综观社交游戏的品牌植入活动

游戏邦注:本文作者为营销分析家Bryan Bartlett,文章主要讲述社交游戏的品牌植入活动,原文发布于2011年1月14日,涉及数据以当时为准。

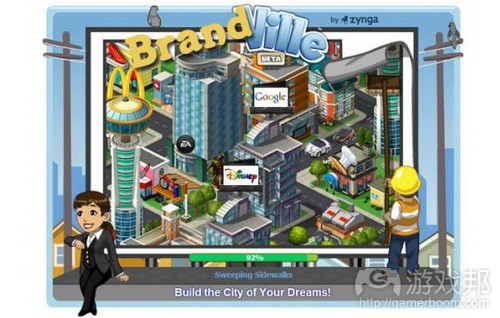

EA、迪斯尼和谷歌不断展开收购活动,社交游戏定将成为下个大型营销平台。庞大用户数量、固有社交属性以及粘性形成潜力都令人难以忽视这片市场。大型品牌公司,如联合利华、本田和麦当劳都开始涉足社交游戏领域。

社交游戏的营销活动

Zynga去年底推出《CityVille》,这款游戏投放市场仅12天,用户就达2600万,如今其月活跃用户数量已远超《FarmVille》,增至1亿,成为Facebook目前最受欢迎的社交游戏。随着游戏越发融入用户日常社交网络(游戏邦注:如FourSquare和SCVNGR),品牌公司的机会也随之而来。本文旨在指导品牌公司如何在纷繁复杂的热门新兴社交平台中选择自己的营销阵地。

引言

和Facebook品牌页面及Twitter公司帐号一样,社交游戏已经成为颇受追捧的“品牌展台”。营销家认为,消费者种植虚拟作物不过是社交游戏的微小组成部分,这类体验更多是关于提高消费者印象和广告商营收底线。Zynga和Cie Games之类的开发商如今已经大幅面向广告商开放,他们甚至让广告商的产品成为游戏设置的关键元素。精明营销者发现,游戏开发商如今已经知晓其给消费者带来的价值,而媒介公司也开始意识到这能够增加营收,所以社交游戏是发展之中的广告平台。

虚拟商品估值达30多亿美元,而既有关系网络则成为社交游戏市场至关重要的组成部分(游戏邦注:据悉,该市场2013年和2015年的市场估值分别有望增至60亿和79亿美元)。虽然“虚拟商品”市场和社交游戏市场有所区别,但Zynga之类的开发商已开始将品牌植入游戏作品和虚拟商品,事实上,二者已经融为一体。Facebook之类的平台通过添加新功能,减少游戏侵入性(换而言之,就是看起来比较不像垃圾信息)推动社交游戏发展。此外,雅虎、Myspace和谷歌早已蓄势待发,准备迎接社交游戏地盘战。社交游戏未来将会突破Facebook平台,融入消费者的移动设备,创造更多用户粘性渠道,覆盖更广阔的用户。品牌公司是时候培养这些消费者,以身试水,开展品牌植入活动。其带来的回报将比虚拟货币或数字作物更显而易见。

开发商综述

谁是社交游戏领域的主要竞争选手?游戏用户有多少?游戏目标群体是谁?营销品牌有哪些?

1. Zynga

热门游戏:《FarmVille》、《FrontierVille》、《CityVille》、《黑手党战争》、《PetVille》和《FishVille》(作品共计42款)。

用户数据:MAU(月活跃用户)约2.97亿;DAU(日活跃用户)约5900万。

合作项目:Cascadia Farms、Microsoft Bing、麦当劳、DreamWorks’s、Farmers Insurance和Columbia Pictures。

财政数据:年营收突破10亿美元。

用户分析:主流群体——中年女性,收入2.5-5万美元,Skew女性、黑人和非裔美国人;典型代表——大学文凭的行政助理

2. CrowdStar

热门游戏:《快乐水族馆》、《Happy Pet》、《Zoo Paradise》和《It Girl》(作品共计20款)。

用户数据:MAU约4762万;DAU约470万。

合作项目:微软、Trident和Cheerios。

用户分析:主流群体——年轻和中年族群,收入2.5-5万,Skew女性,西班牙人;典型代表——高中学历的全职妈妈。

3. EA Playfish

热门作品:《宠物社区》、《Restaurant City》、《Hotel City》和《Pirates Ahoy》(作品共计35款)。

用户数量:MAU约3857万;DAU 690万。

合作项目:《Sims》(EA)和《Madden》(EA Sports)。

财政数据:2009年创收3500-5000万美元;EA以3亿美元收购Playfish。

用户分析:主流群体——年轻和中年族群,收入5-7.5万美元,Skew男性,亚洲人;典型代表——大学学历的在家办公父亲。

4. 迪斯尼 Playdom

代表作品:《City of Wonder》、《Social City》、《Tiki Farm》、《Market Street》和《Sorority Life》(作品共计39款)。

