每日观察:关注Rovio将成立诺基亚游戏开发团队(5.9)

1)据pocketgamer报道,诺基亚日前宣布与Rovio签署战略合作协议,将由后者组建一个开发团队专门针对Lumia设备和Windows Phone平台制作游戏,以便让Rovio将来的新作在第一时间登陆Windows Phone平台。

Rovio与诺基亚还将合作推出“创新型的消费品和针对诺基亚Lumia智能手机的独家内容”,并联手展开市场营销活动。

2)EA日前宣布将向Windows Phone平台发布《FIFA》、《Madden NFL》、《NBA Jam》、《Tiger Woods PGA Tour》、《Mirror’s Edge》和《Yahtzee》等旗下热门游戏。

在此之前,EA已向该平台推出《俄罗斯方块》、《大富翁》、《模拟人生3》、《极品飞车》等游戏,此举表明EA看好Windows Phone平台发展前景。

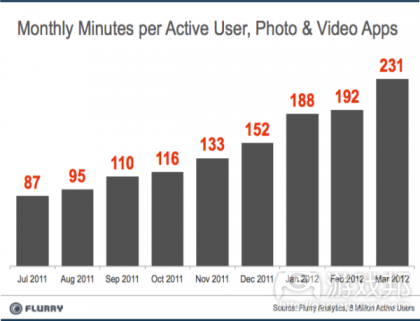

3)移动分析公司Flurry最近数据显示,视频&照片应用已成为发展最迅速的手机应用类型,在2011年10月至2012年3月间,每名活跃用户每月在这类应用上投入的时间已增长89%,达到231分钟,自2011年7月份以来已增长了166%(游戏邦注:Flurry分析数据采自18万款iOS、Android、Windwos Phone、黑莓和HTML5应用,但Flurry的这份报告并未划分视频和照片这两类应用的数据)。

目前增长最快的是音乐应用(自2011年10月以来增幅达72%),其次是办工类应用(增幅为66%),社交网络(增幅为54%)和娱乐类应用(增幅为40%)。

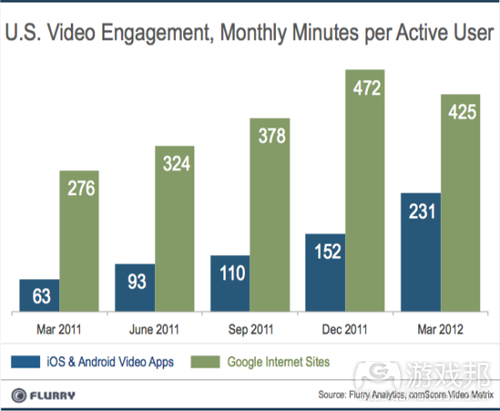

报告还引用comScore的调查数据进行对比,2012年3月份通过谷歌网站观看YouTube视频的美国用户,平均每月在这类视频内容上投入时间为425分钟,低于2011年12月份的472分钟。而用户平均每月投入手机视频内容的时间却呈现持续上升趋势。

4)咨询公司Javelin Strategy & Research最近发布的调查报告将亚马逊、苹果、Facebook和谷歌称为手机银行及支付服务领域的四大创新者,而曾经在90年代令传统银行机构颇为忌惮的微软却不在此列。

Facebook去年通过其在线支付服务创收5.57亿美元,专注于移动领域的苹果和谷歌也在许多方面(包括市场份额和股价)令微软黯然失色。据美国银行家协会支付及技术政策副主席Steve Kenneally所称,现在人们讨论科技行为发展最迅速的先驱时基本上不会提及微软,这种现象反映了过去10多年科技领域的变化趋势。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Angry Birds Space and all future Rovio games coming to Nokia Lumia devices, including with exclusive content

by Jon Jordan

No doubt Nokia and Microsoft weren’t pleased BlackBerry got Angry Birds Space before they did.

That’s the reason they’re keen to point out they now have a strategic deal in place for it and future Rovio games.

Apparently, Rovio is building a dedicated development team to create games for Lumia devices, and the wider Windows Phone ecosystem.

It says the goal is to enable it to publishing all future titles as soon as possible on the platform.

Previously, there was some internal confusion at the company about when and whether it was going to develop for the non-native (C#-based) Windows Phone 7 platform.

Special friends

“Nokia is one of our longest-standing partners, and Windows Phone and Lumia are of strategic importance to Rovio,” said Mikael Hed, Rovio’s CEO.

“We are very committed to bring our games to Lumia devices, and are looking forward to delighting our fans on the Windows Phone platform.”

