每日观察:关注GREE收购团队Funzio游戏盈利性(5.9)

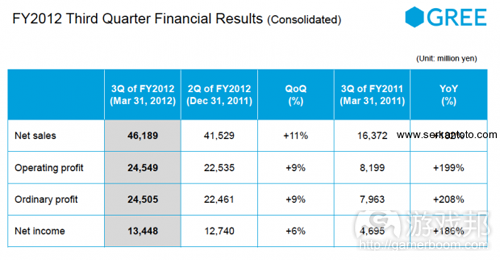

1)GREE最近公布的2012第二财季报告显示,公司在该季度净销售额超过460亿日元(约合5.75亿美元),同比上季度增长11%;营业利润达245亿日元(约合3.07亿美元),同比上季度增长9%,比去年同期增长199%(游戏邦注:据techcrunch报道,GREE该季度收益比Zynga同一时期收益多80%)。

值得注意的是,GREE财报强调其平台将加强对安全问题的重视,更关注现实金钱交易这种较微小的问题,只字未提最近备受争议的gacha这种赌博机制(游戏邦注:据serkantoto报道,在经历“历史性”的股市跌盘之后,GREE和DeNA这两者日前在东京证券交易所的股价已开始复苏并趋于稳定,DeNA也将于近日发布最新财报)。

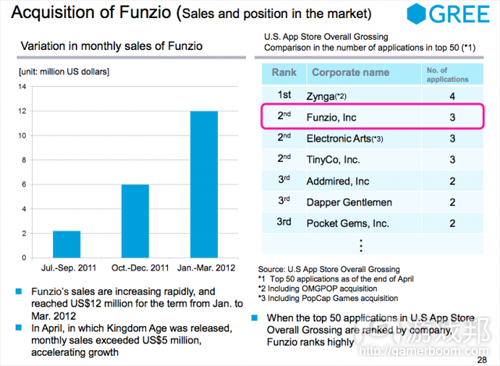

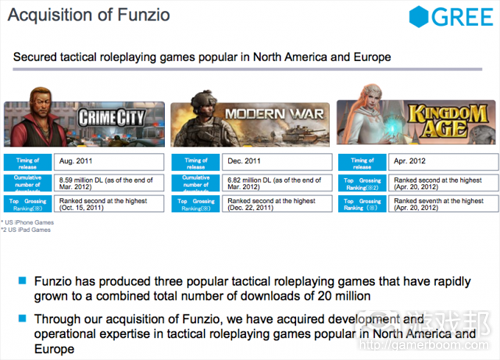

2)GREE不久前收购的Funzio于去年8月向手机平台发布《Crime City》,这款游戏为开发团队在该季度(去年7月至9月)创收200万美元,之后又于11月份推出了《Modern War》,这两款游戏为Funzio圣诞假期季创收600万美元;而上个月才推出的《Kingdom Age》则推动团队实现1200万美元的季度收益。

3)据pocketgamer报道,EA最近财报指出,公司于2011年向日本GREE发布的《FIFA World Class Soccer》成为该平台头号第三方游戏,在上周某天创收100万美元,发布5个月收益达3000万美元。

需指出的是,EA Mobile在过去6个月中的销售额是1.57亿美元(同比上年增长22%),照此计算,《FIFA World Class Soccer》这款游戏仅在日本一个国家就创造了19%以上的EA Mobile收益。

如果这款游戏能够维持一年内创收5000万美元的水平,那对EA无疑是个好消息,但假如将该游戏收益从EA Mobile财报中移除,那么EA Mobile虽然掌握了PopCap手机游戏,它在2012财年的实际销售额仍会下滑。

4)据gamasutra报道,EA股票在5月7日下跌6%左右,在周二开盘时股价为14.25美元,这是自1999年来的最低点。在过去5年中,EA股票贬值将近70%。

有分析者认为EA股票下跌固然与宏观经济环境有关,但EA本身也难辞其咎。EA虽然坐拥大量热门游戏作品,但已经许久没有推出富有影响力的新作,近年来又有大量人才流向Zynga等公司。

