MZ所代表的4X策略手游在近期出现了集体性的瓶颈问题

MZ所代表的4X策略手游在近期出现了集体性的瓶颈问题

原作者:Jon Jordan 译者:Willow Wu

一个月前,我们在朋友圈提到了MZ可能遇到的问题,当时的表述:

我对MZ(Machine Zone)模式和历史有特殊偏好,但不得不说2017年7月,是MZ自己作死的一月

2017年6月起,MZ为了强推梦幻新作Final Fantasy XV:A New Empire进行了挖坑行动,资源大量倾斜给Final Fantasy XV:A New Empire

但很遗憾Final Fantasy XV:A New Empire不是头部产品(没有强势崛起,反倒陷入口碑泥沼)

自2017年7月,Game of War-Fire Age自2013年上架以来,历史上第一次出现下载和营收同步断崖式下滑

自2017年7月,Mobile Strike自2015年上架以来,历史上第一次出现下载和营收同步断崖式下滑

Game of War-Fire Age和Mobile Strike的全球表现甚至要弱于Clash of kings

从稳固的头部第一梯队(Top3-5),纵深一跃到非常飘忽的第二梯队(Top10-30)

Final Fantasy XV:A New Empire的失误,将100亿美元估值的超级公司,瞬间拉低好几个身位

前几天刚跟朋友聊到的:2017年除了全球性的新作乏力,最大的看点就是MZ遭遇了自己瓶颈(MZ的产业链里,营销是核心的竞争力之一)

最近pocket gamer网站也出现了一篇类似的话题探讨,如下:

我一直挺敬佩MZ的商业运营手段,但是我还是不得不向这家美国手游开发商问一句:你们到底是哪里出了毛病?

从2013年开始到2015年,MZ的4X策略手游Game of War和Mobile Strike在全球各大应用商店相继登顶,无论是Game of War还是Mobile Strike都能在一年内狂捞几十亿美金。

当然,这种成功并不是轻易得来的。

甚至连那些玩了很久的忠实玩家都无法否认MZ的这两个游戏在游戏体验上非常逼真,metagame面面俱到,依靠联盟为卖点的氪金手段十分强硬有效。

正因为如此,不管是从绝对消费还是从创新的消费模式角度来说,MZ一直是手游市场中的盈利先锋。

但是现在粗略看一下应用商店的榜单,你会发现这两个游戏好像跌的有点厉害啊。

断崖式下滑

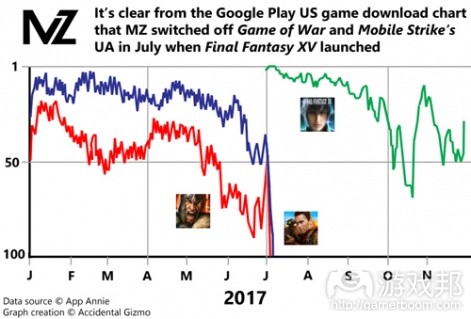

下载榜的数据是最明显的,我们看的是Google Play商店,比较清楚,但是在苹果商店那边情况也是一样。

多亏了MZ没有中断营销投入,Game of War和Mobile Strike的下载量在6月底之前都还保持在前50的位置,然后它们就跳水般地掉出了前100。到7月中旬的时候,这两个游戏被远远地甩到了500名之后。

考虑到MZ数量庞大的忠实玩家基础,还有他们的收益冠军宝座,就算不去挖掘新玩家,也不至于造成这种惨状。但是,现实就是这样。

从7月开始,这两个游戏在美国市场掉出稳固的前五位置,10月继续下滑,告别前十的位置。如果按照这个速度继续下去,它们可能在2018年年初就跌出前50。

换岗

从某种程度来说,这种突然下滑的原因是显而易见的。六月末,MZ发行了《最终幻想15》,这是他们跟Square Enix联手制作的手游。

这游戏跟MZ之前的4X手游十分相似,但是考虑到《最终幻想》系列的庞大粉丝群体,这种IP授权游戏应该还可以做得更大,而且设定为付费游戏的话会更好。

但这并不是说MZ没有投入大量资金去运营这个代理游戏、吸引新玩家,他们还请了模特兼网红Alexis Ren拍摄宣传视频呢。

正是因为这个《最终幻想15》还在Google Play下载榜单的前50之中,但是显然跟7月之前的Mobile Strike差远了。

然而我们可以看到《最终幻想15》现在是Google Play美国地区盈利前十的游戏之一,而且数据还在上升,朝着前五奔去,这说明MZ的营销投入还是有些作用的。

接下来呢?

