为什么现在是瞄准东南亚市场的好时机?

作者:Jacob Stempniewicz

为什么是东南亚?

东南亚的区域面积有将近450万平方公里,大概是美国国土面积的一半。这一区域是由以下国家所构成:

沿海:印度尼西亚,东马来西亚,新加坡,菲律宾,东帝汶,文莱

大陆(俗称印度支那):柬埔寨,老挝,缅甸,泰国,越南和西马来西亚。

20世纪,因为经济与政治上的动荡,这些国家拥有各种不同的命运,但从整体上看来它们还是呈现快速发展的态势。在过去十年里,该区域的平均年增长率超过了5%。如果将东南亚算成一个国家来看,它便会是世界上的第九大经济区。

最近,该区域更是开始追赶发达世界,并且这里也成为了包括手机游戏在内的一个巨大市场。整个东南亚的经济发展前景,庞大的人口以及快速发展的互联网连接(特别是手机方面)都标志着这里具有非常稳定的游戏发展。此外,对于外国公司来说,相比中国或俄罗斯,东南亚还是一个比较容易进入的市场。许多已经成功攻克西方市场的日本,韩国和中国的游戏公司已经开始将自己的注意力转向东南亚,因为不管是从地理还是(游戏)文化看来这里都与本国更相近。同时,西方公司也发现了这一潜力并开始在东南亚设立办公室并进行内容本土化。所以东南亚正逐渐成为手机游戏的一大关键战场,特别是当当地市场还未被当地公司所分割时。

为什么是手机游戏?

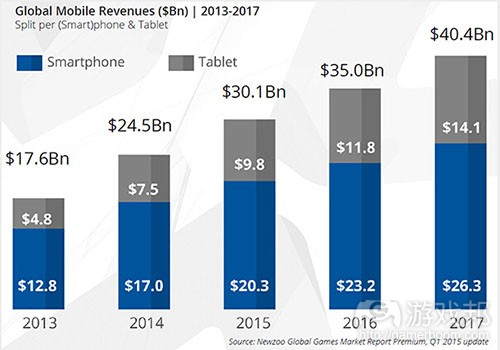

根据Newzoo,2014年全球手机市场已经创造了245亿美元,即手机和平板电脑分别创造了33%与57%的增长率。并且在今后几年里这种发展趋势仍将继续延伸,到2017年手机市场将会创造超过400亿美元的收益。尽管全新平板电脑的单位销量并不乐观,但是平板电脑上的游戏收益却比智能手机游戏收益发展更为迅速,从而使平板电脑成为了一个关键游戏设备。

较高的手机增长率是受到有机增长,整体市场的发展以及同类相食的增长的推动,并且是以其它领域的衰败为代价。除了手机发展一开始所创造的“伤亡”(如掌上游戏机,在线休闲和社交游戏)外,Newzoo还注意到PC游戏和MMO游戏出现了较为缓慢的发展(因为需要与手机设备分摊消费)。从收益来看,在2015年手机已经成为最大的游戏平台。付费玩家的增多以及玩家游戏时间的增长不断推动着西方市场的发展,与此同时伴随着网络连接的发展,智能手机渗透率的提高以及3G和4G连接的实现也推动着像东南亚等新兴市场的快速发展。

东南亚的手机游戏

手机游戏主导着东南亚市场。2015年,手机游戏收益几乎占据东南亚市场总收益(140亿美元)的一半。到2017年,手机收益将以每年56%的增长率发展,并达到130亿美元。而推动这一快速发展的一大根源便是该区域不断发展的手机网络连接。

东南亚中的六个国家占据了该区域手机游戏市场份额的最大比例。这六个国家分别是印度尼西亚,马来西亚,菲律宾,新加坡,泰国和越南。这六个国家的总人口已经达到东南亚总人口的90%。该区域中年轻人占据了巨大的比例。这一点也让东南亚在世界经济体系中拥有强大的竞争优势。

到2017年,东南亚游戏市场的收益将翻两番,即达到220亿美元。并且从游戏收益来看,泰国将仍然作为东南亚最大的市场,紧接着便是印度尼西亚和马来西亚。新加坡仍继续发展,但其市场份额将输给那些发展更快的国家。而越南与泰国将与整体市场同步发展去保持自己的市场份额。

