开发商看3大移动平台的游戏发展态势

作者:Andrew Webster

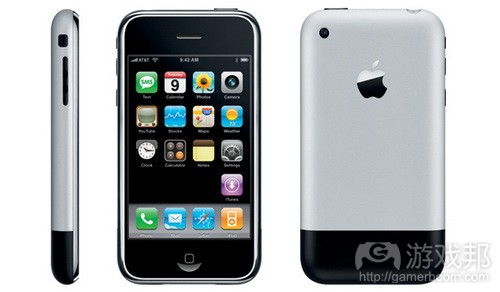

自2008年开发商们开始瞄准iPhone平台开发大量热门作品以来,手机游戏市场迅速崛起,洗刷其原有污名。继iOS获得初步成功后(游戏邦注:iPhone、iPad的风靡将促使该平台继续保持强有力市场地位),其他平台纷纷涌现。Android如今的市场份额高于苹果,微软继续凭其Windows Phone 7进军移动领域。

但现今哪个平台更具可行性?变化趋势如何?本文结合PopCap、Gameloft和Glu公司高管看法,分析日益壮大移动(智能手机和平板电脑)游戏市场的当前态势和未来发展。

iOS平台

自苹果2008年推出App Store以来,游戏就成为推动公司成功的重要因素。《愤怒的小鸟》、《割绳子》之类作品如今已是家喻户晓,而《Sword & Sworcery》、《星噬》之类独立作品的成功也开始受到广泛关注。App Store推出不到2年,应用下载量就超过150亿次,其中以游戏内容为主。

据研究公司Gartner表示,苹果2010年的智能手机市场份额为16%,设备全球销量约4700万部。此数据2011年有望获得明显提高,市场份额有望提高至19%,而设备销量有望增至9000万部。据分析人士预测,到2015年,iPhone销量有望提高至1.9亿部。

至于平板电脑市场,苹果则具有突出优势。苹果2010年的平板电脑市场份额高达80%,iPad销售量为1400万台。虽然其2011年的市场份额或将降至70%(游戏邦注:由于出现众多竞争对手),但设备销量有望增至5000万台。预测该设备在2012年有望增至7000台,2015年有望增至1.4亿台。

究竟是什么促使苹果移动设备独具魅力?Glu Mobile营销副总裁Mike Breslin认为,其“流畅电子商务引擎”促使App Store颇具吸引力。用户能够获得优质购物体验,这反过来会促成高销售量和高收益。和其移动市场不同,开发商需权衡的手机和操作系统范围非常小,这促使开发过程更加畅通无阻。

很多原生游戏在iOS大获成功,但随着市场的发展,游戏数量开始急剧增加,品牌在曝光度方面所起的作用越来越大。新《愤怒的小鸟》衍生品无疑能够轻松问鼎10大畅销作品,PopCap热门作品的衍生作品也不例外。

PopCap移动产品管理总监Andrew Stein表示,“我们已推出系列iOS畅销作品的衍生产品。所以我们入驻App Store时就已家喻户晓。我们既有游戏已售出数百万份,所以当推出新作时,我们能够在这些既有游戏中宣传新产品。”

这使得《宝石迷阵 2》和《植物大战僵尸》之类的作品能够在问世数年后依然颇受追捧。PopCap目前营收约有30%来自移动产品,其中有30%源自iOS平台。

但在App Store问世4年中,平台力作发行模式已发生很大改变,开始更多依靠服务机制。开发商们不是以固定价格发行作品,然后等待用户购买,相反他们现在需要定期更新内容,确保作品售出更多,获得更广泛用户基础。

PopCap移动产品和商业策略高级主管Giordano Contestabile表示,市场如今已转变成这样一种态势:“游戏销量不再是创收的主要筹码。”

内置付费模式越来越普遍,很多游戏如今已完全卸下价格标签,转而采用免费模式。这使得用户规模变得越发重要:玩家越多,进行虚拟交易的可能性就越大。

Breslin表示,“用户规模是关键。采用免费模式后,用户选择性大大拓展。好作品将迈向成功。而劣质作品将难逃失败命运。”

