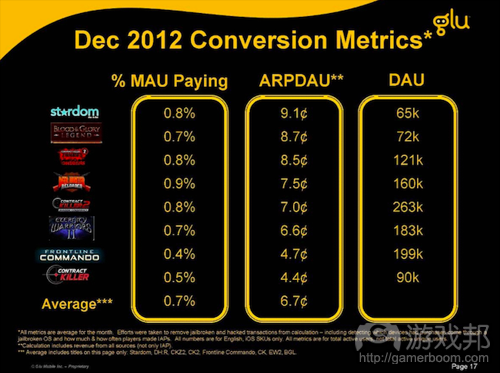

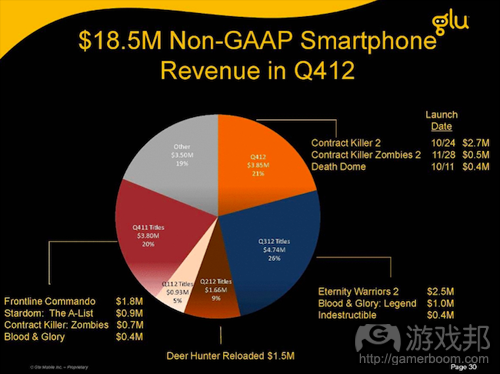

5)据insidemobileapps报道,Glu Mobile日前宣布公司2012年第四季度基于非GAAP的智能手机业务收益为1850万美元,比第三季度时的1830万美元增长1%,比2011年第四季度(1500万美元)增长24%。iOS和Android业务在其收益中占比92%,上一季度时的这一比例为93%。

该公司第四季度总收益达2080万美元,比2011年同期(2010万美元)增长4%,比第三季度(2120万美元)下降2%;该季度基于非GAAP的营业亏损为250万美元(2011年同期亏损为120万美元,2012年第三季度亏损270万美元);基于非GAAP的净亏损则是320万美元。

Glu该季度DAU从第三季度的380万降至350万,MAU则从原来的3770万降至3480万。

该季度每DAU平均收益(ARPDAU)从原来的7.5美分降至6.7美分,但MAU的平均付费转化率仍保持在0.7%。《Death Dome》、《Contract Killer 2》、《Dragon Slayer》以及《Contract Killer Zombies 2》这四款游戏在基于非GAAP的智能手机收益中占比21%,而针对女性玩家的游戏《Stardom: The A List》仍然保持最高ARPDAU水平(9.1美分,但低于9月份时的11.1美分),但其付费转化率已从9月份时的1.1%降至12月份的0.8%。不久前上线的《Contract Killer 2》拥有最高DAU数值,日常访问用户为26.3万,该游戏也是Glu最具盈利性的产品,在第四季度创造了270万美元收益(基于非GAAP),另一款游戏《Enternity Warrior 2》在该季度收益为250万美元。

Glu预计2013年基于非GAAP的智能手机业务收益将达1600-1700万美元,整个2013财年的收益将达1750-1850万美元。

该公司公布这一财报后,其股价下降近5个百分点,每股售价降至2.12美元,目前市值为1.398亿美元。

6)据gamasutra报道,亚马逊日前宣布将于5月份向美国推出自己的虚拟货币Amazon Coins,支持Kindle Fire用户使用这一服务通过亚马逊Appstore购买游戏和IAP内容。该公司表示这一新货币将为开发者的游戏引进更多流量,并增加其游戏盈利性。

亚马逊Appstore开发者通过Amazon Coins所得的收益,仍将采用三七分成原则。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Zynga gets its mojo back with higher-than-expected sales and a small Q4 profit

Dean Takahashi

Zynga got some of its magic back in the fourth quarter, reporting a narrow profit on higher-than-expected revenues.

As the largest social gaming company with a big presence in mobile games, Zynga has become a bellwether for the emerging social and mobile game industry.

The company grew dramatically on Facebook from 2008 to 2012, and it raised a billion dollars in an initial public offering 13 months ago. But the stock cratered in August after the company reported weaker-than-expected earnings and a slowdown in casual simulation games on Facebook.

Zynga reported a profit of 1 cent a share on revenues of $311 million and bookings of $261 million, down 15 percent from a year ago. Analysts expected a loss of 3 cents a share on bookings of $212 million. Zynga itself had guided analysts to bookings of $204 million to $214 million, so the results are much better than expected. In after-hours trading, Zynga’s stock is up 7 percent.

