分析Zynga与EA模拟类游戏发展情况及走向

作者:AJ Glasser

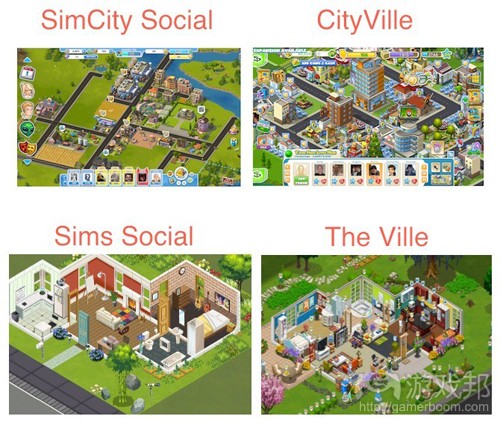

本周EA发布了一款城市建造类游戏(即《模拟城市社交版》),这让我们想起了Zynga在2010年所发布的《CityVille》。在不到24小时后,Zynga也宣称将推出一款类似EA大热游戏《模拟人生社交版》(发布于2011年)的生活模拟游戏。难道相互模仿的Facebook游戏终于要走向末路了?

Zynga的最新游戏《TheVille》也就是一种生活模拟游戏,玩家可以在此创建房屋,并与其他玩家进行交流。而《模拟城市社交版》则是一款城镇建造类游戏,玩家可以通过放置建筑,提高人口数量并满足居民需求而创建起一个大都市。

EA投入了将近2年的时间去开发《模拟人生社交版》(这是EA Playfish与EA北京团队合作的产物)。比起Facebook,中国的社交和手机平台上的城市建造游戏理念历史更为悠久——也就是这里的许多游戏机制都是在《CityVille》风靡于北美市场前就出现了。除此之外,这款游戏的理念主要还是来源于早前的《模拟城市》(游戏邦注:它于1989年在个人电脑领域上掀起了一股巨大的风潮)——从那时起许多开发者都将《模拟人生》作为他们的掌机,PC下载,手机和社交游戏的模版。

而Zynga的“防御”行动则是始终把握住自己最擅长的Ville游戏:使用其它公司已经证明的理念,在此基础上添加一层有趣的社交功能,然后面向Facebook和手机平台上信赖Zynga品牌的玩家推出游戏。所以从过去两年Zynga的行动看来,他们会模仿《模拟人生社交版》也不是什么新鲜事了。Zynga始终坚持于一套经过证明的商业模式,即基于一个紧凑的开发过程而创造出高流量的游戏,以取悦那些不甚了解社交游戏市场的股东。

即使如此,两家公司这种循环利用游戏理念的做法可能都是一招险棋。据AppData数据显示,自2010年12月发布后三个月,《CityVille》的Facebook用户便已达到顶峰,获得了超过1.01亿的MAU以及2100多万的DAU。它至今仍是Zynga畅销游戏之一,并且是Facebook App Center热门游戏排行榜第4名,但是在Facebook上却没有其他哪款城市建造类游戏的吸引力和盈利性能够超越它。同样的,《模拟人生社交版》也在2011年8月发布后2个月迅速获得了超过6600万MAU和1100多万的DAU。虽然这款游戏在Facebook App Center的热门游戏排行榜中屈居12,但是也没有哪一款生活模拟类游戏能够与之匹敌。

这也并不意味着Zynga的“Ville”游戏以及EA的《模拟城市社交版》在发行初期难以吸引到用户的注意。一些数据证明Zynga能够通过发行新游戏而吸引那些非Zynga游戏玩家(游戏邦注:如《Hidden Chronicles》便吸引了那些不再对Playdom《时光花园》感兴趣的玩家)。同时,EA也通过使用“模拟城市”这一品牌吸引硬核玩家(这类玩家之前可能并不喜欢玩Facebook游戏,可能没接触过《CityVille》)。我们预计这两款游戏都会取得快速的发展——但Zynga游戏在发行6至8周内应该就会开始出现快速下滑,而EA的《模拟城市社交版》发展曲线却有可能一直延伸到三四个月后。我们并不认为《模拟城市社交版》能够超越《CityVille》,因为比起2010年和2011年,如今的Facebook游戏发展速度已经大不如前。不过它却有可能像之前的《模拟人生社交版》那样,在AppData排名中直逼《CityVille》。Zynga《TheVille》有可能在短时期内超越《模拟人生社交版》,因为Zynga拥有强大且快速的跨平台网络,但是它缺乏核心品牌支持,所以也不太可能成为Facebook游戏常青树。

