开发者谈手游盈利能力评估以及营销和产品的互助关系

开发者谈如何评估一款手游的盈利能力以及营销和产品的互助关系

原作者:Alexandr Enin 译者:Vivian Xue

我已经在My.Com工作了十三年。这是一家由超过十个不同的工作室组成的大型公司,主要制作手机游戏。公司平均每年要发行3至4款产品。可想而知,在这种工作节奏下,我们需要在项目的每个开发阶段对其进行快速而准确的评估,这对专业性的要求是极高的。

在评估过程中,最令我们头疼的是结果喜忧参半的项目。我们都清楚该如何处理弱势和强势项目,但当你衡量这些项目的数据和增长潜力时,问题就来了。

举个例子,如果一款休闲游戏的首日留存率是20%,那么它显然是一个需要被终止的弱势项目。但如果是一款首日留存率为30%的中核游戏呢?事情看上去没那么简单了,对吧?

当然,你完全可以放弃这款中核游戏,可你承担了错失一款热门作品的风险。也许游戏的潜力尚未被挖掘出来,也许开发者再花个一年时间,就能让这只丑小鸭变天鹅了呢。

但若你真给了开发者一年时间,游戏最终却没蜕变成天鹅,你的公司就失去了时间和机会,因为开发者本可以开发另一款游戏,并且,它本可能成为那只天鹅。

要解决这一难题,你需要学习如何评估项目的潜力,而不是它的当前数据。但我如何才能使用行业标准来计算潜力呢?很抱歉,你不能。行业标准太过模糊和宽泛,无法帮你看清项目的本质。一块放大镜是不足以看到潜力的,你需要一台工业显微镜。

以我的经验来看,人们在项目中遇到这样模棱两可的情况时,总是依靠直觉、信任,或是无尽的测试发行来做判断。这使得这一过程代价高昂、不可预测,有时甚至令人痛苦。

因此今天我想谈谈这个“显微镜”,以及我使用它的感觉。也许这些信息将帮助一些有才华的开发者在正确的时刻做出正确的决定,并促成一个优秀游戏的诞生。

个体潜力被高估了

让我们开始讨论吧,首先我们要对目前我们评估项目潜力以及判断一款游戏成败的认知提出质疑。当然,我们对这些事情都持有自己的观点,但我们的观点很可能是错误的,因为它基于我们对项目的主观看法,受到认知扭曲的影响。

在My.Com工作久了之后,我们逐渐意识到能够正确评估一个又一个游戏潜力的专家根本不存在。当一个游戏大获成功后,许多专家都冒出来说他们早就料到了这一点并且为此发声过。但如果你认真研究他们过往的预测,你会发现大部分都不太准确……

那么我们该如何解决这个问题呢?我的方法是,通过研究自身经历获得启发。

我的工作室是My.Com集团公司的一部分,这意味着我和所有其他开发者一样,可以访问公司旗下所有工作室的统计数据。因此我可以访问几十个不同的项目。我从中选择了符合我成功标准的项目并分析它们的数据,以寻找可以揭示公式的常见元素。

什么是成功?

为了继续这一讨论,我们需要对一款游戏的成功标准形成统一认识。在我看来,成功的游戏在扣除了App Store和Google Play分成后,收入至少应该达到100万美元,并且在全球发行一年后,利润率应该超过30%。

My.com发行的很多游戏都满足这一点,因此我拥有充足的数据继续讨论下去,并很快得出我的第一个结论。我把这一结论分解为两点:

1.没有成功的营销就没有成功的游戏。

2.没有成功的游戏就没有成功的营销。

没错,我们内部的产品研究结果显示,成功的产品需同时具备优秀的品质和优秀的营销战略。尽管这两个因素间不存在直接相关性,但我们发现二者的交叉点代表着某种程度的成功。

这也是为什么我想要强调的另一点:我们在对比两个项目时,应同时考虑游戏指标和营销指标,否则这种比较是无效的。这就好比通过只观察事物的影子来讨论它的颜色。

因此,我们需要从两个不同的角度进一步定义成功的标准:营销和游戏指标。

评估一款产品的成功——从营销角度来看

在研究了我们最成功的游戏的营销历史之后,我们很快发现,它们成功的关键在于它们吸引大量廉价安装的能力。我们通过这些廉价安装达到了收入目标,并在进一步优化后,达到了利润目标。