“免费游戏发行商和开发商的目标是让尽可能多的玩家参与至游戏当中,以实现社交互动和病毒式传播。所以移除促使玩家参与最大障碍(价格)的免费游戏自然颇受开发商和发行商青睐。”

Contestabile补充表示,“免费模式改变游戏设计和营销方式,改变游戏维持和操作方式。所以现在鲜有开发商发行发行作品,然后坐等营收。如今的产品需要持续更新,能够维持几个月、几年的生命力。”

就免费模式游戏而言,搭载Facebook之类的社交网络将成为其成功关键。合理借助社交网络能够增加产品曝光度(想在饱和市场中吸引用户眼球,这点很重要)。

但这并不是说所有游戏未来都会采用免费模式。Gameloft最近表示,免费游戏结合订阅费用也是个成功模式,其iOS MMO《Order & Chaos》(游戏邦注:游戏定价6.99美元)推出2天就创收100万美元。虽然该开发商今年计划尝试免费模式,但其未来仍旧会朝多元化付费结构发展。

Gameloft美国营销副总裁Baudouin Corman解释表示,“我们认为其他商业模式仍有其发挥空间,如付费、混合付费(预先付费+虚拟交易)和订阅模式。这些模式更适合硬核游戏或细分产品。苹果未来若在App Store融入这些模式,定会非常有趣。”

Android平台

虽然苹果是很多公司的关注焦点,但谷歌Android移动平台也悄悄迎头赶上。Android移动设备的每日激活量高于iOS,这促使很多开发商开始关注这个平台,尽管该平台还存在许多显著问题,如设备分散性和繁琐付费过程。

据分析人士表示,Android今年的智能手机市场份额有望增至40%,该比例2012则将增至50%。这意味着截至今年底,Android智能手机销量有望增至1.8亿部。据预测是,设备销量2012年有望增至3亿部,2015年有望增至5亿部。

但此优势地位并未体现于平板电脑市场,Android设备2010年在平板电脑市场的份额只有14%,销量仅250万台。此数据有望获得些许发展,今年底的销量或达1400万。据分析人士表示,到2015年,Android平板电脑同iPad的差距将只有咫尺之遥,设备有望售出1.13亿台,分割38%的平板电脑市场。

很多开发商最初都持观望态度,等待市场环境获得改善。例如,PopCap就待到该操作系统推出2.2版本,此版本能够将应用保存至SD卡功能。Gameloft最先决定进军该市场,当时市场已出现强大手机设备,开发商能够把其高清作品移至Android平台。

即便如此,很多开发商还是持谨慎态度,他们并未选择开发原生应用,而是把成功iOS作品移至Android平台。一般来说,在iOS平台风靡的作品也能够在Android获得成功。

特定Android设备的兴起开始逐步转变这种思维方式,至少在某些情况下。Gamelof推出的《BackStab》(游戏邦注:这是款备受关注的3D动作游戏)最初仅入驻索尼新设备Xperia Play。游戏最终也移植iOS设备,但却是最初少数投放Android设备的作品之一。

Corman表示,“商业机会和技术参数促使平台出现专营现象。若游戏只能搭载特定Android设备,或出于其他商业原因,那么Gameloft或许会推出更多仅瞄准Android的作品。”

但瞄准Android平台发行游戏需注意的是选择销售渠道。和苹果设备不同(其只有一个销售商店),Android有众多应用商店。除谷歌市场外,Android应用还可以通过亚马逊和GetJar等平台购得,或者甚至通过Exent Gametanium之类的服务租用。

虽然这令人望而却步,有时甚至有些沮丧,但开发商却能够从中享有更多权利。例如,PopCap由于不满Android市场布局,决定在推出《植物大战僵尸》时给予亚马逊应用商店一定时间的专营权。

Contestabile(游戏邦注:正是其决定同亚马逊合作)表示,“亚马逊无法解决Android平台的所有问题,但他们在销售数字内容方面经验丰富。他们具备强大付费基础,也就是说,亚马逊商店用户不存在付费问题,只消轻轻一点,费用就会从用户的亚马逊账户中扣除。”

