Flurry调查:智能手机应用已成欧洲第八大传播渠道

作者:Peter Farago

2006年,欧洲手机分析人士将手机称为“第七大众传媒渠道”,紧随印刷物、录制品(游戏邦注:如唱片、录音带和DVD等)、电影、广播、电视和网络之后。然而,手机并未履行其应有的职责。要真正发挥大众传媒渠道的潜力,首先需要克服诸多问题,如缓慢且昂贵的运营商数据网络、管理混乱的运营层面以及极具分裂性的设备。当时大量手机的显示屏窄小、处理器微弱、用户界面令人难以接受,而且WAP浏览器运转缓慢。该渠道中的这些不利因素妨碍了内容制作者发挥自己的才能向消费者提供引人入胜的体验,这使得手机看上去更像定制产品,而并非大众传媒渠道。

随后,2007年iPhone的出现使事态发生改变。除了给全球带来产量颇多的媒体设备外,苹果从运营商手中夺取了控制权,使得运营商向消费者提供平价数据计划。iPhone利用炙手可热的Wi-Fi,同时引进十分有效的手机浏览器。最重要的是,公司构建起冲突较小的健全渠道App Store,内容制作者可以向消费者销售智能手机应用。在短短数年间,苹果成为改变游戏行业的催化剂,应用的下载量已达超百亿次。调查公司In-Stat预测,2015年全球应用下载量将达到480亿次。应用的成功向电视的普及性和网络的吸引力发起挑战。

在这份报告中,Flurry采用了来自4.5万多个公司的逾8.5万个应用的数据。Flurry Analytics跟踪iOS、Android、BlackBerry、Windows Phone和J2ME等系统150亿用户每月产生的数据。

应用扩展之速前所未见

英国、法国、德国、意大利和西班牙这五大欧洲市场,活跃使用应用的设备总数为4600万。五国13岁以上总人口数仅为2.4亿,在这些最大最富裕的欧洲国家中,其市场平均潜在用户数约占人口总数的20%。而且,过去两年的复合月增长率超过10%,因而我们预测仅未来12个月内,智能手机的用户数就会增加一倍以上。

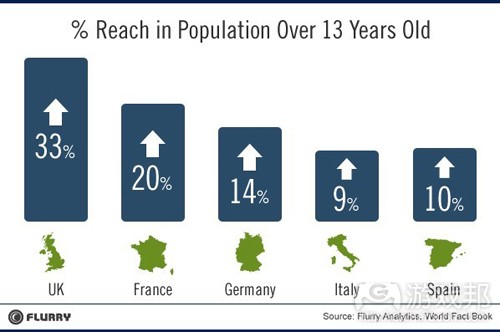

下图显示智能手机应用用户在五大欧洲国家总人口数中的比例(游戏邦注:统计的依然是13岁以上总人口数)。应用在英国的渗透力最强,33%的人每月在智能手机上使用应用。法国位居第二,其比例为20%。接下来是德国、西班牙和意大利,比例分别为14%、9%和10%。

以上是各个国家每月使用智能手机应用的人数,接下来我们来看看各国智能手机的扩张速度。

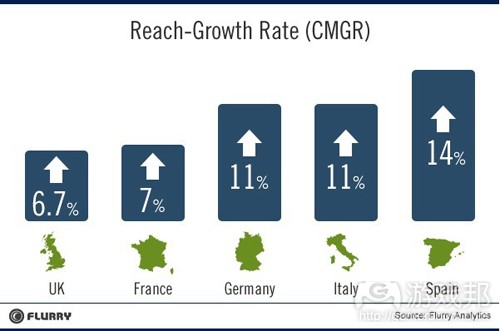

上图显示各国运行智能手机应用的设备的增长速度。虽然英国和法国是目前使用智能手机用户比例最高的国家,但其增长速度稍显落后。西班牙活跃智能手机用户数增长率最大,月增长率为14%。德国和意大利的活跃智能手机用户数增长率同为11%。此外,法国和英国两国的用户数也在增长中,月增长率分别为7%和6%。

