开发者谈论出品一款价值游戏的五个步骤

本文原作者:Peter Fodor 译者ciel chen

在游戏开发界有一点很奇怪的是——许多开发者会在相当浅显的基础构架上搭建游戏或者app,投之以海量的时间、经历与资源。有强大的产品愿景是好的,不过如果开发者不了解市场境况、竞争、目标用户群、获取用户成本和表现评估标准,那就相当于闭眼航行。这样很容易造成大麻烦最后浪费了大把金钱和时间。

如今开发一款游戏的成本剧增,为了游戏能被曝光,花费的营销成本也在急剧增加。像Kabam这样的大型发行商拥有强大的IP可以使用——比如说“漫威游戏”——并且每款游戏都有大概1400万美金的预算;同时他们还有强大的用户基础坐等他们出新游戏。如果你想跟这些游戏业巨头竞争,那制胜关键就是你要在长征的一开始就选对方向。

以下是五个教你如何调查市场并且在着手开发项目之前评估其可行性的小贴士。

第一步:检测自己游戏的商业潜力

大概在一年前AppAgent曾经做过一个游戏代号叫做‘Gods&Guilds’的游戏。这是一个建筑类策略游戏,跟《部落战争》有点像,不过其故事背景是北欧神话。

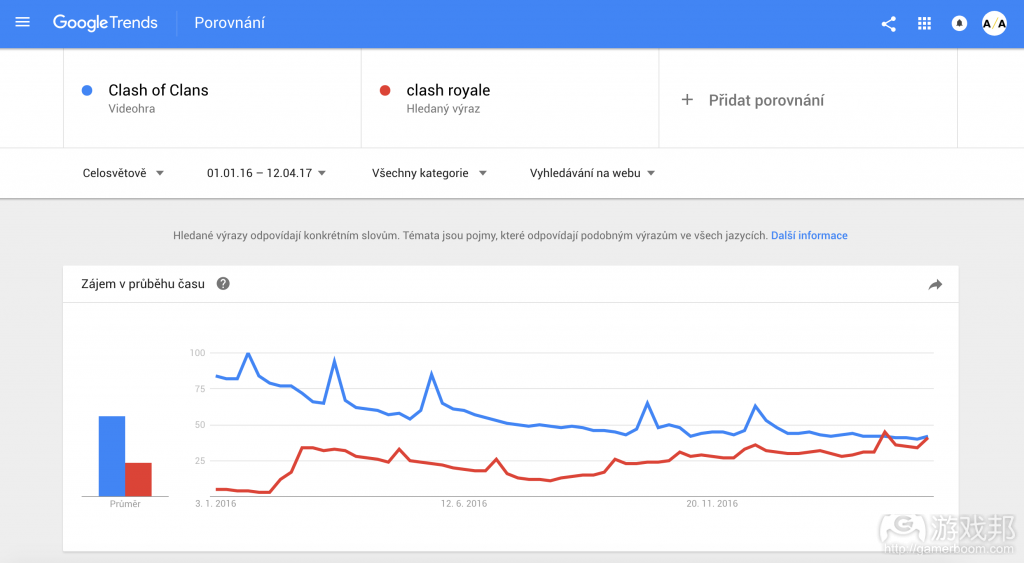

如果你有了对新游戏的想法,那第一件要做的事就是去谷歌趋势(谷歌公司的一项搜索产品)看看,了解一下同类的游戏都是如何展现的。你要做的这类游戏在搜索中是呈衰退趋势还是增长趋势?除此之外AppAnnie的排名也可以提供类似的见解。

这些趋势走向可以帮助你了解你的要开发的新游戏对于市场来说是适时的还是已经晚了的。随着时间的流逝,玩家的口味会变,而开发游戏则需要一两年的时间,所以你不会希望看到自己白白浪费时间开发了一款受众玩家骤减的游戏。在这种情况下,CoC的流行度在减退的时候,《皇室战争》站起来了,这表明了休闲新玩法的游戏吸引了更多的观众。当然了,如果比起大众休闲类游戏,你更想做一款小众或者“hard-core”类的游戏那也完全取决于你自己,不过研究了这个趋势之后你至少能了解一些市场动向。

接下来,你该评估一下各个游戏平台的商业潜力了。Priori Data或者其他收集市场情报的工具可以提供不同平台之间下载量和收入的各个比较。对于“Gods&Guilds”我们确认:尽管苹果系统占了下载量的36%并且几乎包揽了策略类型游戏的一半收益,但安卓系统所产生的收益足以让这款游戏把安卓系统做为第一平台,这让我们能以更低的每安装成本更快地决策发展,这在多人竞技游戏中是一个很重要的因素。

