每日观察:关注中国手机游戏市场现状等消息(3.11)

1)市场调研公司Newzoo日前发布了关于中国游戏市场的报告,指出相比西方和其他亚洲市场,中国手机游戏仍处于萌芽状态。

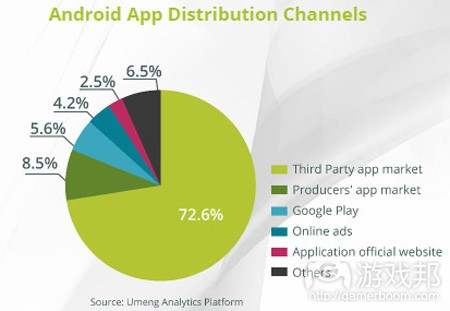

Android仍是中国主要的手机操作系统,其安装量和收益均居于领先地位(但iOS在中国市场收益也占比约25%)。

由于Google Play的缺席,中国Android应用市场呈现极大的分裂性。

中国手机游戏市场最大赢家是腾讯,该公司同时也是中国最大的游戏公司。Newzoo指出腾讯2013年第3季度在中国手机游戏市场份额达15.5%,而LocoJoy(代表作为《我叫MT》)位居第二(占比6.1%),Olaycrab(目前已归属OurPalm旗下)排名第三(4.6%)。

目前来看,手机游戏在整个中国游戏市场中仅占比13.5%,但随着网络和客户端PC游戏转向手机游戏,这一局面将迅速发生变化。

2)据venturebeat报道,Newzoo最近报告指出,中国腾讯已经成为全球游戏收益最高的公司,去年腾讯年增幅达到45%。

预计该公司将在最近的财报宣布上一财年游戏收益达53亿美元左右,这几乎将占全球704亿美元游戏市场收益的8%,超过了微软同一时期的47亿美元收益。

3)据gamezebo报道,澳大利亚开发商Halfbrick最近宣布将推出新手机游戏《Bears vs.Art》,这也是该工作室首款“真正意义上的解谜游戏”。

该游戏目标是控制小熊通过走最短的捷径,破坏125个画廊中的艺术作品(同时要避开大量的保安设施),目前游戏已在澳大利亚和加拿大试发布,但尚未公布全球发布日期。

4)据pocketgamer报道,免费游戏公司Kabam日前宣布收购美国开发商Phoenix Age(游戏邦注:代表作是iOS游戏《Castle Age》、《Underworld Empire》),但并未透露具体成交金额(有知情者称这笔交易额约9000万美元)。

Phoenix Age成立于2009年,拥有44名员工,将继续在自己的工作室中运营,Kabam首席运营官Kent Wakeford强调了Phoenix Age在RPG游戏领域方面的专长,Phoenix Age联合创始人Edwin Shew则将本次收购视为工作室走向全球化的一个重要机会。

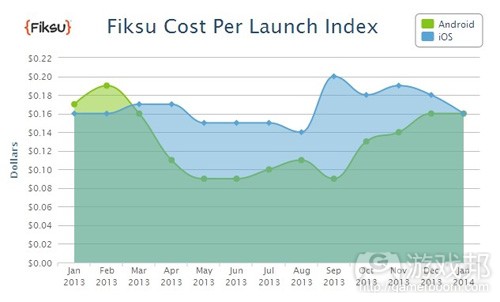

5)应用分析公司Fiksu最近报告显示,2014年1月份iOS和Android平台的应用营销成本非常接近,每应用发布营销成本均为16美分左右。

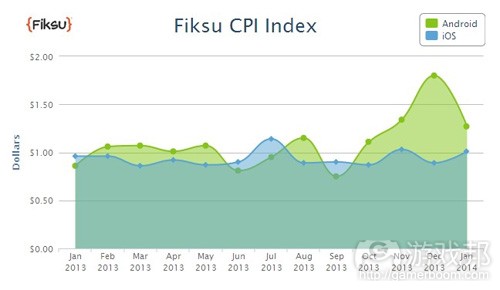

1月份Android应用每安装成本为1.27美元,iOS平台每安装成本则是1.01美元;Android应用每安装成本比去年12月份下降29%,而iOS的这一数据则比12月份的88美分上升了13%。

