分析Zynga如何于2009年一举攻下Facebook平台

作者:Eric Eldon

Zynga即将上市,公司估值高达90亿美元,所以媒体开始争相探究此社交游戏巨头如何获得这般成就。很多话题都围绕该公司的紧张文化氛围,同Facebook存有争议的关系,虚拟交易业务及当前稍显平凡的流量数据——几乎囊括所有内容。但本文主要探究初创公司如何通过正确把握时机和定位赢得市场。

2009年1月1日,Zynga在成立1年半后将自己的MAU发展至2390万。这当时对Facebook平台而言是好事一件,但同其他社交游戏公司相比这算不上什么丰功伟绩。但到了隔年同时间,据AppData数据显示,Zynga的MAU翻了10翻,增至2.4亿,此水平超越其他所有社交游戏公司的数据总和。

Zynga如何做到这一点?

是的,该公司组建富有经验的团队,同时创建旨在快速发展的基础设施机制。此外,Zynga还掌握用户期望的游戏类型(游戏邦注:尤其是休闲模拟游戏),其深知要如何基于这些内容获得丰厚营收。

一个关键点是Facebook自身的改变。2009年初,Twitter开始平台的首轮大规模宣传,Facebook对此忧心忡忡,于是决定从算法消息动态模式转移至锁定状态更新内容的即时信息——旨在吸引微博用户的眼球。

Zynga在此的回应方式是设计自己的即时沟通渠道。这所带来的结果是用户周围充斥各种基于游戏的消息。Zynga于当年6月推出自己的模拟游戏热作《FarmVille》,此时公司就已知晓如何在此新环境中掳获用户的芳心。

这不是Zynga运作策略的全部,它还通过投资Facebook广告创造收益,而此时多数其他公司都还锁定纯自然发展模式。2009年上半年,Zynga开始提高自己的游戏支出——《FarmVille》的发布更是让此策略步入新高度。这些广告不是用于增加用户,而是旨在加快处于成长阶段作品的发展速度。

除公司努力争取的其他目标及新平台积极优化策略,以及庞大广告支出外,Zynga还在随后期间推出系列模拟热作(游戏邦注:包括《咖啡世界》、《PetVille》和《FishVille》)。在每款新作中,Zynga都能够从既有作品中掳获用户。

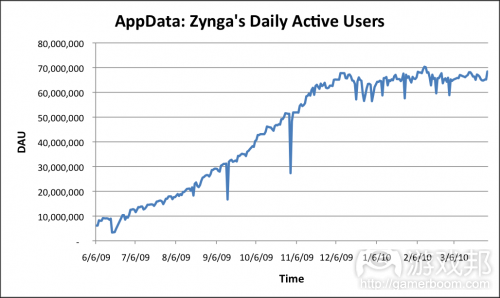

2009年秋末,随着其他开发者的争相购买广告,广告的成本日益提高。Facebook重新审查自己的平台,重返算法新闻动态模式,削减通知之类的病毒式传播功能。Zynga 2009年秋所发行作品的规模都小于早前内容。2009年6月,AppData开始追踪DAU数据,这让我们得以更清楚地获悉Zynga在某具体时刻的用户粘性情况。在尚未发行《FishVille》前,Zynga的DAU约为1000万,同年底此数据逐步达到稳定水平,约7000万。

自2009年来,Zynga陆续推出其他热门作品,其中包括《FrontierVille》、《CityVille》及最新的《CastleVille》,但它们再也没有取得同等规模的发展水平或同样数量的连续热作。据AppData最新数据显示,Zynga当前的DAU和MAU分别是5000万和2.2亿。

但未来投资者不要因此而感到沮丧。

Zynga所采取的策略是提炼所制作过的内容,提供更优质的作品,创造更多的收入。Zynga聘请更多资深游戏设计师制作高质量的游戏,这令公司得以持久留住老牌作品,推出更优质的新作。Zynga如今能够更好地基于既有作品创收。尽管存在广告成本提高及Facebook基于Credits分成30%的问题,Zynga近年来收入仍在稳步提升。

