insidesocialgames:2010年社交游戏行业回顾及前景预测

对游戏开发者来说,Facebook以及社交游戏领域的情况已经今非昔比,虽然社交游戏在2009年发展速度惊人,但到了2010年初,由于Facebook开始对病毒式传播渠道进行限制,Zynga等社交游戏巨头的发展似乎也在同一时刻戛然而止。

自从那以后,Facebook三番五次改变开发商在该平台的游戏规则,逐步强制推行Facebook积分这个虚拟货币系统,从社交游戏营收中抽成30%,种种变化让开发商深深感到,如今在Facebook上的生意真是越来越难做了。

现在要打造一款成功的Facebook社交游戏当然要比2009年时困难得多,但是精明开发商的经历以及AppData所追踪到的数据却表明,Facebook社交游戏时代已经结束的说法并非事实。

游戏邦将通过以下几个方面来说明Facebook社交游戏市场的实际情况:

1. 大型开发商的平均用户规模都在缩减,但这种现象并不值得担忧。

2. 中小型开发商正在稳步发展。

3. 游戏设计的重要性日益突出。

4. 游戏营收方式呈现多样化发展。

大型开发商

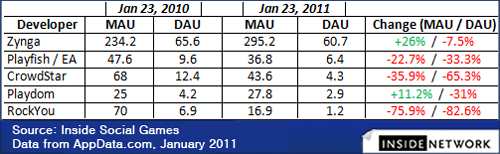

在考察所有Facebook游戏开发商的总体表现之前,首先得将所谓的“前五强”游戏开发商挑出来单独分析:Zynga、Playfish(现为EA旗下公司)、CrowdStar、Playdom(现为Disney旗下公司)、RockYou。不少人正是根据这五强的表现,得出Facebook社交游戏黄金时代已经结束的结论。

这些开发商的麻烦始于去年3月,那时Facebook开始调整有关病毒式传播渠道的政策,这一点直接导致它们的迅猛发展受阻。

以上图表的数据并不能完整地体现这五强的运营表现,因为仅MAU/DAU的比值并不能直接反映它们的营收情况;CrowdStar和RockYou的测试、礼品赠送等非游戏应用也失去了许多流量。可以说,现在只有Zyngar的运营情况和2010初一样表现良好,而且仅靠新游戏《CityVille》就取得了如此巨大的成功。与此同时,Zynga的四个竞争对手的DAU(日活跃用户人数)都至少流失了30%,要知道DAU可是游戏运营是否成功的最佳预测参数。

如果连Zynga这种拥有5亿风险资金的开发商都无法继续在Facebook上立足,那么其他力量更薄弱的开发商还有什么出路呢?这个问题在业内引起了巨大的共鸣,一时间许多开发商纷纷将目光转向了智能手机游戏,不少投资者对社交游戏的热情也开始降温。

但游戏邦认为,这个市场领域仍然可以提供良好的发展机遇。在过去一两年里,Zynga及其同行的巨大成就,曾经让不少人对这一市场抱有无限期望。在社交游戏的繁荣期开始之前,打造一个成功的公司只需要几年时间而已;但现在“繁荣”已经划上了句号,大家就得从原来的幻想中清醒过来,重新面对现实。在不到一年的时间中,Facebook社交游戏市场就开始成熟发展,虽然这一时期并没有涌现更多堪比Zynga的竞争对手,但这也并非什么值得警惕或者令人沮丧的现象。

以下内容均取材于真实的市场数据:

中小型开发商

通过对前250款Facebook游戏的观察,游戏邦发现中小开发商于去年9月份开始在这一市场上站稳脚跟,目前这一趋势仍未有衰退的迹象。

考察这方面情况需要注意3个要点:首先,我们得先观察它们的DAU(日常活跃用户),因为这个参数(以及准确的验算)是游戏黏性的最佳反映。其次,特定游戏的衡量参数每月都发生变化;前250款游戏的排名位置有限,但每月都有新旧游戏自然更替。最后,这些游戏之间的用户互有重叠,也就是说每个用户都可以是多款游戏的日活跃用户;但由于这些用户的消费潜力都很大,很有助于创造游戏营收,所以这一点并不会影响我们的分析。

