每日观察:关注King游戏在Facebook平台的粘性(3.15)

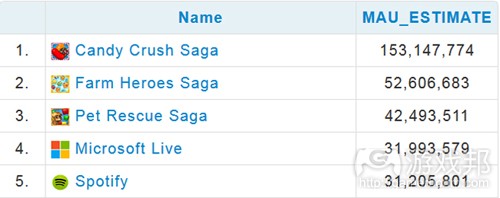

1)AppData最新公布的Facebook应用月活跃用户(MAU)榜单显示,King旗下游戏占据了该榜单前三名,分别是《Candy Crush Saga》、《Farm Heroes Saga》和《Pet Rescue Saga》。位居第四名的是Microsoft Live,第五名则是Spotify。

《Farm Heroes Saga》发布于2013年4月,《Pet Rescue Saga》则发布于2012年10月。这三款游戏几乎占据了AppData最近追踪的前100款应用22%的MAU,King还有另外4款游戏进入该榜单前100名之列。仅King一家公司的游戏就占据了前100名应用榜单25%以上的MAU。

2)据gamaustra报道,Naughty Dog日前宣布旗下PS3动作游戏《最后的幸存者》全球销量已经超过600万份。

该游戏于2013年6月14日发布后三周内销量超过340万份,成为史上最畅销的PS3游戏,并赢得了BAFTA和DICE两项大奖,另外还被提名为GDC 2014大会(将于下周举办)的游戏开发者精选奖。

3)据pocketgamer报道,Big Fish公司日前宣布将发布来自美国初创团队Boss Fight的游戏。该团队由前Zynga达拉斯团队成员所组成,其中包括开发了《Halo Wars》、《帝国时代》和《CastleVille》的元老,目前正在开发尚未公开的中核免费游戏。

Big Fish工作室高管Chris Williams表示,公司在2013年发布了5款免费游戏,有超过半数移动业务收益来自这些产品。

4)据pocketgamer报道,西班牙社交游戏公司Social Point(原先为Facebook游戏开发商,正快速向移动平台转型)日前宣正投入开发4款游戏,预计年收益将达1亿美元。

该公司目前有180名成员,旗下游戏MAU已达5000万。

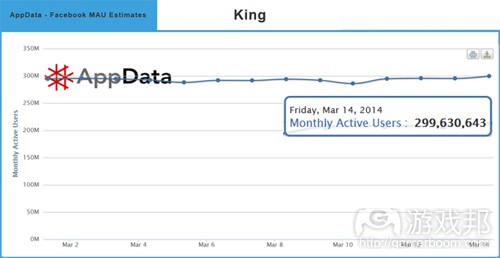

5)AppData最新数据表明,尽管Zynga专注于Facebook业务,但在该市场仍然被King所超越。今年King在Facebook的DAU/MAU粘性增长了17.1%,而Zynga的DAU/MAU粘性仅增长0.7%。

King旗下最热游戏《Candy Crush Saga》今年的DAU/MAU粘性就增长了5%,而Zynga旗下最热门游戏《FarmVille 2》粘性仅增长1.6%。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)DataPoint: King Takes 25% of Facebook App Market

Mona Zhang

AppData announced today that its data are reporting King Digital Entertainment’s ascendance. Although we called into question the sustainability of the developer and its most popular game, the data indicate that King is not a one-hit wonder.

According to the announcement, the company has the top three Facebook apps ranked by Monthly Active Users (MAUs): “King has been the most successful developer to leverage the Facebook app ecosystem to build its business across all platforms.”

Here are the top five apps on AppData’s MAU leaderboard:

Farm Heroes Saga was launched in April of 2013, making its climb to No. 2 particularly notable. Pet Rescue Saga was launched in October of 2012. Together, the three games represent almost 22 percent of MAUs in the top 100 apps that AppData is tracking. King has four more games that appear in the top 100 apps: Papa Pear Saga, Pepper Panic Saga, Bubble Witch Saga and Pyramid Solitaire Saga. With all seven taken into consideration, King’s games alone represent over 25 percent of MAUs in the top 100 apps.(source:insidemobileapps)

2)The Last Of Us surpasses 6 million copies sold worldwide

By Alex Wawro

Naughty Dog announced today that more than six million copies of its post-apocalyptic PS3 action game The Last Of Us have been sold worldwide.