要确定一个项目的引流能力,我们需要看它的广告投放安装率(IR of Advertising)。我认为它是判断项目营销成功与否的参数,它与点击率(CTR)和转化率(CR)直接相关。因此,计算一个项目的IR的公式是:IR=CTR*CR。

为了实现高安装率,你需要创意的广告界面和商店界面来获取高点击率和转化率,并且前提是广告界面和商店界面的内容需保持一致。这将吸引观众并使他们产生正确的期待——这一点对于用户留存至关重要,如果你的信息很吸引人,但它导致玩家对游戏产生了过高的期待,他们很快就会卸载游戏,而你花在吸引玩家上的成本也一去不回了。

根据我的经验,游戏介绍视频的高点击率(>1%)是成功的第一个迹象。接下来你要让商店页面的内容支撑和扩展视频内容;如果能做好这些,你将得到一个30%-40%的转化率,那么安装率大致可以达到0.4至0.5。这些是项目营销成功的证明,并且意味着无论项目存在任何其他问题,它都应该被开发。

我们能怎样影响安装率?

安装率反映了受众的反馈,因此它应该被视为一个外部因素,它只能被计算而无法被控制。这是制作人在预开发阶段(确定游戏概念背景和发行时间)的工作结果。因此一个项目的通过对于制作人来说可能是福也可能是祸。

显然,我的论断建立在以下两点被满足的前提下:

该项目的定位正确并且广告资源投放得当,没出现什么重大的错误。

我们看待的是长期的发展。在短期内,你可以通过投入一两个大广告资源促进安装率提升,但这些资源很快就会消耗完,到时项目又会回到基础水平。从长远来看,我们真正能做的是减缓指标的下跌速度。

我们应该在什么时候测算安装率?

立刻!一旦你对游戏的概念背景有所了解就可以开始了。你甚至不需要等待合适的时机查看投资回报率和目标留存率。正如我之前提到的,游戏介绍视频的高点击率是游戏成功的第一个迹象,并且你不需要等到测试发行时再测算它,某些情况下,你甚至在项目开发启动前就可以测算它。

要做到这一点,你需要把你的视频广告投放到网络平台中,鉴于它们的受众是广泛的,你得到的数据将比较真实。这些数据能够使你客观地比较各个项目。

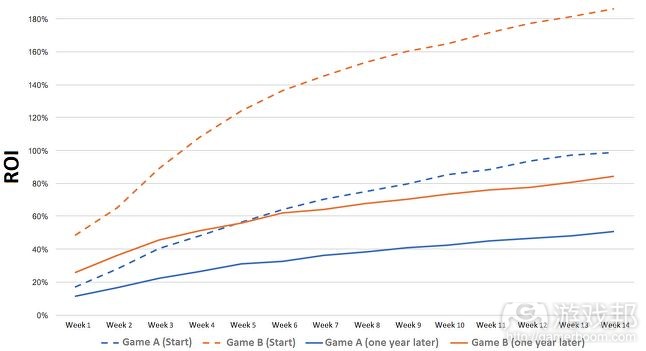

在比较项目时应关注它们各自的生命周期,这也是非常重要的,否则你会得出错误的结论。忽视项目生命周期是一个严重的错误,即使是专业人士也常犯这个错误。这里有一个例子,下面这张图展示了我们的两个热门游戏发行一年后投资回报率的变化。(虚线代表项目开始的状况,实线代表一年后的状况)

对比十分鲜明,刚开始接触目标受众所需的成本很低,报酬还高。但到了某个时刻,它回到了正常的水平,即便经过上一年的调整,投资回报仍然枯竭了。因此当你在比较两个项目时,切记要关注它们的生命周期。

评估一款产品的成功——从游戏指标的角度来看

正如我在文章开头所指出的,营销指标只是衡量项目潜力的因素之一。另一个是游戏指标。

与营销指标相比,游戏指标很难比较。在公司工作的十三年间,我们多次尝试讨论归纳出一个评估游戏质量好坏的标准,但我们从未成功过,而是每每陷入关于不同类型游戏的争论中。

我们所有的产品都被称为游戏,但事实上它们有很大的不同,唯一的共同点是它们的娱乐性。所有的游戏都能娱乐玩家,但是每种类型都有各自的特点。这意味着只有把相同类型的游戏拿来比较才是合理的。但如果你观察手游类型的变化历程,你会发现它们在不断进化,不同类型混合并产生了各种各样的新类型或者亚类型。

这种情况是由手游市场的天性导致的;在手游市场上,那些能够最先提供独特并具长期盈利性的体验的游戏总是占据优势。这使得游戏成为一个极具弹性和活跃性的产品,不同类型间的界限是模糊的,并且将游戏分解成不同指标是一个挑战。

因此,当我们评估手游的游戏指标时,我们无法从数据的角度进行比较。在这种条件下,我们只能粗略比较那些极端的指标,但这把游戏简单分成了好游戏和坏游戏,而无法分析那些介于这两者之间的游戏的潜力。

那么我们该怎么办?是否存在一个以数据为支撑的评估方式?

