分析Facebook游戏留存率下滑现象及其原因

作者:Nicholas Lovell

过去1年我深入分析Facebook游戏,尤其是游戏的留存率(游戏邦注:即DAU/MAU)。

在2010年9月-2010年10月间,某些热门Facebook游戏的留存率下滑25%。

纵观全局,游戏留存率均呈现下滑趋势(除《黑手党战争》外)。受此启发,我还研究系列新款作品的留存率,这些新作的留存率比去年12月的其他作品低很多。

就连EA最近的杰作《模拟人生社交版》的留存率也不能与去年12月的其他游戏相提并论。

Facebook留存率为什么会出现下滑?

我没有进行详尽调查,因此无法确定其根本趋势。也许若进行小样本调查,我们会发现游戏留存率其实正逐步上升,但就我所选取的作品来看情况并非如此。若我们假设游戏留存率呈现下滑趋势,其中可能原因是什么?

* 用户选择更为丰富:如今Facebook存在众多游戏。更别提那些搭载iOS和Android平台的内容(游戏邦注:这些平台的作品促使大家开始脱离浏览器)。是否已无游戏能够维持Facebook 2009年鼎盛时期的留存率水平?

* 季节影响因素:在我还是互联网股票分析师时,曾有人问我为什么互联网市场占有率和创新初创公司的数量由斯堪迪纳维亚半岛到北欧再到南欧依次递减。“天气越好,夏天更长”是我常常给出的答案。这有点油腔滑调,但至少部分如此。你会发现许多游戏的夏季流量都会出现下滑。所以这些下滑属于暂时现象,主要由于玩家利用2周暑假外出度假。

* 病毒式传播方式受限:Trip Hawkins曾发表某有关Facebook病毒式传播减少的文章。简单地说,由于Facebook限制病毒式传播,令DAU/MAU数值大受影响。回到2009年,此比值高达40%。如今据图表显示,游戏能够获得20%的留存率就已非常不错。Trip的观点是减少的病毒式传播(游戏邦注:这令用户获取成本提高)令智能手机平台看起来比Facebook更具吸引力。

Facebook游戏时代是否结束?

在我看来,预言家、分析师和各公司总在预言中低估季节因素。他们的预测呈直线趋势,丝毫未察觉时间带来的影响。

我希望游戏今年最后一个季度的留存率能够有所回升。但整体来看,游戏留存率似乎正不断下降,我常常建议用户在其预测和标杆管理中参照该数据。

夏天会结束,但选择内容还有很多。也许用户的眼光会越来越敏锐,通吃性的游戏内容将逐渐淡出视野。

这将给玩家带来更多选择,更多开发者会选择通过迎合特定细分市场的用户需求创收。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Are consumers falling out of love with Facebook games? Engagement with Facebook Games Has fallen 25% since December 2010

By Nicholas Lovell

I’ve been doing some analysis of Facebook games over the past year. In particular, I’ve been looking at the engagement rate (DAU/MAU) for Facebook games.

Between December 2010 and September 2010, engagement has fallen by around 25% for some of the most popular games on Facebook.

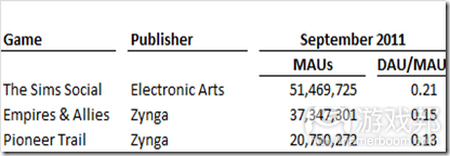

Across the board, engagements have fallen (with the exception of Mafia Wars). Intrigued by this, I looked at the engagement rates of a handful of new games. These new titles have lower engagement rates than most of these other titles had in December 2010.

Even the Sims Social, one of EA’s successes, has lower engagement rate than many games back in December.

Why are Facebook engagement rates in decline?

I haven’t done an exhaustive analysis, so it’s hard to be sure of underlying trends. It’s possible that my small sample size of games means that engagement rates are rising, just not for the games that I’ve picked. If we assume, for a moment, that there is downwards pressure on engagement, what are the possible reasons?

* Increased choice: there are a lot of games on Facebook now. Not to mention all of those on iOS and Android which are keeping people away from their browsers. Could it just be that no game can keep the same level of engagement as in Facebook’s heyday as a gaming platform in 2009?

* Summer: When I was an equity analyst covering the Internet sector, people asked me why Internet penetration and the number of innovative startups was much higher in Scandinavia, then northern Europe, then southern Europe. “Better weather, longer summers” was my stock answer. It’s glib, but at least partially true. You should expect traffic to fall during the summer for most games businesses (the southern hemisphere isn’t significant enough in traffic terms to offset the US and Western European holiday season). So these falls might be temporary, driven by nothing more than lots of Facebook gamers taking a two week summer holiday in the sun.

* Virality shutdown: Trip Hawkins has put together a great post on the decline in Facebook’s virality. Put simply, as Facebook has worked to shut down virality (read: unwanted game spam), it has put a heavy dent in DAU/MAU ratios. Back in 2009, these could be as high as 40%. Now, as the charts show, achieving 20% is a great result. Trip’s view is that the declining virality – and hence increasing customer acquisition cost – is starting to make smartphone platforms look more exciting than Facebook.

Is the Facebook gaming era over?

In my experience, forecasters, analysts and companies always underestimate seasonal factors in their calculations. Their forecasts run following a straight line, with no real awareness of how the time of year affects their business. (Ask a retailer if this is realistic…)

I am hopeful that we will see some recovery in engagement rates in the final quarter of this year. However, across the board, I am reducing the engagement rates that I recommend my clients use for their forecasts and benchmarking.

The summer may end, but there is a lot more choice out there than there was. Maybe customers are becoming more discerning, and the opportunity for one-size-fits-all games is coming to an end.

That would lead to more choice for gamers, and more developers having to make money by satisfying – to the full – a smaller niche of gamers than before.(Source:gamesbrief)

闽公网安备35020302001549号

闽公网安备35020302001549号