中国手机游戏开发者正处于“尴尬时期”?

作者:Jon Jordan

在欧美市场,开发和部署工具强大又廉价,应用推广非常简单,并且有千百万有钱或有闲的玩家。

对欧美的开发者,唯一的问题就是没有结构性问题。欧美市场是一个公平的竞技场,唯一的问题就是竞争程度;精英的完美市场条件。

大部分游戏不会获得太大的成功(不像以前那样),但是,一旦成功,其影响力又大大超过它的制作者的想象。

品质不达标

然而,说到中国的手机游戏市场,这条价值链上的几乎每个部分都是支离破碎的,充满挑战的。

Android是最大、发展最快的平台,但缺少官方应用商店意味着推广的任务被分摊给运营商、网络平台、服务供应商、反病毒软件供应商和其他提供大文件下载渠道的网站。

网络质量是不一致的,费用是不统一的,更何况还存在着诸如盗版、山寨和政府监控等问题。

但也许最大的问题是,中国手机游戏的品质。

中国游戏市场被大型多人电脑游戏——特别是具有丰富的中国文化元素的RPG如以“三国”为题材的游戏,占领多年。作为后遗症,中国手机游戏重复性严重,而忽略图像品质和易玩性。

在2013年的ChinaJoy大会上,奇虎360的副总裁陈杰告诉与会开发者,他们必须更加专注于游戏的用户体验和留存率。

类似的,中国电信游戏运营基地的GM 张鹏认为中国的开发者太看重硬核游戏,主要是因为错误地专注于高ARPU率。

巨头也捉急

这个PC MMOG的后遗症也反映在中国游戏开发领域的企业结构上。

在过去几年的MMOG时代,许多公司凭借大量的投资迅速成长壮大。现在,随着市场的订购量和销量迅速萎缩,这些公司不得不转向开拓手机市场,再斥巨额投资和培养技术人才。

不只是中小规模的公司面临这个困境。上市的大公司如腾讯和空中网都在为转型而挣扎着,尽管这个局面确实为其他公司带来机遇。

蓝港在线CEO王峰提醒他的同行们,他认为“绝大部分中国手机游戏公司将出局”。现在,王峰带着传闻中的香港IPO,希望把他的公司做上市。

考虑到蓝港在线能在PC MMOG的泡沫化时期筹得3000万美元风投资金,而在2012年时几乎面临破产,可以说,这个计划的IPO非常引人注目。

蓝港在线的手机MMORPG《王者之剑》据说在一个月内获利超过4500万人民币(700万美元)。

为时尚早

中国市场最重要的一点在于,这个人口13亿的国家的净规模让心智正常的人都发疯了。

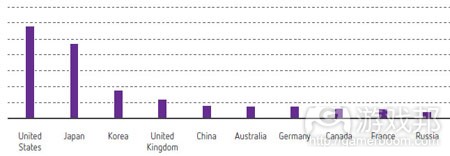

就设备而言,中国已经被认为是全球最大的智能手机市场;就收益而言,中国是第五大手机市场。也许12个月后,中国有望超过英国和韩国。

(名列应用市场收益前十名的国家)

然而,尽管人们已经开始争论中国是否/何时能够在GDP上超过美国,但就财政而言,美国和日本仍然是比中国更大的应用市场;这一现状在短时间内是不会改变的。

根据最乐观的估计,中国智能手机游戏市场在2013年的估值约为15亿美元,也许到2015年会上升到43亿美元。

(2013年上半年,中国手机游戏市场的官方规模是4.1亿美元。)

不能不重视的是,市场分化意味着中国开发者的净收益比那70%的借助App Store或Google Play的欧美开发者来得少。

当然,这不是说所有第三方应用商店、经销商、发行商等都不能赢利,而是只有对于内容制作者来说,中国还不是一个高利润的市场。

仍需巩固的市场

那么我们有何期待?

显然,中国手机游戏市场不会一夜间变得像欧美市场一样。即使Google Play得以发布适用各种Android手机的应用,现在也不会有什么太大作用。推广的骰子已经投了。

但所有领域从开发到发行再到基础建设,都会得到巩固,比如,百度收购中国主要的Android应用推广渠道之一——91无线。

类似地,腾讯扩展它的微信手机社交应用也会影响市场。许多中国行业观察者预期它会走Kakao或LINE的游戏服务的路子并达到相当的普及率;也许到2013年底,对中国手机游戏市场的占有率会达到20%。

然而,除非应用推广市场的发展更加顺利,提供一个更加公平的、奖励最好的内容制作者而不只是最好的连接开发者的竞争环境,否则所谓的“太平盛世”就会变成灾难而不是福祉。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Opinion: Chinese mobile developers live in the most interesting of times

by Jon Jordan

The phrase ‘May you live in interesting times,’ is a western truism about Chinese culture that’s without historical basis.