这就是为什么MZ要做出看似如此激进的决策。

Game of War和Mobile Strike都是非常成功的产品,但是随着它们的寿命逐渐步入晚期,如果要让它们继续保持在盈利榜单靠前的位置,MZ所需的营销投入可能会越来越多。

毫无疑问,MZ是个盈利巨头公司,但是划出30%的资金给营销,跟划出50%的资金相比还是有区别的,会对整体盈利产生显著的影响。

相较之下,很容易就可以算出来花更少的钱在《最终幻想15》上,让它成为收益前五的游戏之一,能得到更多的利润。就算把付给Square Enix特许权费和公司整体的收益下滑算进去,也还是能收获可观的盈利。

因此,更值得期待的是MZ下一步会做什么。

鉴于MZ所创造的成功,我想无论是哪个老牌游戏公司都会很乐意跟Square Enix一样,跟MZ签署类似的授权协议。

也有可能他们不再借助别人的IP,自己创造新游戏。根据他们以往的游戏发行时间来看,从2013、2015再到2017,距离下一个计划我们可能还得等上一段时间了。

本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao

Despite being a longstanding admirer of MZ’s business operations, the question that has to be asked is what the hell is going on at the US mobile game developer?

Since 2013 and 2015 respectively its 4X strategy games Game of War and Mobile Strike have sat atop the world’s app stores, each generating an estimated billion dollars annually.

Of course, that sort of success hasn’t come easy or cheaply.

Not even committed players of the games would dispute they are hardcore experiences, heavy on metagame, and aggressive in their alliance-focused monetisation.

For that reason, MZ has been in the vanguard of mobile game marketing, both in terms of absolute spending as well as creative innovation in terms of how and where it spends.

But as a cursory look at the app store charts shows, it looks like those two games have effectively been sunsetted.

Dropping like stones

The download chart is the most revealing; we’re using Google Play as it’s clearer, but the same is true for the Apple App Store.

Thanks to MZ’s continued marketing, both Game of War and Mobile Strike were top 50 games in terms of downloads until the end of June when they dropped like a stone out of the top 100. Indeed, by mid-July both games were outside the top 500.

Given their committed player base, cutting off the supply of new players hasn’t had such a dramatic impact in terms of their top grossing position, but it has had an impact.

From the start of July, the games dropped out of their usual top five position in the US, dropping out of the top 10 during October. If the current trajectory is maintained they could be outside the top 50 by the start of 2018.

Changing of the guards

On one level, the reason for this sudden reversal is obvious. At the end of June, MZ released Final Fantasy XV, its co-production with Square Enix.

The game is very similar to MZ’s previous 4X games, but the appeal of the licence should make a bigger game in terms of player numbers and more efficient on a dollar-to-download level to market.

Not that MZ isn’t spending big to push the game both in terms of in-game UA and wider campaigns, using model and influencer Alexis Ren.

For that reason it’s one of the top 50 most downloaded games on Google Play, but significantly not at the same high level that Mobile Strike experienced prior to the July switch-off.

Yet, on that basis, we can see the marketing spend has been more efficient as Final Fantasy XV is now within the top 10 top grossing games on Google Play in the US and continuing to rise towards the top five.

What’s next?

And this is the real reason MZ has taken what appears to be such a radical decision.

Both Game of War and Mobile Strike were very successful, but as they aged, the amount of marketing spend required to keep them at the top of the grossing charts was likely increasing.

No doubt, MZ is a highly profitable company but the difference of spending 30% of turnover on marketing compared to spending say 50% of turnover on marketing is stark in terms of overall profitability.

In that context, it’s a fairly simple calculation to work out how much more profitable it will be to spend less marketing Final Fantasy XV into a top five grossing position, even given the royalty fee paid to Square Enix and a decline in overall revenues.

So, perhaps, what will be more significant to see is what MZ does next.

Given its previous and current success, every traditional game company on the planet would happily sign a Square Enix-type licensing deal with MZ.

It likely has its own homegrown ideas about new games too, although given a chronological release sequence that reads 2013, 2015 and 2017, it may be some time before its intentions are clear.

(source: pocket gamer )

闽公网安备35020302001549号

闽公网安备35020302001549号