关于Facebook推HTML5手机应用平台的思考

游戏邦注:本文作者是Kim-Mai Cutler,文章主要探讨Facebook新推的HTML5平台。

Facebook计划推出囊括其主要第三方开发商应用的HTML5版本,这着实不足称奇。早在1月份,该公司首席技术官Bret Taylor提到HTML5的重要性时,我们就已发表过类似内容,今天我们将着重深入分析,

从根本上说,Facebook如今影响力巨大,已经与苹果和谷歌这两大重要新兴智能手机平台公司不相上下。这3家公司都希望从开发商生态系统中获得30%的分成,不论这是否仅能够满足平台运作费用,提高其核心产品(游戏邦注:如设备、搜索和广告)价值或者成为其未来主要营收渠道。在Twitter和Facebook两家公司的关系变微妙后,苹果选择Twitter作为其iOS设备的社交媒介。

此外,那些曾经对Facebook canvas信心满满的开发商开始转投iOS和Android平台。然而,设备和操作系统存在的分裂性问题使得手机应用开发充满挑战性。

所以,Facebook认为,通过HTML5其有望让开发商凭借同一个应用覆盖所有用户,假若它能够解决手机网络的推广、运营和营收问题,这些问题使得手机应用难敌原生应用。

Facebook手机应用策略的新细节内容如下:

* 大概有80家第三方开发公司同Facebook合作,针对该平台开发应用,其中包括Zynga和赫芬顿邮报。

* 最初方式是使用iOS设备的Safari(游戏邦注:这是苹果推出的手机浏览器)。

* 从本质看,其运作模式如下:登陆手机版Facebook网站,用户会看到应用下拉菜单。Facebook页面会提供给用户所有应用,提供某些基本功能及Credits使用权限。Facebook表示其不会创建一个同iOS竞争的平台。该公司表示,“我们不希望开发商陷入HTML5和原生应用的抉择当中。我希望他们能够像我们一样兼顾二者。我们将HTML5视作技术,而不是平台。”

然而,通过把HTML5版网站同Credits绑定,Facebook实际上为手机开发商创建另一营收方案。

退一步讲,Facebook无疑有望创建一个富有吸引力的手机平台。虽然最令该公司引以为傲的是其比竞争对手更加年轻,反应更敏捷,但通常过于年轻也有其不足。Facebook的选择机会有限,因为其缺乏OS或设备之类的基础技术。谷歌2005年收购了Andy Rubin的公司,为Android打下基础,而苹果在iPhone问世(游戏邦注:2007年推出,当时Facebook只有5000万用户)前,致力该设备多年。

以下是Facebook对手机开发商而言存在的机遇和挑战。

HTML5版Facebook机遇

Facebook将给排名100之外的长尾手机应用提供适当推广方案:浏览iOS商店显得有些过时。这就好像雅虎20世纪90年代倡导的基于目录的人类策划方式。置身榜单之首的开发商,其下载量不成比例(游戏邦注:有时一天下载量超过100万,但接着安装数量随应用排行榜名次的下滑跌势更甚)。

由于赢家通吃效应,拥有资本的开发商将会尽其所能(交叉推广、开展大量手机和网络活动及在应用免费日购买插槽),这样他们就能跻身榜单之首。这就是为什么借助供应墙的奖励安装在过去几年如此风靡,一直到4月份苹果开始压制此类行为。想要有效管理具有相当规模的公司,开发商需学会预测产品投放市场将带来的反应。

富有意义的新推广渠道选择有待进一步探索。Twitter-iOS联姻极具潜力,但Twitter平台仍旧不是游戏(游戏邦注:这是手机应用中,规模最大,营收最丰厚的类型)的最佳病毒式传播渠道。