Fiksu分析出现这一现象的原因在于,iOS平台有许多第三方服务提供了低成本、高价值的营销工具帮助开发者提升安装量和应用商店曝光率,而Android平台的安装量在Google Play没有直接的曝光影响和价值,所以Android营销人员就在节日旺季投入更昂贵的安装来源,并在1月份切换到更有成本效益的第三方服务网络。

Fiksu数据还显示1月份iOS每忠实用户获取成本为1.8美元,比12月份增长3%,比去年同期增长15%。1月份平均每天应用下载量为640万次,同比去年增长6%。

6)据gamasutra报道,YouTube娱乐频道Machinima日前获得由华纳兄弟公司主导的1800万美元融资,前者CEO兼主席Allen DeBevoise认为这是他们与华纳兄弟建立联系的一个绝佳机会,能够利用后者力量最大化自己的内容价值。

该轮融资参与者还包括MK Capital、红点投资、Google Capital。Machinima制作了大量直接发布到YouTube的视频内容,并且还发布游戏发行商和开发商提供的新游戏预告视频,据Machinima所称,其视频浏览量每月已突破20亿次。

7)据venturebeat报道,软银旗下投资公司Softbank Ventures Korea(SBVK)日前宣布向纽约游戏开发工作室Turbo投资。

Turbo这家新公司拥有来自任天堂、索尼、CCP、Riot、Rockstar Games、OMGPOP、Q-Games、Kabam和Zynga等主流游戏公司的成员,旨在开发“跨屏幕”游戏,或称支持人们在多种设备上体验的游戏。

Turbo成立于2013年,将使用Unity 3D引擎开发游戏。其代表成员Ishii(前CCP Games高管)表示,他们认为纽约是一座文化和创意之都,有可能成为下一个赫尔辛基。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留转载,如需转载请联系:游戏邦)

1)Chart of the Week: 3 graphs that demonstrate the opportunities and challenges of China’s mobile games market

by Jon Jordan

Market intelligence outfit Newzoo has just produced a 42-page report looking at the state of the Chinese games market.

It’s in-depth, and free – so you should get registered and download it – here.

In terms of mobile games, however, what’s clear is that compared to western and other Asian markets, China remains nascent.

This is something I’ve been arguing for awhile now.

Sure it has massive potential, but it also has massive challenges, especially for non-Chinese developers and publishers, but even for Chinese developers and publishers who aren’t properly plugged into the ecosystem.

Conclusion – it’s a friction-heavy place in which to operate for companies who just rely on their creative smarts.

Slices of the pie

There are three graphs from Newzoo’s report which demonstrate this.

The first is one we’ve all seen before. Android is the key mobile OS in China, both in terms of install base and revenue (although iOS still has around 25 percent of market revenue).

Yet, because of the absence of Google Play, the Android app distribution market is massively fragmented.

One outcome of this, is that revenues are also heavily fragmented. Unlike companies such as Supercell-GungHo and King, which suck up a massive percentage of global mobile game revenues, in China the biggest company is infrastructure outfit Tencent.

it’s the biggest internet company in China as well as being the biggest games company in China, and is also pushing out into mobile games thanks to its mobile social network WeChat.

Newzoo reckoned Tencent had 15.5 percent of the Chinese mobile gaming market share in Q3 2013, with LocoJoy (I AM MT) second with 6.1 percent, and Playcrab (now part of OurPalm) third with 4.6 percent.

Obviously, however, the most important element of this graph is ‘Others’, which have over 50 percent of the market.

Market in transition

This is something that will change over the next 12 months, as China experiences the rise of superhit games and certain companies consolidate their market share.

There will be a few winners and many, many losers.

Combined with this change, is the more general massive opportunity of the Chinese mobile games market. At the moment, mobile games only account for 13.5 percent of the total Chinese games market, but this is changing very quickly as web and client PC gamers switch to mobile gaming.(source:pocketgamer)

2)Research firm: China’s Tencent is now a bigger gaming company than Microsoft and Activision

Jeffrey Grubb

The biggest gaming company in the world doesn’t have its own console, doesn’t make Call of Duty, and doesn’t even really make its own games.

