每日观察:关注《Monster Strike》及僵尸应用(5.13)

1)据venturebeat报道,任天堂将与其合作伙伴DeNA在明年发布5款智能手机游戏,但并未透露这几款手机游戏将运用到哪个任天堂IP。

任天堂总裁岩田聪表示,公司有意在游戏发布后投入大量时间运营这个项目,以显示任天堂在智能设备业务上的决心。

2)据venturebeat报道,日本手机游戏及社交网络公司Mixi发布财报显示,截止3月31日,动作角色扮演游戏《Monster Strike》(发布于2013年10月)全球下载量已超过3000万(据gamasutra报道该游戏日收益为380万美元),推动公司销售额同比去年增长828.9%。上一财年第4季度公司收益超过3.5亿美元。

Mixi还宣布已投入开发任天堂3DS版本的《Monster Strike》(预计于今年底发布),并且计划在今年向日本推出基于这款游戏的动画片。

尽管有媒体看好《Monster Strike》,认为它将成为继《Puzzle & Dragons》之后的第二款收益超10亿美元的手机游戏,但日本游戏行业分析师及顾问Serkan Toto对此持怀疑态度。他称《Puzzle & Dragons》仅在日本的下载量就超过3500万次……《Monster Strike》还面临尚未实现国际化的问题,它有90%以上的收益来自日本玩家,它在美国或中国等关键市场的表现仍然是个未知数。

3)据venturebeat报道,日本社交游戏公司Gree日前关闭温哥华荛室,并终止了该工作室所有的应用开发项目。

该公司于2012年成立温哥华工作室,希望借此扩大西方市场业务,但最近该公司重新评估了市场情况,决定专注于开发旗下最大的游戏业务,因此做出了这一决定。

Gree公司国际业务首席运营官Andrew Sheppard发表博文指出,手机游戏市场在过去10年发生了巨大变化,人人都有机会推出热作的时代已经远去,现在这一行已经成为收益排名第二的游戏领域,开发预算不断攀升,顶级开发商每月投入营销费用多达4000万美元。Kabam等其他大公司也在重组业务,将重心转向最具盈利性的游戏业务。

Gree仍将投入运营在欧洲的游戏业务,并准备推出一系列手机游戏新作。

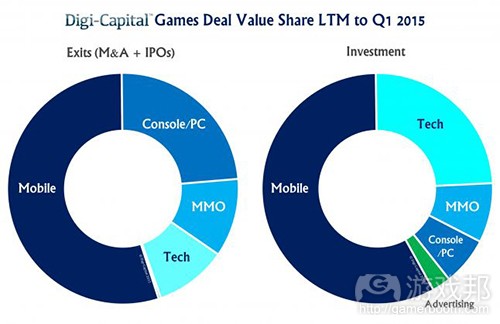

4)Digi-Capital最新报告显示,2015年第一季度投资者对游戏行业的投入下降了7%, VC过去一年中对游戏行业的总投入为14亿美元。行业风险令资本市场对游戏领域持谨慎态度。

VC对制作游戏开发工具的公司支持率较高,但并不看好制作主机和PC游戏的公司。基于手机游戏在2015年收益将达290亿美元,到2018年将增长至450亿美元的预测,投资者对这一领域的支持占据最大份额。位于中国、日本和韩国的战略投资者则普遍投入移动开发领域和科技公司。

在亚洲之外的游戏市场所获投资变少的一个原因在于,许多工作室已经转向Kickstarter等众筹平台进行融资,但这种渠道的收获仍然是杯水车薪,在所有电子游戏投资额中占比不足2%。