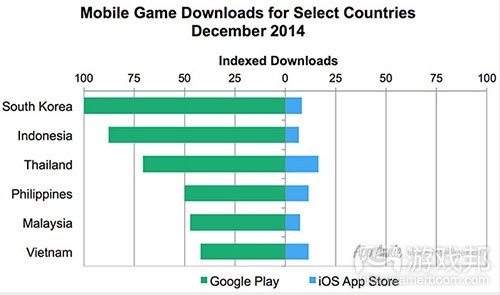

在该区域,游戏是人们使用手机设备的最大目的之一。根据谷歌的调查,在这六大东南亚市场中有超过1/3的智能手机拥有者在过去七天里至少会玩一次游戏。我们可以在iOS App Store和Google Play上看到该区域强大的手机游戏用户,特别是在与世界上最大且最具影响力的应用市场韩国相比较时。在2014年12月,印度尼西亚的游戏下载量已经达到韩国的90%。而拥有较低下载量的越南也将近韩国游戏下载量的一半。

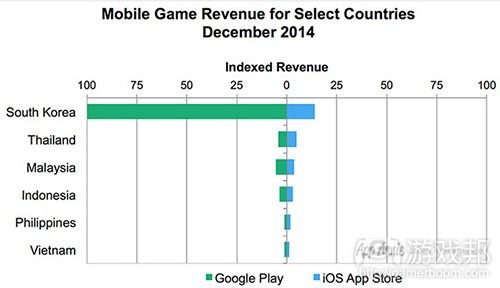

尽管这里拥有较高的游戏下载量,但其应用商店收益仍然处于较早的发展阶段,就像第二张图表上所显示的那样。

值得注意的是应用商店收益只是这些国家整体手机游戏机遇中的一部分。发行商也经常会使用广告和其它间接或基于补贴的盈利策略去补充游戏从应用内部购买,付费下载以及应用内部广告中所创造的直接收益。IAP与广告之间的裂缝正在不断变大。一些发行商已经开始提供游戏内部货币去取代观看广告的设置。就像韩国那样,马来西亚和泰国都是较为传统的亚洲在线PC游戏市场,从2000年代以来人们才开始习惯于花钱玩在线游戏。同时根据Euromonitor在2014年上半年的一系列研究,比起其它三个市场,马来西亚和泰国拥有更高的每年可支配收入与信用卡渗透率。而那些愿意且有能力在马来西亚和泰国消费的玩家将引导着这两个国家的手机游戏盈利的发展。

东南亚手机游戏的迅猛发展

看着东南亚市场的快速发展是很有趣的。从2013年到2014年,智能手机在印度尼西亚的渗透率从13.8%发展到21.3%,并且在2015年将达到26.3%,即将创造出超过6000万的消费者。同样地,根据Global Connected Consumer2014年的研究,现在已经有36%的越南人拥有智能手机,这一数值是过去一年的两倍。从历史上来看,印度尼西亚和越南在经济方面一直落后于马来西亚和泰国,即这些国家拥有较低的PC和网络渗透率。所以智能手机和手机网络在这类型市场中取得了更大的变革,因为它们面对的是拿些缺少发达的地上通讯网络设备的较低收入用户。手机游戏将通过提供可支付且具有吸引力的娱乐形式(游戏邦注:即用户能够随时随地访问这些内容)而推动应用的发展。有趣的是,收益的发展更迅速。这五个东南亚国家在iOS和Google Play上的总收益从2013年到2014年整整翻了两倍。越南和马来西亚更是拥有最高的增长率,即分别为150%和115%。甚至在拥有最低增长率的泰国,其手机游戏收益也增长了75%。

