AdParlor解析Facebook广告与用户获取成本的关系

游戏邦注:本文作者是广告管理公司AdParlor的CEO侯赛因·法扎勒(Hussein Fazal),AdParlor公司的客户包括法国游戏公司育碧、社交游戏开发商PlayFirst和五分钟。

社交游戏开发商最常遇到的一个问题就是:我的Facebook游戏获取用户的成本是多少?这个答案要取决于多方面的因素。

举例说,一款全新的男女通吃、老少皆宜的印度尼西亚休闲游戏,在每名用户身上仅花了几分钱,也有可能迅速收获成千上万的用户;与之相反的是,另一款针对40多岁美国男性用户、已经拥有相当的用户规模、设置了一连串准入门槛的扑克类游戏,却也有可能在每名用户上花了数美元的冤枉钱。这其中究竟有何玄机?我们将在下文中探究讨广告营销中关于用户获取成本的一些问题。

一般来说,开发商在Facebook上投的广告每吸引10万名用户,用户获取成本就会增加10%。在讨论这一现象的成因之前,我们首先要了解广告点击率(CTR)以及Facebook通过广告点击率创收的方法。

关于点击率以及它对Facebook的价值

如果社交游戏开发商的广告点击率仅为0.01%,每点击成本(CPC)是1美元,那么你就要付0.1美元的CPM(千次印象费用)给Facebook;Facebook每展示1000次广告,也只会收取10美分的费用。

所以广告点击率要是提高到了0.02%,那么即便你的CPC出价降到了0.5美元,你的广告对Facebook来说也只会增值而不会贬值。广告点击率越高,它对Facebook来说就越有价值,你就掌握了更多主动权,可以大幅降低广告支付价格。

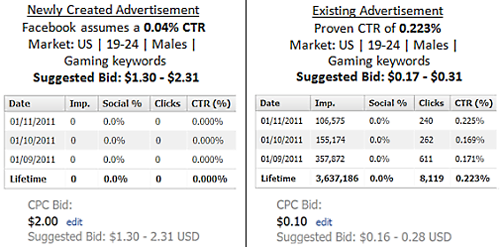

以下是针对美国市场的一个对比图,左边是一个新广告推广报价示意图,右边则是一个点击率已经很高的广告报价图,观察这两者数据我们就不难发现,开发商完全有可能以0.1美元的CPC,实现更高的点击率。

为何用户获取成本会不断增长?

我们首先提到点击率的问题,就是为了给下面要讨论的用户获取成本做铺垫。

首先要切记,用户获取成本和目标用户数量是相辅相成的。即使是同一款游戏,你的每点击成本也有可能在0.3至3美元之间波动起伏。为了便于讨论,我们先假设在每日目标用户数量不变的前提下,对其他的影响因素进行调整,保持现有的目标用户规模。

如果我们在Facebook发布了一款全新的城市建设类游戏,并决定在该平台展开广告宣传活动。在这个平台投放广告的优势很明显,因为Facebook上总有大量“无所事事”的用户,还有不少喜欢尝鲜的铁杆城市建设类游戏玩家,他们都是我们的目标用户。只要游戏本身及广告宣传创意到位,就一定不难吸引大量的游戏用户。

在如此有利的条件下,我们的广告要实现0.15%的点击率和65%的用户转化率(CVR)是完全有可能的,如果你的CPC出价是0.5美元,那么就有希望每天从主流英语国家(游戏邦注:比如美国、加拿大、英国、澳洲等)引进1万5千名的用户。但问题是,这种良好的发展势头究竟能持续多久?

随着广告活动的推进,总有些情况会发生转变:不管你多勤快地更新广告图片,用户也还是会逐渐厌烦这个广告,更重要是,铁杆游戏玩家也开始陆续走人。

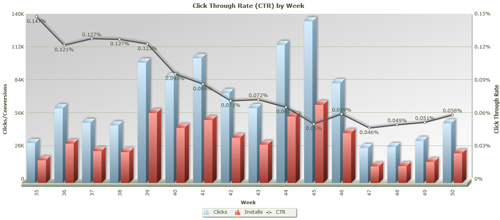

为了在控制成本的前提下保证用户数量,我们就必须针对目标用户重新定义一些关键词。虽然这些关键词同样很奏效,但广告点击率已经没法再攀到原来的高度了,甚至会随着广告活动的进展逐渐走低(详见下图)。

经过以上分析,我们就会清楚点击率下降会影响广告价值,这样一来,CPC还是维持原价,但广告印象却变得更少了,用户转化率也开始下降,这些因素都会直接影响用户获取成本。

在点击率和转化率逐渐下降的情况下,开发商如果还想保持用户数量增长,就只能选择提高CPC。我们在上文已经提到,每增加10万名新用户,每点击成本就会增长10%,所以开发商可真要算清这笔帐了。

能否打破这个规律?