5)据insidesocialgames报道,Zynga最新社交游戏《Bubble Safari》将于近日同时登陆Facebook和Zynga.com平台。

这款泡泡射击游戏将与King.com旗下热门游戏《Bubble Witch Saga》形成竞争,后者于去年9月发布于Facebook平台。《Bubble Safari》与其他同一题材的Facebook游戏玩法没有太多区别,它由Zynga圣地亚哥工作室开发,由高级创意总监Mark Turmell(游戏邦注:他是拥有Apple II和Atari 2600时代街机游戏开发背景的行业元老,《Bubble Safari》是他在Zynga开发的第一款街机类游戏)负责监管项目开发工作。

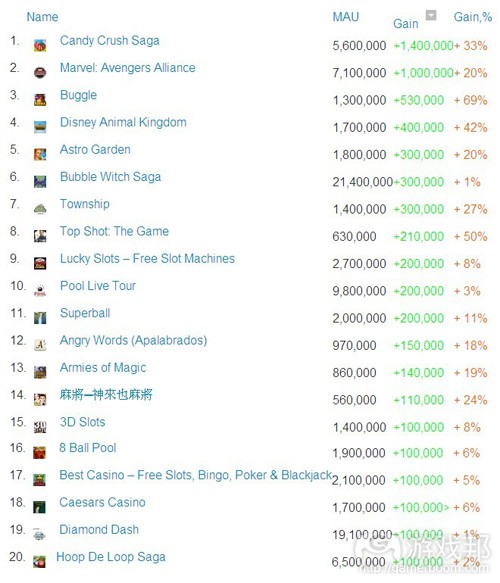

6)在本周Facebook新晋游戏(MAU低于100万)榜单上,King.com旗下的《Candy Crush Saga》持续领先,在过去一周中新增140万MAU,增幅达33%。迪士尼Playdom的《Marvel: Avengers Alliance》新增100万MAU,增幅达20%;《Buggle》位居第三,新增53万MAU,增幅为69%。

其他增幅超过20%的游戏包括迪士尼Playdom游戏《Disney Animal Kingdom Explorers》(新增40万MAU,增幅达42%),RedSpell的《Astro Garden》(由6waves发行,新增30万MAU,增幅为20%),Playrix旗下的《Township》(由6waves发行,新增30万MAU,增幅为27%),A&E Television Network游戏《Top Shot: The Game》(新增21万MAU,增幅达50%), God Games Inc.《麻将–神来也麻将》(新增11万MAU,增幅达24%)。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)GREE’s Q3: Sales +182%, Profit +199% Year-On-Year [Social Games]

by Dr. Serkan Toto

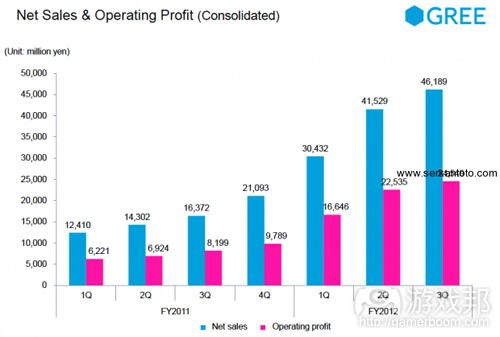

GREE continues to be in overdrive: very similar to what the company reported back in February for Q2, sales and profit have gone through the roof in Q3 of fiscal 2012.

Net sales reached over 46 billion yen (US$575 million) in Q3, while operating profit hit 24.5 billion yen (US$307 million) – in three months.

GREE’s financial report can be downloaded in English from here. I could post all slides here, as the report is highly relevant, but will leave it to these two instead (sorry about the watermark on the first image: sales are up 182% year-on-year):

What’s interesting about the report is that:

•GREE has put slides regarding their efforts to make the platform safer for users before everything else

•GREE isn’t mentioning the word “gacha” once in the report but focuses more on real-money-trading, the smaller problem they are currently facing

•GREE’s global expansion plans take up more room in the report than ever

*GREE and the Japanese social gaming industry as a whole are currently under fire for using gambling-like game mechanics in their games. Companies operating in this field of business lost billions in market value yesterday after various media reports suggested regulation of the “kompu gacha” mechanic is around the corner.(source: serkantoto)

2)Funzio Was Making $5M In Sales Per Month When It Sold To GREE For $210M

Kim-Mai Cutler

San Francisco-based mobile gaming startup Funzio had just come off making more than $5 million in sales per month when it sold to Japan’s GREE for $210 million last week. Profits may be another story, and there’s less visibility into that. But Funzio had to decide between raising additional funding or selling at the time the deal happened.