For the past six months or so, Zynga’s world seemed to fall apart. Zynga’s No. 2 executive John Schappert, the former No. 2 executive at Electronic Arts, resigned on Aug. 8, and a bunch of other executives followed, including chief marketing officer Jeff Karp, chief creative officer Mike Verdu, chief security officer Nils Puhlmann, chief technical officer of infrastructure Allan Leinwand, OMGPOP chief revenue officer Wilson Griegel, Words With Friends co-creators David and Paul Bettner, and Zynga chief financial officer David Wehner. And just last week, Zynga’s chief game designer, Brian Reynolds, also left the company.

In the meantime, chief executive Mark Pincus reorganized the management team and laid off 5 percent of the staff. He appointed David Ko as chief operations officer and promoted several other executives. He also shut down nonperforming games. The actions seem to have helped turn the company around, but the results are still mixed in a number of ways.

Growth just isn’t what it used to be. For the full year, Zynga’s revenue was $1.28 billion, up 12 percent from a year ago. Bookings were $1.15 billion, down 1 percent. The full-year net loss was $209 million, and adjusted earnings before income tax, depreciation and amortization (EBITDA) was $213 million.

The full year GAAP earnings per share loss was 28 cents, and non-GAAP earnings per share were 7 cents.

On a GAAP basis, Zynga reported a quarterly net loss of $48.6 million. EBITDA was $45 million, down 34 percent. GAAP earnings per share were a loss of 6 cents, and non-GAAP earnings per share was a profit of a penny.

“The biggest highlight of the quarter was seeing our team deliver a successful sequel in FarmVille 2, a next-generation social game that offers cutting edge 3D experiences loved by millions of FarmVille fans,” said Pincus, CEO and founder of Zynga. “In 2013 we’re excited to bring this new class of social games to mobile phones and tablets and build a network that offers an easier,better way for people to play together.”

During the quarter, the number of daily active users increased to 56 million, up 3 percent from 54 million a year ago. But compared to the prior quarter, DAUs were down percent from 60 million in the third quarter of 2012.

Monthly active users were 298 million in the fourth quarter, up 24 percent from 240 million a year ago. But MAUs were down 4 percent from 311 million in the third quarter.

The number of monthly unique users was 167 million, up 9 percent from 153 million a year ago. And it was down 6 percent from 177 million in the third quarter.

Average daily bookings per average DAU were 51 cents, down from 61 cents a year ago and up 8 percent from 47 cents in the third quarter. That means Zynga is making more money per daily user than it did in the third quarter, but less than a year ago. The number of monthly unique payers was 2.9 million, down 1 percent from a year ago and down 2 percent from the third quarter.

In the fourth quarter, Zynga released six new games, including four on the web: Bubble Safari Ocean, CityVille 2, CoasterVille, and the Friend Game. It released two mobile games: Ayakashi and Party Place. It also launched mobile versions of Bubble Safari and Ruby Blast.

On Dec. 31, Zynga had five of the top 10 games on Facebook, according to AppData, in terms of DAUs. In the fourth quarter, Zynga expanded its third-party publishing platform, launching eight web games and four mobile games designed by outside game developers. In December, Zynga mobile gamers in the U.S. spent more time in Zynga games than the next five game companies combined.

“Our team executed well in the fourth quarter and made important progress in building sustainable new revenue streams and further aligning our company around our best growth opportunities,” said David Ko, chief operations officer of Zynga, in a statement. “2013 will be a pivotal transition year and we are focused on achieving three strategic objectives: growing our franchises on mobile and web, expanding our network and maintaining profitability on an adjusted EBITDA basis. With 298 million monthly average users, including 72 million on mobile alone, Zynga already has the largest social gaming audience and remains the best positioned company to lead in building the future of social gaming.”

Zynga closed the year with $1.65 billion in cash, down from $1.92 billion a year ago. In the fourth quarter, ad revenue was $36.8 million, up 35 percent from a year ago and up 19 percent from the third quarter. Zynga repurchased 5 million shares of common stock in the quarter.

For the first quarter of 2013, Zynga project revenue of $255 million to $265 million. It expects a loss of $12 million to $32 million, and earnings per share losses of 2 cents to 4 cents a share. Bookings are expected to be $200 million to $210 million. For the full year, Zynga is projecting a profit in terms of earnings before income tax, depreciation and amortization.(source:venturebeat)

2)The numbers are in: Here’s what Americans spent on games in 2012

By Frank Cifaldi

The United States collectively spent $14.8 billion on video games in 2012.

That’s according to estimates from The NPD Group, which released its annual tally on Tuesday. That figure incorporates all possible spend on video game software: physical and digital, new and used, rented and permanent, full games and pieces of content. It does not, however, include hardware and accessories.