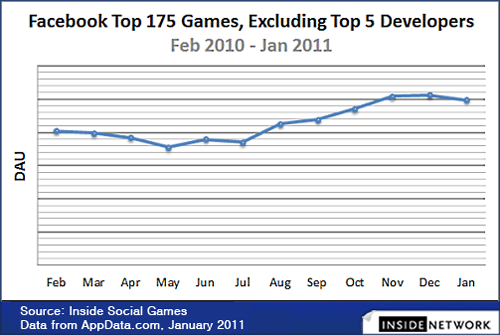

第一个趋势代表社交游戏市场的整体平稳发展。以下图表显示,这些游戏的DAU在最后出现了一个小高峰,这主要得益于《CityVille》的问世。

由此我们不难猜测,如果上述所提到的前五强社交游戏开发商都在走下坡路,而整个市场却仍然保持平稳发展,那么肯定是其他的开发商的增势支撑了这种局面。

为了更准确地分析这一市场的发展情况,不妨先把前五强(游戏邦注:Zynga、Electronic Arts、CrowdStar、Playdom、RockYou)排除在外,现在就针对剩下的175款游戏来进行分析:

与之前的250款游戏的图表不同,以上图表以及下面图表的DAU曲线到最后都出现了下滑,这一点有可能是受到圣诞节的影响,该时期所有社交游戏DAU增长均减缓,游戏邦认为这只是暂时现象,可以通过2月份的数据再次进行检验。这个图表还显示,这些游戏的DAU在过去一年中增长了23%,比2010年5月的最低点增长了40%。

在这份图表中的游戏包括《Millionaire City》、《Monster World》和《Car Town》等许多DAU在100万以上的游戏,它们都是在Facebook限制病毒式传播渠道之后才推向市场。总体而言,排除“前五强”开发商后,前25名的游戏总共有22个开发商,它们的DAU数值都足够庞大,假如用户付费转化率很理想,那么这些游戏也能实现很可观的营收。

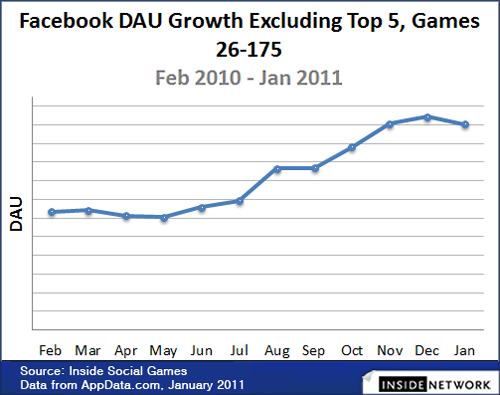

如果再排除掉前25名的游戏,我们就可以通过第26至175名游戏的DAU增长情况,更准确地判断中小开发商的市场表现。

在过去的一年中,这些游戏的DAU流量增加了两倍以上,也就是说有更多的开发商得到了发展。排除前五强开发商后,在剩下的前175名游戏中,DAU超过10万的游戏数量已从去年2月的67款,增长到了2010年圣诞节前的107款。

ARPU情况

通过以上图表,我们还不能轻易判断游戏的相对利润率,更何况许多开发商都对营收数据守口如瓶。但我们至少可以通过ARPU(每用户平均消费金额)发现,不同游戏的ARPU差别很大,即使是同一风格的游戏也不例外。

不同开发商对有效的营收方式的理解也是千差万别,但在2010年已经有一些社交游戏率先创造了成功的营收渠道,其中最为典型的范例之一就是由Digital Chocolate开发的城市建设类游戏《Millionaire City》。

因为这种游戏风格本身的局限性,城市建设类游戏往往难以鼓励用户多花钱,但《Millinaire City》却做到了这一点,它的ARPU值比其他同类游戏多了好几倍。游戏能否更好地实现营收,关键就在于其选择的基础设计。《Millionaire City》集强大的虚拟货币系统、竞争元素、清晰的主题以及故事背景于一体,与其他设计乏味的城市建设类游戏形成了鲜明对比。

还有一些能够在主题、设计上别出心裁的模拟类游戏的运营情况也比较理想,例如《烘培人生》(Baking Life),它是2010年另一款成功的模拟类游戏,也是Facebook上第一个以烘培为主题的游戏,据称它的ARPU也超出了一般游戏的平均水准。

除了营收方式的创新,独特的题材和强大的设计原则也很有助于吸引更多玩家。《Nightclub》、《Monster World》、《Car Town》、《Crime City》、《Ravenwood Fair》和《Monster Galaxy》这几款游戏在2010年的表现都很出色,不但虏获了众多粉丝,吸金能力也超过了同类竞争对手。