The numbers were revealed in GREE’s earnings statement today. Funzio’s acquisition comes at a very fascinating time for GREE, a $4.8 billion mobile gaming company from Japan. Like Zynga in the U.S., GREE and its archrival DeNA are part of a younger vanguard of freemium gaming companies that have found success in their home market of Japan. The company made $168.5 million (13.4 billion yen) in net income on $578.9 million in revenue (46.2 billion yen) in the quarter ending in March. Just for comparison, that’s about 80 percent more revenue than Zynga in the same time period.

But there are threats on the horizon. GREE’s shares were absolutely slaughtered on the Tokyo Stock Exchange on Monday. The company’s shares fell a record 23 percent after the Japanese government said it was investigating the legality of various game mechanics in the social gaming industry. Many Japanese games have a slot machine-like mechanic called “Gacha,” where players will randomly win different special items. If they win all the items, they might get a grand prize. The National Consumer Affairs Agency said it’s now looking at regulating this tactic, which could seriously crimp revenues for GREE.

If anything, this underscores the urgency there is in expanding the company abroad. With the Japanese market becoming saturated, GREE is looking to the West and it’s done two major acquisitions to break into the U.S. with the $104 million deal to OpenFeint and last week’s $210 million deal to buy Funzio. The plan is to be a dual games platform and developer, just like the company is in Japan. They’ll make their own in-house games, but they’ll also distribute, publish and promote games from other developers.

San Francisco’s Funzio fits into the first-party game development side. The company, which was started by experienced game developers who had spent time at Zynga, Storm8 and hi5, had three mobile gaming titles to its name. They were behind graphical role-playing games like the mafia-themed Crime City, the military-themed Modern War and the fantasy-themed Kingdom Age.

They only arrived on mobile platforms last August with the debut of Crime City, a brand that the company had already put on the Facebook platform. That set them up to have a $2 million quarter between July and September of last year. Then they launched Modern War in November and the two titles got them to a $6 million quarter during Christmas. Finally, Kingdom Age, launched last month, got them to a $12 million quarter.

Just after Kingdom Age launched, I spoke with Funzio’s vice president of business development Jamil Moledina. Even though the game was downloaded at roughly the same pace that the company’s earlier games were, engagement was up. Both Modern War and Kingdom Age got to 1 million downloads in about the same time. But Kingdom Age saw the equivalent of 93 years of gameplay, while Modern War saw about 50 years of gameplay in its first five days.

Again, I don’t really have visibility into profits. But it wouldn’t be surprising if margins were tight as the cost of marketing apps and acquiring users has gone up dramatically over the past year. Glu Mobile, another San Francisco-based mobile game developer that’s publicly traded, posted very strong quarterly growth with $17 million in smartphone revenues for the first quarter. But it still reported a net loss of $6.8 million, which was probably partially fueled by its lingering featurephone gaming business.(source:techcrunch)

3)FIFA World Class Soccer on GREE made EA Mobile $30 million in five months

by Jon Jordan

Over the past six months, EA Mobile has booked $157 million in sales.

That’s up 22 percent compared to the same period 12 months ago.

Pretty good going, but not unexpected given that it’s added the revenue from PopCap.

He shoots, he scores

But what’s this we read in the small print of its financials?

“In November, FIFA World Class Soccer launched on the GREE network in Japan and became the top-ranking third party title on that system.

“It had a million dollar day last week, and has racked up $30 million in just five months.”

Putting that into context, this means that one game (FIFA World Class Soccer) in one country (Japan), accounted for over 19 percent of EA Mobile’s entire revenue.

On one hand, it’s a massive positive for the company, especially if the game can sustain its revenue to account for, say $50 million over a year.

