每日观察:关注Zynga放弃在美国真钱博彩游戏计划(7.26)

1)据insidesocialgames报道,Zynga今年第二季度财报显示,公司收益、玩家规模均出现下滑,并计划放弃在美国的真钱博彩游戏的资质申请。

Zynga月活跃用户(MAU)与日活跃用户(DAU)均低于去年同期水平,2012年第二季度MAU为3.06亿,DAU为7200万。而今年第二季度MAU则是1.87亿,DAU为3900万,分别比去年同期下降39%和45%。

今年第二季度Zynga收益为2.31亿美元,比去年同期的3.32亿美元下降31%,不过平均每名玩家日常收益则从原来的0.046美元增长至0.053美元。

最值得关注的是Zynga显然放弃了在美国的真钱博彩游戏项目计划,将重新把重心转移到免费社交游戏。

2)据venturebeat报道,Zynga首席运营官David Ko在最近的分析师会议中宣布,公司不再投入位于美国的真钱博彩游戏项目,将收回在美国的真钱在线赌博执照的申请。这一消息公布后,Zynga股票下跌12个百分点,目前每股降为3.05美元。Ko指出公司旗下高盈利游戏《》在第二季度遭遇强劲竞争对手(例如Double Down Interactive及其他社交博彩游戏公司的作品),他认为Zynga在此方面盈利下滑的原因在于网络上的“非法使用信用卡活动”的兴起(用户以信用 卡购买虚拟筹码)。他认为扑克游戏的发展在于休闲游戏领域而非真钱博彩游戏行业。

Zynga目前月付费用户为190万,比上一季度时的410万下降22%;该公司目前员工为2368人。

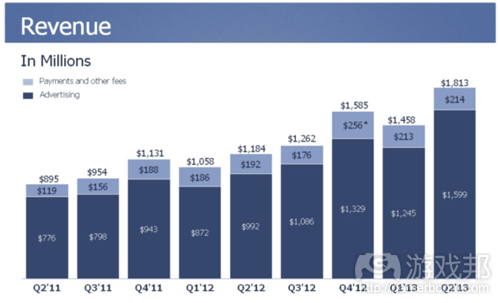

3)据mobile-ent报道,Facebook第二季度财报显示公司总收益达18.1亿美元,比去年同期的11.8亿美元增长53%。

其中广告收益为16亿美元,在总收益中占比88%,同比去年增长61%,移动平台在所有广告收益中占比41%。

值得注意的是,去年第三季度Facebook移动广告在所有广告收益中仅占比14%,但在去年第四季度增长23%,今年第一季度增长了30%。

Facebook移动平台月活跃用户同比去年增长51%,达到8.19亿,而日活跃用户则达到4.69亿。

总体月活跃用户为11.5亿,同比去年增长21%,而日活跃用户则增长27%,达到6.99亿。

4)据venturebeat报道,Facebook股票在日前上涨25%,在7月25日上午每股价格一度上升至34.9美元。

Facebook指出其6月份平均每日用户人数为6.99亿,该月有11.5亿人至少登陆Facebook一次,同比去年增长21%。该月有8.19亿用户通过移动平台访问Facebook,同比增长51%。

用户在Facebook投入时间也持续增长,平均每天超过200亿分钟。

5)据gamasutra报道,前微软娱乐高管及现任Zynga首席执行官Don Mattrick在最近的投资者财报会议中列出了自己的90天计划,其中包括针对Zynga“自上而下的业务回顾”,“花时间同团队交流以便打破一些坏习惯……”

他承认Zynga还将面临6至12个月的动荡期,并强调要优化Zynga产品的质量。针对Zynga有2300多名员工的规模却不敌仅有400多成员的King这一问题,Mattrick坦言King的市场表现确实很棒,但问题并不在于Zynga的人员问题,Zynga应该有效利用这种人员优势。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Zynga’s Q2 2013 earnings report shows losses in revenue, players, and an abandonment of real-money gaming

Brandy Shaul

Zynga today reported its Q2 2013 earnings, with the social and mobile game developer announcing losses of revenue, a decreasing player base, and plans to abandon its push for real-money gaming in the United States.

Zynga’s monthly and daily active users decreased year-over-year. Q2 of 2012 saw 306 million monthly active users and 72 million daily active users. Those figures had decreased to 187 million monthly active users and 39 million daily active players in Q2 2013, a decrease of 39 percent and 45 percent, respectively.

Revenues of $231 million for Q2 2013 are 31 percent lower than the $332 million reported in the same quarter last year, while average daily spending per player increased from $0.046 in Q2 2012 to $0.053 in the second quarter of 2013. This increasing figure could be due to the decreasing size of the overall player base, causing the remaining paying players to make up more of the overall total and therefore increase the average. However, specifics on the increase weren’t detailed.

Perhaps most interesting is Zynga’s apparent abandonment of its push into real money gambling in the US. The company previously launched its first two web-based real money gaming portals in the UK in April: Zynga Plus Poker (our review) and Zynga Plus Casino (our review). The push into real-money gaming in the US had continued even until last June, when Zynga’s annual shareholders meeting reportedly focused heavily on real-money gaming as an avenue for new growth into the future.

