阐述游戏玩家类型的划分方法及意义

作者:Chris Toepker

在改进游戏设计和计划市场营销策略时,必须非常明确消费者细分。然而,作为游戏从业者,我们通常依靠过分简化和经常变化的定义来指导我们的工作。在下文中,我将解释玩家细分的意义。

考虑一下其他行业是否将消费者分为定义明确的类型。比如,电子产品、家电、电影、电视、服装或食物,这些大行业都会花大量钱分析他们的消费者。它们通过分类挖掘消费者的生活作风、花钱习惯、关注点、个人志向和理想等。这种分类是全面的,不只是关注人们在某种产品或服务上的消费情况。

借助这种分类,公司一方面可以更好地做出更好的产品设计和易用性,另一方面可以优化市场营销和拓展方案。以飞利浦和通用电气为例,电动刮胡刀、牙刷和小家电的市场变化并不快。然而,这两家公司肯定在消费者分析上有所投入。再举个更直白的例子,电影总是要根据消费群体来选择上映日期。简单地说,如果你要在这一周上映一部动作电影,你的受众中有多少人在上周已经看过Bruce Willis(游戏邦注:他是著名的美国动作电影明星)的电影,还准备来看你的电影?与此类似,你的受众在哪些地方花时间以及看什么(杂志?广告牌?网页?)?太好了,你知道要从哪些方面入手寻找你的受众了。当观众只是匆匆扫一眼,你能看出什么?还是那句话,通过消费者分析就能揭露信息。

这里我们只做了皮毛分析。相比于其他行业,我们游戏业只根据热门术语如“硬核”和“休闲”或最近出现的“中等硬核”来区分玩家,是否让人感到受挫?我们是否有一套通用的定义?如果有,那些标签意味着什么?它们如何指导我们开发出更好的游戏?或者找到更多受众?与其行成功的行业相比,我们的分类法又如何?依我个人的拙见,我们还有很长的路要走。

下面这张关于玩家分类的图片能说明什么?

我们应该深入挖掘这些术语,想出更实用的定义。

根据我的经验,“硬核”玩家相当于“狂热者”,他们是指那种在一款游戏或几款游戏上既花钱又花时间的玩家。除了花时间玩游戏,他们还花时间准备或参加游戏相关的活动。过去的硬核玩家要研究地下城、计算数值、召集队友、开小会,甚至提供零食。现在的硬核玩家要熟知关卡、牢记多人地图、练装备、研究模式、精通所有武器的属性、经营公会等等。当然,他们买游戏、通常也买资料片,以及拉朋友一起玩。他们成为自己建立的社区的核心成员,因此甚至觉得自己对游戏的占有与发行商和设计者一样多。自然而然地,他们更加致力于少数几款游戏。毕竟时间和金钱是有限的,况且他们在自己选中的游戏中有大量投入。

从这个层面上看,“硬核”玩家就是“硬核”游戏粉丝。这与体育迷一样,“硬核”粉丝会观看所有比赛,知道选手的信息、谁受伤不能上场、谁上了第一场比赛等等。类似地,他们成群结队地与赛场一起移动、订购手机应用观看比赛、购买主题运动衫、帽子等等。他们只忠心于少数几个团队,或甚至是一两名选手,他们也要为自己的狂热付出时间和金钱。服装或食物或小车等的“硬核”粉丝也类似。

那么,“中等硬核”的时尚迷应该是怎么样的?!我们能从他们的表现中知道服装公司应该如何设计秋装吗?或营销秋装吗?

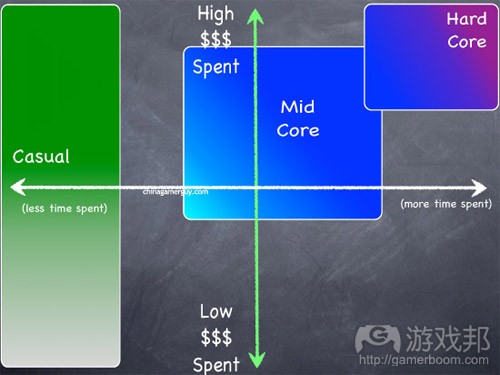

我们来看看下面这张新图:

根据我的经验,“中等硬核”玩家花钱的范围比硬核玩家更广,并且程度也相当高,但因为很大一部分玩家花钱极少,所以整体指标不如“硬核”玩家的高。这类玩家的一个更典型的特点是,他们花在游戏上的时间明显更少。记住, 所谓“花在游戏上的时间”不只是指“玩游戏”,还包括与游戏间接相关的活动。另一个区别就是,他们对某款游戏的忠实度并不高,会经常性地换游戏。

考虑到以上所有特点,我认为这类群体可以叫作“支持者”。与运动或品牌的支持者一样,他们也是重要的玩家基础。然而,他们的程度远不如硬核玩家。

这些分析对我们的市场营销有何意义?