国家间的差异

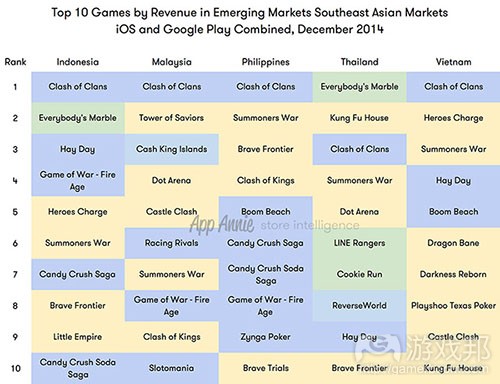

在过去十年里,不同的经济条件与电信基础设施在新兴的东南亚市场的个人计算机设备渗透与互联网使用方面扮演着关键角色。结果便是消费者将拥有不同的应用与手机行为和喜好。像印度尼西亚和菲律宾等较不发达的国家并不能吸引太多来自应用发行商的注意。这些国家的手机游戏趋势大多都是受到西方市场的影响,同时也会受到中国,日本和韩国的影响。在印度尼西亚,像《部落战争》和《Candy Crush Saga》这样具有全球知名度的游戏在2014年12月于收益排行榜中的排名是第五,而下载量排名则是第七。而在菲律宾的排名是收益第五,下载量第七。然而与在日本和韩国不同的是,Supercell和Kind并未依赖于电视和户外广告活动去获取用户或提升排名。似乎在这五个新兴东南亚市场中的发展都更加有机化。在印度尼西亚和菲律宾,用户获取更多是通过像Facebook等自动化广告渠道。

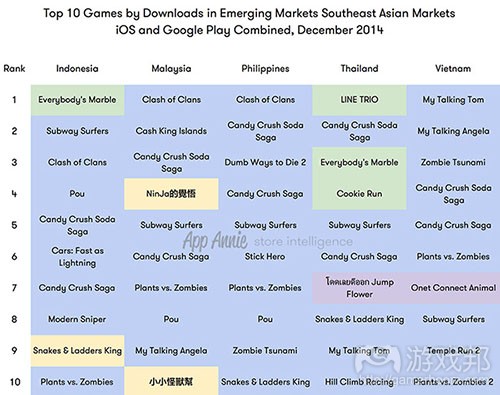

蓝色:全球/西方游戏 黄色:亚太区游戏 紫色:东南亚游戏 绿色:LINE游戏

蓝色:全球/西方游戏 黄色:亚太区游戏 紫色:东南亚游戏 绿色:LINE游戏

而越南,泰国和马来西亚的故事与印度尼西亚和菲律宾有所不同。因为拥有更优越的经济条件和基础设施,所以这些国家也拥有更强大的PC渗透率与互联网使用率,这也为它们的PC在线游戏发展奠定了基础。在过去十年里。来自中国,日本和韩国的游戏公司通过在这里建立附属公司或给予当地合作者游戏授权而进入了这些市场。在2014年12月,像《Summoners War》,《Dot Arena》和《Castle Clash》等侧重内容的亚洲角色扮演游戏或策略游戏在马来西亚,泰国和越南的收益排行分别为第五,第四和第六。印度尼西亚和泰国拥有最多玩家—-将近50%的玩家在此购买手机游戏。而新加坡的付费手机玩家数相对最低,但是在这里每个玩家所消费的数额却相对更高。

移动通讯平台和游戏

在中国,日本和韩国,消息应用不断延伸着自己的功能并变成了连接新用户与游戏和在线服务的桥梁。而在去年这一趋势也延伸到了东南亚市场。Andovar的客户LINE便是该区域的市场领导者。2014年12月,在马来西亚,印度尼西亚和泰国,LINE在应用排行榜上占据着第一名的位置,同时它也在下载排行榜前20名内。在菲律宾和越南,尽管LINE并未出现在前10下载排行榜单中,但其收益仍在前10。而微信在马来西亚的渗透率也很高,可以说是该国另一大通讯应用领头军。尽管在该区域还有像Viber,Facebook Messenger和BBM等受欢迎的通讯应用,但LINE仍然是创造巨大的游戏组合的大功臣。不过在其它东南亚市场中,通讯平台还处于较早的发展阶段。一旦它们能够吸引足够的应用去利用这样的网络效应,它们便能够将游戏和服务传递给大量的用户基础。像Viber和Tango等西方通讯应用也希望能够凭借这一趋势将游戏整合到自己的平台而赚取更大利益。在2014年获得来自阿里巴巴的2.5亿美元的投资的Tango已经拥有超过2.5亿注册用户以及大量的游戏(游戏邦注:不管是国内还是国外)。根据该公司所提供的信息,游戏在Tango平台上比不在该平台上拥有超过2至3倍的用户终身价值。2月份的时候,Viber为其2.36亿月活跃用户提供了游戏服务,并在这五个国家成功进行了两个月试运行。