此外,全球最大搜索公司谷歌尚未覆盖Android Market内容搜索,因为内容缺乏检验过程,导致许多平淡无奇或成本低廉的复制作品会在每次搜索热门游戏时涌现。

过去几年也涌现了系列第三方解决方案,如来自Appsfire、Heyzap、Explor、Apptitude及手机社交游戏网络OpenFeint和Scoreloop的应用。这些应用大多没有获得广泛吸引力,因为产品存在仍在克服中的相同曝光问题。这使得这些公司很难在iOS平台创收,因为苹果垄断内置付费渠道。

Facebook使得手机开发商能够以低成本有效获取用户,因为用户会同好友分享应用。这样开发商将会拥有另一尝试机会,有望跻身前100名应用之列,这样他们数个月的付出就不会白费。无论是好是坏,掌握病毒式传播渠道优化技能的社交游戏开发商最终定能够将这些技能应用至手机平台。

Facebook是唯一能够提高第三方手机应用流量的大平台:目前全球只有少数粘性颇高、用户基础7亿左右的公司能够说服其庞大用户群使用其手机应用。

HTML5版Facebook不足

那些头几年屡遭挫折的Facebook开发商希望走差异化道路:这就好比昔日Facebook大型开发商Crowdstar跳过Facebook,将一款iOS应用直接投放市场。因此,所有手机开发商都应提防过度依赖单一平台(游戏邦注:不论是iOS、Facebook还是Twitter)。许多Facebook开发商自2007年至2009年期间过度依赖廉价病毒式传播渠道后,开始吸取该教训,当Facebook公司宣布向使用Credits的公司抽成30%时,他们都颇受打击。

该平台的运作依然比原生应用略逊一筹:原生应用速度更快,运作更流畅。他们能够借助手机摄像头、GPS或NFC之类的硬件设备。Facebook如今开始致力某些项目,意在说服第三方开发商HTML5能够支持高性能游戏。Cory Ondrejka和Bruce Rogers因Walletin去年秋天的收购活动开始涉足Facebook领域,他们目前正在制作JSGameBench(游戏邦注:这是Facebook新推测试基准,旨在帮助领域内的技术开发者们更准确地把握电脑桌面和移动平台浏览器在运行这类游戏时的速度),目的是测试浏览器运行游戏内容的速度。当然,这还处在测试阶段,HTML5的运作性能尚无法匹敌原生应用。

Facebook的信用卡用户数量能否超越苹果的2.25亿呢?该公司恐怕难以匹敌这家全球信用卡帐户数量数一数二的公司。苹果拥有2.25亿的iTunes信用卡帐户以及iOS设备用户惯用的无缝隙支付系统。我们无法准确估算Facebook的信用卡帐户数量。然而,假设Facebook有一半用户玩游戏,而只有个位数比例的人掏钱,那么公司信用卡帐户显然不太可能超过3000万,特别是Credits还不是其canvas游戏的统一货币,其强制实行日期是7月1日。不论是谷歌的Android平台,还是Fcebook,它们都在迎头赶上。

这也可能带来反效果。开发商也许仅将Facebook HTML5平台的病毒式传播功能用于推动原生应用的下载量:有些开发商或许能够推出掳获用户芳心的优质应用,但结果促使用户通过下载匹配原生应用体验更多游戏内容。如此一来,Facebook就无法获得其30%的收入分成。这样看来,该公司得添加开发商政策新条款,阻止这一情况发生。

后续思考

30%的利润分成是否站得住脚?若苹果要求同样利润分成,但其通过原生应用,提供更多信用卡帐户、更流畅付费流程以及更优质用户体验呢,开发商还有什么理由选择分羹于Facebook?

就像我们提供给谷歌的建议一样,Facebook或许会考虑降低利润分成吸引开发商。苹果已在同媒介领域及网飞、亚马逊之类中间商的30%利润分成问题上有所让步,允许他们在应用中添加商店外内容。

让我们衷心希望随着这些平台开始争相吸引开发商的眼球,以便开发商未来能够处于优势地位。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Facebook’s HTML5 Mobile Platform Strategy Has Risks, But It Has No Other Choice

By Kim-Mai Cutler

Facebook’s plan to build a rich HTML5 version of its site complete with apps from its biggest third-party developers should be no surprise. We’ve written about this strategy several times here, here with more detail and analysis and here, when the company’s chief technology officer Bret Taylor alluded to the importance of HTML5 in January.

