开发者解读数据分析公司Flurry关于手游沉浸度下滑的问题

原作者:Guest Author 译者:Willow Wu

Wilhelm Taht是Rovio的游戏执行副总裁。

与行业内的许多同事朋友一样,我之前一直努力想要理解Flurry所发布的年度行业观点:手游沉浸度正在走下坡路。

他们最近的文章是关于2016的宏观数据,还有其他的,比如:“录像带杀死游戏大亨:游戏类app曾一度被认为是‘移动业内的宠儿’,相较去年,用户在游戏类app上投入的时间已经减少了4%。”

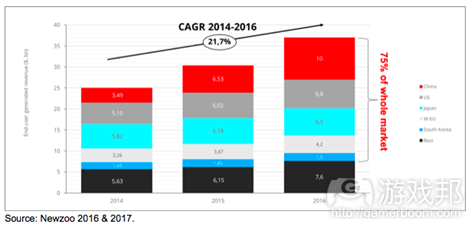

鉴于手游产业2014至2016的全球年均复合增长率(CAGR)达到了惊人的21.7%,IAP收益占到了整个移动行业的80%,Flurry的数据看起来是有点费解。

红色:中国,灰色:美国,浅蓝色:日本,浅灰色:欧洲,蓝色:韩国,黑色:其他国家

2016年,手游也是整个游戏行业中收益领跑的类别,终端用户产生的IAP收益多达370亿美元,这是一个非常庞大的数字,2016年整个游戏产业的终端用户收益是1000亿美元,手游就占了37%。

还有不要忘了,广告收益(例如原生广告视频)并没有包含在这个数字里,这也是手游经济中不可忽视的一大部分。

既然如此,那为什么数据显示用户每天玩游戏的时间和流程次数都在减少,沉浸度一年不如一年呢?

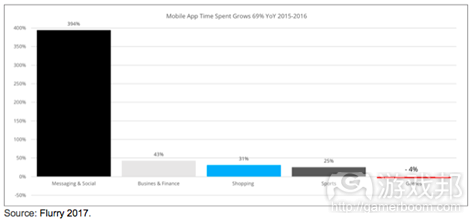

上面的图表体现了用户在移动应用上花费的时间,从2015年到2016年增长了69%,游戏类app却下滑了4%。

好吧,或许是有几个原因。

F2P手游和付费手游的整体差异

F2P(Free-to-play/Freemium)手游这几年来一直是行业内最赚钱的游戏类型。现如今,手游行业内大概99%的终端用户收益都来自IAP。

免费游戏想要赚钱,那就得吸引玩家回到游戏中。通常这会被总结为“静态留存率(static retention)”或者“N天留存率(Day-N retention)”。

你能把玩家留得越久就越好。难就难在只要是游戏(不管是不是F2P游戏),它多多少少都有重复性。

关于F2P游戏,有个大家都懂的道理就是如果你让玩家一次性就玩完了所有内容,那明天没有新东西,他们就不会回来玩游戏了。

因此,如果让玩家认为他/她已经把这个游戏玩透了,或者是“这游戏没有什么新鲜的了”,那就会失去这个用户。F2P游戏最不想看到的就是用户流失。这就是为什么F2P游戏这么擅长运用所谓的“流程机制”。

F2P游戏中众所周知的情景,比如“体力值已耗尽 -> 请一个小时候之后回来”或者“你已经种下了种子 -> 两个小时后回来查看花朵”这都不会让玩家放弃游戏,玩家会继续玩下去。之后,对游戏进行优化,尽可能地延长玩家生命周期,让玩家更投入于游戏中。

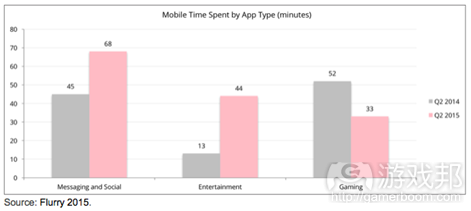

反过来说,实用性APP——例如信息类、视频娱乐类、音乐类、运动类、社交类等等,针对的就不是这类消费者行为了。它们努力想要让你花更多时间在这些应用上,不让你脱离它们的手掌心。而且这些APP基本上都不像游戏那样具有重复性。

鉴于亚洲和西方市场的移动应用市场处于成熟状态(去年,两个地区共计有23亿智能手机用户,他们每天平均要花一个小时在移动应用上,这个观点应该是大家都没意见的),消费者的分秒争夺战已经打响了。