该区域与其它区域的区别

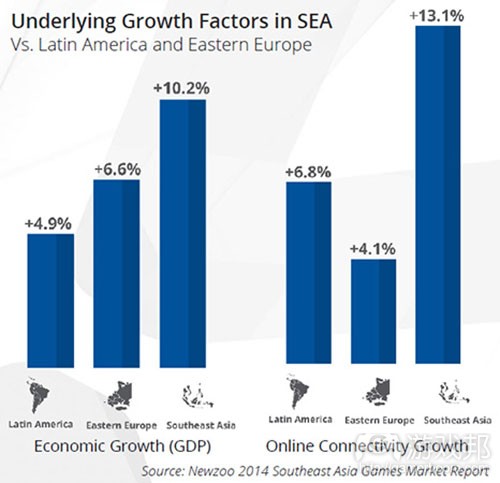

在看到了手机游戏的需求后,许多来自亚洲的PC和主机游戏发行商很快便转向了手机为主的运行策略。那时候,投资社区不断往这个市场中投钱并创建更多公司去争夺在手机领域的主导地位。在中国,日本和韩国,手机游戏竞争从未如此激烈,一些充满斗志的发行商们不断寻找着全新机遇。而东南亚市场便成为他们的下一个目标,就像在其它市场那样,游戏也将引领该区域的发展。就像下图所示,东南亚的发展速度比拉美和东欧等同样的新兴区域更迅速。

尽管中国也是一个具有较快发展速度以及庞大人口的巨大市场,但是对于西方手机发行商来说要进入东南亚市场更加简单。因为这里拥有较低的竞争率,较少的规则以及关于Google Play和iTunes App Store等西方国家传统的分销渠道的广泛使用率。在菲律宾,西方游戏是最受欢迎的,即占据了游戏排行前列的65%。而在泰国,排行前列游戏中只有35%是来自西方国家,这也是六大东南亚国家中最低的比例。到目前为止King和Supercell是最具主导性的西方发行商,我们总是可以再该区域的每一个前20名排行榜中找到她们的游戏。

此外东南亚还具有许多与西方国家一样的社交网络选择。就像在越南95%使用手机社交网站或聊天应用的人都是选择Facebook。而在该区域Facebook用户最少的国家是印度尼西亚,但其用户仍然高达78%。在这里Twitter和Instagram也很受欢迎,就像泰国的Siam Paragon是2013年Instagram上最多人定位的位置。

Android还是iOS?

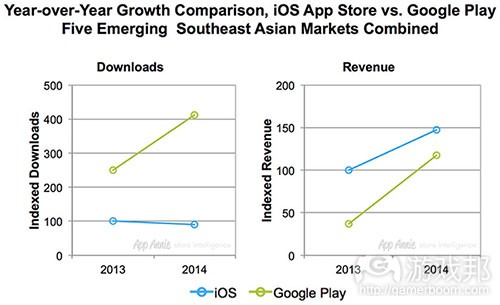

在五大新兴东南亚市场中(游戏邦注:越南。马来西亚,菲律宾,泰国和印度尼西亚),从安装率看来,Android的影响力超过了iOS。因为该区域的购买力普遍偏低,所以价格较低的Android设备更占优势。2014年,Google Play所创造的手机游戏下载量是iOS App Store在五个新兴东南亚国家的手机游戏下载量总和的4倍。这两大平台间的最大差距出现在印度尼西亚,在这里Google Play的规模是iOS的9倍大。而最小的区别则在越南,Google Play的规模是iOS的3倍大。而在2014年,iOS仍维持着其在游戏盈利的主导地位,并且在上述五个市场中的总盈利数是Google Play的1.3倍。在泰国,越南,印度尼西亚和菲律宾,iOS App Store的主导性大概是在1.3倍至2倍。而马来西亚应该是唯一一个在2014年Google Play收益未低于iOS App Store的国家。从每年的发展来看,不管是下载量还是收益,Google Play的发展速度都快于iOS。在这五个东南亚市场中,Google Play在2014年的下载量增长了65%,并远远超过了iOS。同时,Google Play的收益增长了将近220%,而iOS只有45%。因为比起2013年的iOS,Google Play是从较低的起点开始增长,但在这短短的一年内它的确拥有惊人的增长速度。

