每日观察:关注Gamevil对成功游戏的评价标准(5.15)

1)据pocketgamer报道,微软最近数据显示,Windows Phone平台应用数量达14.5万款。在今年2月底,Widnows Phone Store应用数量为13万,也就是说该平台在过去75天中仅增加了1.5万款应用,平均每天约新增200款应用。

这种迹象表明,Windows Phone平台发展正在减缓;在2012年2月,该平台平均每天新增250款应用。

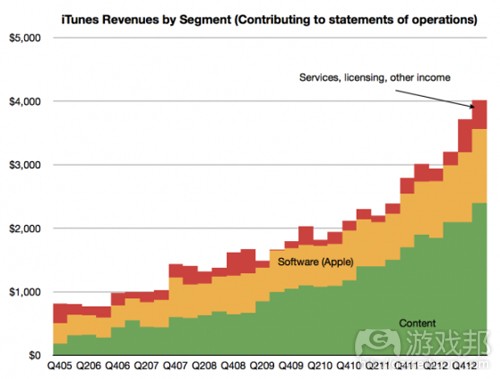

2)据venturebeat报道,苹果在最近财报中指出,iTunes在今年第一季度收益达40亿美元(其中的内容收益为24亿美元);如果按照这一数据来计算,iTunes全年销售额将达160亿美元。值得注意的是,在过去6年中,iTunes每季度收益一直稳定保持29%左右的增长率,所以这只是对iTunes年销售额的保守估计。

苹果分析师Horace Dediu指出,苹果用户平均每天在苹果设备上投入1美元左右;iTunes当前应用下载量已达499亿次,尽管Google Play发展速度超过苹果App Store,但苹果在下载量上仍然最为领先,其收益也是Google Play的2.6倍。

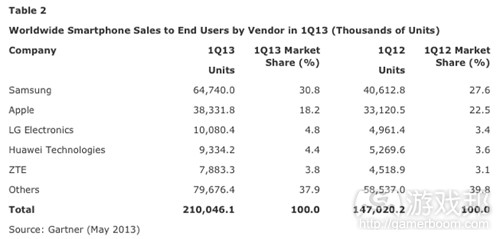

3)Gartner最近发布报告显示,2013年第一季度全球手机销售达4.258亿部,同比上年仅增长0.7%;其中智能手机达2.1亿部,同比上年增长42.9%。

亚太地区销量增长最为显著,同比上年增长6.4%,而EMEA(欧洲、中东和非洲)地区则下降3.6%,北美下滑9.5%,拉美也流失3.8个百分点。

三星仍是头号移动设备制造商,销量增长13%,达到1.007亿部,其次是诺基亚,销量为6320万部,苹果则是3830万部。从智能手机市场来看,三星占比30.8%,苹果占比18.2%,LG占比4.8%。

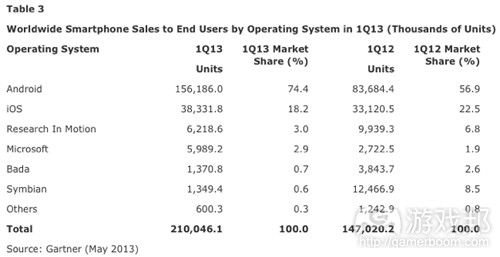

Android仍是领先的智能手机操作系统,占比74.4%,iOS占比18.2%,黑莓占比3%,Windows Phone占比2.9%。

该季度亚太地区手机销量超过2.26亿部,中国手机销量在该时期增长率为7.5%,其销量在全球市场中占比25.7%,同比上年增长近2%。

4)据insidemobileapps报道,日本手机社交游戏巨头GREE最近财报显示,2013财年第三季度公司收益为379亿日元(3.709亿美元),营业利润为108亿日元(1.057亿美元),销售额同比上季度下降4%,利润同比下滑24%。收益比去年同期(462亿日元,即4.521亿美元)下降18%,营业利润同比去年(245亿日元,即2.397亿美元)下降56%。

该公司竞争对手DeNA在5月9日发布的财报显示,DeNA该季度收益达5.28亿美元,营业利润为1.84亿美元,增长率分别为42.4%和74.1%。

GREE日前股票售价为每股1194日元(11.68美元),增长1.8个百分点。

5)据gamasutra报道,Rovio日前宣布成立一个新手机游戏发行部门Rovio Stars,专为第三方游戏提供发行服务。

该公司执行副总裁Jami Laes表示,该部门只会选择将最具创新性的第三方游戏发布到移动平台,首批合作项目包括Nitrome游戏《Icebreaker:A Viking Voyage》以及5 Ants游戏《Tiny Thief》。

6)据pocketgamer报道,韩国手机游戏公司Gamevil美国总裁Kyu Lee在最近的Mobile Gaming USA West 2013大会上表示,早期的发行商角色就是利用自己的用户资源交叉推广新游戏,但随着即时服务的重要性与日俱增,发行商也开始提供运营环节方面的新服务。