接着,对游戏收入排行榜榜首的第十名、第五十名、第一百名的平均收入进行分析也是一件很有趣的事。这帮助你了解其财政图表曲线、了解自己是否能赚到足够的钱(不管你能不能达到跟《部落战争》一样的流行程度)。

Newzoo可以提供很全面并且完全免费的市场报告和几个支付分析,这些数据主要针对个别行业、个别地域以及几个比如参与度指标、市场指标、趋势或者消费洞察力这些方面的。

第二步:清楚你竞争者的表现

一旦你感觉到选定的游戏类型有潜力,这时候就该看看你的竞争对手了。你要检查以下几个方面:

数字统计:等级评定、下载量、收入估值(从Priori Data和AppAnnie调查)

主题:你产品的独特卖点是什么?(可以从App Stroe/Play Store了解,最理想是从AppAnnie那里获悉)

主要特色:产品的主要优点是什么

回顾:优点、缺点以及实时的评级趋势(AppAnnie)

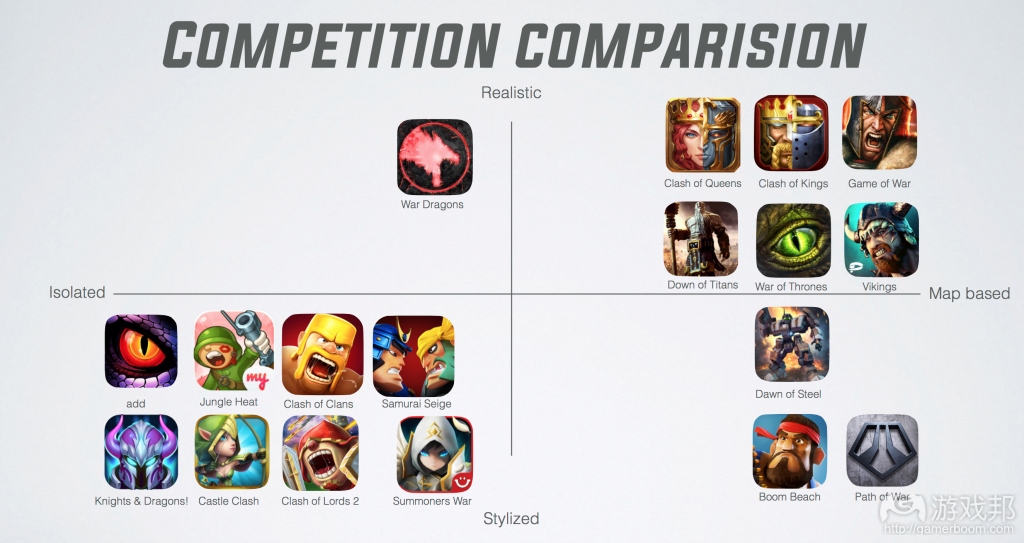

视觉效果:app在电子商城的展示效果如何

为了对Gods&Guilds有更深入的了解,我们编制了一个含几个关键指标的简单表格,然后在指标表格中观察竞争者的几个主要特征。在这里我们可以看出《部落战争》的游戏运营情况根本无人可比。就连其他大型游戏都没有它那么快的下载速率、ARPU也就3.5美元左右。再从视觉效果和概念上来看Gods&Guilds——作为一个独立游戏,要想把掌握住那种真实的视觉效果还有比较大的距离。

所以这个步骤是可以帮你的游戏找到一个独特的定位让它给市场带来一些新内容。这在Gods&Guilds中的体现是——构建一支由北欧神话中的英雄所组成的军队,以多人竞技的游戏模式为主,然而其现有的程序化的视觉效果跟很多其他市面上的游戏相矛盾。

第三步:找到关键性的用户见解

个人而言,分析用户是我最喜欢的部分,因为这让我能够形成一个很清晰的玩家档案。用户不仅仅是构建产品基础的一部分,而且是游戏的设计、商店清单、广告付费的预算以及创作引人注目的广告语时的信息提供方。

最佳的入手点就是从Facebook的Audience Insights,在这里你可以选择你所在领域中的顶级游戏或apps,分析用户的性别、年龄、地位还有甚至他们与该游戏其他粉丝之间在页面上(facebook)所存在的关联。Facebook还做了玩家分类,这让我们在用户个性上能够有所启发。也许这个方法有点过时了把,不过它依旧是最有用的方法:

你得要“深入地挖掘”更多的细节,来了解喜欢特定游戏或app的用户想法,他们是属于善于社交的还是竞争力强的,是否有客观的收入。最后一个问题可以在一定程度上由市场情报收集工具来回答,通过它你可以将游戏收益与下载量比值按照国家/平台/游戏类型来得到一个“购买指数”。这个指数值,结合一个估算出来的CPI和到达榜首的难度来考虑,可以帮助你游戏全球发行后挑选出你要主攻的目标市场。

目标用户群调查的关键在于市场规模的估算。技巧就是利用Fcebook Ads Manager来捣鼓捣鼓不同用户群的重叠部分有什么玩头以及甚至要从国家的层面上去了解玩家规模和玩家概况。即使你使用了其他广告网站(比如Adwords),或者视频网站,这都是对市场规模做一个相对比较的很好入手点。不过开发者还要意识到的是有一些特定的城市Facebook跟一些当地巨头公司比如俄罗斯的Vkontakte公司是存在竞争关系的。

第四步:计算利润

在这个什么都流行免费的世界里,商业表现的或起或落大多取决于每安装成本和生命周期价值的关系方程。如果游戏的生命周期价值能超过获取用户成本,这款游戏就能够扩大用户基础规模并提高收入。

LTV的计算将会是另外一篇文章的主题,因为在不远的将来这种模式将会产生更多不同的方法、方法论以及其他内容。计算生命周期(LTV),首先要将预期的用户留存指标乘上想达到的每日常活跃用户平均收益。这里不包括病毒式的或由于不同游戏类型、不同平台以及不同国家产生的有机提升,不过至少它让你对LTV的组成有了基本了解。如果你想了解更多有关LTV的内容可以读读Yaniv Nizan发表的文章,讲了很多不同的计算方法:

用户获取成本这一部分是比较容易估算的。我们可以使用AppAgent的两个免费数据资源:

Chartboost CPI Index:从美国地区3.48美元的CPI和Gods&Guilds的多玩家经济模式来看,大量活跃玩家的需求时非常明显的,因此我们需要在用户获取上支付上有大量的预算。这里为了促进游戏与“当地”的匹配程度,可以集中焦点在特定的时间区间来达到目的。

FB Ads Manager:现在开始进行CPI评估,首先要通过感兴趣目标群体选出你的竞争者清单,然后选出一个城市以及平台来查看建议的每点击成本。如果你把建议零售价除以电子商城中估算的转化率(如果你没有自己的历史数据,付费传播渠道IOS的平均转化率大概是45%、Android大概是40%)你就可以得到很好的每安装成本的估算了。如果你的开发者朋友中有人开发过你现在做的游戏类型的游戏,问问他们的在Google Play Console上用户获取费用报告中其转化率指标如何。目前对于Gods&Guilds而言,使用WIFI连接游戏的美国男性玩家CPI为3.65美元,这无疑表示需要高价值的游戏生命周期来经营可盈利的活动。然而优秀的游戏用户获取经历是能够利用新的格式、原始的创造力和想好办法确立指定目标让CPI降低的。并且,与此同时 IP大大们的转化率提升明显,CPI降低显著,这种情况Will Newell,前Space Ape Games的UA经理在《变形金刚:地球大战》已经证实过了。

从这里开始你就可以勇往直前去构建自己的增长模式了,该模式里面包括了付费和自然的传播渠道(交叉推广、口碑、甚至你对游戏自信的担保)。一旦你在用户留存量上和ARPDAU值上有所增加,你就很有可能在财政上有所收益。在Mobile Growth Stack web上William Gill描述了对手游成长模式的基本定义:definition of a mobile growth model。

第五步:检测出最有吸引力的游戏主题

鲜少有开发者会意识到检测游戏的创意方面内容。Will Newell就在AppAgent上透露说在Space Ape Games的时候他们就曾经通过Facebook Ads和CPM招标来检测变形金刚游戏的名字标签。因为有三个粉丝页面对这款游戏分别贴上了三个不同的产品标签。最后决定这款游戏的名字就是今天耳熟能详的“变形金刚:地球战争”。

在Geewa,我们最近提出了100个为新游戏想的名字。最后只有短短的四个名字进入了Facebook的检测阶段,广告把游戏品牌展现的像个艺术品,而主要的KPI就是这些广告的点击率。我最喜欢的‘Smashing Four’点击率是2.6%,而其他几个名字最低1.1%最高就1.6%。

Pixel Federation在这条路上走得更远,他们从视觉主题上对三款游戏进行了较量。“我们用了FB ads和Splitmetrics来测广告点击率和电子商城转化率。获胜的名字概念叫做BUTTON Blast,其点击率比其他两个多出1%。从转化率上来看,它以25%的转化率赢过了第二名17.5%的Music Match,Yummi Blocks以12%的转化率垫底。”Pixel Federation的手游市场经理Matej Lancaric这样说道。