Rovio and Nokia say they will also partner up to develop what they call “innovative new consumer products and content exclusively for Nokia Lumia smartphones”, as well as integrated marketing initiatives.(source:pocketgamer)

2)EA bringing FIFA, Madden and Tiger Woods to Windows Phone

by James Nouch

The Windows Phone marketplace may have grown to more than 80,000 apps, but publishers still routinely overlook Microsoft’s non-native mobile OS in favour of iOS and Android.

That’s slowly changing, though, and EA has announced that some of its biggest gaming franchises will now appear on Windows Phone, including FIFA, Madden NFL, NBA Jam, Tiger Woods PGA Tour, Mirror’s Edge and Yahtzee.

Things can only get better

These won’t be the first EA titles to hit the Windows Phone marketplace – Tetris, Monopoly, The Sims 3, and the Need for Speed series are already available – but the announcement suggests that the publisher has more confidence in the Windows Phone platform.

Or perhaps a deal with Microsoft and/or Nokia, as the case may be.

The good news follows on from Rovio’s announcement that it’s forming a dedicated team for Windows Phone development.(source: pocketgamer)

3)Report: Photo & Video Now The Fastest Growing Mobile App Category

Frederic Lardinois

Ever since Facebook’s $1 billion acquisition of Instagram, the search for the next “Instagram of [insert app category here]” has been on. One area many pundits have focused on in this context is

video and according to the latest data from mobile app analytics company Flurry, that’s probably not a bad bet. Video & Photo is now the fastest growing mobile app category across the major mobile platforms. The time spent on photo and video apps per active user increased 89% to 231 minutes per month between October 2011 and March 2012 and a massive 166% since July 2011.

This data is based on Flurry’s analysis of the 180,000 apps that currently use its analytics software on iOS, Android, Windows Phone, BlackBerry and HTML5. Other mobile app categories that, according to Flurry, are currently growing fast are music (72% since October 2011), productivity (66%), social networking (54%) and entertainment (40%).

With the advent of affordable phones with built-in HD video cameras and increased network bandwidth, it does indeed look as if the time is right for social video apps.

Sadly, Flurry doesn’t distinguish between video and photo apps in its report. The fact that active users now spent an average of 231 minutes per month in photo and video apps, however, clearly shows the momentum that apps like Viddy, Socialcam and Color are trying to capitalize on.

The quick rise of this app category becomes even more impressive when compared to how much time users are spending on Google’s YouTube. According to comScore, Internet users in the U.S. watched an average of 425 minutes of video content per month on Google’s site in March 2012 – a number that was actually down from a record 472 minutes in December 2011.

This data doesn’t quite make a convincing argument that these mobile video and photo apps are cutting into the time that users’ would otherwise spent on YouTube. As Flurry’s Peter Farago rightly argues, though, “the shift in time spent between these two platforms appears to be a signal of disruption.”(source:techcrunch)

4)In hot ‘digital wallet’ race, where’s Microsoft?

By Greg Lamm and Emily Parkhurst

A recent survey called Amazon, Apple, Facebook and Google the “Gang of Four” innovators when it comes to mobile banking and payment processing. There was no mention of Microsoft.

Nearly two decades ago, banks considered Microsoft Corp.’s software a threat to their traditional business models. These days, finding the Redmond software giant in a crowded field of technology innovators is more like a game of “Where’s Waldo?”

Nowhere is that more obvious than in the business of mobile devices such as smartphones and tablets, particularly in the growing niche market of using those devices to buy things online and in retail stores.

Using a smartphone or tablet as a sort of digital wallet, replacing cash or credit cards, is known as mobile payment processing, and is emerging as a trend likely to sweep through the industry.

However, Microsoft, feared by banks in the late 1990s for its potential as a banking software powerhouse, has been notably absent from the mobile payment technology race.

Some technology companies have found that they can significantly grow their revenue by collecting fees for processing the payments people make with smartphones or online. Facebook made $557 million from online payments last year.

A recent survey by consulting firm Javelin Strategy & Research called Amazon, Apple, Facebook and Google the “Gang of Four” innovators when it comes to mobile banking and payment processing.

There was no mention of Microsoft.

While Microsoft appeared to be on the cutting edge in some fields in the late 1990s, the impression that the company dominates the technology industry has faded significantly. Today, tech companies such as Apple and Google that have focused on mobile products have quickly eclipsed Microsoft in many ways, including market share and stock price.

Microsoft may still have a trick or two up its sleeve, but that’s not apparent to many yet.

Making up lost ground

Steve Kenneally, a vice president focused on payments and technology policy with the American Bankers Association, has been closely watching the mobile payment innovations from Apple and Google.

But Kenneally said Microsoft’s name has not been mentioned in talks among bankers and with federal policymakers about how new technologies could affect the banking industry and consumers.(source:techflash)

闽公网安备35020302001549号

闽公网安备35020302001549号