分析工作室进军手机游戏发行领域的可行模式

作者:Eric Seufert

Supercell最近的1亿美的融资引发了一些关于手机游戏开发者如何利用一款成功游戏的有趣问题。根据最近高收益的游戏案例来看,一款名列美国应用商店排行榜前10名的游戏每天可以创造50万美元以上的收益。

但这种创收能力与企业价值并不成正比,因为这些收益流不是他们自己的业务单位。在许多情况下,成功的游戏只被当作意外收获:1)不能指望它们成为长命的摇钱树;2)不可复制性(也就是,一鸣惊人的游戏往往是剑走偏锋的结果,一般的生产策略不可能产生同样程度的成功)。

为了给成功的游戏挖掘一条可持续的收益渠道,有些工作室已经开始涉足一系列发行活动了。理由显而易见:

1、大部分情况下,客户资产(游戏邦注:所有当前的和未来的消费者终生价值之和)就等同于手机游戏工作室的企业价值。品牌资产不能代表收益价值;如果玩家退出过去很成功的游戏,那么手机游戏工作室(除非他们有多样化的收益流,如Rovio)现在就什么也得不到。

2、手机游戏开发是一个费时又耗资源的过程。在开发过程中,很难判断一款手机游戏能否成功,特别是考虑到手机游戏市场的竞争越来越激烈,同时手机技术也飞速革新。一旦开发周期超过一年,游戏的发布所产生的未来收益的当前价值就会急剧减少。

3、不断上涨的市场营销成本把许多小工作室排挤出用户开发市场。对于没有大量资金储备和病毒式营销能力的工作室,发行是唯一可行的选择。

因此,有两类工作室都很需要发行:一是工作室已经推出成功的作品,但开发出下一款游戏仍然需要很长的时间(即他们的下一个发行日期距今超过9个月,而且当前成功游戏的玩家群体正在明显地流失);二是小工作室虽然开发出大有潜力的游戏,但没有营销预算和庞大的玩家基础。

发行协议通常分为两个部分:收益共享和用户开发。发行商提前给开发工作室支付开发预算,而工作室则同意将发行后的收益分给发行商(通常是五五分成,但有时候收益也拿来抵偿用户开发费用,即80%的收益归发行商,直到这部分费用偿清)。

按这种结构制定的协议对开发者来说是没有风险的,因为由发行商担保游戏的市场开发,且不需要预付任何资金(除了开发成本)。而对于发行商,这种协议则有一定的风险,尽管发行商可能已经确认了游戏的赢利潜力。总之,发行商急需满足当前用户需求(以免他们流失,之后还要开发),而开发者急需游戏发行的营销预算,所以这种方案对二者都是有好处的。

这种协议的问题在于:开发者要根据什么标准选择签或不签发行协议?什么因素对成功的决策具有决定性的影响?成功的决策能否模式化?

我已经尝试过模式化这种决策;我认为应该考虑到6个决定性因素:

1、CPI(每安装成本)是由市场决定的外因,不受开发者影响。

2、ARPDAU(每日每用户平均收益)体现的是游戏的赢利能力,它显然是计算总收益的关键部分。

3、K因素是游戏的病毒性传播力范围。

4、每月自然安装是指通过非病毒性、非付费来源的安装量。

5、每月开发预算是指开发者每月用于支付开发用户的费用。 它与CPI共同决定了开发者每月可获得的付费安装量。

6、净收入再投资是开发者用于下个月用户开发活动的费用占净收入的比例(游戏邦注:假设开发者每个月底结算收入,每个月初计划用户开发预算)。换句话说,这个占净收入比例的费用、平台费用和(适合的)发行分红会在下个月里计算到每月用户开发预算中。

这些假设值的调整结果清楚地表明,收益几乎完全是由病毒性传播力、开发预算和再投入率决定的;当K因素高时,收益以产生恒定ARPDAU的复利率增长,无视任何初期开发预算,但通过未来支付开发与净收入的持续再投入成正比。当病毒性传播力小时,只有非常高的再投入比例能使用户基础保持增长(假设自然安装不是一些外因如平台特点导致的)。

在模型中使用的游戏的初始假设表明,对于一个普通的商业平台,10美元的ARPDAU是不错的,但不算特别突出,15%的K因素算强,但还不算太强。另一方面,体现在模型中的发行交易的条款虽不是有利的,但并非完全不现实的。

值得注意的是,只有在这个模型中考虑到的费用与用户开发相关,而基本建设支出、销售额、行程和娱乐等因素则无关。这不是一个完整的财政模型,但是一个描述特定决策点的操作模型。

这个模型考察了以下6种情况:

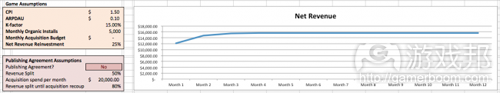

0美元的初始月开发预算,25%的支收入再投入,无发行交易

* 52周的总净收益:18万2969美元

* 月收益曲线:

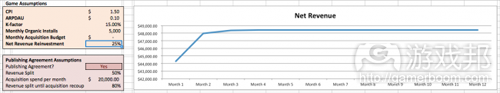

0美元的初始月开发预算,25%的支收入再投入,有发行交易(月支出为2万美元,偿清开发费用后收益分红比例为50%,偿清开发费用前的收益分红比例为80%)

* 52周的总净收益:28万8168美元

* 月收益曲线:

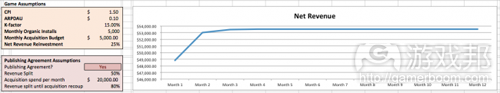

5000美元的初始月开发预算,25%的支收入再投入,无发行交易

* 52周的总净收益:25万1915美元

* 月收益曲线:

5000美元的初始月开发预算,25%的支收入再投入,有发行交易(月支出为2万美元,偿清开发费用后收益分红比例为50%,偿清开发费用前的收益分红比例为80%)

* 52周的总净收益:31万8642美元

* 月收益曲线:

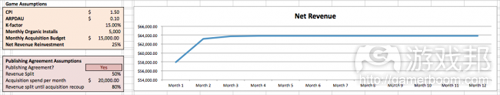

1万5000美元的初始月开发预算,25%的支收入再投入,无发行交易

* 52周的总净收益:38万9805美元

* 月收益曲线:

1万5000美元的初始月开发预算,25%的支收入再投入,有发行交易(月支出为2万美元,偿清开发费用后收益分红比例为50%,偿清开发费用前的收益分红比例为80%)

* 52周的总净收益:37万9592美元

* 月收益曲线:

在不同游戏和发行协议假设的情况下的使用这种模型的结反映了游戏发行经济中一些真实情况:

1、一般的小型游戏开发商从标准发行协议中受益最多.

2、病毒传播力强的游戏只需要较少的营销预算就能建立用户基础。相对于开发者靠成功游戏的收入再投入形成的用户开发能力,由发行商提供的用户开发预算很快就会减少。

赢利程度不高的游戏会受到高预支用户开发费用分红方式的损害。

用户开发的再投资能再次促进收益的积极增长,从而减少开发者对发行商的用户开发支出的依赖,除非用户开发支出随着时间增多。

在某些情况下,发行对于发行商和开发者都是一个“帕累托最优”选择(游戏邦注:这是由意大利经济学家帕累托提出来的一种经济状态,是指具有以下性质的资源配置状态,即任何形式的资源重新配置,都不可能使至少有一人受益而又不使其他任何人受到损害。人们通常也把能使至少一人的境况变好而没有人的境况变坏的资源重新配置称为帕累托改进,所以帕累托最优状态也就是已不再存在帕累托改进的资源配置状态。),但那些情况符合特定的参数。开发者从发行协议中的获利程度与游戏的病毒性安装量、以及开发者留给市场营销费用的收益成正比。

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

The economics of mobile game publishing

By Eric Seufert

Supercell’s recent $100mm secondary financing round raises some interesting questions about how mobile game developers capitalize on a hit game. A title in the Top 10 grossing chart for the US can, as evidenced by a number of recent high-profile examples, generate upwards of $500,000 per day.

But this capacity for revenue generation does not directly scale with enterprise value for the firm because these revenue streams are not themselves business units. Rather, in many cases, hit games are evaluated as short-term windfalls that 1) cannot be expected to persist permanently into the future and 2) are assumed to be non-repeatable (ie. a huge hit game is seen as an aberration, not the result of a product strategy that can be re-implemented in another game to the same degree of success).

In order to build sustainable streams of revenue out of massive hit games, some studios have begun engaging in publishing activities. The reasoning is clear:

In most cases, Customer Equity (the aggregate total of all current and future Lifetime Customer Values) is the sole component of enterprise value for a mobile gaming studio. Brand Equity represents no monetary value; a mobile gaming studio (unless they have diversified into other revenue streams, as has Rovio) gains nothing in the present from a hit game in the past if those users have churned out of the ecosystem.

Mobile game development is a long and resource-intensive process. And the success of a mobile game in development is difficult to assess, especially given the rapidly escalating competitive landscape of the mobile gaming marketplace and the brisk pace at which mobile technologies evolve. The present value of future cash streams attributed to a future release decreases drastically as the timeline for projection exceeds one year.

Increased marketing costs have priced many small studios out of the user acquisition market. Publishing is the only viable launch option for studios without large cash reserves, absent incredibly virality.

The publishing model therefore sits at the confluence of the needs of studios sitting on large hits but with long-term product pipelines (ie. their next release date is more than nine months away, when the user base of the current hit is expected to have decayed substantially) and small studios sitting on games with great potential but without the marketing budget to seed their game with a large user base at launch.