这也改变了发行商挑选游戏的方式,Lee称过去他们会寻找拥有出色游戏的独立开发商,但现在主要选择能够为自己的游戏提供一两年支持的开发公司。

Gamevil过去一年发布40-50款游戏,一名项目主管要同时接手多款游戏,而现在则是一名项目主管只监管一款游戏。

该公司目前有230人,其中有150人专注于运营第三方开发者的游戏。

与此同时,Gamevil对游戏的成功标准也发生了变化,Lee表示过去他们认为一款游戏销售额达到20万美元就算不错了,但在2012年Gamevil平均每款游戏收益就高达80万美元,所以现在如果一款游戏收益不足100万美元,那就算是失败项目。

Lee表示自己希望公司最出色的游戏年收益能够达到1000万美元,Gamevil现在表现最佳的游戏平均每日收益为5万美元。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Windows Phone hits 145,000 apps, but is growth slowing?

by Matthew Diener

In amongst a blog post detailing Nokia’s new Lumia 928, Microsoft has pegged the number of apps available for Windows Phone at 145,000.

Said figure is noteworthy, not just because it depicts the continued expansion of what many believe is the third major ecosystem in the smartphone race, but also because it suggests the platform’s growth is slowing.

Slowing pains

Back at the end of February, we reported that the Windows Phone Store was sitting at 130,000 apps.

75 days later, however, and said total has only grown by 15,000 titles, equating to around 200 new apps a day.

Not exactly a rate to be sniffed at – it’s unlikely any consumer on the planet would be able to muster the funds or time to sample 200 new releases every 24 hours – but, by our calculations, it’s 20 percent down on the 250 new apps a day the Store was amassing back in February 2012.

A touch worrying for Microsoft, then, as it looks to secure third spot in the smartphone race ahead of BlackBerry.(source:pocketgamer)

2)iTunes users spend $40/year on apps, music, and digital shtuff

John Koetsier

San Francisco, CA Early Bird Tickets on Sale Apple has built a massive and fast-growing $16 billion annual revenue stream in digital content alone, Apple analyst Horace Dediu says.

The company announced that quarterly iTunes revenues topped $4 billion — including $2.4 billion in content alone — in its latest earnings report. Based on historical numbers alone, that’

s a $16 billion annual run rate, thanks to Apple’s 500 million iTunes users. But since it also has grown at a fairly steady 29 percent per quarter for the past six years, it’s also an underestimate of the annual value of the iTunes ecosystem.

And it gets better as users have more Apple devices.

“Apple users spend about $1/day for each Apple device in use,” Dediu says.

iTunes digital media revenue by product segment.

All of which means that Apple is still king of the mobile ecosystem, at least as far as monetization is concerned. Users have currently downloaded 49.9 billion apps, and Apple is currently

running a contest which will see the downloader of the 50th billion app win $10,000 in iTunes cash. While Google Play is growing faster than Apple’s app store, Apple still leads in

downloads, and it holds a 2.6-times revenue advantage.(source:venturebeat)

3)Global mobile phone sales hit 426m in Q1; APAC drives growth

by Zen Terrelonge

Sales in all other regions declined.

Gartner has released comprehensive results of the global mobile phone sales market for the first quarter, finding that there was an increase of just 0.7 per cent year-on-year to hit 425.8

million. Of that figure, smartphones accounted for 210m and rose 42.9 per cent year-on-year.

Region

The data shows that Asia Pacific was indeed the regional champion for the mobile phone sales increase during the quarter, experiencing a 6.4 per cent increase year-on-year. APAC outshone

the declines in all other regions, as EMEA dropped 3.6 per cent, North America dropped 9.5 per cent and Latin America dropped 3.8 per cent.

Manufacturer

Meanwhile, Samsung remained the number one OEM with sales up 13 per cent to shift 100.7m units (23.6 per cent share), followed by Nokia with 63.2m units (14.8 per cent share, and Apple on 38.3m units (nine per cent share).

When broken down by smartphones, however, the top three positions change to Samsung on a 30.8 per cent share, Apple on a 18.2 per cent share and LG on a 4.8 per cent share.

Operating system

Samsung’s widespread reach meant that Android was the leading smartphone operating system. The Google OS commanded a 74.4 per cent share in the quarter, followed by iOS on 18.2 per cent, and BlackBerry on three per cent, while Windows Phone trailed narrowly on 2.9 per cent.

Anshul Gupta, principal research analyst at Gartner, said: “More than 226 million mobile phones were sold to end users in Asia/Pacific in the first quarter of 2013, which helped the region

increase its share of global mobile phones to 53.1 per cent year-on-year.

“In addition, China saw its mobile phone sales increase 7.5 per cent in the first quarter of 2013, and its sales represented 25.7 percent of global mobile phone sales, up nearly two per cent year-on-year.

“The Chinese and local manufacturers have been exemplary at addressing the demands of buyers by offering affordable devices with optimum features such as 2.5G (EDGE) instead of 3G in a

smartphone. In the smartphone market, local and Chinese manufacturers are making faster inroads as they account for 29 per cent share in the first quarter of 2013, up from 13.2 percent a

year ago.