While $14.8 billion is nothing to scoff at, that figure is down from a year ago: the estimate for 2011 is $16.34 billion, meaning that Americans spent 9 percent less in 2012.

That entire $1.54 billion difference is more than explained by 2012′s rough year for physical, boxed games, which saw a 22 percent — or $2.03 billion — decline in 2012. Digital sales are on the rise — up 16 percent from $5.09 billion to $5.92 billion — but it wasn’t enough to make up for retail’s performance in a rough transitional year.

The following numbers were provided by the NPD Group as part of its “2012 Games Market Dynamics: U.S.” report:

•Total Physical (new, used, rental) $8.88B (from $11.25B, -21%)

•Digital: $5.92B (from $5.92B, -9%)

•Total: $14.80B (from $16.34B, -9%) (source:gamasutra)

3)EA (the worst company in America) was the best-reviewed publisher of 2012, says Metacritic

Jeffrey Grubb

The same year its “customers” voted Electronic Arts the worst company in America, the game publisher also released the best-reviewed titles on average, according to review-aggregation site Metacritic.

In 2012, EA had an average critic score of 75.2 on Metacritic, which collects the average score from dozens of different reviews for each game. That was enough to put it ahead of Microsoft, Sony, and Nintendo as its best-reviewed game publisher of the year. The company’s best reviewed game was Mass Effect 3 with a 93. It’s best original published game was Kingdoms of Amalur:

Reckoning with an 81. It’s worst-reviewed game was Medal of Honor: Warfighter with a 53.

Electronic Arts decided to pull the plug on future Medal of Honor games based on Warfighter’s poor performance at retail. The fact that it was the company’s worst reviewed game of the year probably didn’t help.

Electronic Arts beat out Microsoft’s average review score by almost 2 points. The Xbox 360 manufacturer’s published games came in second, followed by Sony and Nintendo. You can see the full list on Metacritic’s rundown 2012′s best game publishers.

Interestingly, EA’s most direct competition, Activision, only just cracked the top 10. The Call of Duty publisher only managed an average score of 64.4 on the strength of Diablo III’s average review of 88.(source:venturebeat)

4)Com2uS revenues dip quarter-over-quarter to $19.5M in Q4

Scott Reyburn

Mobile game developer and publisher Com2uS reported revenues of 21.2 billion KRW ($19.5 million) and profits of 3 billion KRW ($2.8 million) in Q4 2012. Both revenues and profits quarter-over-quarter for the South Korean company were down by five percent and 60 percent, respectively. Last quarter, Com2uS saw 22.4 billion KRW ($20.5 million) in revenue and 7.5 billion KRW ($6.8 million) in profit. However, both revenues and profits were up year-over-year, with an 89 percent increase in revenues and 145 percent increase in profits.Com2uS logo

Com2uS’ smartphone revenues for Q4 were 19.8 billion KRW ($18.2 million), up from 138 percent in Q4 2011 at 8.3 billion KRW ($7.6 million), but down 6.2 percent quarter-over-quarter. Smartphone sales attributed to 93 percent of the company’s total revenue, slightly down from 94 percent in Q3 2012. The company saw stable revenue from existing games like Tiny Farm and from titles within the Kakao Talk Game Center like Com2uS Homerun King, Derby Days and Tiny Pang.

Sales in South Korea accounted for 64 percent of total sales in 2012 at 49.1 billion KRW ($45.1 million), up 163 percent from 2011 domestic sales of 18.6 billion KRW ($17.1 million). Overseas sales for Com2uS in Q4 were down 17 percent quarter-over-quarter at 6.7 billion KRW ($6.1 million), although up 18 percent year-over-year. The company said launch delays of new games led to the quarter-over-quarter smartphone and international revenue decreases.

Com2uS also revealed its earning estimates for 2013, expecting 101.7 billion KRW ($93.3 million) in revenue, which would be a 32 percent increase from 76.9 billion KRW ($70.6 million) in 2012. The company also estimated 24.1 billion KRW ($22.1 million) in profit, up 18 percent from 20.5 billion KRW ($18.8 million). Other plans for the company in 2013 include launching approximately 50 new games (33 in-house, 17 third-party), an app to compete with messenger apps KakaoTalk and Line and expanding to core — the U.S., Japan and China — markets through local platforms.(source:insidemobileapps)

5)Glu Mobile’s Q4 2012 smartphone revenues up 1% quarter-over-quarter to $18.5M, up 24 percent Y-o-Y