从股市行情来看,游戏领域的收获较为理想,在过去一年中平均收益率为11%,手机游戏的这一比率为19%,MMO游戏为16%。

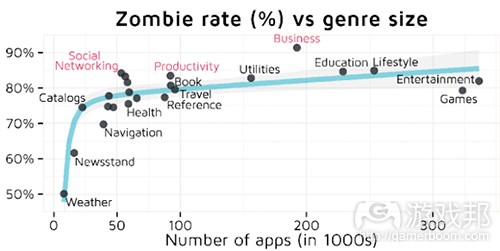

5)应用分析公司Adjust今年发布报告显示,iTunes App Store的僵尸应用(即超过两天时间未进入前300名的不活跃应用)数量仍在持续增长。

报告称截止2014年底,该应用商店将近140万款应用中的僵尸比率达83%,2014年初时的这一比例为74%(当时应用总数为89万)。

Adjust指出有些分类栏目中的僵尸应用比例更高,如果某个特定分类列表中的应用数量超过25万,那么其僵尸率增长也会更快。其中以娱乐类应用最为典型,在该分类中的33万6539款应用中,僵尸应用占比82%。

值得注意的是,位居其次的是游戏应用(总数为32万3357),其僵尸应用比例也高达79%。

僵尸比例低于70%的只有报刊杂志和天气应用,分别为62%和50%。

从世界各地区的App Store情况来看,德国和中国的僵尸率高于日本和俄罗斯。

Adjust认为这种现象反映了应用分类选择对排名的重要性,以及开发者应选择正确的ASO技巧,才有可能推动应用跻身榜单前列。(本文由游戏邦编译,转载请注明来源,或咨询微信zhengjintiao)

1)Nintendo to release 5 smartphone games by fiscal year 2017

Dale North

Nintendo’s plan to move into mobile is finally taking shape.

Nintendo will release its first five apps through its partnership with mobile games company DeNA by the end of next fiscal year, the company announced today in a briefing following its financial results. This is the first solid detail of the Kyoto, Japan-based company’s plans to push into the $30 billion mobile games market. Company president Satoru Iwata said that it’s aiming to make mobile games “one of the pillars of Nintendo’s revenue structure.”

The company did not specify which Nintendo properties would be used for these releases, but notes that it will “carefully select IP and titles” for its mobile debut.

Company president Satoru Iwata notes that while five might sound like a small number, the company wants to “thoroughly operate every one of them for a significant amount of time after their releases” and that this should demonstrate its commitment to the smart device business.

He also confirmed that the company’s new integrated membership service, developed jointly with DeNA, will start with the first game application by the end of this calendar year.(source:venturebeat)

2)Monster Strike makes $3.8 million daily — and could be Japan’s second billion-dollar mobile game

Dale North

Mixi’s mobile game is truly a monster.

Japanese mobile gaming and social networking company Mixi has released its financial results for the year ending March 31, 2015, and it shows that its action role-playing game Monster Strike continues to perform well. Since its launch in October 2013, this mashup of pinball and Pokémon has seen over 30 million downloads worldwide, helping the company see an 828.9 percent increase in sales year over year. Mixi saw Q4 revenues exceed $350 million (over 42 billion yen) thanks to Monster Strike, and the recent launch of the title Hong Kong, China, and Southeast Asia could bring continued growth.

With this success comes expansion. Along with these results, Mixi announced today that a Nintendo 3DS version of Monster Strike is in development, scheduled to release late this year. A television animation series based on the game is also scheduled to broadcast in Japan this year.

Analyst and consultant Serkan Toto told GamesBeat that Mixi has succeeded in what many people previously thought would be impossible: establishing the next billion dollar mobile game franchise in Japan. It could be on its way to being the next Puzzle & Dragons, a mobile game that has made over $1 billion the past two years.

“I personally have little doubt that Monster Strike’s overall revenue will climb higher when downloads go up: at the moment, the Mixi app has ‘just’ 25 million downloads worldwide, while Puzzle & Dragons passed 35 million [in Japan],” Serkan said. “So there is still room for Mixi to boost that number to well over $4 million per day. And this isn’t counting the revenue the company can make from licensing out, as planned, the Monster Strike IP to anime production companies or releasing a 3DS version.”

“For context, Puzzle & Dragons Z, the 3DS game that’s based on the mobile app, has sold around 2 million copies in Japan only since launch in December 2013 — not a bad number at all.”