“他们拥有服务Android游戏的强大曝光和推荐引擎。他们同时还有强大网页基础,他们能够凭此在各平台推广PopCap产品。你可以选择购买PC产品、掌机产品或者是Android产品。所以我们觉得这也是跨平台交叉推广的好途径。”

Android的相对灵活性也带来iOS平台所没有的潜在机会。例如,Contestabile表示PopCap有望携手硬件设备制造商在手机平台植入游戏,绕过各种应用商店。

但Android存在的一大缺陷是其用户鲜少掏钱。和iOS的一次性点击购买不同,Android用户面临更多阻碍,这将促使降低销量。这是平台目前存在的一大问题,但并非永久问题。开发商已意识到用户行为的变化,他们相信不久之后,Android用户也会变得同其iOS伙伴一样。

但二者之间存有某些共性,那就是朝免费模式发展。免费模式游戏要获得成功只消让尽可能多玩家参与至游戏当中,所以跨平台游戏至关重要。这降低独家经营的可能性,但不排除作品先入驻Android平台,再移至其他设备。例如,Glu的《Gun Bros》最初就是先投放Android平台,然后再移至Facebook和iOS。

Glu Breslin表示,“我们的重心是制作高质量免费作品,不针对特定平台,相比瞄准单个平台,我们从多平台投放策略中获得更多益处。”

Windows Phone

下面就来谈谈微软。尽管竭尽全力,此计算机巨头公司还是无法在智能手机市场中占据有利位置。Windows Phone 7于去年底问世,亮点是这个独特操作系统,同时整合Xbox Live设备,但其在移动领域的份额仍旧微乎其微。微软 2010年在智能手机的市场份额低于5%,手机设备销量约为1200万部,其销量今年底有望翻一番。据预测,Windows Phones 2015年的市场份额有望增至20%。

PopCap Stein(游戏邦注:他是WP7设备的忠实用户)表示,“该操作系统显然尚未获得用户广泛共鸣。就Windows Phone设备安装基础来看,我们的游戏销量情况其实相当不错,营收也相当可观。只是用户基础还有待进一步扩展。”

PopCap从一开始就瞄准Windows Phone,《Bejeweled Live》就是针对Windows Phone打造的,《植物大战僵尸》未来也将移至该平台。

市场份额小并非限制WP7发展的唯一因素,PopCap Stein表示,阻碍开发商投身WP7平台的因素还包括技术问题。

他表示,“微软坚持使用C sharp而非C++作为标准开发语言,因此开发商需付出更多劳动。”

即便如此,凭借其更新内容和Mango代码,微软不断添加新功能,这将强化WP7的游戏体验(游戏邦注:不论是从开发商角度,还是从用户角度看)。从今年秋天开始,开发商有望借助设备摄像头、传感器和陀螺仪功能开发游戏,同时利用通讯录和日历信息。

调整是否能够满足用户和开发商需求,还有待观察。但显然要想成为可行游戏平台,WP7设备需吸引用户眼球。

总结

3大平台将继续发展,不断成熟,且差距会越来越小。至少iOS 和Android未来会不相上下。两大平台都开始朝服务型经济模式发展,将虚拟交易视作主要营收渠道。

WP7在用户覆盖率方面或许略逊一筹,但微软显然正不断完善平台的游戏效能,这或许能够促使WP7成为具有可行性的平台选择。3大平台齐头并进(游戏邦注:或许还包括其他平台)是个好趋势。

Breslin表示,“成功平台更具可行性、更富有意义,行业就会获得更好发展。”

但不论你瞄准什么平台,移动游戏都是极具潜力的游戏类型。这个类型存在众多潜力和创作机会,这也是投身移动平台所能够瞄准的少数内容之一。但目前尚未出现轰动巨作。

Contestabile表示,“地理定位游戏趣味横生,具有商业可行性,我认为新作品应该充分利用这些机会,因为从某种程度看平台更适合新型有趣内容。”(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Smartphone And Tablet Rundown: What Developers Need To Know

by Andrew Webster

[Gamasutra takes a look at the state of the market for iOS, Android, and Windows Phone 7, marrying statistics with commentary from PopCap, Gameloft and Glu to uncover the present and future of the markets for both phones and tablets.]