Scott Reyburn

Glu Mobile today reported total non-GAAP (generally accepted accounting principles) smartphone revenues of $18.5 million for Q4 2012, up slightly by one percent from Q3 2012′s $18.3 million, and up 24 percent from Q4 2011′s $15 million. iOS and Android accounted for 92 percent of the mobile game developer and publisher’s revenue, barely down from Q3 2012, where games on Apple and Google’s mobile platforms accounted for 93 percent of Glu’s sales.Glu Mobile logo

The company’s total revenue for the fourth quarter was $20.8 million, up 4 percent from total revenue of $20.1 million in Q4 2011, although down two percent quarter-over-quarter from total revenue of $21.2 million in Q3 2012. Non-GAAP operating loss was $2.5 million for the quarter compared to Q4 2011′s $1.2 million and Q3′s $2.7 million. Glu’s non-GAAP net loss was $3.2 million in Q4 2012, resulting in a loss of $0.02 per share.Glu Q4 non-GAAP smartphone revenue mix

According to Glu Mobile CEO Niccolo de Masi, smartphone revenue was flat compared to Q3 2012 due to the company’s decision to delay the global launch of approximately half of its Q4 2012 titles.

In Glu’s earnings call, he said the delay allowed Glu’s recently appointed president of studios Matt Ricchetti to improve ARPDAU for those games.

The San Francisco-headquartered company launched four freemium games in the fourth quarter including Death Dome, Contract Killer 2, Dragon Slayer and Contract Killer Zombies 2. The four titles 4 accounted for 21 percent of non-GAAP smartphone revenue in the same quarter. Glu plans to launch five titles in Q1 2013, none of which have been released yet, and 15 titles in total for 2013.

Daily active users (DAU) dropped from 3.8 million in Q3 to 3.5 million in Q4. Monthly active users (MAU) also fell from an 37.7 million in Q3 to 34.8 million in Q4.

This quarter, only Glu’s average revenue per daily active user (ARPDAU) figure fell quarter-over-quarter from 7.5 cents in Q3 to 6.7 cents in Q4, while the average for the percentage of MAU converting to paid players remained the same at 0.7 percent. Stardom: The A List continued to have the highest ARPDAU at 9.1 cents, despite being down from 11.1 cents in September 2012. Although the female-focused game was dethroned as the conversation rate leader by Deer Hunter Reloaded, which had converted 0.9 percent of MAUs to paid users. Stardom: The A List’s conversation rate fell from 1.1 percent in Sept. to 0.8 percent in Dec. Recently released Contract Killer 2 reported the highest DAU count, with 263,000 players opening the game on a daily basis.Glu Q4 2012 December 2012 conversion metrics

Contract Killer 2 was also the most lucrative title for Glu, generating $2.7 million in non-GAAP revenue in Q4 for the company. In close second was Eternity Warrior 2, pulling in $2.5 million in the same quarter, up from $2 million it generated in Q3 2012.

For its first quarter in 2013, Glu estimated non-GAAP smartphone revenue between $16 million and $17 million, which is lower than Glu’s estimate for Q4 2012 of revenue between $17.5 million and $18.5 million. The company predicted between $84 million and $88 million for the 2013 fiscal year, up from its prediction of $73.6 million to $74.6 million it gave in the Q3 2012 earnings report. As of Dec. 31, 2012, Glu finished the year with 22.3 million of cash in its war chest.

The company’s stock price fell by nearly five percent after the release of its earnings report to $2.12 per share, with a market cap of $139.8 million.(source:insidemobileapps)

6)Amazon launching its own virtual currency this May

By Mike Rose

As Amazon looks to more fully enable game developers through its various online distribution services, the company today revealed its own virtual currency, which can be used by customers to purchase game and in-app items.

Amazon Coins can be purchased for the Kindle Fire tablet, and used via the Amazon Appstore. The company says that the new currency will provide developers with the opportunity to drive more traffic to their games, and increase monetization as a result.

The initiative will launch in the U.S. in May, and Amazon says it will give away tens of millions of dollars’ worth of free Amazon Coins to customers, as a means of tempting users into purchasing more.

As usual, Amazon Appstore developers will continue to earn their standard 70 percent revenue share when games and in-app purchases are made using Amazon Coins.

Developers who already have apps or games in the Amazon Appstore don’t need to do anything to capitalize on this move, as the functionality will be added automatically.

Those studios outside of the Appstore who want to get in on the act are advised to add their games before April 25, such that the monetization avenue is prepared in time for launch.

More details can be found on the Amazon Dev blog.

This is the latest move by Amazon to attract game developers to its online store. Most recently, the company’s ‘GameCircle’ and free-to-play linking were put in place, showing that Amazon is serious about taking on the mobile competition. (source:gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号