每款游戏的吸引力和目标用户的情况都有差异,所以它们的点击率和转化率也会有所不同。但只要持续推陈出新,增加游戏吸引力,找准市场定位,也极有可能成功对付用户获取成本上升的问题。AdParlor曾经帮助一些游戏应用在维持原来CPI水准的条件下,在较短时间内引进50万左右的美国用户,CPC支出仅0.5美元。但即使是在这种案例中,我们也还是不可战胜市场的力量,而且如果要保持用户数量,CPI比例就一定是有增无减。(本文为游戏邦/gamerboom.com编译,转载请注明来源:游戏邦)

Facebook Ads and the Rising Cost of User Acquisition

One of the most frequent questions we are asked is ‘How much will it cost to acquire users for my Facebook game?’ The answer to this question depends on many factors.

A brand new casual game targeting both genders and all ages in Indonesia can pick up tens of thousands of users very quickly, for pennies per user. On the flip side, a poker application with a large existing user base and a laundry-list of permissions, targeting 40-year old American males, can pay several dollars per user. Important background information on the many factors that affect pricing is discussed in our longer white paper – this post instead examines an interesting sub-topic around user acquisition. We dig deep into the rising cost of user acquisition over the length of a campaign, and why this occurs.

On average, for every 100,000 users you attract to your application via Facebook Ads, you can expect your cost of user acquisition to increase by 10%. Before examining why this happens, we’ll first take a closer look at click-through rates (CTR) and how Facebook makes money on a cost-per-click ad campaign.

CTR and its value to Facebook

If you were to bid and be charged $1 per click with a CTR of 0.01%, you then have an effective cost per thousand users, or CPM, of $0.10 to Facebook. For every 1,000 times Facebook shows your ad, they are only making 10 cents.

If you can double that CTR to 0.02%, your ads will have the same value to Facebook, even if you’re paying only $0.50 per click. By increasing your CTR, your ads can be much more valuable to Facebook, allowing you to significantly drop your bid.

The screenshots below highlight a target market in the US and compare the suggested bid for a new ad versus a proven high CTR ad. In the case of the high CTR ad, we can get a fair amount of clicks even at $0.10!

Why does the cost of user acquisition increase over time?

Once we look at why the cost of user acquisition increases over time, you’ll understand why we started by examining CTR. But first, remember that user acquisition pricing and volume goals go hand-in-hand. For the same application, you may be able to acquire users for $0.30 or $3.00. For the purpose of this discussion, we’re going to assume that the daily volume desired stays consistent – while other factors need to be changed to sustain this volume.

Let’s say we build a brand new city-building game on Facebook application and decide to launch a Facebook Ads campaign. We have several good things going for us. There are a ton of users who are ‘low-hanging fruit’ which we can go after – the subset of hard core Facebook game players who are constantly looking for the hottest new game to play. We can also leverage interest targeting and go after players who are fans of other city-building games. The game and the creative in the ads are brand new, and hopefully spark interest in those users you’re targeting.

Given these favourable conditions, a click-through-rate (CTR) of 0.15% and a conversion rate (CVR) of 65% is very achievable. If you’re willing to pay $0.50 per user given these metrics, you should be able to bring in 15,000 users per day in the prime English speaking countries – US/CA/GB/AU. The question now is, how long can this last?

As you continue your advertising campaigns, a few things are happening. Users are starting to get tired of your ads, despite an attempt to keep refreshing new images and copy. More importantly, the most hard core game players are starting to dry up.

The market of active targetable users who are interested in other city games is starting to diminish, and in order to keep the volume of users up without increasing the rate, we must open up keyword targeting on the users. While these other keywords / interests also work well, the CTR will not be as high as when specifically targeting city-building games. Gradually there’s a drop in CTR across the campaign. (Click the image below for a higher resolution.)

From the anecdote above, we saw the effect a drop in CTR can have on the value of that ad to Facebook. On an aggregate level across our ads, we’re now getting fewer impressions for our same CPC bid. Additionally, the conversion rate (CVR), or the percent of users who end up clicking on allow and entering the game post-click, also begins to drop, having a direct effect on our cost of user acquisition.

As CTR and CVR gradually declines, and if we want to maintain a consistent volume of new users, we eventually have no choice but to increase the price we’re willing to pay per user. Our cost of user acquisition begins to rise roughly at the rate mentioned above – 10% for every 100,000 users we bring on.

Is this always the case?

Every application is different in terms of its appeal and the size of its target market – hence, the speed of its CTR and CVR erosion. With constant refreshing of creatives, an appealing application, and a commitment to finding the target markets that work on a granular level, it’s quite possible to fight off the rising cost of user acquisition. We’ve worked with applications that were able to drive half a million US users at $0.50 within a relatively short period of time, without having to increase the CPI rate. But even in these cases, the market forces eventually win, and in order to sustain volume CPI rates must be increased.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号