“There are two clear leaders in the OS market and Android’s dominance in the OS market is unshakable. With new OSs coming to market such as Tizen, Firefox and Jolla we expect some market

share to be eroded but not enough to question Android’s volume leadership.”(source:mobile-ent)

4)GREE’s Q3 2013 sales declined quarter-over-quarter to $370.9M, profits down 24 percent to $105.7M

Scott Reyburn

Mobile-social gaming giant GREE today reported 37.9 billion yen ($370.9 million) in revenue and 10.8 billion yen ($105.7 million) in operating profit for the third quarter of 2013, a quarter-over-quarter decline of both sales and profits. Sales fell 4 percent and profits 24 percent. Year-over-year, revenues are down 18 percent from 46.2 billion yen ($452.1 million) in Q3 2012 and operating profit dipped by 56 percent from 24.5 billion yen ($239.7 million).GREE Q3 2013 earnings

The Japanese company, which was established in 2004, also posted an “extraordinary” loss of 4.03 billion yen (39.4 million) on one-time write-off of assets related to some titles. The loss was part of GREE’s plans to shift growth strategy to “selection” and “concentration”, where it will streamline its portfolio of core titles. Card battle titles from Pokelabo, the

Japanese game studio GREE acquired in October 2012, are performing well for GREE. Three of the top 25 grossing iOS apps in Japan include Guardian Battle of Glory at No. 7, Sword of Phantasia at No. 10 and Clan Battle of Fate at No. 25. GREE also plans to share its successful Android lessons with Pokelabo, while Pokelabo plans to do the same for GREE with iOS lessons.

In Japan, GREE’s coins consumption, a virtual currency users can exchange for in-game content, on smartphone titles grew, particularly from Pokelabo’s existing titles, but fell short of targets. Overseas, coin consumption has doubled on strong performance from titles developed by GREE’s Funzio studio including Crime City and Modern War.

Japanese mobile-social gaming rival DeNA latest earnings on May 9 outperformed GREE’s significantly, with $528 million in revenue and $184 million in operating profit, an increase over

GREE of 42.4 percent and 74.1 percent, respectively.

Advertising revenues decreased 3 percent quarter-over-quarter from 3.1 billion yen ($30.3 million) in Q2 to 3 billion yen ($29.4 million) in Q3, which falls in line with GREE’s decline in revenues.

For the remainder of 2013, GREE plans to release 15-20 titles in Japan and 5 titles overseas. The company lowered its fiscal year 2013 estimate for net sales and profits due to its Q1 to Q3 results and recent trends. GREE now forecasts 150 billion yen ($1.5 billion) in revenue and 46 billion yen ($450.2 million) in operating profit. By the end of Q3, which ended March 31, GREE

had 37.2 billion yen ($364.1 million) in its war chest.

GREE stock closed today at 1,194 yen ($11.68) per share, up 1.8 percent.(source:insidemobileapps)

5)Angry Birds studio Rovio today launched a new mobile game publishing initiative, through which it plans to forge its first path into the world of third-party titles.

Rovio Stars is the “logical step” for the company at this point in time, says Rovio’s EVP Jami Laes, and the initiative will be looking to bring only the most innovative games from third-party studios to mobile platforms.

The company will begin by focusing on a small number of games, including Icebreaker: A Viking Voyage by Nitrome, and Tiny Thief by 5 Ants.

Rovio already hinted at the idea of moving into publishing just over a year ago, when CEO Mikael Hed said, “It would be very easy for us to just go shopping. To get lasting benefit is the hard part.” (source:gamasutra)

6)#mgusa We want to publish games that will do $10 million a year, says Gamevil

by Jon Jordan

Mobile publishing is changing fast.

That was the first topic of conversation at Mobile Gaming USA West 2013 in San Francisco.

One of the big companies to experience and succeed in this transition is Korean developer and publisher Gamevil.

“Early on, the role of the publisher was leveraging its user base to cross-promote new games,” said Kyu Lee, president of Gamevil USA.

“But as live services have been become more important, the operations part is the new value that publishers are providing to developers.

“It’s not about squeezing the margins anymore. There are games making millions of dollars per year, but you need offices or partners around the world to successfully run these games globally.”

Less is more

This change has filtered through to the way publishers source their games

“We used to look for small indies with great games, but now we’re looking for companies who can support their games for one or two years,” Lee said.

“The real game starts when the game is launched.”

This has combined with an industry-wide move for less but higher quality releases.

Gamevil used to release around 40-50 games a year, with project manager handling multiple games. Now it’s streamlining with one project manager on one game.

Indeed, the 230-strong company has 150 staff dedicated to running its thirdparty developers and their games.

Cash up

In turn, this means that the success metric for a game has increased.

“It used to be that if a game hit $200,000 in sales, we thought that was ok,” Lee explained.

In 2012, however, Gamevil’s average revenue was around $800,000 per game, and now if a game doesn’t hit $1 million, it’s seen a failure.

“I want to see our best games doing $10 million per year,” Lee said. Indeed, the company’s best performing game is doing $50,000 per day.(source:pocketgamer)