我想是存在的。

我们花了一定的时间才找到了这种方式。它不是系统性地被发现的,而是出于偶然,关于这一点我们要感谢Google Play。基于他们的市场分析我们开始了研究,从而找到了答案。

是这样的,2017年,Google Play在巴西为他们的开发者举办了一次会议,并分享了各种信息。其中的一张演示幻灯片上展示了四组成功游戏前10分钟的留存曲线。

当时的我们正忙于研究如何提高《剑圣战争》(Juggernaut Wars)的留存率,因此这项调查结果极大地鼓舞了我们。它使我们从一个全新的角度思考留存率,即游戏在开始的几分钟内留存率有多高,以及从那之后它是如何增长的。

Google Play的数据显示,起始数据越高、前几分钟内的增长越快,游戏的潜在受欢迎程度就越高。我们研究了自己的游戏,结果是相符的!

上面这张图标反映了我们的两款热门游戏和一款中等游戏的留存率曲线,结果和Google Play的描述相当一致。(黄实线和蓝实线代表热门游戏,绿实线代表中等游戏)

“哇哦,你可以通过游戏前10分钟的表现来评估它的潜力,”我们想。

为了充分理解这个结论,请你试想一下:玩家愿意花一分钟玩一款游戏意味着他们第二天很可能再次玩这个游戏。并且如果我们讨论的是一款热门游戏,那么一分钟对于一款尚未确定的热门游戏的留存率来说具有足够大的影响力。玩家在一分钟内能做什么呢?几乎什么都做不了。他们最多浏览一下游戏的设置和基本操作。他们不会仔细考察整个游戏,而是看看什么是不能改变的。你可以把它称作这个项目的DNA。

因此我们假设每个项目都有各自的DNA,它可以被理解为一种以数据的方式向你呈现游戏潜力的指标。

一个项目的DNA指的是玩家在游戏的前几分钟内探索的一些基本的游戏内容。它决定了几分钟后的留存情况,以及从那之后的留存率的边际增长。起始值越高,边际增长越高,DNA及和游戏潜力越强。

这种微观分析法打破了类型的限制,使我们从最原始的角度看待一个项目。通过评估一名玩家在一分钟后继续玩游戏的意愿,并估算他们接下来玩游戏的意愿,我们得知了玩家的潜意识反应。这么短的时间范围几乎无法呈现玩家有意识的选择的情况,但我们可以了解他们的下意识选择。如果一款游戏的概念足够强大、实施效果足够好,它将使玩家下意识地参与,并且玩家玩的时间越长,游戏的影响力就越大。

什么时候才是评估项目DNA的合适时机?

当你们做出了一个大于10分钟的高质量成品时,就可以对它进行评估了。

只要你的游戏运作良好,从理论上说,你可以在垂直切片(vertical slice)阶段评估它的潜力。事实上,由于你需要大量的数据,你可以选择在内测之后进行评估,采用经典的按分钟计算留存的方式。你需要招募具有代表性的用户群体,据我们估计至少需要40,000名用户。只要你为这样规模的用户们提供你的10分钟高质量成品,你将能够确定项目的DNA。

如何解读项目DNA?

按照这样的方式,最终你将获得一条曲线。这条曲线的数据只有同其它以相同方式获得的曲线进行比较时才有意义。当你研究每分钟的留存率时,研究很大程度上取决于项目。了解用户是如何登录和退出、服务器如何读取这些数据是非常重要的。当你把项目与其它具有相同服务器解决方案(server solutions)的项目进行对比时,你将能确定它的最大价值。

即使你找不到可对比的案例,你仍然可以通过观察项目的增长情况来评估它。一款成功游戏的留存率呈每分钟递增的状态,这也就意味着玩家的数量越多,他们对游戏的喜爱程度越大。如果留存率不增反降,意味着游戏存在一个根本问题。我把这个问题称作一个虫眼(wormhole)。下面这张图反映了我们的游戏中存在的一个明显的虫眼。