2015年2月,Google在菲律宾和印度尼西亚发布了Android One设备,并承诺之后会推出更多产品。Android One是针对于发展中国家而设计的一组智能手机,即侧重于让人们购买他们的第一款智能手机。Android One智能手机将运行Google Mobile Services并能够基于谷歌所提供的硬件设计参考。因为谷歌深入参与硬件和软件标准,所以便减低了制造商去创造具有更高性价比的手机的研究与开发成本,而这也是发展新兴经济的市场份额的关键。

东南亚国家的语言

尽管因为国际业务以及流行文化的关系,该区域所有国家的居民都很熟悉英语,但却不是每个国家的居民都能流利地使用这门语言。在新加坡和菲律宾,英语是作为他们的第二官方语言。在马来西亚,英语是第二活跃语言,而在其它东南亚国家里,英语通常只是用于业务场合中。另一方面,在中国英语的渗透率仍然不到1%。我们可以从下图看出其中的差异。

尽管在马来西亚和新加坡会有许多玩家能够接受英文版本的游戏,但是在其它东南亚国家可不一定如此。举个例子来说吧,泰国是其中最大也是最有前途的市场,但是在提到英语水平时它却远不如其周边国家。同时,比起使用原有的西方国家语言,面向泰国进行本土化更具挑战性。老挝语,柬埔寨语和缅甸玉也是如此,它们都有各自的难度。

结论

手机游戏已经大大推动了全球应用经济的发展。在2014年12月,手机游戏已经占据了游戏总收益的80%,并且iOS和Google Play上的下载量也达到了游戏总下载量的40%。在中国,日本和韩国这些亚洲最大的应用市场中,手机游戏已经站稳了脚跟。而现在我们相信东南亚也是一个值得开拓的市场,因为:

在新兴的东南亚市场中,游戏已经是最大的手机应用类别。尽管今天在这里手机游戏收益还不是很多,但是它们正以一种惊人的速度快速发展着。

2014年在新兴东南亚市场中手机游戏经历了超快速的发展。在iOS和Google Play的游戏下载量增加了50%,有些国家的游戏收益更是增长了100%。

拥有大量渴望娱乐体验并随时准备着购买下一款热门游戏的居民的区域仍然存在巨大的市场潜力,并且这也将为游戏分销平台提供巨大的机遇。

对于一些国际性发行商来说,比起像俄罗斯或中国等新兴国家,东南亚市场更容易挤进去。

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转发,如需转载请联系:游戏邦)

Why now is the time to localize your mobile game for Southeast Asia

by Jacob Stempniewicz

Why Southeast Asia?

Southeast Asia is an area of approximately 4.5 million square kilometers, roughly half the size of the United States. Countries that make up the region are:

Maritime Southeast Asia: Indonesia, East Malaysia, Singapore, Philippines, East Timor, and Brunei.

Mainland Southeast Asia (known as Indochina): Cambodia, Laos, Myanmar (Burma), Thailand, Vietnam, and West Malaysia.

In the 20th century, the countries have seen mixed fortunes in terms of economy and political upheavals, but overall the story has been one of rapid growth. Over the past decade, the region has averaged a growth rate of more than five percent per year. If Southeast Asia were one country, it would be the world’s ninth-largest economy.

Until recently, the region was seen as playing catch-up with the developed world, but it’s now achieving a status of a significant market, including for mobile gaming. Southeast Asia’s economic growth prospects, huge population and fast-rising internet connectivity (especially mobile) all point towards solid growth in terms of game spending for many years to come. In addition, for a foreign company Southeast Asia is a region that could be easier to access than for instance China or Russia. Southeast Asia is interesting for one other reason. Many Japanese, Korean and Chinese game companies have had mixed success in trying to conquer the West and have since shifted their attention to Southeast Asia which is closer in terms of geography and (game) culture. At the same time, Western companies have spotted the potential and set up local offices and localized content. Southeast Asia is gearing up to be a key battleground for mobile games, especially since the local market has not been divided up between homegrown players yet.

Why mobile gaming?

According to Newzoo, the global mobile market reached $24.5Bn in 2014, following impressive growth rates of +33% and +57% for (smart)phones and tablets respectively. Growth is expected to continue in the coming years, with the mobile market generating more than $40Bn by 2017. Despite a widely reported slump in new tablet unit sales, game revenues on tablets are growing faster than smartphones, cementing their position as a key gaming device.