然而,在付费平台(或者是包月付费平台)的战争和F2P平台的战争完全是不一样的。付费游戏(或者是包月付费游戏)一开始就想要争取尽可能多的玩家时间,F2P游戏是随着时间吸引越来越多的玩家。

从宏观角度来看,我相信手游的沉浸度下降,其他类型的APP上升,还不算意外之事,也就是说,手游的沉浸度下降可以归咎为“游戏设计”:“这是个游戏特色,不是bug。”

Flurry在移动应用生态环境中的位置

接下来要讲的这个原因实际上跟上面所讲的有点矛盾。让我解释解释。

大家都知道(就随便选一篇Mobile Dev Memo的博文读读)手游的数据是至关重要的。

数据,玩家数据,人们经常会用精炼的语言总结它。如果说产品是一枚硬币,那么一面就是复杂的KPIs,另一面就是游戏本身。

如果没有数据,那么F2P策划人、产品经理和游戏分析师都会陷入困境之中。手游的数据(很不幸地)也是不能通用的(甚至都无法大范围使用)。

对比一下这两种游戏:有saga地图的三消解谜游戏和实时PvP对战游戏。他们的游戏设计、相关玩家数据是完全不一样的。

是的,平均每付费用户收入(ARPDAU)和日活跃用户数量(DAU)都是高层次的衡量标准,不同游戏的这两项数据是十分接近的。任何一个数据分析系统都可以告诉你结果。

但是如果你要在数据驱动的游戏设计上追求卓越,那么这些衡量标准并没有多大帮助。数据驱动的游戏设计和优秀的在线运营需要在游戏核心和用户行为方面下更多功夫。

移动应用生态环境经历了翻天覆地的变化,对于Flurry来说,它的黄金增长期就源于之前那个时代。在付费手游年代,Flurry就是移动应用数据分析的代名词。

2017年2月,不知道美国收益榜前100的游戏有多少使用了Flurry。为什么不知道?我是有问过,而且是两次。但是我现在都没有得到答案。

@FlurryMobile 的更新:https://t.co/rix8dc73mj 现在在美国最赚钱的100个游戏有多少用了Flurry @Simonkhalaf

— Wilhelm Taht (@wilhelm_taht) 2017年1月30日

@FlurryMobile 现在在美国最赚钱的100个iOS游戏中有多少用了Flurry? https://t.co/oPH0IQfB6Z

— Wilhelm Taht (@wilhelm_taht) 2017年2月23日

手游行业向F2P经济转化,在数据方面也会变得更加复杂。因此不出意外的话热门的手游会越来越少地使用Flurry,这个想法我认为还是比较合理的。

考虑到热门游戏通常都是“噬时者”(能够让玩家长时间地沉浸在游戏中),如果Flurry对热门游戏的渗透率随着时间持续下降,那么它的宏观数据表明玩家的游戏沉浸度下降也就不足为奇了。

这正好就能解释为什么整个手游行业的收益还呈现增长趋势而Flurry宏观数据体现的是下降趋势。

补充:这个理论也支持了Unity和SuperData近期发布的数据,和Flurry相反,他们的数据表明沉浸度在2016年第四季度相比一年前上涨了19%。

确实,他们的样本数据跟Flurry是不一样,Unity的数据收集对象规模非常大,从大热门到无人问津的游戏都有。

噬时者理论当然只是我的个人看法,但我确实认为最赚钱的游戏相比一般游戏肯定能够让玩家投入更多时间。毕竟沉浸度是F2P游戏设计中的核心要素。

Flurry的其他观点体现了他们有时候目光过于狭隘

这最后一个原因不会给我加太多分,但是我还是得说说。

还有一篇相似的文章同样也解释了为什么手游的沉浸度持续下滑(参照前文),其中有这样一句话:

“今年的首个热门游戏Pokemon GO,它的冷却速度相对还是比较快的,因为消费者们逐渐对该游戏失去了兴趣,只有在大型假日活动才回来玩一下。”

Flurry和Yahoo的PR能让这样的文章过审?简直太让人震惊了。撰写这篇文章的时候(2017年2月23日, 早上9:14,位于芬兰的赫尔辛基),Pokemon GO还是美国收益榜的冠军啊。

它是史上最快达到5亿下载量的手游。截止2017年2月,Pokemon GO的累计收益已经达到10亿美元,这项数据也打破了之前所有的手游记录。这确实是一项令人叹为观止的成就,并且它的持续热度也是很惊人的。