用户数据:MAU约3170万;DAU约309万。

合作项目:联合利华(多芬和Breyers)。

财政数据:2009年创收6000万;迪斯尼约以7.632亿美元收购Playdom。

用户分析:主流群体——中年族群,收入5-7.5万美元,Skew男性,白种人;典型代表——拥有学士学位的专业白领。

5. Cie Games

代表作品:《CarTown》

用户数据:MAU约721万;DAU约109万。

合作项目:本田 CRZ、State Farm(游戏邦注:这是家保险公司)、丰田普锐斯和TireBuyer。

用户分析:主流群体——中年族群,收入2.5-5万美元,Skew男性;典型代表——高中学历的失业人员。

6. Google Slide

代表作品:《SPP Panch!》、《Rock Riot》和《SuperPoke》(作品共计8款)。

用户数据:MAU约176万;DAU约12万。

财政数据:谷歌以1.82亿美元收购Slide。

用户分析:主流群体——中年族群,收人2.5-5万,Skew女性,白种人;典型代表——全职妈妈,某些有大学学历。

以上是Facebook主流开发商的简单列表。用户基础和相关财政数据表明社交游戏营收十分可观,收购活动络绎不绝。

活动发起阶段

首先,理解社交游戏机制很重要。社交游戏通常融入真实世界场景(游戏邦注:有时是以十分琐碎的方式)。游戏通常涵盖这类作品的共性。

社交游戏机制的简要说明:

* 社交游戏并非紧张游戏环节;他们是休闲体验,或利用早餐时间,或利用午休时间。

* 大部分游戏都无需花费很长时间。玩家“能量”有限,一旦耗尽,只有等待方能重新获得(除非花钱购买)。

* 游戏过程通常循序渐进。玩家有时需花费几小时或几天等待作物成熟,建筑竣工。

这类游戏设置方便品牌公司以休闲方式同玩家互动;玩家能够加快游戏进程,因此会定期返回游戏寻求更多益处。企业可通过使用其他媒介(游戏邦注:如网站和社交媒体内容)轻松提醒玩家回访游戏,参与品牌活动。

有些游戏十分贴近现实,甚至主动寻求与品牌公司合作。例如,Playdom《Market Street》的特色产品Ybox、LameStation和Doors 7。

但这并不表示所有品牌都能同社交游戏完美结合。以下是企业展开品牌植入活动前需考虑的问题:

1. 是否准备充分?

品牌是否能够无缝隙植入游戏机制,同目标群体有联系?游戏目标群体是否和产品一致?

2. 你是什么类型的企业?

产品是否便于理解,容易辨识?若提及产品或产品出现在屏幕中,玩家是否能够识别、理解?或者企业是否需要更多互动、屏幕停留时间或视频广告,以便充分传递信息?

3. 是否能够完美呈现?

交易内容是什么?玩家观看广告或分享内容的奖励因素是什么?虽然虚拟商品是个有利可图的市场,但真正付费的玩家并不多。企业可通过替玩家支付高价位虚拟商品,换得他们的粘性。WildTangent(游戏邦注:美国大型电子游戏发行商)的广告平台使这切实可行。高价位虚拟商品或能够让玩家在游戏中更快晋级,或是稀有收藏,充当玩家的炫耀资本。例如,Farmers Insurance向玩家提供贴牌小型飞船,飞船能够短时间保护作物。巧妙之处是:Farmers Insurance小型飞船出现在玩家农场仅10天而已,但他们不会介意,因为对他们来说飞船很有价值。

这是企业开展品牌活动前需要考虑的几个问题。需要注意的一点是植入活动没有既定模式。企业需充分利用突破机会,树立自己的标准。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

360° Overview: Brand Marketing In Social Games

By Bryan Bartlett

With huge acquisitions from EA, Disney and Google, social gaming is poised to be the next big thing for advertising. Mind-boggling user numbers, inherent social nature and opportunities for creative engagement are hard to ignore. Super brands such as Unilever, Honda and McDonald’s are already experimenting with social gaming – perhaps you should too.