从图中你可以看出,在最初的10分钟内,留存率的增长缓慢。我们最畅销的游戏可以达到250%,但此处只有20%。同时,第二分钟的留存率比第一分钟结束后要低,这表明玩家们不仅没被游戏吸引,还流失了。只要一个项目存在这样的虫眼,它就不可能有效地获取新玩家。

总结

在一家旗下拥有10多个的工作室、不同工作室手头进行多个项目的公司工作,我有机会了解我们所有的成功开发经历,并通过分析报告和亲身实践对它们进行评估。

我的任务是评估项目,不只是把它们分成强势项目和弱势项目,还要通过分析它们的增长潜力,创造出一种用于评估优劣性尚不明确的项目的方法。尽管项目的增长潜力时常不明显。

我希望我的研究能帮助有才能的开发者在项目启动或收尾时解决所遇到的复杂问题。因为制作游戏不仅要付出精力,还有时间。尽管开发者们总是不辞辛劳,但时间是非常有限的资源,因此还是要明智地使用它。祝好运!

本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao

Dissecting Success

I’ve been working at My.Com for the past 13 years. This is a very big company comprised of more than 10 different studios making mostly mobile games. The company releases 3-4 games a year on average. This type of workflow understandably demands huge expertise when it comes to the quick and accurate evaluation of projects at every step of their development.

The biggest challenge in this process comes with projects showing mixed results. While it’s quite clear what to do with weak or strong projects, these projects generate problems as you shift from evaluating stats to evaluating growth potential.

For instance, if a casual project has a Day 1 retention of 20%, then it’s definitely a weak project that needs to be ended. But what if it’s a midcore game with a Day 1 retention of 30%? Not so simple now, is it?

Of course, you can always shut down this midcore game, but then you risk ending a hit. Its potential may not have been explored yet and it is possible that developers need another year for this ugly duckling to transform into a swan.

But if you do give developers this extra year and there’s still no swan in the end, the company ends up losing money and opportunity since these same developers could have been working on another game which, maybe, could have been that swan.

To find your way around this conundrum, what you need to do is learn to evaluate the potential as opposed to the current state of a project. But how can you calculate potential using industry standards? Unfortunately, you can’t. Industry standards are too vague and universal to look into the soul of a specific project. A magnifying glass isn’t enough to see the potential; you need an industrial microscope to do that.

In my experience, all decisions involving these ambiguous projects are made with the help of intuition, a credit of trust, or endless soft launches. This makes the process costly, unpredictable, and sometimes even painful.

So today I would like to talk about this microscope and what it’s been like using it in my experience. Maybe this information will help some talented developer make the right decision at the right moment and result in the birth of an excellent game.

Individual Potential is Overestimated

Let’s start our discussion by questioning what we currently know about assessing a project’s potential and predicting success of one game or another. We all have our own opinion about these things, naturally, but this is most likely wrong as it is based on subjective points of view regarding projects, making it hostage to all sorts of cognitive distortions.

We here at My.Com have had to go through a long journey to understand that experts who can correctly evaluate the potential of one game after another simply do not exist. Evidently you will find situations where a game’s success draws multiple experts to say they correctly wager that it will do well and have been vocal about it. But if you study the history of their predictions, you will see a large proportion of their forecasts were simply off target…

So how do you solve this? My solution was inspired by our own track record.

My studio is part of the My.Com group of companies, which means I, like all of our other developers, have access to the statistics of all our partners’ studios, and not just my own. So I had access to dozens of various projects, and I picked the ones that filled my criteria of success and started crunching data to find common elements that would reveal a formula.

What Counts as a Success?

In order to continue this discussion, we need to agree on the criteria which make a game successful. According to my system, these games should make at least $1 million after App Store and Google Play fees, and have a margin of more than 30% one year after global launch.

My.Com releases quite a few of these games on a regular basis, therefore I had enough data to go on and draw my first conclusions pretty soon. I have broken them down into two postulates:

1. There are no successful games without successful marketing

2. There is no successful marketing without a successful game

That’s right, our internal product research has shown that successful products always have a history of success for both the game and its marketing. Despite the fact that these factors are not in direct correlation, it’s where their lines cross that we find the necessary level of success.

This is why the next strong point that I would like to note is that it is futile to compare projects using game metrics without combining them with marketing metrics. It’s the same as talking about an object’s color by looking only at its shadow.

So now we need to further define criteria for success from two separate perspectives: marketing and game metrics.