对任何一个传统游戏开发团队来说,在游戏主题、故事和趣味性设计等元素上下功夫,是再容易不过的事情了,但社交游戏同行却还需要多掌握一项技能,即如何把这些元素融入到病毒式传播渠道以及游戏机制的设计中。

还有一些开发商十分擅长创建纯竞争类游戏或者“硬核”游戏。比如Kabam公司就因《Kingdoms of Camelot》而声名远扬,还有一些没啥名气的游戏像《Wild Ones》也在很早就开始推行支持玩家相互对决的游戏机制。但大多数开发商都还在学习如何针对更庞大的用户群体,开发富有竞争性的游戏。

另一种趋势是一些开发者正积极向更富有创造性的模式转型。例如CrowdStar,该公司的玩家数量和营收都很可观,依然是Facebook的顶级游戏开发商之一。不过据游戏邦所知,它的上一代热门游戏《快乐水族馆》(Happy Aquarium)、《快乐岛》(Happy Island)以及《开心宠物》(Happy Pets)的ARPU都普遍较低。

作为首家签约使用Facebook积分的开发商,CrowdStar的游戏营收被Facebook抽成了30%,很可能还有另外10%的营收投向了积分推广和Facebook市场营销活动。今年游戏邦发现,CrowdStar正明显改变其运营策略,不仅换掉了CEO,解雇了一些员工,最近推出的新游戏也呈现了完全不同的风格——《It Girl》和《Might Pirates》这两者都是极富个性和竞争元素的RPG游戏。

风险和回报

虽然我们无法描述Facebook的下款热门游戏究竟是何模样,但至少可以对这一平台的现实发展趋势做一些预测。

其一就是开发者应继续发展多种营收渠道,而不能指望光靠游戏本身的设计实现收益。越来越多用户习惯体验在线游戏和购买虚拟商品,他们的付费意愿也在逐步上升。据inside Virtual Goods不久前发布的报告显示,社交游戏的ARPU/ARPPU比值在2011年还会持续增长,美国虚拟商品交易市场规模将达21亿美元。

另一个趋势是国际用户的增长。据游戏邦了解,在《CityVille》的1亿月活跃用户中,国际玩家比例超过一半。寻找接受多国付款的计费渠道很困难,所幸开发商并不需要亲自操心这个问题,因为有许多支付网站和发行商都在快速发展,而且Facebook积分也正针对不同地区不断添加多种付费方式。再加上Facebook的国际用户最多,所以开发商极可能从上亿的国际用户中发现商机。

还有就是挑战性。回到《Millionaire City》的例子,它是Digital Chocolate唯一的大作;不管它的营收方式有多成功,影响力也仍然有限。一个开发商仅有一款成功游戏的现象在这一行实在太普遍了,部分是因为游戏投放市场后,还需要有一个团队持续向其注入心血。此外,许多开发商都面临同样的问题,即推出第一款成功游戏后便难以超越自我,再获突破。

市场营销成本有增无减。有人曾预测Zynga、Electronic Arts 和迪士尼仍将持续向Facebook加大广告投入,而且来自其他行业的巨额广告投入,也让社交游戏开发商徒增了许多压力。因为这些企业认定Facebook是最划算、最容易争取新客户的广告展示平台——-不论是推销商还是网络教育机构,都有可能与社交游戏广告商正面交锋,甚至不惜砸下重金,让开发商彻底出局。

最大的挑战莫过于来自智能手机游戏市场的诱惑。不过,手机游戏市场目前仍然缺乏社交元素,用户规模也只是Facebook的一点零头,另外在产品发售渠道以及手机操作系统、支付方式上也仍然面临不少问题。(本文为游戏邦/gamerboom.com编译,转载请注明来源:游戏邦)

An In-Depth Look at the Social Gaming Industry’s Performance and Prospects on Facebook

Facebook, and social gaming, appears to be a vastly different place for game developers today versus just a year ago. While social gaming visibly grew at astounding rates through 2009 and into early 2010, producing massive successes like Zynga, growth seemed to suddenly stop in the spring of 2010 as Facebook began limiting the viral channels that made big gains possible.

Since then, Facebook itself has repeatedly changed the rules that app developers play by, and has increasingly forced usage of Credits, a virtual currency that skims 30 percent of in-game sales when used, leading some developers to conclude that Facebook is now too difficult to work on.