Basically, Facebook has become so large and powerful that its interests no longer really align with those of the two companies managing the two emerging and dominant smartphone platforms — Google and Apple. All three companies want a 30 percent revenue share from their developer ecosystems, whether that’s just to cover platform operating costs, drive value for their core product (hardware, search, advertising, etc.) or become a significant sttbream of future income. Apple also chose Twitter over Facebook as the social layer for iOS after the relationship between the two companies faltered.

At the same time, developers that once saw the Facebook canvas as rife with opportunity are moving to iOS and Android. However, fragmentation between devices and operating systems has made the creation of mobile apps challenging for them.

So Facebook sees an opportunity through HTML5 to create a way in which a developer can reach all consumers with a single app — provided that it can help solve the distribution, performance and monetization problems that have made the mobile web less attractive compared to native apps.

TechCrunch found additional confirmation of this strategy this week (see right) after the blog received a leaked set of documents outlining the company’s mobile plans. The new details the site uncovered include:

* Eighty or so third-party developers are working with Facebook to create applications for this platform, including Zynga and The Huffington Post

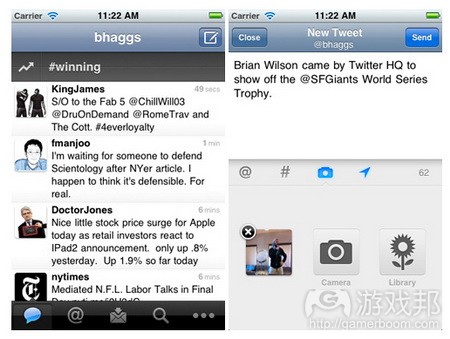

* The initial approach is to use mobile Safari on iOS devices

* Essentially, it works like this: Load the Facebook mobile web site and users will be able to access a drop-down menu for apps. A Facebook wrapper will deliver the user to the app, providing some basic functionality as well as the ability to use Credits.

Facebook responded, stressing that it isn’t building a competitive platform to iOS. “We don’t expect developers to choose between HTML5 and native apps,” the company says. “We expect they will choose both, just as we did. We view HTML5 as a technology, not a platform.”

Yet by lacing this HTML5 version of the site with Credits, Facebook is in effect creating an alternative monetization scheme for mobile developers.

Taking a step back, there are definitely opportunities for Facebook to provide an attractive mobile platform. However, even though the company has long prided itself on being younger and more agile than competitors, this is a case where being too young has its costs. Facebook’s options are limited by the fact that it doesn’t have ownership of lower levels in the technology stack like the OS or hardware. Google laid the groundwork for Android when it bought Andy Rubin’s company in 2005 and Apple was working on the iPhone years before its launch in 2007 – when Facebook had just 50 million users.

That said, here are some of the ways Facebook could offer more to mobile developers, and then some of the ways where it might fall short:

Opportunities

Facebook could finally be a decent distribution solution for the long-tail of mobile apps that don’t have a top 100 ranking: Navigating the iOS store is strangely anachronistic. It’s almost like the human-curated, directory-based approach Yahoo pioneered in the 1990s. Developers at the top of the charts get a disproportionate amount of downloads — sometimes more than 1 million a day at this point — and then the number of installs drops dramatically the farther down the list an app falls.

Because of this winner-take-all effect, developers with capital do anything they can — cross-promotion, spending on burst campaigns on mobile ad networks, paying for a slot on Free App A Day, etc. — just so they can break into the top of the charts. That’s why incentivized installs through offer walls became a widespread practice over the past year until Apple cracked down on them in April. To run a sizable business, developers need to predictably be able to get their products in front of consumers.