现在的问题就在于,EA将旗下游戏与原有品牌结合起来的能力究竟有多强大。而这也是Zynga所无法复制的——并且EA在提升手机游戏和社交游戏间的跨平台兼容性理念更先进。同时他们还努力将所有游戏与其Origin平台整

合在一起,以此扩大他们用户获取渠道的规模,并为在线游戏提供坚实的基础设施。但该公司最近经历了重组,并致力于将原来的盒装商业模式转变成数字模式,因此目前势力略为削弱。如果Zynga能在EA的Origin平台走上正轨并实现目标前将其Zynga.com平台发展成一个可自主支持的健康系统,Zynga便能够获得领先地位。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Zynga and EA: Dog chasing tail

AJ Glasser

This week, we saw EA launch a citybuilder game that evokes memories of 2010′s CityVille from Zynga. Less than 24 hours later, Zynga announces a life simulation that looks an awful lot like EA’s 2011 hit The Sims Social. Has the copycat phase of Facebook games finally jumped the shark?

As we’ve detailed in our coverage, The Ville is a life sim where players build a dream house and interact with other players’ avatars — going so far as to have sex with them where possible.

SimCity Social is a citybuilder where players construct a metropolis by placing buildings and increasing a population while also meeting its citizens’ needs (or ignoring them to cause pain and suffering).

In EA’s defense, SimCity Social was in development for nearly two years as a collaboration between EA Playfish and EA Beijing. Citybuilding games on social and mobile platforms are a much older concept in China compared to Facebook, so many of the gameplay mechanics were established as best practices long before CityVille popularized them in North America. Plus, the game draws most of its concept from the original SimCity games that first hit personal computers in 1989 — and many developers since then have used the game as a template for console, PC download, mobile and social games in the same genre.

In Zynga’s defense, The Ville is an example of what the company does best: taking a game concept proven by another company, adding a layer of polish and social features, and then feeding it to a massive network of dedicated users on Facebook and mobile that trust the Zynga brand. It shouldn’t come as a surprise that Zynga is doing to Sims Social exactly what it’s done for the past two years. The developer has a proven business model that it sticks to, both to produce high-trafficking games on a tight development schedule and to please anxious stockholders that don’t necessarily understand the social games market.

Even so, both companies could be taking a misstep in recycling game concepts that may be past their prime on the Facebook platform. According to metrics recorded by our AppData traffic tracking service, CityVille peaked on Facebook three months after its December 2010 launch with over 101 million monthly active users and above 21 million daily active users. Though still one of Zynga’s top-earning games and the No. 4 top grossing game on Facebook’s App Center, no other citybuilding game on Facebook has ever found comparable traction or monetization that we’ve known of since CityVille. Likewise, The Sims Social peaked two months after its August 2011 launch at over 66 million MAU and above 11 million DAU. It’s now Facebook’s No. 12 top grossing game in App Center, but no other life sim has been able to follow it.

That doesn’t mean The Ville and SimCity Social won’t see early rises in users. Zynga has a proven track record of capturing lapsed fans of older non-Zynga games with fresh new ones (e.g. Hidden Chronicles winning over lapsed Gardens of Time players while Playdom’s Gardens of Time sequels can’t come near the traffic of the original). EA, meanwhile, can tap into the hardcore gamer market using the SimCity brand to build trust among the demographic, which may not otherwise deign to play a Facebook game (and may have missed out on CityVille). We expect to see both games spike in growth quickly — with Zynga’s dropping off coming rather quickly after six to eight weeks, while EA pushes out SimCity Social’s growth curve to three or four months. We do not expect SimCity Social to surpass CityVille’s peak traffic because the Facebook platform is a lot less amenable to rapid games growth as it used to be in 2010 and 2011. We do, however, think it stands as much of a chance to unseat CityVille’s current position in AppData rankings as Sims Social once did. The Ville could pass Sims Social’s peak traffic in the short term because Zynga’s cross-platform network is incredibly powerful and fast-acting, but the game probably won’t enjoy as much long term support with no core franchise to support it.

A very big question mark comes from EA’s ability to connect its games to the rest of its franchises. This is the one thing Zynga simply cannot copy — and EA has the right idea in ramping up cross-platform compatibility between mobile and social titles titles. It also seems to be taking steps to integrate its Origin platform across all games regardless of platform — increasing the size of its user acquisition funnel and supporting online games with a solid infrastructure. But EA has also lost some momentum as the company undergoes corporate restructuring and struggles to transition its packaged goods-based business model to a digital one. If Zynga can grow its Zynga.com platform into a healthy self-sustaining ecosystem before EA finds its footing and accomplishes similar goals with its Origin platform, Zynga may come out ahead. But for now, with The Ville and SimCity Social being the big Facebook game releases of the summer, it looks more like the dog is chasing its tail.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号