Last time we checked in on Naughty Dog’s sales figures The Last Of Us was being lauded as the fastest-selling PlayStation 3 game ever made using new intellectual property, with over 3.4 million copies sold worldwide in the three weeks following its June 14, 2013 debut.

Since then the game has continued to receive significant critical acclaim, winning big at both the BAFTA Awards and the DICE Awards.

The game is also nominated in multiple categories of the Game Developers Choice Awards, which will be held next week during GDC 2014. (source:gamasutra)

3)Big Fish looks to go midcore, will publish debut F2P game from ex-Zynga Dallas team

by Jon Jordan

It’s best known for casual hidden object games and casino titles, but Big Fish is keen to demonstrate it can be successful in other genres.

That’s the thinking behind its announcement that it will be publishing the debut game from US start-up Boss Fight.

Created by the old Zynga Dallas team, including veterans from Halo Wars. Age of Empires and Castleville , Boss Fight is making as-yet unannounced midcore free-to-play experience.

BF squared

Underpinning the deal is Big Fish’s veep of studios Chris Williams, who’s been leading Big Fish’s F2P charge over the past 18 months.

“Big Fish launched 5 F2P games in 2013 and more than half its mobile revenue stemmed from those products,” he revealed.

“In 2014, the company will be focused on launching hit F2P games – some in genres that may be unexpected. The game with Boss Fight is one of those surprises.”

David Rippy, Boss Fight’s CEO added, “We were impressed with Big Fish’s ability to take Big Fish Casino and scale it worldwide to the #1 grossing app in the casino genre.”(source:pocketgamer)

4)Social Point looks to mobile action-strategy genre to boost 2014 sales to $100 million

by Jon Jordan

Spanish social gaming company Social Point is looking forward to a big 2014.

Previously a strong Facebook publisher, it’s rapidly moving to mobile, announcing it has four titles in development, and its expectation to hit the $100 million-mark in terms of annual revenue.

Now comprising 180 staff, its games already have 50 million monthly active players.

In 2014, it’s looking to expand from its core expertise of breeding games like Dragon City and Monster Legends to what it labels ‘mobile action, social strategy’.

A time to fight

In this regard, the company’s next mobile launch will be League of Warriors, a real-time strategy game which gives players the full control of their armies.

And Social Point’s future mobile games will further deepen gameplay complexity.

“We understand the MASS category is underserved, and our next series of titles address a consumer segment that is hungry for more strategic mobile gameplay, built on competitiveness that can be played for months and years,” said CEO Horacio Martos.(source:pocketgamer)

5)DataPoint: Zynga Focuses on Mobile, Playing Catch-Up With King

Mona Zhang

Zynga is introducing some of its most-popular games to iOS and Android in a few select markets before officially launching them at the end of June. The social gaming developer is playing catch up with competitor King, which got into the mobile space sooner.

“Did the company miss a beat with the transition to mobile? Absolutely. Are we fixing that? Yes, we are,” CEO of Zynga Don Mattrick told Reuters.

The company’s acquisition of NaturalMotion earlier this year also signals a new focus for the company on mobile.

Even though Zynga has focused on Facebook, King has been outperforming the company there, too. This year alone, King’s DAU/MAU engagement has increased by 17.1 percent, while Zynga’s DAU/MAU is up only 0.7 percent, according to research from AppData.

Candy Crush Saga, King’s most popular game, is up 5 percent in DAU/MAU engagement this year. FarmVille 2, Zynga’s most popular game, has grown 1.6 percent in DAU/MAU engagement in the same time period. Check out a comparison of each developer’s most-popular games, courtesy of AppData.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号