The high mobile growth rate is driven by both organic growth, lifting the overall market, and cannibalistic growth, at the expense of other segments. In addition to the initial casualties of mobile growth (handheld console and online casual and social gaming), Newzoo notes signs of slower growth in (online) PC games and MMOs as spending is diverted to mobile devices. Mobile is now expected to become the largest game segment by revenues in 2015. Mobile games continues to grow in terms of players and revenues across regions. An increase in the number of paying gamers and time spent gaming is fueling the Western markets while rising online connectivity, smartphone penetration and the availability of 3G and 4G connectivity drives rapid growth in emerging markets, such as Southeast Asia.

Mobile gaming in SEA

Mobile games dominate in Southeast Asia. In 2015, mobile revenues already account for nearly half the $1.4Bn Southeast Asian games market. By 2017, mobile revenues alone will approach $1.3Bn, growing at an impressive CAGR (2013-2017) of +56%. Underlying this growth is the fast-rising (mobile) internet connectivity across the region.

Six countries in Southeast Asia are responsible for the lion’s share of the region’s mobile gaming market. The “Big 6” are Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam. The Big 6 countries account for nearly 90% of the population of Southeast Asia. Much of the region’s population is young, with the majority in, or about to enter, the working age demographic. This plays a key role in the region’s current and forecast competitive advantage in the world economy.

Revenues of the Southeast Asian games market are expected to double to $2.2Bn by 2017. Thailand will remain the largest market in terms of gaming revenues in Southeast Asia, closely followed by Indonesia and Malaysia. Singapore will continue to grow but will lose market share to faster growing countries. Vietnam and Thailand will grow in line with the overall market, maintaining their market share.

Gaming is one of the most popular uses for mobile devices in the region. A Google survey indicated that over 1/3 of smartphone owners in each of the Big 6 Southeast Asian markets played mobile games at least once in the last seven days. The popularity of mobile gaming in the region is reflected in the iOS App Store and Google Play, especially when compared to South Korea, one the world’s largest and most influential app markets. In December 2014, the download volume for games in Indonesia was approximately 90% of South Korea’s. Vietnam, with the smallest download volume in the region, amounted to half of South Korea’s.

While download numbers are high, app store revenues are still in the very early stages of growth, as shown in the second chart.

It is also worth noting that app store revenue is just a part of the overall mobile game opportunity in these countries. Publishers commonly use advertising and other indirect or subsidy-based monetization strategies to supplement the direct revenue that games generate from in-app purchases, paid downloads and in-app advertising. The split between IAP and advertising is growing ever wider toward advertising. Some publishers go as far as offering in-game currency in exchange for watching ads. Like South Korea, Malaysia and Thailand are traditional Asian online PC game markets since the 2000s where people are much more used to paying for online games. Also, according to a series of research conducted in early-mid 2014 by Euromonitor, annual disposable income and credit card penetration are higher in Malaysia and Thailand than in the other three markets. Both the willingness and ability to pay in Malaysia and Thailand might lead to better monetization of mobile games in these two countries.

SEA Mobile Gaming Skyrocketed

It is also interesting to see how quickly the Southeast Asian markets developed. Game downloads on iOS and Google Play combined across Vietnam, Malaysia, Philippines, Thailand and Indonesia grew 45% from 2013 to 2014. Vietnam claimed the highest growth rate, increasing 95% over this period. Indonesia was next with an increase of 85%. Philippines and Thailand saw moderate growth of about 25%, while download growth in Malaysia stabilized like mature markets such as South Korea and Japan.

Skyrocketing smartphone penetration was a major driver of this download growth. According to eMarketer, smartphone penetration in Indonesia grew from 13.8% to 21.3% between 2013 and 2014, and is expected to reach 26.3% in 2015, which translates to more than 60 million consumers. Similarly, the Global Connected Consumer Study 2014 claimed that 36% of Vietnam’s population currently own a smartphone, nearly double previous year’s figure. Historically, Indonesia and Vietnam have lagged behind Malaysia and Thailand on economic metrics, contributing to lower PC and internet penetration in those countries. Smartphones and mobile internet are more transformative in these types of markets because they are accessible even to low-income users who lack access to well-developed landline network infrastructures. Mobile gaming propelled app growth by providing an affordable and engaging form of entertainment which users can access anytime and anywhere. Interestingly, revenue experienced even more impressive growth. For these five Southeast Asian markets combined, the total mobile gaming revenue on iOS and Google Play nearly doubled from 2013 to 2014. Vietnam and Malaysia experienced the highest growth rates, at 150% and 115% respectively. Even Thailand, with the lowest growth rate among the five, saw its mobile gaming revenue grow by a staggering 75%.