Growing a game on Facebook is certainly more difficult today than it was in 2009. However, the view that succeeding is too difficult, and that growth has ended on Facebook, is belied by the experience of savvy developers, and hard data about Facebook apps from our AppData tracking service.

Our own view of the Facebook market considers each facet of the market separately. Here’s what we’ll cover below, in brief:

Overall audience size for large developers has declined on average, but this is not necessarily cause for concern

Small and medium-sized developers are steadily growing

Good game design is increasingly important and effective

Monetization is improving in several ways

Large Developers

Before we can look at the performance of games across all Facebook developers, we should split out data for what were considered the “top 5” developers on Facebook in early 2010: Zynga, Playfish (now part of Electronic Arts), CrowdStar, Playdom (now part of Disney) and RockYou. This is because views that Facebook’s heyday has already ended are largely based on the performance of this handful of companies.

The trouble for these developers began last March, when Facebook made the first of several viral channel changes that would end their fast-paced growth:

The above table is not an entirely straightforward measurement of how any of the five developers listed is doing, since MAU / DAU measurements alone don’t directly predict revenue; CrowdStar and RockYou also lost significant amounts of traffic from non-game quiz and gifting apps. Even so, only Zynga is arguably doing about as well as it was in early 2010, and only with the massive success of its brand-new game CityVille. Its four competitors lost 30 percent or more of their DAU, which is the best publicly-visible predictor for success.

If Zynga, with over $500 million in venture capital, can’t continue growing on Facebook, what chance do smaller players have? This question has clearly resonated with the wider community; many Facebook developers are now shifting their attention to smartphone games, and investors have by and large ended their investment in pure-play web-based social gaming.

In our view, however, the market still offers healthy opportunities. Expectations were distorted by the outsized success, over just a year or two, of Zynga and its peers. Before the social gaming boom, it typically took several years to build successful companies; now that the “boom” is over, this reality has resumed. The fact that more players of Zynga’s size have not popped up in less than a year of Facebook’s matured social gaming market is neither remarkable or distressing.

This view proceeds from real market data, which we dive into in the following two sections.

Small and Medium Developers

We first found evidence that the social game market was growing for small- and medium-sized developers last September, when we looked at a dataset of 250 Facebook games using AppData. The nascent trends that we discovered at the time have continued as we’ve updated our data. (Note that you’ll need to be an AppData Pro subscriber in order to access full categorized historical data.)

Three brief notes on methodology. First, we’re again measuring daily active users (DAU) here, which (along with other sanity checking) is the best public indicator of healthy engagement. Second, the specific games measured change from month to month; the list includes only the top 250 games for each given month, with a natural churn of older titles slipping off the list and newer ones taking their place. Finally, these users are non-deduplicated, meaning that one person can be counted as a DAU for more than one game; however, since such power-users often monetize well, that is not a problem for our purposes.

The first trend is a flattening of growth for the social game market as a whole. The chart shows one significant uptick at the end, caused by CityVille:

From here, it would be an easy guess that if the “top 5” developers considered above are uniformly declining but the market shows a plateau, some other group is experiencing growth.

To measure this growth, we simply remove games by the top 5 (again, these are Zynga, Electronic Arts, CrowdStar, Playdom and RockYou). This leaves us with a set of about 175 titles, which do show gains:

Note that the above chart, and the two that follow, show a dip at the end, unlike the top 250 chart. This dip is a predictable effect of Christmas, when growth slows for all social games, and is (we think) only temporary; we’ll check again when we record the numbers for February. Still, the chart shows growth of about 23 percent over the course of a year, and 40 percent from the low point in May 2010.

The largest games in the set above include a dozen titles with over a million daily active users, like Millionaire City , Monster World and Car Town – all of which were launched after Facebook made its spring changes that impacted viral growth. In all, the top 25 games excluding the “top 5” includes 22 different developers, all of whom have enough DAU to succeed if their users are well monetized (more on this in the next section).

We can get a final, and most impressive, look at growth by considering games 26-175 on our list from AppData, which takes us from titles developed by growing medium-sized companies down to very small developers:

In the past year, DAU traffic to these titles has more than doubled. In other words, more developers than ever are growing. Among the full top 175, excluding the top 5, the number of games with over 100,000 daily active users rose from 67 last February, to a peak of 107 right before Christmas.