According to the company’s latest financial results, however, Zynga is instead looking to get back to basics and focus on free-to-play social games. The statement reads: “While [Zynga] continues to evaluate its real money gaming products in the United Kingdom test, Zynga is making the focused choice not to pursue a license for real money gaming in the United States.

Zynga will continue to evaluate all of its priorities against the growing market opportunity in free, social gaming, including social casino offerings.”

Zynga’s Q2 2013 earnings call presents a rough situation for the company, but it’s one new CEO Don Mattrick believes can be overcome.

“It’s clear that the market opportunity around us is growing at an incredible clip. It’s also clear that today we are missing out on the platform growth that Apple, Google and Facebook are seeing. In short, we can do better,” said Mattrick. “Getting a business back on track isn’t easy and isn’t quick. We have a lot of hard work in front of us but I believe we can succeed as a team and Zynga can do this.”

Mattrick continued to say that his focus will now be on “conducting top to bottom business reviews” and improving Zynga’s overall product quality.

“The next few years will be a time of phenomenal growth in our space. This is a relatively new market that has proven that a hit franchise can generate more than $1 billion dollars in bookings. From box office to music to console to TV – few things in the history of entertainment have grown as quickly while creating such incredible value,” Mattrick added. “As our market grows, the hits are only going to get bigger. Zynga has incredible assets to take advantage of that growth and I believe its biggest opportunities are ahead. There are good winds at our back – my job is to get our sails up and Zynga pointed in the right direction.”(source:insidesocialgames)

2)Zynga exec explains why it’s abandoning online gambling in the U.S.

Dean Takahashi

Real-money gambling and FarmVille just don’t mix.

Zynga chief operations officer David Ko said in an analyst conference call today that the company decided not to invest in U.S. real-money online gambling because it needs to stay focused on social gaming and its core casual audience.

The San Francisco company slightly beat Wall Street expectations, but it continues to bleed users. This, and the decision to withdraw its plans to bid for real-money online gambling licenses in the U.S., led to a tumble in the company’s stock price after-hours trading. The stock is now down about 12 percent to $3.05 a share.

Ko noted that Zynga Poker, the company’s big money maker, slipped in the second quarter because “competitors are closing the gap.” The poker game competes with rivals such as Double Down Interactive and other social casino game companies. Ko said Zynga saw a decline in part because of a rise in “illegitimate credit card activity” on the web, where people pay for virtual poker chips with credit cards. He said he believes the growth in poker is in the casual end of the market, not the real-money gambling side.

“We must stay focused on our priorities. … The decision we made around real-money gambling was around focus,” Ko said after a question from an analyst on the call. He said the company needs to execute on its existing social games.

This change is the first big one since Zynga got a new boss. It hired Xbox boss Don Mattrick as its new CEO on July 1, shifting founder Mark Pincus to chairman and chief product officer.

That gave the stock a bounce in the past few weeks, but the mostly dour report is causing investors to think twice.

Pincus introduced Mattrick on the analyst call, saying that he “shares my visions for social gaming” and that he shares his passion for gaming. Pincus said Mattrick set up his office in the middle of the FarmVille studio on his first day, a sign that Mattrick will be focused on games.

“I am here to support Don in whatever way I can,” Pincus said.

Zynga reported revenues of $231 million, down 31 percent from a year ago, and bookings of $188 million, down 38 percent from a year ago. The company lost $16 million, or 1 cent a share.

Analysts expected Zynga to report a loss of 2 cents a share on bookings of $181.2 million for the second quarter.

In June, Zynga said it expected a loss of 3 cents to 4 cents per share on revenue ranging from $225 million to $235 million. Last year, Zynga’s second quarter revenue came in at $332 million and earnings per share loss of 3 cents to 5 cents. The company also made cutbacks at various game studios around the world.

Daily active users were just 39 million in the second quarter, down from 52 million in the first quarter and 72 million a year ago. Web DAUs were 23 million and mobile DAUs were 16 million.

Monthly active users were 187 million, down 39 percent from 306 million a year ago and 253 million in the first quarter. Monthly web numbers were 129 million and mobile was at 57 million.

But on the positive side, Zynga’s average daily bookings per average DAU grew from $0.046 in the second quarter to $0.053 in the second quarter, up 14 percent from a year ago. Monthly unique payers were 1.9 million, down from 4.1 million a year ago and down 22 percent from the previous quarter.

Zynga has 2,368 employees today. Mattrick said that he met Pincus when the company had just 100 employees, but he described the chance to join Zynga now as a once-in-a-lifetime opportunity.

He noted the firm has $1.5 billion in cash and investments. The aim is to make games social and accessible to everyone.(source:venturebeat)

3)Facebook pockets 41 per cent of total ad revenue from mobile

by Zen Terrelonge

Achieved as the social network’s mobile monthly actives reach 819m.