Pokemon GO如今的热度还像它刚发布一周时的那样吗?当然不是。Pokemon GO现在还是手游界的一大巨头而且拥有大规模玩家吗?是的。

我个人更希望数据公司可以更多地利用分析的方法发表观点,而不是用这种不符合事实的观点博人眼球。

总结

好了,来总结观点吧。我认为风险投资者和手游行业不用担心所谓的整体沉浸度“下滑”。关于沉浸度还是有其他因素在起作用,而不是像Flurry分析的那样。

虽然手游行业放缓了发展脚步,或者说走向成熟,但是这个行业接下来几年的增长率应该还是比较合理的(预计2016年至2020年的全球年均复合增长率为11.9%)。

作为独立的游戏制作人,我们要保持低调,不要去过多思考那些高高在上的宏观层面数据,而是应该集中精力创造出最好的手游,外面还有上百万个玩家等着玩你的艺术大作呢。

我们发行新游戏的当天还有其他699个新游戏也会在同一天上线,这就是一个更大的挑战。所以,保持低调就是最好的办法。

本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao

Wilhelm Taht is Executive Vice President of Games at Rovio. This article was originally published on Mobile Dev Memo.

Along with many colleagues and friends in the industry, I have been trying to wrap my head around Flurry’s yearly statements on engagement dropping in mobile games.

Their most recent statement regarding 2016 macro data states, among other things, that: ”Video Killed the Gaming Star: Gaming, the app category formerly known as “the darling of the mobile industry,” saw time-spent decline by 4% year-over-year.”

This seems a bit incomprehensible, given that the mobile games industry has grown from 2014 to 2016 at an astonishing 21.7% CAGR globally and commanded over 80% of IAP revenues generated in the mobile entertainment industry in 2016.

Red: China, Grey: US, Light Blue: Japan, Light grey: EU, Blue: South Korea, Black: Rest of world

During 2016, mobile games also took the helm in terms of overall games industry revenues, reaching a whopping $37 billion in end user generated IAP revenues, representing 37% of the 2016 total games industry’s $100 billion in end user generated revenues.

And keep in mind, this figure does not take into account advertising revenues (e.g. native reward videos), which is a considerable portion of the mobile games economy.

So how can it then be that engagement is reported to drop significantly year over year, both in terms of time spent per day and amount of sessions?

The above chart shows mobile app time spent in games, which grew 69% year-on-year in 2015 to 2016, with games falling by 4%.

Well, there are probably a few factors at play here.

#1 The overall difference between F2P and premium apps

Free-to-play / Freemium / F2P has been the dominant form of monetisation now in mobile games for a few years. At this point, roughly 99% of all end user generated revenues in mobile games originate from IAPs.

For a freemium economy to work well, you need players to return over time. Often times this is summarised as static retention or Day-N retention.

The more days you can engage a player of the player’s lifetime in the game, the better. What makes matters challenging in this respect is that games (regardless of whether they are F2P or not) are somewhat repetitive in nature.

In F2P games it’s a well-known fact that if you let players play through the content all at once, you won’t have anything for them to come back to the next day.

Consequently, it’s enough to let a player perceive he / she has played through everything or “seen everything”; that will make the player churn. And churn is the enemy in F2P. This is why F2P games have become quite good at employing so called “session mechanics”.

The widely known situations in F2P games such as “no more lives left -> return in an hour” or “you’ve now planted a seed -> come back in two hours to see the flower” are by no means there to throw players out; they are there to make players come back. Later – optimised to maximise the overall player lifetime engagement.

On the flip side, utility apps – messaging, video entertainment, music, sports, social media, etc. – are not built around this type of consumer behavior. They try to gulp up as much of your time as possible and not let you out of their grip. And they are, by and large, not as repetitive as games tend to be.

Given that the market is mature for mobile apps overall within Asia and the West (with 2.3 billion smartphone users globally last year spending on average one hour per day within mobile apps, this idea is fairly uncontroversial), it’s fair to say that the battle for consumer minutes is on.

However, this battle is fought completely differently in premium (or subscription) apps vs. F2P games. Premium (or subscription) apps try to command as much time as possible, F2P games spread it over time.

Taken to the macro level, I believe it’s to be expected that engagement is shown as dropping within mobile games and rising in other areas, i.e. an engagement drop in the mobile game space could be argued to be “by design”: “It’s a feature, not a bug”.

#2: Flurry’s position in the mobile app ecosystem

The next possible explanation actually slightly contradicts the previous one. Let me explain.