总结

随着开发成本日益增高,越来越残暴的用户获取价以及游戏业越发激烈的竞争,做到尽可能降低失败的风险,作出聪明的商业决策是非常有必要的。而且现在有这么多免费数据和工具可以使用,你可以找到通往成功更直接的路。

以上说到的只是一些你可以做的事,似乎还有很多其他的技巧方法是能帮助分析市场验证思路的。作为想不断进步的狂热分子,我很乐意听到这些技巧方法。

本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao

Surprisingly, many developers invest enormous amounts of time, effort and resources in developing games or apps that are built on very shallow foundations. It’s great to have a strong product vision, but without understanding the market situation, competition, target group, acquisition costs and performance benchmarks, you are navigating blindly. As a result, it’s highly likely that you will run into trouble – wasting your time and your money in the process.

The cost of producing a mobile game has increased dramatically, and so have the marketing costs associated with getting your game noticed. Big publishers like Kabam work with strong IPs – Marvel in this case – and budgets of around $14M per game. They also have a large user base waiting for new titles. If you’re looking to compete with these industry giants, it’s vital to start the journey by heading in the right direction.

Here are 5 tips on how to research the market and evaluate the viability of your business prior to commencing development.

Step 1: Check the business potential

About a year ago AppAgent worked on the marketing of the game code-named ‘Gods&Guilds’. It’s a building strategy game similar to Clash of Clans, but based on the Norse mythology.

The first thing to do if you have an idea for a new game is to check Google Trends to understand how similar games are performing. Are they fading in search popularity or still going strong? Rankings in AppAnnie can provide similar insights.

The trend will help you understand whether your new game will be timely or late to the market. Over time, players’ tastes evolve, and with product development taking between 1 to 2 years you don’t want to waste your time developing for an audience that is shrinking. In this case, the popularity of CoC has declined as Clash Royale has grown, demonstrating a shift to more casual and fresh format addressing a larger audience. Of course, it’s entirely up to you if you prefer a more niché or ‘hard-core’ game genre than a mass-market casual approach, but by studying the trends at least you will know.

Next, you should estimate the business potential of each platform. Priori Data or other market intelligence tools provide comparison of downloads and revenues per platform. For Gods & Guilds we identified that, while iOS accounts for 36% of downloads and nearly half of the revenue in strategy games category, Android generates large enough revenues for it to be used as the first platform, enabling us to scale faster and at a lower Cost Per Install, which is an important factor for a multiplayer game.

Also, it’s interesting to analyse the average revenue of games at the 10th rank, 50th rank and 100th rank in the top grossing charts. This helps you to understand the monetary chart curve and see if you can earn enough money, even if you aren’t able to reach the popularity of a game like Clash of Clans.

Newzoo provides great – and totally free – market reports and several paid analysis focusing at specific verticals, regions or aspects such as engagement metrics, monetization metrics, trends or consumer insights

I also recommend Eric Seufert’s presentation: “Using (Free!) App Annie data to optimize your next game”.

Step 2: Identify the performance of competitors

Once you feel that the selected genre has potential, it’s time to look at the competition. You should check:

Stats: rating, downloads and revenue estimate (Priori Data, AppAnnie)

Proposition: what’s the unique selling proposition of your product (App Store/Play Store, ideally using AppAnnie)

Key features: what are the main product benefits

Reviews: pros and cons, the trend of the rating in time (AppAnnie)

Visual style: how the app is presented in the store

For a better understanding of Gods & Guilds we compiled key metrics in a simple table and then visualised main characteristics of the game’s competitors on a matrix chart. Here we can see that Clash of Clans operates in a completely different league. Even other big games have much smaller download velocity and an average ARPU of around $3.50. In terms of visuals and concept there’s a big space for an isolated game play with realistic visuals.

The result of this step is to help you find a unique position and to bring something new to the market. In Gods&Guilds the approach was to build an army of heroes from Norse mythology and focus at multiple game modes, yet the existing stylized visuals conflicted with many other games on the market.

Step 3 – Find key audience insights

Personally, my favorite part is the analysis of the audience because it helps to form a clear player profile. It’s the foundation for the product but also informs the design, the store listing, creating targeted paid ads and creating a compelling advertising message.