State of Advertising in Social Games

Zynga Introduced CityVille just 2 months ago. In 12 days it had 26 million users and has already surpassed FarmVille with 100 million monthly users, making it the most popular social game on Facebook right now. As gaming becomes more ingrained in everyday social networking (think FourSquare and SCVNGR), the opportunities for your brand could follow swiftly. This overview explains how your brand can secure a marketing stronghold in some of the hottest new social platforms.

Introduction

Much like Facebook brand pages and Twitter corporate accounts, social gaming has become a much-desired “Brandstand.” In marketers’ eyes, social gaming is less about consumers growing virtual crops and more about growing consumer impressions and advertisers’ bottom lines. Game developers such as Zynga and Cie Games are opening up to advertisers in big ways — even making advertisers’ products critical components of gameplay. Shrewd marketers recognize the potential in social gaming engagement, game developers see the value to consumers and media companies see dollar signs, it’s an advertising platform in the making.

Virtual goods are estimated to be $3.0+ billion business and the relationships established now will be critical to the share of an estimated $6-$7.9 billion industry by 2013 and 2015, respectively. While a distinction exists between the “virtual goods” market and social game advertising, game developers such as Zynga are ramping up brand integration into their products and virtual offerings – in effect blending the two avenues into one. Platforms such as Facebook have addressed social gaming growth as well by offering new features and making games feel less intrusive (in other words, less like spam). Furthermore, Yahoo, Myspace and Google have all made large plays in preparation for the social gaming turf wars. Social games will soon reach far beyond the Facebook platform and integrate even further onto consumers’ mobile devices, creating an explosive engagement channel that will reach a far greater audience in the future. Now is the time for brands to cultivate these consumers and test the waters. The payoff could be much more tangible than virtual currency or digital crops.

Developer Overview

Who are the major players? How many users are there? Who are playing these games (besides Bing Gordon)? What brands are advertising?

This is just a short list of the most popular social game developers on Facebook. The user base and available financial figures demonstrate that social gaming is immensely profitable and big media players are buying up the largest properties.

Getting started

First off, it is important to understand the mechanics of social games. Social gaming often depicts real-world scenarios (sometimes in the most trivial manner). Most likely, it already incorporates your product category generically.

Some quick notes on the mechanics of social gaming:

Social games are not intense gaming sessions; they are typically played leisurely, over morning coffee or during lunch break.

Most games don’t allow play for long periods of time. Users are limited to a certain amount of “energy” that once depleted, can be obtained only by waiting for it to replenish (unless they buy more, of course).

Progress in the game is also delayed. Users sometimes have to wait hours or days for crops to grow, buildings to finish, etc.

This style of gameplay makes it very easy for brands to interact with consumers at leisure; players get their quick fix and come back for more throughout the day, week or month. By using other mediums (e.g., website, social media properties), you can easily remind them to go back and engage with your brand.

Most games ring so true to real life that it almost begs for the incorporation of your brand. For example, Playdom’s Market Street features products such as Ybox, LameStation and Doors 7.

But that does not mean your brand will be a perfect fit in a social game atmosphere. Here are a few questions to consider before putting your brand in the game:

1. Are You Ready to Play?

Does your brand have the ability to integrate seamlessly into gameplay and remain relative to the audience/target consumer? Are you putting ads in games whose audience matches your target consumer?

2. What Type of Player are You?

Is your brand easy to understand and identify? If it were simply be mentioned or shown on the screen, would players recognize and understand it? Or do you need more interaction, time on screen, video ad, etc. to fully communicate your proposition?

3. Will You Play Nice?

What is the transaction? What incentive can you provide social gamers in exchange for viewing your advertisement or sharing your content? While virtual goods are a very lucrative market, very few players are actually willing to pay for more content. Pick up their tab by offering high-value virtual goods (VGs) in exchange for engagement. WildTangent’s advertising platform makes this possible. High value virtual goods typically allow users to advance more quickly in the game or are part of rare collections that give users virtual bragging rights. For Example, Farmers Insurance offered users a branded blimp that protected their crops for a limited period of time. The catch: users had a Farmers Insurance blimp on their farm for 10 days, however users didn’t mind because it was valuable to them.

These are a few of the questions you should be asking about your brand prior to developing a campaign. It is important to note that no definitive model has been established. Use the opportunity to disrupt and set standards.(Source:nmincite)

闽公网安备35020302001549号

闽公网安备35020302001549号