Chinese investment company Tencent, which owns League of Legends developer Riot, is now the biggest company in the world in terms of game-related revenue, according to industry research firm Newzoo. This comes after Tencent experienced an annual growth rate of 45 percent last year. The company expects to report around $5.3 billion in game revenue for its last fiscal year during its upcoming March 19 financial filing. That will account for almost 8 percent of the $70.4 billion global gaming market. For comparison, estimates put Microsoft at $4.7 billion in gaming revenue over the same period.

Tencent, in addition to owning Riot, also has major investments in companies like Gears of War creator Epic and Call of Duty publisher Activision. Prior to making those purchases, the company established itself in China’s $13 billion gaming industry with popular PC releases through its QQ Games portal. QQ is part of Tencent’s hugely popular WeChat client that distributes digital titles in that market. WeChat has 300 million registered Chinese users. The report doesn’t include revenue that WeChat produces from non-gaming sources.(source:venturebeat)

3)Halfbrick’s next game has bears. They win.

By Jim Squires

Art is stupid. Bears are awesome. You might disagree with one (or both) of these statements, but you know who doesn’t care? Halfbrick. The makers of Fruit Ninja, Jetpack Joyride, and Colossatron are about to take the art world by storm – by tearing it apart with Rory the Bear.

The next game from Australia’s mobile masters is Bears vs. Art, their “first true puzzle game,” according a press release issued today. And thanks to an early launch in Australia and Canada, you don’t have to go by the press release alone.

The object of the game is to destroy the art in 125 galleries by taking the shortest route possible (while avoiding a multitude on security measures). Mostly because bears are awesome.

There’s no date yet on a worldwide release, but with a soft launch already live, we don’t imagine you’ll have to wait too long to get grizzly on a Picasso. (source:gamezebo)

4)Kabam acquires RPG dev Phoenix Age for a rumoured $90 million

by Matthew Diener

Free-to-play specialist Kabam has announced that it’s acquired fellow Bay Area dev Phoenix Age, known for its work on Castle Age on iOS and Facebook as well as Underworld Empire on iOS.

The studio has a proven track record with creating durable social role-playing games, with Kabam looking to fold the developer’s library into its catalogue of games.

Speaking on the acquisition, Kabam’s COO Kent Wakeford stressed the importance of Phoenix Age’s expertise in RPGs.

“Phoenix Age’s hit games and world-class talent further solidify Kabam’s leadership role in the free-to-play games space while expanding Kabam into new genres,” detaileds Wakeford.

Rising phoenix

For his part, Edwin Shew – co-founder of Phoenix Age – sees the acquisition as a chance to grow globally.

“We couldn’t be more excited about joining Kabam,” said Shew, “Becoming part of their team instantly gives us the expertise, experience and infrastructure to scale our games to a global level we couldn’t achieve independently.”

Although terms for the deal were not disclosed, an anonymous source sent over a screenshot from the popular app Secret – Speak Freely that puts the figure for Phoenix Age at “around $90 million”.

We’ve contacted Kabam to see if we can receive confirmation on the figure and will update this story when we hear back.

Phoenix Age was founded in 2009 and has 44 employees in-house. Kabam has announced Phoneix Age will continue to operate in its current offices.(source:pocketgamer)

5)Fiksu will help measure the horribly depressing costs of acquiring mobile app users and gamers

Dean Takahashi

Fiksu is launching a couple of new mobile app marketing indices today that show how the costs of acquiring new users are rising.

These costs matter to developers and publishers because they show that, on average, the cost of getting new users often exceeds the revenue that comes from those users. That’s a recipe for disaster, and it means a lot of mobile app and game companies will go out of business, while only some will survive as hit makers.

The new indices show app marketers that in January, the cost of marketing apps on iOS and Android were pretty close, or about 16 cents per app launch apart. That’s after about 10 months when there was a considerable gap. Fiksu calls that a “post-holiday correction.”