The best starting point is Facebook Audience Insights where you can select top games or apps in your segment and analyse audience by gender, age, status and even affinity to other fan pages. Facebook also conducted a segmentation of gamers which can serve as an inspiration how to think about user personas. It’s a little outdated, but it’s still useful:

You should ‘dive deep’ into the details to understand what users like about specific games or apps, if they are social or competitive and if they have a disposable income. The last question can be partly answered using a market intelligence tool where you can divide the revenue by downloads per country/platform/category and get an “Purchase Index”. This value, combined with an estimated CPI and difficulty to reach top charts, helps you to pick markets which you can focus on after the global launch.

A critical part of target group research is an estimation of the market size. The trick is in using Facebook Ads Manager to play with overlaps of different groups and understand the audience size and profile, even on a country level. Even if you will use other ad networks such as Adwords or video networks, it’s a good starting point providing a relative comparison of market sizes. Just be aware of specific countries where Facebook competes with local giants such as VKontakte in Russia.

Step 4 – Count the profitability

In the freemium world, the business stands or falls on the equation of Cost Per Install and Lifetime Value. If the LTV exceeds acquisition costs, you’re able to scale the user base and grow revenues.

The LTV calculation is a topic for a separate article which will follow in a near future as there are different approaches, methodologies and other elements of the model. To begin with you should start by calculating lifetime from expected retention benchmarks and multiply the value by desired Average Revenue Per Daily Active user. This doesn’t include any virality or organic uplift which differs by game genre, platform and country, but at least it gives you a basic understanding of the LTV component. For more about LTV read post by Yaniv Nizan where are different calculators:

The part of acquisition costs is easier to estimate. We at AppAgent use two free data sources:

1) Chartboost CPI Index: With a CPI of $3.48 in the US and Gods&Guilds multiplayer modes requiring a critical mass of active players it’s clear, we will need a big budget for the paid acquisition. The solution could be a focus at specific time zones to improve a “local” matchmaking in the game.

2) FB Ads Manager: to start the CPI estimation, select a list of your competitors using Interest targeting, pick a country and platform and check the suggested Cost-Per-Click. If you divide the suggested price by an estimated conversion rate in the store (for paid traffic this could be in average about 45% for iOS and 40% for Android if you don’t have own historic data) you get quite good Cost-Per-Install estimate. If some of your fellow devs have a game within your category, ask for Conversion Ratio Benchmarks in the Google Play Consoles under the Acquisition Reports tab. For Gods&Guilds the current estimate for the US male audience using Wi-Fi connection is $3.65 which creates high demand on the user lifetime value to operate profitable campaigns. Yet great mobile acquisition managers can drive the price lower, leveraging new formats, original creatives and smart approach to targeting. Also, big IPs significantly increase the conversion rate and drive the CPI much lower, a situation confirmed by Will Newell, former UA manager at Space Ape Games on Transformers: Earth Wars.

From this point on you can move forward and build your own growth model where you include paid and organic traffic (cross-promotion, word-of-mouth, even featuring if you’re confident to secure it). Once you add retention numbers and ARPDAU values you will get a possible financial outcome. A basic definition of a mobile growth model is described by William Gill at the Mobile Growth Stack web.

Step 5: Test the most appealing theme

Not many developers are aware of testing creative aspects of the game. Will Newell revealed at the AppAgent Academy that at Space Ape Games they’ve tested the name tagline of the Transformers game using Facebook Ads with CPM bidding. With three fan pages the test used the same creatives but different product taglines. The winning name is well known today: “Transformers: Earth Wars”.

At Geewa, we recently proposed over 100 names for a new game. The final shortlist of four went to the Facebook test, where the main KPI was the Click Through Rate of a mobile ad showing the brand name as an artwork. My favorite ‘Smashing Four’ reached a CTR of 2.6% where others reached between 1.1% to 1.6%.

Pixel Federation went even further and tested the visual theme of an upcoming match 3 game. “We’ve used FB ads and Splitmetrics to measure both the ads CTR and the store conversion. The winning concept called Button Blast reached 1% better CTR. In terms of conversion rate it won with 25% by far ahead of the second concept Music Match with 17.5% and Yummi Blocks with remaining two below 12%,” said Matej Lancaric, mobile marketing manager.

CONCLUSION

With high development costs, brutal acquisition prices and fierce competition, it’s necessary to lower the risk of failure and be smart about your business decisions. With the free data and tools available you can find a much more direct route to the success.

These are just some of the things that you can do, and it’s likely that there are several other techniques out there that can help you to analyse the market and verify ideas. As a growth fanatic I would love to hear them. Don’t hesitate to reach me via Twitter or by email peter at appagent.co.(source:gamasutra.com )

闽公网安备35020302001549号

闽公网安备35020302001549号