随着使用iOS和Android系统智能手机的用户数逐渐增多,诺基亚即将发布Windows Phone 7系统手机,而且多数用户积极使用手机应用,我们预测这个大型市场传媒渠道还会不断增长,直到整个智能手机市场趋于饱和。如果我们假设智能手机用户数增长率保持不变,那么这五个国家的公民将在两年多后全部使用智能手机。

游戏和社交网络

Flurry追踪整个应用使用流程(从用户打开应用直至关闭)的数据,将这些应用划分为游戏、新闻和旅游等类别。在全世界范围内,使用率位居前列的类别是:游戏、社交网络、运动休闲和新闻。下图显示五大欧洲市场各应用类别的用户使用情况。

除意大利外,游戏是其余四个国家中最流行的应用类别。在意大利,领衔的不是游戏而是社交网络。与其他类别应用相比,38%的意大利人使用社交网络应用。比较各个国家对各类应用的使用比例,法国用户玩游戏的人最多,有45%的用户热衷于游戏应用。西班牙新闻应用的用户比例高过其他国家,而领衔运动休闲类别的是英国。在这五个国家中,四大类别占所有流量的80%。

稳定的用户留存率和粘性

2011年5月,全世界中平均获得6个月用户留存率的应用比例为36%。换句话说,在所有6个月前下载应用的用户中,36%的人在5月的最后7天(游戏邦注:Flurry在统计留存率时采用每月最后7天的数据)内还在使用这款应用。在五大欧洲国家中,各国拥有6个月留存率的应用比例都超过30%。以下是各国拥有6个月留存率的应用比例与世界平均值的对比图。

从图表中可以看出,英国独占鳌头,比例为38%。紧随其后的是法国,比例为37%。德国、西班牙和意大利的比例分别为34%、32%和31.5%。通常,我们将应用留存率视为市场成熟与否的标志。我们注意到用户经常会尝试多款应用并从中挑选出最喜欢的类别,接下来他们每周甚至每天都会使用数次。在较不发达国家中,我们会看到这种实验应用的数量较多。这份报告列举出的五大国家显然都是高度发达国家。

作为大型市场传媒渠道,现在智能手机应用不仅拥有数量可观的用户,而且还在继续飞速增长。该渠道丝毫没有发展缓慢的迹象,这足以令人惊叹。智能手机应用的用户积极参与其中,将他们的智能手机视为最重要的个人财产,我们相信第八大众传媒渠道确实已在欧洲出现。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Smartphone Apps in Europe: The 8th Mass Market Media Channel

Peter Farago

In 2006, European mobile analysts dubbed mobile the “seventh mass media channel” following print, recordings (e.g., albums, cassettes, DVDs, etc.), cinema, radio, television and the web. However, mobile failed to fulfill its promise. For mobile to have reached its true potential as a mass media channel, it needed to overcome slow and expensive carrier data networks, poorly managed carrier decks, and a heavily fragmented handset base which featured a myriad of small screens, weak processors, confusing user interfaces and clumsy WAP browsers. With so much friction in the channel, content creators were stymied in their ability to deliver compelling experiences to consumers, making mobile look far more like a niche than mass media channel.

Then, in 2007, the iPhone changed everything. In addition to unleashing a prolific media device, Apple wrested control of the storefront from carriers, convinced carriers to offer flat-rate data plans to consumers, tapped into blazing Wi-Fi as a pipe and shipped a useful mobile browser. Most importantly, they built a low-friction, robust channel through which content creators could distribute smartphone apps to consumers: the App Store. In a few short years, with Apple as a game-changing catalyst, applications have already been downloaded tens of billions of times. Research firm, In-Stat, forecasts there will be 48 billion app downloads in 2015. With their success, apps already challenge the television in terms of reach and the Internet in terms of engagement.

For this report, Flurry used data from over 45,000 companies across their more than 85,000 applications. Flurry Analytics tracks over 15B user sessions per month across iOS, Android, BlackBerry, Windows Phone and J2ME.