Boston-based Fiksu is launching its Cost per Install index, which focuses on download costs and measures the cost per app install directly attributed to advertising. The cost per install in January was $1.27 on Android and $1.01 on iOS. The Android CPI number was down 29 percent from $1.80 in December, while the iOS number was up 13 percent from 88 cents in December.

On iOS, incentivized networks provide a low-cost, high-value marketing tool that drives installs and boosts app store visibility during the busy holidays. On Android, however, install volumes have less immediate value and impact on visibility in the Google Play app store. So Android marketers focused their spending over the holidays on relatively more expensive sources of installs and then moved to more cost-effective incentivized networks in January.(source:venturebeat)

6)Warner Bros. invests in Machinima, in a round worth $18 million

By Christian Nutt

YouTube entertainment channel Machinima has netted $18 million in a funding round led by major media company Warner Bros., the company announced today.

Why? “There are myriad opportunities to connect Warner Bros.’ content to our audience across YouTube and our highly successful apps, and similarly to maximize the value of our content by utilizing Warner Bros.’ expertise in global distribution beyond YouTube,” said CEO and chairman Allen DeBevoise in a statement.

The funding round also included MK Capital, Redpoint Ventures, and Google Capital — all existing investors. The company last announced funding of $35 million in May of 2012.

Warner Bros. chief digital officer and EVP of strategy and business development Thomas Gewecke called the company a “pioneer and category leader” in the YouTube space in the statement, saying that Warner has been “impressed with Machinima as a distribution partner” so far.

Machinima produces a variety of shows that it posts directly to YouTube; it also posts publisher and developer-provided trailers for upcoming games. According to Machinima, its videos are viewed over 2 billion times a month.(source:gamasutra)

7)SoftBank Ventures Korea invests in game developer Turbo

Dean Takahashi

Extending its global reach, Softbank Ventures Korea is announcing an investment in New York game development studio Turbo.

The investment in the new company is a reflection of the global nature of today’s game business, where it’s increasingly common to see cross-border deals. The Brooklyn, N.Y.-based Turbo is coming out of stealth today with talent from console and mobile companies such as Nintendo, Sony, CCP, Riot, Rockstar Games, OMGPOP, Q-Games, Kabam, and Zynga.

Turbo has assembled what it calls a “dream team” of game designers obsessed with refined gameplay mechanics for “cross-screen” games, or those that people can play on multiple devices.

“We’re finally coming out from under the radar,” said Turbo CEO Yohei Ishii in an interview with GamesBeat. “We want to elevate what an indie game studio is capable of. We are focused on cross-screen games for the core gamer, with a our lead platform on mobile.”

SoftBank has been active in the game business, investing in Japan’s GungHo Entertainment. Its Puzzle & Dragons is one of the best monetizing mobile games of all time. It also paid $1.53 billion for a 51 percent stake in Supercell, the Finnish company that makes Hay Day and Clash of Clans, two titles that have been in the top grossing mobile apps for more than a year.

“As an umbrella group, SoftBank is very thoughtful about investing,” said Ishii. “That gave us a lot of confidence in partnering with them. They have a track record of supporting long-term plans.”

“We’re working with Turbo because they have the seasoned background and visionary ideas to reinvent how games are played,” said Daniel Kang at SoftBank Ventures Korea in a statement.

“Our meticulous investment choices have led to strong position in gaming and we hope to benefit from the expertise of other subsidiaries of SoftBank Group, such as Supercell and GungHo. We look forward to furthering this success when Turbo’s first game is released in late 2014.”

Turbo opened in 2013, and it expects to use the Unity 3D game engine for its games. Ishii, a former CCP Games executive, said he isn’t ready to share the names of the creative leaders yet beyond James Mielke, formerly of 1UP.com and a former editor-in-chief of Electronic Gaming Monthly.

Ishii said it chose to put the company in Brooklyn because of New York’s reputation as a cultural and creative hub.

“We decided to tap into its wellspring of cultural energy,” Ishii said. “We think it could be the next Helsinki,” as a game hub.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号