But, on the other, if you remove that game/revenue from EA Mobile, its annual sales would actually have declined in FY12, despite adding PopCap’s mobile revenue to its accounts.(source:pocketgamer)

4)EA shares lowest since ’99 – is it now a takeover target?

by Chris Morris [Business/Marketing, Exclusive]

Electronic Arts has been the rumor mill’s favorite grist for years — but in recent weeks, the company has found itself the subject of even more whispers than usual.

Reports that Nexon was planning a bid for the company proved to be a significant misunderstanding by a major news outlet, but with the company’s revelation Monday that subscribers to Star Wars: The Old Republic are leaving at an alarming pace and that the future earnings outlook is tepid, those takeover talks may be resurrected.

EA shares are taking a hit today on yesterday’s revelations — down some 6 percent (which, admittedly, is better than the 10 percent drop that came in after-hours trading yesterday).

Shares opened Tuesday at $14.25, a level the company hasn’t seen since July 1999. In the past five years, EA shares have lost nearly 70 percent of their value.

A lot of that loss is tied to the broader economic downturn, but there’s plenty of blame on EA’s side. While it has had its share of hits, it hasn’t published a new category-defining title for a long time — and it has lost several strong members of its management team to companies like Zynga. Meanwhile, the publishing side of the business — the bread and butter for any traditional game company — continues to be battered by sluggish retail sales. (source: gamasutra)

5) Zynga’s Bubble Safari takes aim at Bubble Witch Saga’s success on Facebook

AJ Glasser•

Zynga’s newest social game, Bubble Safari, targets the casual arcade genre recently cornered on Facebook by King.com with its hit game Bubble Witch Saga. The casual arcade shooter launches on Facebook and Zynga.com simultaneously tomorrow.

The bubble shooter genre predates Facebook by more than 25 years. The goal of these games is match like-colored bubbles by firing a single bullet upward into a cluster of connected bubbles. A level is cleared when all rows, or a certain number of bubbles have been cleared. Like match-3 puzzle games such as Bejeweled, scoring bonuses are usually applied based on speed, matching bubbles in quick succession or by hitting special bonus items placed within the puzzle. These games have found a high degree of success on Facebook because users can learn and play the games quickly, and because they’re easy for developers to program and monetize. Like other Facebook-based arcade games, bubble shooters monetize through the sale of power-up items that increase scoring bonuses or through an energy mechanic that limits the number of sessions a user can play in a day.

King.com shot to the top three Facebook game developers by daily and monthly active users in the last six months on the strength of its bubble shooter, Bubble Witch Saga, which launched last September. That game was predated by King.com’s Bubble Saga, GameDuell’s Bubble Speed, wooga’s Bubble Island and several other variations on bubble shooters. Zynga hopes to make a splash with its bubble shooter by building on features that each of these games has introduced, adding a few of their own and introducing a new Flash engine that can run the game at 60 frames per second and produce high-gloss visual effects.(source:insidesocialgames)

6)Candy Crush Saga still on top of fastest-growing Facebook games by MAU

Mike Thompson

King.com’s Candy Crush Saga continues to dominate the list of fastest-growing Facebook games by monthly active users. The game took the No. 1 spot this week with a 1.4 million gain for a 33 percent increase.

Disney Playdom’s Marvel: Avengers Alliance continues to benefit from the record-breaking popularity of Marvel’s The Avengers, increasing by 1 million MAU for a gain of 20 percent. Cookapps bubble shooter Buggle is quickly climbing the charts, grabbing the No. 3 spot with a 530,000 MAU and a 69 percent gain.

Five other games on this week’s list had gains greater than 20 percent. Disney Playdom’s Disney Animal Kingdom Explorers grew by 42 percent with 400,000 MAU; RedSpell’s Astro Garden went up 300,000 MAU for a gain of 20 percent; and Playrix’s Township expanded by 300,000 MAU for a 27 percent increase. Note that the latter two games were published by 6waves. Meanwhile, A&E Television Network’s Top Shot: The Game increased by 210,000 MAU for a 50 percent gain. Finally, God Games Inc.’s 麻將─神來也麻將 (“Also Mahjong Mahjong ─ God to”) gained 110,000 MAU for a 24 percent increase in total size.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号