Ever since developers began churning out hits for the iPhone in 2008, the mobile gaming market has exploded, and the stigma of games on mobile phones has all but disappeared. Since the initial success of iOS — which continues to be a strong market thanks to the continued popularity of the iPhone and now the iPad — other platforms have popped up as well. Android now maintains a larger overall market share than Apple, while Microsoft continues its attempt to push into the mobile space with Windows Phone 7.

But which of these platforms is most viable right now? And how will that change going forward? Speaking to developers at PopCap, Gameloft, and Glu, Gamasutra explores the present and future of the ever-expanding smartphone and tablet gaming market.

iOS

Ever since the iPhone App Store debuted in 2008, games have been an important part of its success. Titles like Angry Birds and Cut the Rope have become household names, while indie success stories like Sword & Sworcery and Osmos are gaining prominence. Less than two years after the App Store launched, one billion applications had been downloaded, many of them games.

According to research firm Gartner, in 2010 Apple maintained nearly 16 percent of the smartphone market, with worldwide sales approaching 47 million units. That number is expected to grow even larger in 2011, with 19 percent market share and over 90 million devices in the hands of users. By 2015, analysts predict that there could be nearly 190 million iPhones sold to consumers.

And when it comes to the tablet market, Apple is in a relatively dominant position. In 2010 Apple owned more than 80 percent of the tablet market, with over 14 million iPads sold. And though that market share is expected to dip below 70 percent in 2011 thanks to a number of competing devices, the number of iPad users is expected to grow to nearly 50 million. In 2012 it could be 70 million, and in 2015 140 million.

So what is it that makes Apple’s line of mobile gadgets so appealing? According to Mike Breslin, VP of marketing for Glu Mobile, the “frictionless e-commerce engine” that powers the App Store is a big attraction. Consumers get a better overall shopping experience, which in turn leads to higher sales and increased revenue for developers. And unlike other mobile marketplaces, the range of handsets and operating systems developers need to take into consideration is minimal, making development a relatively smooth process.

There are plenty of original games that have been very successful on the platform, but as the market grows and the sheer number of games available expands, brands are becoming ever more important for visibility. A new Angry Birds spin-off is sure to reach the top 10 sales charts, as is a new release from one of PopCap’s stable of popular franchises.

“We are launching games that are adaptations of hugely successful products on the platform,” explains Andrew Stein, PopCap’s director of mobile product management. “So when we come to the App Store we’re a known quantity. We’ve already sold millions and millions of copies of our existing games, so if we launch something new we can get visibility for those new products in the existing games.”

This has allowed games like Bejeweled 2 and Plants vs. Zombies to remain best-selling titles even years after their initial release. PopCap currently receives around 30 percent of its revenue from mobile releases, with the largest chunk of that 30 percent coming from iOS.

But in the App Store’s four years of existence, the model for releasing successful games has changed dramatically, shifting steadily towards a more service-based system. Instead of simply releasing a game for a set price and then waiting for the sales to come in, developers now need to regularly update games with content to ensure a steady stream of sales and a happy customer base.

According to Giordano Contestabile, PopCap’s senior director of mobile product and business strategy, the market has shifted to a place where “sales of the game are not necessarily the primary revenue driver.”

In-app purchases are becoming more and more common, and a large number of titles now shed their price tag all together, going the freemium route instead. This creates a space where sheer numbers become even more important: the more people who are playing your game the bigger the potential in-app sales are.

“Volume is the answer,” says Breslin. “With the freemium model, the consumer consideration funnel broadens by multiples. If a game is good, it will succeed. If it’s not good, it won’t succeed.

“As a publisher and/or developer of freemium games, the goal is to get as many people to play your game as possible to allow for the social and viral hooks to work. So, it’s easy to see how a freemium model that takes away the number one hurdle to a consumer, cost, is attractive to developers and publishers.”