顺利朝手机游戏领域转移及庞大消费能力,连同在Facebook的主导地位——所有这些因素促使Zynga得以成功发展至今,Zynga的未来发展颇耐人寻味。目前Facebook的前五款热门作品依然出自Zynga之手,同时该公司也开始在手机平台获得众多新用户,Zynga非常清楚行业的发展趋势。在公司上市前的巡回说明会上,Zynga表示公司预期社交网络用户将从10亿增至20亿,其中网络社交游戏用户将达到9亿。所以Zynga也许能够重现其2009年的辉煌。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

How Zynga Won The Facebook Platform In 2009

By Eric Eldon

Zynga is about to go public at a valuation that could make it worth around $9 billion, so the press is busy looking back at how the social gaming leader came to be this successful. There’s lots of discussion around its intense company culture, its contentious relationship with Facebook, its virtual goods business, its currently flattish traffic — or basically everything, if you read this giant article today by my former colleague Dean Takahashi at VentureBeat.

But here’s a closer look at how the company came to dominate social gaming on Facebook in 2009, based on conversations I’ve had with Zynga employees and rival developers over the years. It’s a case study in how startups can win markets by hitting them at the right time and place.

On January 1 of 2009, a year and a half after its founding, Zynga had grown its user base to a respectable 23.9 million monthly active users. That was good for the Facebook platform at the time, but nothing mind-blowing compared to other social gaming developers. But by the same time next year, it had grown by ten times that number to 240 million, according to AppData, and was larger than all of its social gaming competitors combined.

How?

Yes, it had built up an experienced team, and an infrastructure system designed to scale quickly with growth. But it had also figured out the types of games that users wanted — especially casual simulations. And it knew how to bet big on those.

One key way was Facebook’s own changes. In early 2009, Twitter has hitting its first big hype cycle, and Facebook was concerned. So it decided to move from an algorithmic news feed of stories to a real-time stream of information that focused on status updates — a bid to grab the attention around the micro-blogging form factor.

Zynga reacted by designing its communication channels for real-time. The result was users seeing all sorts of stories around games (“spam,” as many of us called it). When Zynga launched its formative simulation hit, FarmVille, that June, it had already refined how to reach users in this new environment.

That wasn’t all the company was doing. It had also discovered that it could get a return on its investments in Facebook ads when many other developers were still aiming for purely organic growth. During the first part of the year, it began increasing its spending for games — and kicked that tactic up a notch when FarmVille launched. These ads weren’t so much used to seed users, but to help accelerate growth once a game was already growing.

On top of all of the other things it had going for it, plus the aggressive optimization for the new platform, and the heavy ad spending, it was able to roll out a line of other simulation hits over the rest of the year (Café World, PetVille, FishVille). And with each new hit, Zynga was also able to cross-promote users from existing games.

By the late fall of that year, ads were becoming more expensive as other developers (and other advertisers) began buying them more. And Facebook re-overhauled its platform, going back to an algorithmic news feed and cutting back on other viral features like notifications. Each Zynga launch that fall was smaller than the previous one. AppData began tracking daily active users that June, which provides us with a more detailed view of just how engaging Zynga got during this time. The company started with around 10 million DAU before FarmVille, and then plateaued at nearly 70 million at the end of the year (see graph above).

Since 2009, Zynga has come out with other hits, like FrontierVille, CityVille and newer ones like CastleVille. But it’s never seen the same scale of growth or the same number of consecutive successful launches. Today, AppData shows the company with nearly 50 million DAU and 220 million MAU.

Prospective investors shouldn’t get all depressed, though.

What Zynga has done is refine everything it has had to offer better products and make more money. It hired more and more veteran game designers to build higher-quality games, which has helped it maintain older titles for years and launch better new ones. And it has gotten better at monetizing from its existing user base. The company has steadily grown revenue over the years, in spite of factors like increasing ad costs and the addition of Facebook’s 30% cut from Credits, it has shown in S-1 filing amendments.

Along with its still-dominant position on Facebook, its increasingly successful moves into mobile gaming, and its massive spending power — and all of the other factors that have made it successful to date — Zynga has an interesting future. It still has the top five games on Facebook. It’s also gaining solid numbers of new users on mobile, and it has big ideas for where things might go. In its pre-IPO roadshow, it says it expects social network users to double from one to two billion, with web social gaming growing to a market size of 900 million. So maybe it’ll have another 2009.(Source:techcrunch)

闽公网安备35020302001549号

闽公网安备35020302001549号