简单地说,“硬核”玩家最容易通过PR开发出来。你给他们呼朋引伴到你的游戏中去的理由、工具和方法,让他们代表你为游戏做宣传推广。给他们认同和奖励,会让你跟他们——你的最佳客户保持坚实互惠的关系。

而“支持者”需要借助广告才能开发出来。将你的游戏放在这些玩家面前,重点介绍核心特征,以便尽可能让他们为感兴趣的方面花钱,无论是直接付费还是在免费游戏中的微交易。那么应该选择什么渠道来联系这些玩家?应该使用什么营销工具?两个答案:一是深入分析游戏的潜在受众;准备面对这个残酷的现实:“我知道有一半的广告预算是浪费了,但我不知道是哪一半。”可以肯定地说,我并不主张你浪费预算!即使是在这样一个数字平台和信息爆炸的时代,你也仍然需要分散广告网。所以,如果你没有充分了解你的受众,你肯定会放错广告或者犯类似的错误。

有可能把“支持者”变成“狂热者”吗?当然有可能。但是,要用现实一点的眼光看待这个转变过程。一个真正的硬核受众会迷恋多少款游戏?多少本书?多少部电影?多少个角色?多少种品牌?如果你的计划是把一大批“支持者”变成“狂热者”,你可能需要得好好考虑一下这个过程。这需要的预算和时间可能远超你的想象。

那么“休闲”玩家呢?这个概念也大有挖掘空间。如果说“支持者”和“狂热者”一定要看电影,那么“休闲”玩家就满足于看电视。电视观众是非常多的,分散于成千上万个频道和节目中。做出一款热门的游戏或经营一类畅销的产品,是完全有可能的,但前提是,你必须充分了解你所服务的受众,以及掌握联系到这类受众的渠道。

再进一步说,我们还可以使用这些简单的分类来理解为什么游戏在某些国家会移植不成功?例如,在中国,玩家喜欢比较休闲的游戏:几乎不需要精神投入,对游戏世界、角色、互动和玩法也没有太多要求。然而,他们却非常乐意在这种游戏上砸钱!答案就在下面这张图中:

随着我们进一步了解游戏业,我们会更加领会到理解玩家特点、有针对性地设计和营销是成功的关键。我们可以从其他行业中借鉴到许多经验,无论是娱乐业还是传统商业。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Correcting Core Confusion

by Chris Toepker

Improving game design and marketing requires more clearly understanding consumer segmentation. All too often we in gaming rely on simplistic and regularly-changing definitions and understandings in order to direct our work. Here is a simple way to start the conversation: a helpful core breach for our enterprise, if you will. Engage.

Consider for a moment how much other industries spend on breaking consumer groups into definable segments. Whether electronics, appliances, movies, TV, fashion or food, each of the big players easily spend tens of millions of dollars to understand their consumers. The understanding provides in-depth descriptions of lifestyle habits, monies spent, trends appreciated, personal aspirations and ambitions, and so on. Notably, the understanding is holistic, it is not merely focused on people’s consumption of a particular product or service.

The segmentation allows companies to better the design and usability of the products themselves, and equally importantly better understanding enables improved marketing and communications. Take Philips or General Electric for example. The electric shaver, toothbrush and appliances are not changing rapidly. However, these companies are sure to spend when it comes to segmentation research. Perhaps more close to home, consider movies. Picking the right weekend to launch takes segmentation into consideration. Putting it simply, think of it this way: if you’re launching an action movie this week, how many of your fans have already seen the Bruce Willis movie last weekend, and are ready to come see yours? Likewise, where do your fans spend their time and what are they looking at (e.g. magazines? billboards? online? Etc.?) Bingo, you know where to reach people who will appreciate you. And what should you be saying when they glance your way? Again, segmentation studies provide revealing information.

As we scratch the surface here, who else feels frustrated that we game makers rely on buzzwords like “core” and “casual,” or the latest addition “mid-core”? Do we even share a common definition? And if we do, what can these labels tell us? How can they help us direct and develop better games? Reach and communicate larger and better audiences? How does our segmentation compare with practices in other successful industries and businesses? In my humble opinion, we have much to learn.