“That [shift to freemium] literally is changing the way games are designed, games are marketed, and it’s changing the way games are maintained and operated,” adds Contestabile. “So we don’t have, anymore, a developer that develops a game, publishes it, and then sits back and waits for the revenue. It’s actually a living product that they need to update and keep alive over the months and over the years.”

For those games that do go the freemium route, there’s a good chance that the ability to connect to social networks like Facebook could become a large factor in their success. Proper social networking integration provides more visibility for games, which is important to get noticed in an increasingly crowded marketplace.

However, that’s not to say that all games will be free in the future. Gameloft has recently demonstrated that premium titles coupled with a subscription fee can be successful, as its iOS MMO Order & Chaos (which costs $6.99, as of this writing) managed to generate $1 million in revenue in its first 20 days. Though the developer is planning on testing the freemium waters this year, it will also be using a variety of payment structures going forward.

“We think that there’s still a place for other types of business models: premium, paymium (small premium up front and in-app purchases), subscription-based models,” explains Baudouin Corman, Gameloft’s VP of publishing Americas. “These models are probably better adapted to more hardcore games or more niche products. It will be interesting to see how Apple makes these models coexist on the App Store.”

Android

While Apple may be the focus for many, Google’s Android mobile platform is slowly creeping up on it. The fact that there are more daily Android activations than iOS has forced developers to take notice, in spite of the platform’s well-documented issues, such as fragmentation of hardware and inconvenient payment processes.

According to analysts, Android’s share of the smartphone market will be around 40 percent this year, and could jump as high as 50 percent by 2012. That means that by the end of this year there are expected to be nearly 180 million Android-enabled smartphones in the hands of consumers, and that number could top 300 million by next year, and 500 million by 2015.

That dominance doesn’t translate to the tablet market, however, where Android devices managed to account for just 14 percent of the market in 2010 with 2.5 million devices sold. However, that number is expected to grow quite a bit, with nearly 14 million tablets sold by the end of the year. And by 2015 analysts predict that Android tablets will be in striking distance of the iPad, with 113 million units sold, accounting for 38 percent of the tablet market.

Many developers initially took a wait-and-see approach, biding their time until the conditions of the market improved. PopCap, for instance, waited until the operating system reached version 2.2, which introduced the ability to save applications to an SD card. Gameloft first decided to enter the market when more powerful phones were released, allowing the developer to bring its high definition mobile games over to Android.

That being said, most developers still take an even more cautious approach to the platform, porting successful iOS titles to Android as opposed to developing original experiences. Generally speaking, games that sell well on iOS will also sell well on Android.

The rising profile of certain Android phones appears to be slowly changing this way of thinking… at least, in some instances. When Gameloft first launched BackStab, a high-profile 3D action game, it was a timed exclusive for Sony’s brand new, PlayStation-branded Xperia Play device. Eventually the game made its way to iOS as well, but it was one of the few high-profile games to debut on an Android handset.

“Exclusivities on a platform are driven by business opportunities and technical features,” says Corman. “If a game can only run on a specific Android hardware and/or if there’s a good business reason then you’ll certainly see more Android exclusive titles from Gameloft.”

The one thing you will need to think about when releasing a game on Android, though, is where you want to sell it. Unlike Apple devices, which feature one unified store for purchasing apps, Android has many. In addition to Google’s marketplace, Android apps can be purchased from places like Amazon and GetJar, or even rented from through services such as Exent’s Gametanium.

While this can be daunting and sometimes frustrating, it can also give developers more power. For example, because PopCap wasn’t entirely happy with the way the Android market was set-up, it decided to make the debut of Plants vs. Zombies on Android a timed exclusive for the Amazon app store.

“Amazon doesn’t solve all of the problems and issues around the Android platform, but they do have a lot of experience in selling digital content,” says Contestabile, of the decision to partner with Amazon. “They do have a very large database of credit cards, which means that if you are an Amazon store customer, the billing issue goes away, because with one click you just charge on your Amazon account.

“They do have a very powerful discovery and recommendation engine that they can deploy for Android games. And also, they have a very strong web presence through which they market PopCap products across every platform. You can buy PC games, and console games, and Android games, etc. And so we also felt it was a good way for us to promote products across different platforms.”