It’s ironic, then, that it’s Chinese mobile game developers who are living through the most ‘interesting of times’.

In western markets, development and deployment tools are robust and cheap, app distribution is straightforward, and there are there are hundreds of millions of hungry players and wealthy payers.

For developers, the only problem is there are no structural problems. It’s a level playing field where the only issue is the amount of competition; perfect market conditions for meritocracy.

Most games don’t hit big (as it ever was), but those that do hit bigger than their creators ever imagined.

As one UK prime minister is misquoted as telling his ungracious electorate – “You’ve never had it so good”.

C-c-c-challenges

When it comes to the Chinese mobile games market, however, almost every part of the value chain is fragmented and challenging.

Android is the largest and fastest growing platform, but the lack of an official app store means distribution is split between carriers, internet platforms, ISPs, anti-virus software providers and other popular websites who provide sideloading channels for the increasingly large files that are too big for over-the-air download.

Network quality is patchy, billing is fragmented, while issues such as piracy, cloning and government control bubble along in the background.

Perhaps the biggest issue, however, is the very quality of Chinese mobile games.

The legacy of the years when the Chinese games market was dominated by massively multiplayer PC games – typically highly culturally-specific RPGs themed around the Three Kingdoms era – Chinese mobile games tend to be heavy on repetition and light on graphical quality and usability.

It was something highlighted at the ChinaJoy 2013 conference where the VP of distribution outfit Qihoo 360 Chen Jie told developers they needed to focus much more on the user experience and retention rates of their games.

Similarly, Zhang Peng, GM of China Telecom’s game operation base, said Chinese developers were too focused on hardcore games, mainly because of a misguided focus on high ARPU rates.

Too big, will fail

More generally, this PC MMOG legacy is also reflected in terms of the corporate structure of the Chinese game development scene.

With a lot of investment cash injected in previous years, many companies grew too large in the MMOG era. Now, with subscriptions and sales in these markets decreasing fast, such companies are having to reinvest and reskill fast to make mobile games.

And it’s not just small and medium -sized companies either. Publicly-owned outfits such as Tencent and KongZhong are struggling to make the change, although the situation has proved to be an opportunity for others.

After warning his fellow developers that he thought the “majority of Chinese mobile game companies would die out”, LineKong CEO Wang Feng is now looking forward to taking his company public with a Hong Kong IPO rumoured.

Still, given that LineKong raised $30 million in VC money during the bubble PC MMOG era, and almost went bust in 2012, it’s could be argued the planned IPO is a case of striking while a new iron is attractively hot.

LineKong’s mobile MMORPG The Legend of King is reportedly making over RMB 45 million ($7 million) a month.

Find your perspective

When it comes to the Chinese market, the bottomline is that it’s the sheer scale of a nation of 1.3 billion that makes otherwise sane men and women go crazy.

China is already reckoned to be the largest smartphone market globally in terms of devices and is the fifth largest mobile market in terms of revenues, with the likelihood it will overtake the UK and South Korea over the next 12 months.

Distimo’s August 2013 breakdown of top app markets by revenue

Yet, as with the debate about if/when China will overtake the US in terms of Gross Domestic Product (the basic measure of a national economy), the US and Japan remain substantially larger app markets in financial terms than China; something that’s not going to change anytime soon.

According to the most optimist Chinese sources, the country’s smartphone gaming market could be worth around $1.5 billion in 2013, perhaps rising to $4.3 billion in 2015.

(Placing this in context, the official size of the Chinese mobile games market in the first half of 2013 was reckoned to be $410 million.)

And what shouldn’t be discounted either is that market fragmentation means that the net revenue of a developer is smaller than 70 percent western developers receive working through the likes of the App Store or Google Play.

Of course, this isn’t to say that the various thirdparty apps stores, distributors, publishers and the like shouldn’t get a cut, only that for the content creator, China is not yet a high margin market.

Time to consolidate

What should we look forward to then?

It’s clear that the Chinese mobile games market won’t suddenly become like western markets. Even if Google Play was allowed and shipped with every Android phone, it wouldn’t make much difference now. The distribution die has been cast.

But consolidation will happen in all sectors from developers and publishers to big infrastructure deals such as Baidu acquisition of 91 Wireless, one of the main Android app distribution channels in China.

Similarly, moves such as Tencent’s rolling out of its WeChat mobile social network will impact the market. Many Chinese commentators expect it to follow a similar adoption rate to Kakao or LINE’s game services, maybe accounting for 20 percent of the Chinese mobile games market by the end of 2013.

However, unless the app distribution market becomes smoother, providing a more level playing field that rewards the best content creators – not just the best connected developers – these interesting times will be more of a curse than a blessing.(source:pocketgamer)

下一篇:中等硬核游戏的成功要素之留存率