Unprecedented and Accelerating Reach

The chart above shows the number of people actively using apps on their smartphones in May 2011 across the top five European markets. Flurry calculates active smartphones by first measuring its own penetration across these devices via apps into which Flurry Analytics has been integrated. For example, Flurry detects roughly 85% of all iOS and Android devices worldwide. We then grossed this number up, by country, for our estimates.

Combined, the top five European markets – the UK, France, Germany, Italy and Spain – actively use apps on 46 million devices each month. With a combined population of just over 240 million, for ages 13 and over, the addressable market through smartphone apps averages approximately 20% of the largest, most affluent European countries. Additionally, with a month-over-month growth rate (Compounded Monthly Growth Rate, CMGR) of more than 10% over the last two years, we project the installed base of smartphones will more than double over the next 12 months alone.

In the chart below, we show the smartphone app audience as a percentage of each top European country’s population, again ages 13 and over. The UK leads in penetration with a whopping 33% of its population using apps on smartphones per month. France places second with a sizable 20%, next followed by Germany, Spain and Italy coming in with 14%, 9% and 10%, respectively.

After having established the percent of each country’s monthly population that can be reached through smartphone apps, we next look at the pace of smartphone adoption, by country.

The chart above shows just how quickly the base of devices running smartphone apps is growing by country. While the UK and France are the most penetrated to date, as a percentage of their countries’ populations, the laggard countries are closing the gap in terms of growth. Spain leads in growth of its active smartphone user base with a monthly growth rate of 14%. Germany and Italy’s active smartphone bases are both growing at 11%. Additionally, France and the UK continue to grow, month-over-month, by 7% and 6.7%, respectively.

With growing adoption of iOS and Android-based smartphones, the imminent release of Nokia phones based on Windows Phone 7, and the fact that the majority of consumers actively use applications, we predict that the growth of this mass market media channel will continue to grow until near total smartphone market saturation. To underscore just how aggressively this channel is growing, if we assumed the growth of smartphone adoption continued at their current rates, all five countries would have full smartphone penetration in just over two years.

Games and Social Networking Rule

Flurry tracks the total number of application use sessions, from when consumers start app sessions to when they end them, and groups these sessions into categories such as games, news and travel. The top categories ranked by session usage worldwide are: Games, Social Networking, Sports & Entertainment and News. The graph below shows how consumer usage varies by app category across the top five European markets.

With the exception of Italy, the games category is the most popular app category across all countries. In Italy, the one country where the games category does not lead, Social Networking is the top category, with 38% of Italians using Social Networking apps compared to other categories. Comparing each country’s proportion of usage by category, more consumers play games in France than compared to other countries – a massive 45% of all French app sessions are Games. In Spain, a greater percentage of the Spanish population consumes news compared to other countries, and the UK leads in relative Sports & Entertainment app consumption. In all 5 countries, the 4 top categories make up 80% of all traffic.

Solid App Retention and Engagement

In May 2011, the average worldwide 6-month retention rate for all apps was 36%. In other words, of all consumers who downloaded an app over the last six months ago, 36% had used that same app within the last 7 days of May (Flurry looks at “last 7 days” for its retention metric). Continuing to look at the top 5 European countries, all have posted 6-month retention rates of greater than 30%. The chart below breaks out each countries 6-month retention rate compared to the worldwide average.

Reviewing the chart, we note that the UK leads in retention with 38%, followed by France at 37%, Germany at 34% and then Spain and Italy at 32% and 31.5%, respectively. Generally, we see a correlation between the maturity of a given market and app retention. We observe that consumers typically try several apps before they settle into using a group of favorites, which they then use several times per week, even per day. In less developed countries, we often see much more app experimentation. The five countries we review for this report are clearly all highly developed economies.

As a mass market media channel, smartphone apps not only reach a sizable audience today, but also continue to grow at staggering rates. The channel is already formidable with no signs of slowing. Smartphone app consumers are highly engaged and consider their smartphone among their most important personal possessions; we believe the 8th mass market media channel has indeed arrived in Europe. (Source: Flurry)

闽公网安备35020302001549号

闽公网安备35020302001549号