The terms of a publishing agreement generally involve a revenue sharing component and a user acquisition component. The developing studio agrees to split revenues with the publisher (generally at a rate of 50% of net revenues) in exchange for a pre-determined acquisition budget to be spent by the publisher on the game (sometimes the revenue split will compensate for the acquisition spending, eg. 80% of the revenue goes to the publisher until acquisition spending has been recouped).

An agreement structured this way is no-risk for the developer because the game is guaranteed to receive users without any upfront costs (except for development costs, which are sunk). The structure of the agreement involves some risk on the part of the publisher, although the publisher would have thoroughly vetted the game in terms of its potential to generate revenue. In all, it is a good solution for a publisher starved for a destination for its current users (lest they churn out, requiring re-acquisition in the future) and for a developer starved for a marketing budget with which to launch a title.

The question that arises from these agreements is: on what criteria should a developer make the decision to go with a publishing agreement or not? What factors determine the prudence of the decision? And can this decision be modeled?

I have attempted to model the decision; the Excel spreadsheet can be downloaded here. I used as primary determinants of the decision six assumptions:

CPI (cost per install) is exogenous and set by the market; it can’t be influenced by the developer.

ARPDAU is a function of the game’s ability to monetize and is obviously a key component in calculating total revenue.

K-factor is the extent to which the game generates viral installs – more background information can be found here and here.

Monthly organic installs is an estimate of installs from non-viral, non-paid sources.

Monthly acquisition budget is the amount of money a developer is willing to spend on paid acquisition each month. This, combined with CPI, determines the number of paid installs acquired by the developer each month.

Net revenue reinvestment is the percentage of net revenue the developer is prepared to reinvest in the next month’s acquisition campaign (assuming that revenues are paid out at the end of the month and acquisition budgets are set at the beginning of each month). In other words, this percentage of revenue net of expenses, platform fees, and (when applicable) publishing split will be added to the monthly acquisition budget in the next month.

Adjusting the values of the assumptions illustrates clearly that revenue is driven almost entirely by virality, the acquisition budget, and the rate of re-investment; when k-factor is high, revenue growth increases at a compounding rate given constant ARPDAU, negating the need for any initial acquisition budget but justifying continued re-investment of net revenue through future paid acquisition. When virality is low, only a very high re-investment percentage allows the user base to grow (assuming organic installs don’t surge as a result of some external event, such as platform featuring).

The starting assumptions about the game used in the model reflect a mediocre commercial performer; an ARPDAU of $.10 is respectable but not exceptional, and a K-factor of 15% is strong but not overly viral. On the other hand, the terms of the publishing deal illustrated in the model are not favorable but not altogether unrealistic.

It should be noted that the only expenses considered in this model are those related to acquisition, not capital expenditures, salaries, travel and entertainment, etc. This is not a full financial model but rather an operational model describing a specific decision point.

The following six scenarios are examined:

$0 initial monthly acquisition budget with 25% net revenue reinvestment, no publishing deal

52-week total net revenue: $182,969

Monthly revenue curve:

$0 initial monthly acquisition budget with 25% net revenue reinvestment, publishing deal (monthly spend=$20,000, revenue split after acquisition recoup=50%, revenue split before acquisition recoup=80%)

* 52-week total net revenue: $288,168

* Monthly revenue curve:

$5,000 initial monthly acquisition budget with 25% net revenue reinvestment, no publishing deal

* 52-week total net revenue: $251,915

* Monthly revenue curve:

$5,000 initial monthly acquisition budget with 25% net revenue reinvestment, publishing deal (monthly spend=$20,000, revenue split after acquisition recoup=50%, revenue split before acquisition recoup=80%)

* 52-week total net revenue: $318,642

*Monthly revenue curve:

$15,000 initial monthly acquisition budget with 25% net revenue reinvestment, no publishing deal

* 52-week total net revenue: $389,805

* Monthly revenue curve:

$15,000 initial monthly acquisition budget with 25% net revenue reinvestment, publishing deal (monthly spend=$20,000, revenue split after acquisition recoup=50%, revenue split before acquisition recoup=80%)

* 52-week total net revenue: $379,592

* Monthly revenue curve:

Examining different scenarios with the model under different game and publishing agreement assumptions reveals a few realities of the economics of game publishing:

Small developers with mediocre games benefit most from a standard publishing agreement.

Viral games need smaller marketing budgets with which to seed a user base. The acquisition budget contributed by publishers quickly diminishes relative to the developer’s capacity for acquisition through reinvestment with a viral game.

Games that don’t monetize to a high degree will suffer from a high pre-acquisition recoup revenue split.

Reinvestment into acquisition creates a compounding effect on positive revenue growth that reduces the relative contribution of publisher acquisition spend unless that spend scales over time.

Publishing in some cases is a Pareto optimal choice for both publisher and developer, but those cases conform to specific parameters. The degree to which a developer will benefit from a publishing agreement relates directly to that developer’s ability to generate viral installs and its tolerance for setting revenue aside for marketing expenditure.(source:gamezebo)

闽公网安备35020302001549号

闽公网安备35020302001549号