Facebook embarked on a mission to monetise its mobile services last year, and it’s a move that’s paid off judging from its second quarter figures – ending June 30th 2013.

Overall revenue for Q2 reached $1.81 billion at a 53 per cent year-on-year increase from $1.18bn.

Advertising, of course, brought home the bulk of the figures at $1.6 billion – equivalent to 88 per cent of total revenue – up 61 per cent year-on-year, with mobile accounting for 41 per cent of all ad revs.

The figures are really impressive, given mobile ad revs accounted for just 14 per cent of all ad revenue back in Q3 2012 – the period when mobile ads were first introduced – despite analysts predicting mobile to secure a third.

However, this gradually rose to 23 per cent in Q4 2012 and 30 per cent in Q1 2013.

Mark Zuckerberg, founder and CEO, Facebook, said: “We’ve made good progress growing our community, deepening engagement and delivering strong financial results, especially on mobile.

“The work we’ve done to make mobile the best Facebook experience is showing good results and provides us with a solid foundation for the future.”

Meanwhile, further evidence to support the mobile boom comes as mobile monthly active users climbed 51 per cent year-on-year to reach 819 million, while daily actives reached 469m.

Comparatively, overall monthly actives were up 21 per cent year-on-year to reach 1.15 billion, while daily actives grew 27 per cent to hit 699m.

The company is currently trialling pushing mobile ads to user notifications to build revenue opportunities, and noted the success of campaigns from Unilever, Pimm’s, and Pepsi.

Other moves in the business during Q2 saw Facebook introduce video to Instagram, which encouraged users to upload five million videos in the first 24 hours. Users can now also embed content into web pages.(source:mobile-ent)

4)Zynga CEO Don Mattrick lays out his 90-day plan for the company

By Kris Ligman

Departed Microsoft entertainment chief and inbound CEO for Zynga, Don Mattrick, spoke this afternoon during the company’s earning call with investors. He addressed Zynga’s rough financial quarter and expressed optimism that there was light at the end of the tunnel for the troubled social giant. He also laid out what he termed his “90 day plan” for the company.

“It is clear the market is growing at an incredible clip, and we’re missing out on the market Apple, Facebook and Google are seeing,” said Mattrick. “Getting a business back on track isn’t easy and isn’t quick… We need to get back to basics, and that means a longer-term view.”

Mattrick’s outlined 90-day plan, he says, will consist of “top-to-bottom business reviews” throughout the whole of Zynga, and “spending time heads-down with teams [to] break some bad habits

and get back to good fundamentals.”

Mattrick spoke candidly about the company’s poor performance, saying bracingly that Zynga could face another six to twelve months of volatility before regaining its stride. He emphasized

improving the quality of Zynga’s output, saying what was needed was “a little more focus; a little more polish.”

During the following Q&A with investors and analysts, Mattrick was asked point-blank why Zynga did not continue on its recent volley of layoffs and whittle down the company’s 2,300-strong workforce to a more manageable size — like that of King, which at 400-odd employees is outpacing Zynga in the market.

Mattrick took the blunt question on the chin, mildly admitting he, too, was a fan of King’s Candy Crush, and praising the competing developer for its performance. But he didn’t talk layoffs. Instead, he reemphasized the need for “focus.”

“Imagine if we can start getting the same leverage out of our 2,300 that King gets out of their 400,” said Mattrick. He maintained that Zynga’s scale was not the issue; “effectively using

the scale,” he said, was.(source:gamasutra)

5)Facebook stock jumps to year-long high, almost back to IPO levels

John Koetsier

Something is going very right at the world’s biggest social network. At least according to Wall Street.

After popping 19 percent last night in after-hours trading, Facebook shares are up 25 percent today to over $33, as the stock is flirting with levels not seen since its botched IPO over a

year ago, when shares jumped as high as $43. The stock briefly hit $34.90 this morning before subsiding.

The company reported strong revenue and earnings growth yesterday and has shown that it can control costs while still accelerating revenue.

Facebook’s payments revenue jumped 11 percent this year, and it brought in $1.6 billion of advertising revenue, up 61 percent from the year-ago quarter. Interestingly, mobile — not so

long ago Facebook’s Achilles heel — accounted for 41 percent of the company’s total ad revenue, and CEO Mark Zuckerberg said that figure would soon increase to over half of Facebook

revenue.

Facebook continues to grow members and usage, with 699 million people using the service on any average day in June, while 1.15 billion people accessed the social network at least once during the month. That’s up 21 percent since last year. As you would expect for a company with 41 percent of its revenue coming from mobile, Facebook said that 819 million Facebook users

accessed its services at least once from mobile platforms in June, up 51 percent.

And time spent on the site continues to increase, the company said, to over 20 billion minutes per day.

Interestingly, Facebook also said that teens are increasingly using the site. There’s been some talk of younger users migrating away from Facebook — where parents and teachers connect,

after all — to emerging platforms such as Snapchat, but Facebook said that over the past 18 months, the number of teenagers on the site has been “steady or increasing.”(source:

venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号