For a basic example, what can a picture of “mid core” really tell us…?

We need to breach “core” buzzwords and develop a more useful picture.

In my experience, a “core gamer” is a shortening of “hard core gamer.” It refers to players who spend both time and money on their game or games. In addition to time spent playing, they also spent a lot of time preparing or anticipating. Once upon a time, these were the players who prepared the dungeons, painted up the figures, gathered the players, ran the sessions and even provided snacks. These days, it’s the players who read up on the levels, the multi-player maps, delve into The Forge, author mods, know all the stats for all the weapons, run the guilds and so on. Of course, they bought the game and usually buy the downloadable content as well as evangelize and get their friends to play. They become the center of a community that they built, and as a result, often wind up feeling they own the game as much as the publisher or designers. Naturally, they are more dedicated to a small(er) set of games. After all, they have a lot invested in their chosen entertainment, both in terms of time and money.

In this sense, the “core gamer” is just like any other “hard core” fan. Take sports. “Core Fans” attend all the games, know the players’ stats, who is on the injured list, who is on the first string and so on. Likewise, they travel with the team for away games, subscribe to mobile apps to watch the games, buy jerseys, caps and so on. They are loyal to a small set of teams and maybe a player or two, largely because of the time and money invested in their fandom. Likewise for fashion or food or cars and so on.

So, what would a “mid core” fashionista be?! Does it tell us anything useful about how a fashion house should design the fall collection? Or market it?

Let’s attempt a new map, and a new name for the segment.

In my experience, “mid core” gamers spend a wider range of money than hard-core fans. The range reaches nearly as high, but is weighted down by a bigger segment of players who spend significantly less. Even more defining is the significantly smaller amount of time spent with the game(s). Keep in mind, it is not just the playing, but includes activities indirectly involved with playing. Another contrast is that they are not as loyal to particular games and switch quite regularly.

Considering all this, I tend to think of this group as “boosters.” Again, like sports or band boosters, they are considerable fans. However, they do not quite go to the same length as their hard-core counterparts.

How can this understanding help us in our daily approaches? Let’s turn for a moment to marketing.

Put simply, “core gamers” are best reached and communicated with using PR. By giving them reasons, tools and methods for gathering their friends to your game, you empower their activism and evangelizing on your behalf. Giving them recognition and rewards only makes the relationship with them, your best customers, all the more solid and mutually helpful.

On the other hand, “boosters” require advertising. By putting your game in front of these players, and focusing the message to attractive key features, you stand the best chance that they will pay for aspects they appreciate, whether buying the game outright or in F2P micro-purchases. How do you focus the message and be single-minded in its communication? What communications channels should you choose to reach these players? What marketing communications tools should you develop? Two answers: first, deeper segmentation on the potential fans for your particular game. Second, be prepared to face the truism: “I know half of my advertising budget is wasted, I just don’t know which half.” To be sure, I am not advocating you prepare to waste your budget! Still, even in today’s world of digital platforms and plentiful data, you need to spread a wide advertising net. As you begin, especially if there isn’t sufficient understanding of your segment(s), there is bound to be some ads misplaced or similar missteps.

Isn’t it possible to migrate players from being “boosters” to being “core”? Of course it is. However, it’s important to be realistic about this. In the normal course of fandom, how many games, books, movies, characters, fashions or anything else can anyone be truly hard core about? If your business plan is to migrate a large portion of “boosters” toward being “core,” you probably need to take a moment and think that through. It will likely take a larger budget and longer time than you are imagining.

What about “casual” players? There is a lot of room for deeper understanding here as well. If “boosters” and “core” fans are like adamant movie goers, “casual” is similar to cable TV. There is a huge audience, and it is fragmented into a million channels and programs. It is possible to make great games and have great business, but it means you must completely understand the niche segment you want to serve, and reach them as directly as possible. In this, and put extra simply, consider the successes of the farm, truck, train and so on simulators.

Going just a bit further, we can also use these sorts of simple segments to understand why transplants may or may not work in other countries. For example, in China, players get involved in games that by all appearances are casual: reguire little engagement or differentiation between game worlds, characters, interaction and play. However, they are willing to spend quite a bit of money on them! Why? Segmentation will tell us.

As we further understand our game-making enterprise, understanding player segments and realistically addressing them with designs and marketing is key to avoiding a “core breach.” There are many lessons to be learned from other industries, whether in entertainment or more mundane businesses. Here’s to taking them to heart!(source:gmasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号