Differences between countries

Over the past decade, differing economic conditions and telecommunication infrastructures played a key role in shaping personal computing device penetration and internet access in emerging Southeast Asian game markets. As a result, consumers developed different app- and phone-related behaviors and preferences. Less developed countries like Indonesia and Philippines have drawn less attention from app publishers. Fashion and trends in mobile gaming in these countries have been heavily influenced by Western markets, with inroads from China, Japan and South Korea. In Indonesia, globally popular games like Clash of Clans and Candy Crush Saga took 5 of the top 10 spots by revenue and 7 spots by downloads in December 2014. In Philippines, global leaders took an even higher share: 6 of the top 10 spots by revenue and the entire top 7 by downloads. However, unlike in Japan or South Korea, Supercell and King did not rely on massive TV and outdoor advertising campaigns to acquire users and climb up ranks. It seems that the growth in these five emerging Southeast Asian markets was more organic. In Indonesia and Philippines users were acquired more through advertising automation channels such as Facebook.

Blue: Global | Western Games | Yellow: Asia-Pacific Games | Purple: Local Southeast Asian Games | Green: LINE Games

Blue: Global | Western Games | Yellow: Asia-Pacific Games | Purple: Local Southeast Asian Games | Green: LINE Games

The story in Vietnam, Thailand and Malaysia is different from Indonesia and Philippines. Better economic conditions and infrastructure in these countries enabled higher penetration for PCs and internet access, which laid the foundation for PC online games. Over the past decade, game companies from China, Japan and South Korea entered these markets by establishing subsidiaries or licensing game products to local partners. In December 2014, Asian content-heavy role playing or strategy games like Summoners War, Dot Arena and Castle Clash took 5 of the top 10 spots by revenue in Malaysia, 4 in Thailand, and 6 in Vietnam. Indonesia and Thailand boast the largest percentage of payers – nearly 50% of players there spend money on mobile games. While Singapore has the lowest percentage of paying mobile gamers, in dollar terms they spend more than others per player.

Mobile Messaging Platforms and Gaming

Messaging apps are expanding their ability to serve as gateways to new audiences for games and online services in China, Japan and South Korea. This trend was already evident in Southeast Asia in the past year. Andovar’s client LINE is a market leader in the region. In Malaysia, Indonesia and Thailand, it took the #1 spot by revenue among apps outside of games in December 2014, and also ranked in the top 20 on the download charts. In Philippines and Vietnam, even though LINE didn’t rank in the top 10 by downloads, it still reached the top 10 by revenue. WeChat, which made significant progress in Malaysia, could be another major messaging app contender in the country. While there are other popular messaging apps in the region like Viber, Facebook Messenger and BBM, LINE was the only one that has successfully built a large game portfolio. However, in other SEA markets messaging platforms are still in the earlier stage of their product lifecycle. Once they hit a critical level of users to capitalize on network effects, they could roll out games and services to their massive user bases. Western messaging apps are also hoping to cash-in on this trend with popular apps such as Viber and Tango integrating games into their platforms. Tango, which received $215 million in investment from Alibaba in 2014, has over 250 million registered users and a huge selection of games, both in-house and externally made. According to the company, games on the Tango platform have 2-3x Life Time Value than that of the same games off platform. In February, Viber made its game service available to its 236 million monthly active users, following a successful two month pilot in five countries.

How does the region compare to others?

Witnessing the demand for mobile games, many PC and console game publishers from Asia swiftly pivoted to a mobile-first strategy. At the same time, the investor community continued to inject cash into the market and incubate companies vying for mobile dominance. Competition in the mobile game sector has never been fiercer in China, Japan and South Korea, motivating publishers to seek fresh opportunities. Southeast Asia could become that next frontier, and games are set to lead this growth just as it has elsewhere. Southeast Asia is growing faster than other emerging regions such as Latin America and Eastern Europe, as illustrated below.