It’s Not the Size of the Boat…

One measure of success that can’t be easily shown in the above graphs is relative profitability of games. Most companies keep this data close to their chests; however, ARPU (average revenue per user), for different games can vary widely, even within the same genre.

Understanding of the correct methods for monetization has varied widely between developers. However, some early examples of games that were finding more success at monetization began to appear in 2010. One example was Millionaire City, the successful city-building game by Digital Chocolate.

As a genre, city-builders have sometimes struggled to make much from their users. By contrast, Millionaire City has at times enjoyed an average revenue per user (ARPU) of several times what normal sim-style games make, according to our sources. The reasons for the game’s better monetization likely lies in fundamental design choices. Millionaire City was able to combine a strong virtual currency system, competitive elements and a clear theme and story, in contrast to the rather bland design of most city-builders.

Other sim games that have led the way in their theme and design have also done well. For example Baking Life, another of the big successes of 2010, was the first baking-themed game on Facebook, and has had better than average ARPU, we’ve heard.

The advantages extend beyond monetization, of course, as games with more unique themes and strong design fundamentals have also attracted more players. In 2010, titles like Nightclub City, Monster World, Car Town, Crime City, Ravenwood Fair and Monster Galaxy all stood out, both attracting more players and, in most cases, making more money than competitors.

Putting effort into theme, story and “fun”-based design would seem like a no-brainer to any traditional game development team, but the social game industry is still learning how to combine those characteristics with its heritage of virality and metrics-based design.

Some developers are also doing quite well with purely competitive, or “hardcore”, games. Kabam is well known for its success with Kingdoms of Camelot, but there are also less-known games like Wild Ones that benefited early on from player vs player mechanics. But for the most part, developers are still learning how to combine competitive gameplay with higher user numbers.

The ongoing shift at some developers to a newer, more creative model is in plain sight. CrowdStar, for instance, is still one of the top developers, by playerbase and revenue, on Facebook. However, its older generation of games, including the hits Happy Aquarium, Happy Island and Happy Pets, all made generally lower ARPU, we hear.

As the first company to sign up to use Facebook Credits exclusively, CrowdStar signed away up to 30 percent of its revenue, plus, in all likelihood, another 10 percent or more for the promotional Credits that flooded Facebook’s economy early on. We’ve thus seen CrowdStar change its strategy significantly this year. Not only did the company switch CEOs and lay off some workers, its last two titles have also been RPGs with their own unique personalities and competitive elements, It Girl and Mighty Pirates.

Risks and Rewards

Despite some clear trends, we can’t necessarily describe what the next hits on Facebook will look like. However, we can make some predictions about life on the platform.

One is that developers should continue to improve monetization, and not always as a direct result of game design. As players become accustomed to playing games online and paying for virtual goods, they become more likely to spend real money. In our most recent Inside Virtual Goods report, which covers the future of social gaming in much more depth, we predict a reasonable increase in ARPU/ARPPU in 2011, and growth of the US-based virtual good market to $2.1 billion.

Another trend is increasing access to international audiences. As we recently pointed out, over half of CityVille’s 100 million MAUs are international players. Finding ways to accept payments from a diverse international audience is difficult, but luckily, developers will not have to handle this problem on their own; dozens of payment networks and publishers are rapidly growing, and Facebook Credits is also constantly adding to its list of supported payment methods used in various geographies. Since a large majority of users on Facebook are now international, developers have a significant opportunity to monetize hundreds of millions of new users opening up to them.

There are challenges. Returning to the example of Millionaire City, the game is Digital Chocolate’s one and only big hit; no matter how well it monetizes, it still has its limits. Having a single hit is not all too uncommon in the social gaming market, caused in part by the necessity of keeping a team of people constantly at work on games after they’ve launched. Some developers seem to be having difficulty getting past their first big game.

Marketing costs also continue to rise. Despite some predictions that Zynga, Electronic Arts and Disney would drive up ad rates on Facebook, pricing pressure is also coming from other industries that have found Facebook’s performance ads a relatively cheap way of reaching new clients. Any industry that can draw high lifetime values from users who click their ads – from merchandisers to online universities – can potentially outbid, and thus push out, competing social game advertisers.

The biggest challenge of all may be staying committed to producing new Facebook games while the fast-growing smartphone market is beckoning. However, the mobile market is still missing social elements and the sheer scale of Facebook. It also offers unique challenges around distribution and, if not on the iOS, payments.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号