Evaluating a Product’s Success – Marketing

After studying the marketing of our greatest games, it quickly became evident that the key to their success is in the project’s ability to attract many cheap registrations. Revenue targets were reached through these registrations, and after further optimization, we reached the required margins.

To describe the effect that allows a project to attract a lot of traffic, we need to look at the Install Rate (IR) of advertising. In my opinion, it is the parameter to look at when considering a project’s marketing success, and it is directly tied to Click-Through Rate (CTR) and Conversion Rate (CR). So the calculation for determining one’s Install Rate is IR = CTR * CR.

In order to achieve a high IR you need to have a high click-through rate on your creative elements and a high store page conversion rate. And you can achieve this only in the case where both your creative elements and your store page carry the same message. This will captivate the audience and form the correct expectations from the product. This is a must to retain the attracted user. If your message is captivating but it creates false expectations, the players will leave quickly and the costs of luring them in won’t be compensated.

In my experience, the first sign of looming success is high CTR on gameplay video creative content (>1%). The store page’s next goal is to support and expand the message of the video content, and if all is done right, you get a CR of 30-40%, which combine for an overall IR of 0.4-0.5. These are signature values of a project’s successful marketing, and it means the project should be developed despite any other problems it may have.

How can the Install Rate be affected?

Because the IR is a reflection of the audience’s reaction, it should be considered an external factor as it can only be calculated and not controlled. This is the result of the producer’s work during pre-production when the game’s concept was approved along with its setting and time of release. Greenlighting a project therefore can become the producer’s blessing or curse.

Evidently, I can only say this so confidently if the following clauses have been met:

● The project’s positioning has been executed correctly and advertising assets were produced at a decent quality level without any major mistakes.

● We are looking at the longer term. In the short term, you can give your IR a nitro boost from time to time with a great advertising asset or two, but those burn out quickly and the project descends back to its baseline. In the long run, all we can really do with the index is to slow down its drop.

When should we measure the Install Rate?

Right off the bat! Pretty much as soon as you have an understanding of the game’s concept and setting. You don’t even have to wait for the right conditions to check the index through positive ROI and target retention. As I said earlier, the first sign of a successful game is a high CTR on gameplay videos and you don’t need to wait for the soft launch to measure it. In some cases you don’t even need to wait for the project’s development to kick off.

To do that, you need to carry out your video ads’ UA in video networks, as their target audiences are broad, so your results will be as unbiased as they can get. The results allow for an objective comparison of various projects.

It is also very important to bear in mind the life cycle of the projects you are comparing. If they are different ages, you will end up drawing the wrong conclusions. Ignoring the life cycle is a grave mistake that even professionals tend to make. Here’s an example of how the ROI for two of our hit projects’ marketing campaigns changed just one year after launch.

This sharp contrast in ROI illustrates how the target audience you engage from the start is very cheap and pays well. But there comes a time when it runs its course, and returns dry up despite the past year’s tweaks. So when you’re comparing two projects, always mind their life cycles.

Evaluating a Product’s Success – Game Metrics

As I indicated at the beginning of the article, marketing metrics are just one of the main pieces of the puzzle that is a project’s potential. The other one would be gaming metrics.

Unlike marketing IR, gaming metrics are very hard to compare. Over the 13 years I’ve been at the company we’ve had plenty of “Holy Wars” in an attempt to narrow it down to one concept of evaluating a game’s quality. None of these attempts were successful since they would always crash into counter-arguments about different genres.

All of our products are called games, but in truth they are all very different products that are united only by their entertaining nature. All games entertain players, but every genre has its specifics. This means that it is only correct to compare games of the same genre. But if you look at the genres of mobile games on a timeline, you will see that they evolve perpetually and you get all sorts of explosive combinations when genres mix and give birth to new genres and subgenres.

This happens because of the nature of the mobile games market; it rewards the games that were the first to provide a unique experience that can be monetized in the long run. This makes games an extremely elastic and dynamic product where genre borders are blurred and breaking games down to gaming metrics is a challenge.

So when we speak about mobile games and forming the criteria to evaluate their game metrics, we find ourselves in an extremely chaotic environment which does not allow us to carry out comparisons based on mathematical calculations. The only thing we can do in these conditions is to carry out a rough comparison of game metrics in their extremes, which could split games into good and bad, but cannot provide any insight into a mixed feeling game’s potential.

So what do we do? Is there a mathematically backed solution rather than one based on trusting this or that developer?

I think so.