A meaningful alternative for distribution has yet to emerge. The Twitter-iOS integration is promising, but the Twitter platform has not proven itself to be decent viral channel for games, the biggest and most lucrative category of mobile apps.

At the same time, Google, the premier search company in the world, hasn’t really fixed Android Market search and because there is no review process, many spammy or cheaply-produced copycat apps can crop up for every bonafide hit.

There are also a number of third-party solutions that have emerged over the past few years like apps from Appsfire, Heyzap, Explor and Apptitude and mobile-social gaming networks like OpenFeint and Scoreloop. Most have not gained widespread traction because these products suffer from the very same discovery problems they are trying to solve. That, and it’s hard for these companies to monetize on iOS because Apple monopolizes in-app payments. (On Android, it’s too early to tell.)

Facebook could make it cheaper and more reliable for mobile developers to acquire users as people share apps with friends. Developers will have an alternative to rolling dice in the dark, hoping and praying that they can crack the top 100 apps so their months of effort won’t be in vain. For better and for worse, social game developers who have refined the art of optimizing viral channels can finally put these skills to use on mobile.

Facebook is probably one of the only entities big enough to drive real traffic to third-party mobile web apps: There are few, if any other companies, in the world who have a sticky enough product and a substantial user base at roughly 700 million users that could compel tens of millions of consumers to try out mobile web apps through them.

Weaknesses

Developers burned by the first couple of years on the platform want to diversify: It was a sign of the times yesterday when Crowdstar, one of the biggest developers on the Facebook platform, brought an iOS app to market without a Facebook integration. At this point, most mobile developers should be wary of being too dependent on any single platform — whether it’s iOS, Facebook or Twitter. Many Facebook developers learned this the hard way after becoming complacent with cheap virality from 2007 to 2009, then being stung when the company effectively introduced a 30 percent tax on developers through Credits.

Performance still lags behind native applications: Native apps still run faster and more smoothly. They can access hardware like the phone’s camera, GPS or NFC. Facebook has been working on projects to prove to third-party developers that HTML5 can support high-performance games. Cory Ondrejka and Bruce Rogers, who came to Facebook through the Walletin acquisition last fall, have been building JSGameBench to test how quickly browsers can render moving objects. Still, this is an experiment and HTML5 is far away from offering comparable performance to native apps.

Can Facebook get enough credit cards accounts to compete with Apple’s 225 million? It’s hard to compete with what is probably one of the biggest repositories of credit card information in the world. Apple has 225 million iTunes accounts with credit cards and a seamless payment system iOS device owners are comfortable and familiar with. We don’t have an accurate estimate on the number of credit card accounts Facebook has. However, presuming that half of the company’s users play games and then a single-digit percentage of those actually pay, it’s hard to imagine the company having more than 30 million cards on file — especially considering that Credits won’t even be mandatory for canvas games until two weeks from now on July 1. Both Google’s Android platform and Facebook are coming from behind here.

It could backfire. Developers could use the virality of Facebook’s HTML5 platform just to drive downloads of their native apps: Some developers might make a web app that’s decent enough to hook a consumer, only to tell them to go download the appropriate native app to play more of the game. Then Facebook won’t get their 30 percent revenue share. Presumably, the company might add a clause into their developer policy to prevent this.

Other Questions

Can the 30 percent margin stand? If Apple is asking for the same revenue split, but has an order of magnitude more credit cards accounts, a more frictionless purchasing flow and a better experience for users through native apps, why should developers give up the same share to Facebook?

Like we’ve argued for Google, Facebook might consider dropping its margin for mobile apps to attract developers. Already, Apple has kind of budged on the 30 percent margin for the media industry and intermediaries like Netflix and Amazon by allowing them offer content in their apps that’s sold outside the store.

Let’s hope that as these platforms compete for the mindshare of developers, developers win.(Source:insidemobileapps)