It’s a known fact (just read almost any other blog posts on Mobile Dev Memo) that data is important within mobile games.

Data, player data, often then summarised in high level, impressive sounding KPIs is one side of the “product coin”, where the other side is the game itself.

Without data, F2P designers, product managers and game analysts are utterly crippled. Data, when it comes to mobile games, is also (unfortunately) not one size fits all (or even one size fits most).

Take as a comparison a saga map based match-3 puzzle game vs a real time PvP battle game. The difference in design and the associated player data is immense.

Yes, ARPDAU and DAU are high level measures, largely comparable from one game to another, and any analytics system can spit those out.

But those metrics are rather useless for excellence in data driven game design. Data driven game design and excellence in live operations needs to go much, much deeper into the core game and player behavior.

Flurry’s strong growth within the mobile app ecosystem comes from a time where the landscape was vastly different than it is today. Flurry became synonymous to mobile app analytics during the premium era of mobile games.

In February 2017 it is unknown how many of the Top 100 grossing mobile games in the US use Flurry. Why unknown? Well, I have asked. Twice. And I have not received an answer yet.

@FlurryMobile re new study: https://t.co/rix8dc73mj what %age of current top 100 grossing games in the US has Flurry integrated @Simonkhalaf

— Wilhelm Taht (@wilhelm_taht) January 30, 2017

@FlurryMobile what percentage of top100 grossing iOS mobile games in the US use Flurry nowadays? https://t.co/oPH0IQfB6Z

— Wilhelm Taht (@wilhelm_taht) February 23, 2017

Given the evolution of the mobile games industry to a freemium economy, which is very complex in terms of data, I think it’s fair to expect that Flurry’s penetration within the top mobile games has diminished over time.

Considering top grossing games as a proxy for “time hogs” (games that gulp up most of a player’s time), it’s to be expected that Flurry’s macro level data would suggest that engagement is indeed dropping, if the percentage penetration in top grossing games also drops over time.

This would neatly explain why Flurry’s macro level data shows a downward trend in mobile game player engagement, all while mobile games industry revenue is continuing to grow.

Edit: This theory would also support the counter claim presented in the most recent data released by Unity and SuperData claiming that “mobile engagement was 19% higher in Q4 2016 than the year before”.

Indeed, the sample data for their study would be different than Flurry’s, considering that Unity aggregates their data from a huge scale of top to low performing mobile games.

The time hog theory is of course my own personal suggestion, but I do think it’s reasonable to expect that the games making the most money also command a better engagement than the average. Engagement is after all one of the key pillars in F2P design.

#3 Flurry’s other statements point to sometimes not having the big picture in mind

This last reason won’t win me many popularity points within Flurry’s ranks, but it has to be pointed out.

The very same blog post explaining the diminishing engagement in mobile games (referred to above) has this statement within it as well:

“This year’s first ‘hit’, Pokemon GO, faded relatively fast, as consumers lost interest in the game, only returning for marquee holiday events.”

It is absolutely astonishing that this statement got past Flurry’s and Yahoo’s PR Review. Pokemon GO is at the precise moment when writing this post (February 23rd 2017, 9.14 AM in Helsinki, Finland) the #1 Grossing App in the US.

It is the fastest mobile game ever to reach 500 million downloads. By February 2017, Pokemon GO has grossed a cumulative $1 billion in revenues. This is also breaking all previous records in mobile games; a truly breathtaking achievement and astonishing sustained performance.

Is Pokemon GO as hot as it was one week after its launch? Of course not. Is Pokemon GO still a behemoth and absolutely massive in scale at this point? Yes, it is.

Personally, I would expect a more analytical approach from an analytics company than running with such a populistic and uninformed statement.

Wrapping up

So, to wrap up the point. I think VC investors and the industry should not be very worried about the “slow down” in engagement overall. There are way more factors at play in this respect than what Flurry has shown in their analysis.

As an industry, albeit slowing down or ‘maturing’, mobile games still shows a very healthy growth rate over the next years (assumed global CAGR 2016 to 2020: 11,9%).

As individual games makers, let’s keep our heads down, not think too much about the macro level clouds that are sometimes painted above our heads, and focus on creating the best possible mobile games to the billions of players out there waiting to engage fully with our art.

That’s the best way to overcome the much larger challenge we all face the day when we release a new game: the 699 other new mobile games also being released that same day.(source:pocketgamer.biz )

闽公网安备35020302001549号

闽公网安备35020302001549号