We did not come to this understanding straight away in our studio. It wasn’t discovered systemically. It was circumstantial, and for that we should thank Google Play. It is their market analysis that was the starting point for our own research, which in turn gave us the answer.

This happened in Brazil in 2017. Google Play held a conference there for its developers and shared all sorts of information with them. One of their presentation slides revealed four groups of projects whose success is measured by the retention curve in the first 10 minutes of the game.

At that moment in time we were obsessed with improving retention in our game Juggernaut Wars, so this research inspired us greatly. It suggested looking at retention for a new point of view, i.e. how high it is from the first minute of the game and moving into quality growth straight after that.

Google Play’s data suggested that the stronger the starting point and growth in the first minutes, the higher the game’s potential popularity. We used this concept for our own research and it worked!

We ended up having this chart with reflected retention of two of our hit games and one middle game and it correlated with their commercial success very accurately.

“Wow, you can actually assess a game’s hit potential by its first 10 minutes,” we thought.

To fully understand the power of that conclusion, think of this equation: just one minute spent playing a game provides a stable mathematical chance of re-visiting this game the following day. And if we’re talking about a hit game, then one minute is enough to make a huge difference when it comes to retention for a game that isn’t a definite hit. And what can a player really see over just one minute? Next to nothing. It will only mean glancing at the setting and base mechanics. They will see what is impossible to change without overhauling the whole project. You could say this is the project’s DNA.

This is how the hypothesis that every project has DNA was born. It can be interpreted as the metric that gives you a mathematical representation of a game’s potential.

A project’s DNA is a set of fundamental aspects of a game that a player dives into in the first minutes of playing. This determines the chance of retention after the first minute as well as the marginal chance of growth with every consecutive minute in the game. The higher the starting value and the higher the marginal growth, the strong the DNA and its potential.

This microanalysis allows looking beyond genre boundaries and seeing a project completely raw. When we assess a player’s will to continue playing after the first minute and measure how much more they’re inclined to keep playing with every other minute, what we get is a player’s subconscious reaction. This short timeframe provides very little to no data for a gamer to make a conscious decision. But it is made subconsciously. If a game’s concept and its implementation are strong enough, this will keep the player engaged subconsciously and the longer they play the stronger its influence.

When is the right moment to assess the DNA?

This concept works once a project has at least 10 minutes of ready-for-release quality gameplay.

Once you get the game up and running well enough, its hit potential can theoretically be measured at the vertical slice stage. You can, in reality, measure it no earlier than at the closed alpha stage since you need a large volume of data to form a graph. This research is based on classic by-the-minute retention. In order to compile the data into a chart, you need representational groups of users for each of the 10 minutes. Our estimations suggest that at least 40,000 registrations are the required minimum. As soon as you can provide that volume of users for 10 minutes of ready-for-release quality gameplay, you will be to determine the project’s DNA.

How to interpret the DNA?

Your result will be in the form of a curve with the base data only providing value when compared to other curves calculated the same way. When you’re dealing with minute-by-minute retention, the task depends very much on the project. It’s important to know how users log in and log out and how the server is reading this data. Your maximum value will be determined in comparing projects with similar server solutions.

Even if you have nothing to compare with, you can still assess the project by looking at the growth dynamics. A successful game would have retention growing with every passing minute, so it means the more that players play, the more they like it. If retention is not growing or even dropping, it indicates a fundamental problem. I call this problem a wormhole. Here’s an example of an evident wormhole in one of our games.

As you can see from the chart, retention growth over the first 10 minutes is very low. While our best-selling games see it at 250%, here it’s just 20%. At the same time retention at the second minute is lower than after the first minute, and that means the game is not only failing to engage, it is losing its attracted audience. As long as a project has a wormhole, it cannot effectively acquire new players.

Making the call

Working at a large company which unites more than 10 different studios, each of which is constantly engaged in several projects, I had the opportunity to look at all of our positive experiences and study our success cases, assessing them through analysis and from my own experience.

My task was to learn to evaluate projects not only splitting them into strong or weak, but also by creating a method to assess mixed-feeling projects by analyzing their growth potential, which at times was not evident yet.

I hope my research helps talented developers make weighed decisions when dealing with complex issues as the launch or closing of a project. Because working on a game is not just effort but also time. While developers are always eager to put in the hard work, time is a very limited resource, so use it wisely. Good luck!(source:Gamesindustry.biz )

闽公网安备35020302001549号

闽公网安备35020302001549号