But Mixi will must figure out how to spread the appeal of Monster Strike internationally to take on GungHo. Serkan notes that over 90 percent of Monster Strike’s sales come from Japanese players.

“However, very similar to GungHo, Mixi does have a hard time in one important area: internationalization,” Serkan says. “Months after launch there, we are not hearing much about Monster Strike’s performance in key regions like the US or China, and I don’t think I have to tell you what that means.”

But the numbers Monster Strike in China look promising, and mobile gaming is growing in that market at an alarming rate.

“What is clear from the most recent results is the impact of launching in China,” Stewart Rogers, an analyst at VB Insight said. “While the North America launch barely registered a blip in downloads over the Taiwanese version, China increased the number of players by a staggering amount. The original Japanese launch still accounts for over 70 percent of the install base, but the growth rate of Chinese players suggests it could overtake the home market within a year.”

Mixi also needs to move beyond its one hit game, and 2015 may be the year for that. Its financial report notes that new smartphone titles are in development, planned for release in 2015. The company says it wants to create games for “everyone to enjoy among friends.”(source:venturebeat)

3)Gree shuts down its Vancouver studio & refocuses on its biggest brands

Dale North

Gree is trimming down to focus on its biggest game properties.

The Japanese mobile gaming company has shut down its studio in Vancouver and has discontinued development of all apps from that studio. The publisher established the Vancouver studio in 2012 in an effort to expand its reach Westward. A blog post from international chief operating officer Andrew Sheppard notes that the company has evaluated market conditions and has decided to focus on development and service for its biggest franchises. Sheppard oversees Gree’s international business, which saw revenues over $1 billion last year.

The blog post notes that mobile gaming has changed since Gree rose to prominence about 10 years ago. Sheppard said it used to be that pretty much any developer had a fair shot at creating a hit game. But the industry has grown to become the second largest gaming category in terms of revenue, where development budgets climb for increasing expectations and top developers are spending up to $40 million a month on marketing campaigns. Other large companies such as Kabam are also restructuring to focus solely on its top money-making titles.

Sheppard calls the closure in this climate “the next difficult step” in the journey to become a “global gaming powerhouse in the West.”

Gree will continue to invest in operating its games in Europe and also notes that it is preparing to invest in a new batch of mobile hits.(source:venturebeat)

4)Fewer venture capitalists are betting on game companies

Jeff Grubb

The game-making business is risky, and that’s led to less capital available for startups in recent years.

Investment in gaming has dropped 7 percent in the first quarter of the year, according to advisory firm Digi-Capital. That’s on top of a capital market that has already declined 25 percent from 2011 to 2014. Total investment in games from venture capitalists was $1.4 billion over the 12 months leading up to the end of March. The problem is that the partners at most firms are risk-adverse, and it’s difficult trying to predict where to put money in a hit-based industry.

“The games investment market has narrowed to specific pools of capital,” Digi-Capital managing director Tim Merel said. “There are relatively few venture capitalists investing in games compared to other sectors — although the VC universe broadens slightly for games technology.”

While people making specific games for console and PC are struggling to find financial backers, it’s not nearly as bad for companies building tools that a lot of other studios use. VCs are willing to take a chance on something that could turn into an industry standard.

But beyond the tech, mobile is still getting the most attention. And that’s primarily coming out of Asia. Strategic investors in China, Japan, and South Korea are all putting cash into mobile developers and tech companies geared toward that part of the world.

“There is considerable presence [from investors] in follow-on investment rounds for developers with strong metrics and potential to flourish in domestic Asian markets,” said Merel. “Such investments have proven a good step toward long-term exit relationships, with some larger deals in recent years coming from Asian buyers who were early-stage investors.”

The withdraw of investor capital from gaming in most of the rest of the world, however, is one of the reasons so many studios have turned to crowdfunding projects on websites like Kickstarter. But that is hardly filling in the money gap.

“Crowdfunding remains a source of early stage funding,” said Merel. “But it accounts for less than 2 percent of total video games investment.”

And while recent Kickstarters have had great success, it seems unlikely that consumer-backed funding will ever fully replace venture capital.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号