While China is a very attractive market also characterized by high growth and a huge population, Southeast Asia may be easier to enter for Western mobile publishers. The reasons behind this are lower competition, less regulation and widespread use of established Western distribution channels such as Google Play and iTunes App Store. Half the top grossing games in Southeast Asia are Western titles. Western games are the most popular in the Philippines, where they make up 65% of the top games. Only 35% of the top games in Thailand are Western, the lowest percentage out of the Big 6. King and Supercell are by far the most dominant Western Publishers, with appearances in every Top 20 ranking.

Southeast Asia also shares many of the same preferences for social networks as the West. As high as 95% of those using mobile social networks or chat applications in Vietnam are actively on Facebook. The lowest percentage of Facebook users in the region is Indonesia, and that is still high at 78%. Twitter and Instagram are also popular, with Thailand’s Siam Paragon mall topping the global list of locations on Instagram in 2013.

Android or iOS?

In the five emerging Southeast Asian markets (Vietnam, Malaysia, Philippines, Thailand and Indonesia), Android holds a significant lead over iOS in device install base. The combination of lower purchasing power prevalent in the region and direct smartphone distribution favors the lower-priced Android devices. In 2014, Google Play generated more than 4 times the mobile game downloads as the iOS App Store in the five emerging Southeast Asian countries combined. The largest difference occurred in Indonesia, where Google Play was 9 times the size of iOS. The smallest difference was apparent in Vietnam, where Google Play was 3 times the size of iOS. iOS maintained its lead position in game monetization and was 1.3 times as large as Google Play in the abovementioned five markets combined in 2014. In Thailand, Vietnam, Indonesia and Philippines, the iOS App Store’s lead ranged from approximately 1.3 times to 2 times. Malaysia was the only country where Google Play’s revenue did not trail iOS App Store’s in 2014. In terms of year-over-year growth, Google Play grew faster than iOS in 2014 in both downloads and revenue. In the five Southeast Asian markets combined, Google Play downloads grew by 65% in 2014, substantially outpacing iOS. Meanwhile, Google Play revenues grew by approximately 220% and iOS by roughly 45%. Google Play’s growth started from a much lower base point compared to iOS in 2013, but it has exhibited impressive growth velocity in just one short year.

In February 2015, Google released Android One devices in Philippines and Indonesia, promising more were on the way. Android One is a set of smartphone standards designed for customers in developing countries primarily focused on people buying their first-ever smartphones. Android One smartphones run nearly stock Android with Google Mobile Services and can be built on reference hardware designs provided by Google. Google’s deeper involvement in software and hardware standards should reduce manufacturers’ R&D costs to help create more affordable phones, which is key to growing market share in emerging economies.

The languages of Southeast Asia

While all countries in the region are familiar with English as a language of international business and popular culture, actual fluency varies by country. In Singapore and the Philippines, English is an official second language. In Malaysia, English is an active second language, while other countries in Southeast Asia widely use English in business contexts. In China, on the other hand, English penetration is still less than 1%. The below EF EPI English proficiency index by English First shows the differences clearly.

While many players in Malaysia and Singapore will be satisfied with English language version of the game, the same cannot be said about remaining countries. For example, Thailand is one of the largest and most promising markets, but is far behind its neighbors in the region when it comes to English proficiency. At the same time, localization into Thai is much more challenging than into established Western languages, or even Chinese or Japanese due to a complex writing system. The same can be said about Lao, Cambodian and Burmese, which all pose their own difficulties. With offices in Singapore and Thailand and many years of experience with Southeast Asian languages, Andovar is able to advice on the best approach and ensure successful localization into the languages of the region.

Summary

Mobile gaming has driven the growth of the global app economy. In December 2014, games accounted for roughly 80% of all revenue and 40% of all downloads generated worldwide on iOS and Google Play. In China, Japan and South Korea, Asia’s largest app markets, mobile gaming already has a strong foothold. We believe Southeast Asia is especially interesting to enter now because:

Games is already the largest mobile app category in emerging Southeast Asia. Although mobile game revenues may not be large today, they are growing at a staggering rate.

Mobile games experienced surprising growth in 2014 in emerging Southeast Asia. Game downloads across both stores climbed nearly 50%, with some countries showing game revenue growth of over 100%.

There are still blue-ocean markets in the region with entertainment-hungry populations ready to consume the next hit game, and ripe opportunities for game distribution platforms.

Southeast Asian markets are easier to enter for international publishers than other emerging countries, like Russia or China.(source:gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号