The relative flexibility of Android also opens up potential opportunities that aren’t possible on iOS. For instance, Contestabile says that PopCap could potentially partner with a hardware manufacturer to embed its games on phones, bypassing the various app stores all together.

But if there’s one constant complaint about Android, it’s that users don’t like to spend money. Instead of the one-click purchasing that’s available on iOS, Android users are faced with more friction, which leads to fewer sales. That’s a problem now, but not necessarily a permanent one. Developers are already seeing consumer behavior change, and many believe that over time the Android user will eventually become much like its iOS counterpart.

The two already have something in common, though, and that’s the freemium shift. And because a large part of being successful in freemium gaming is simply getting your game played by as many people as possible, multi-platform games are key. This makes exclusives less likely, but doesn’t preclude the idea of a game debuting on Android before spreading to other platforms. Glu’s Gun Bros, for example, launched initially on Android before making its way to both Facebook and iOS.

“As it’s our focus to deliver top quality freemium mobile games no matter the platform, it’s more beneficial to have our games be available on all appropriate platforms vs. just one,” says Glu’s Breslin.

Windows Phone

Which brings us to Microsoft. Despite its best efforts, the computer giant hasn’t managed to take a big bite out of the smartphone market. Launched late last year, Windows Phone 7 features both a unique operating system and integration with Xbox Live, but it’s still a relatively small slice of the mobile pie. In 2010 MS had less than five percent of the smartphone market with around 12 million Windows Phones sold, though that number is expected to double by the end of 2011; by 2015 Windows Phones could account for almost 20 percent of the market.

“It certainly hasn’t resonated with consumers as anyone would like,” says PopCap’s Stein, who uses a WP7 device as his everyday phone. “Given the install base of Windows Phone devices, our games have actually sold quite well, and it monetizes very well for customers who have a Windows Phone. There just aren’t enough of them right now.”

PopCap has been with the platform from the beginning, releasing Bejeweled Live as a launch title, and will be bringing Plants vs. Zombies to the platform in the future as well.

It’s not just the small market share that’s holding back WP7, as PopCap’s Stein also says that there are technical issues that could potentially be holding back developers from creating games for the platform.

“Microsoft insists on a different development paradigm with C sharp instead of C++,” he says. “So it’s a lot more work for developers to support Windows Phone as a platform.”

That being said, with its next update, code-named Mango, Microsoft is adding new features that will enhance the gaming experience on WP7, both from a developer and user perspective. Starting this fall, developers will be able to access cameras, sensors, and gyroscopes built-in to handsets, as well as utilize contact and calendar information, among other changes.

Whether or not these changes are enough to entice consumers — and developers — to the platform remains to be seen. But it seems clear that in order to become a viable platform for game development, WP7 phones simply need to be in the hands of more users.

In Conclusion

It seems that as the platforms continue to grow and mature, the differences between them become increasingly small. At least, that appears to be the case with iOS and Android. Both platforms are steadily shifting towards a more service-based economy, with a focus on in-app purchases as the major revenue source.

WP7 may be dragging behind in terms of consumer adoption rates, but Microsoft is clearly making efforts to improve the platform from a gaming perspective, and this could very well lead to WP7 being a viable option for developers. And having all three platforms, and potentially others, become successful can only be a good thing.

“The more viable and meaningful platforms that succeed,” says Breslin, “the better we as an industry will do.”

But no matter which platform you’re developing for, there is still one genre of game that could potentially be the next big thing in mobile gaming. It’s a genre that’s rife with potential and creative opportunities, and is also one of the few that can only truly be done on a mobile device. But it hasn’t produced a blockbuster hit just yet.

“We’re starting to see interesting and fun and commercially viable location-based games,” says Contestabile, “and I think new titles are going to take advantage of these kinds of opportunities because the platform lends itself to new and interesting stuff, in a sense.”(Source:Gamasutra)

上一篇:阐述移动应用设计7大主流趋势

闽公网安备35020302001549号

闽公网安备35020302001549号