每日观察:关注App Annie日本移动游戏市场报告(1.29)

1)应用商店分析公司App Annie日前发布日本移动市场数据显示,在2012年10月,日本Google Play收益超过美国,成为Anroid平台盈利性最高的市场,在全球Google Play收益中占比29%。尽管如此,日本iOS App Store收益仍然远远高于Google Play。

值得注意的是,在此之前(截止2011年底)日本智能手机市场份额仅为23%左右。

日本移动市场过去主要由NTT DoCoMo、KDDI和软银这三大运营商主导大局(游戏邦注:这也是功能性手机长期在日本盛行的主要原因),但iOS和Android系统的问世使这三大巨头对手机内容的控制权受到冲击。

App Annie报告还分析了2012年1月至9月日本前20名iOS发行商(根据收益排名)的情况,并指出游戏发行商在其中占据了18个席位,这20家发行商占据了所有iOS内容半数以上收益,其中前五大发行商占据了将近三分之一的收益。此外,该榜单以日本公司为主,只有韩国NHN(LINE开发商)、法国 Gameloft和苹果是其中为数不多的三家海外公司。而Zynga、EA和Rovio等在其他地区极具影响力的大型公司甚至无法跻身日本前20家发行商之列,由此可见西方公司攻克日本市场的难度极大。

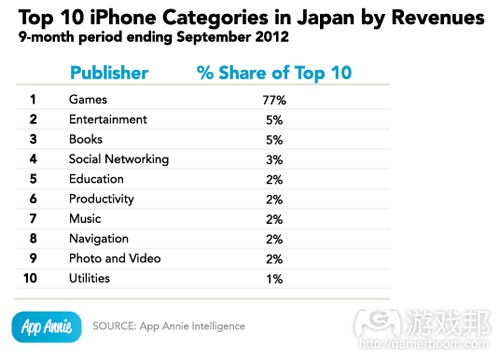

从收益来看,游戏仍然最占优势,在所有内容收益中占比77%(游戏在其他地区市场也同样如此,在美国市场收益占比59%)。

另外值得一提的是社交网站应用,从2012年1月至9月,这类应用在iOS平台收益增长383%,其中Line的用户已突破1亿,成为截止2012年9月在日本收益最高的社交应用。

2)日本开发商GungHo日前宣布免费智能手机游戏《Puzzle & Dragons》iOS和Android注册用户已在1月18日空破700万(在本月初已宣布用户达600万)。

观察者指出,这款游戏下载量持续上升除了得益于电视广告,还有一个原因就是它在1月11日登陆了Kindle Fire。

《Puzzle & Dragons》于2012年2月份在登陆日本iPhone平台,在9月份入驻Android平台,11月份向美国App Store发布英文版本。

该游戏目前是日本iPhone、iPad和Android平台收益排名第一的游戏,其开发商GungHo目前市值达1952亿日元(22亿美元),身价超过了Zynga(19亿美元)。

3)Strategy Analytics最新报告指出,上一季度全球智能手机销量达2.17亿部,增幅为38%,整个2012年智能手机销量超过7亿部,其中Android设备占比68.4%,而iOS仅占比19.4%。2012年全球手机设备总出货量达16亿部,这意味着智能手机仍然低于半数比例。

从设备制造商来看,苹果2012年手机出货量为1.358亿部,而三星则是3.965亿部(其中多为智能手机)。诺基亚出货量为3.356亿部,但其中多为非智能手机设备。

2012年第四季度苹果智能手机出货量达4780万部,所占市场份额为22%,略低于去年的24%;该季度苹果和Android在全球智能手机出货量中占比92%。

4)据techcrunch报道,中核游戏开发商Kabam日前宣布2012年总收益达1.8亿美元,同比2011年增长70%(游戏邦注:这是总收益数据,并未扣除苹果、谷歌或Facebook等平台供应商的30%抽成),但并未透露公司利润。据Gamesbeat报道,其中有1亿美元来自《Kingdoms of Camelot》、《Arcane Legends》和《The Hobbit》这三款iOS和Android游戏,而在2011年该公司所有的1亿美元收益均来自Facebook平台。

有传言称该公司在2011年5月融资7500万美元时的估值至少达5亿美元,Kabam至今已至少融资1.25亿美元,远超另一家中核游戏开发商Kixeye(已融资1900万美元)。

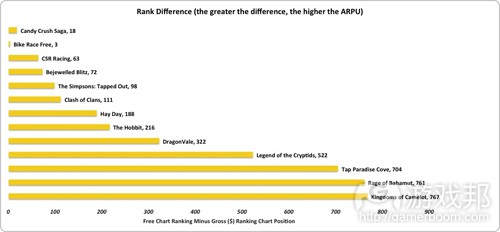

5)英国开发商Kwalee财务经理Tom Aherne最近调查了热门游戏在美国免费游戏营收榜单,以及英国榜单排名情况。其数据显示,在过去三个月中《CSR Racing》、《The Simpson: Tapped Out》以及《Candy Crush Saga》在免费和营收榜单排名相对较高,而《Kingdoms of Camelot》和《Rage of Bahamut》在营收榜单名次较高,但在免费榜单排名相对较低。

但从ARPU来看,《Kingdoms of Camelot》和《Rage of Bahamut》这两款游戏表现最佳,由此可以推测这两款游戏发行商——Kabam与DeNA在美国投入的用户营销成本更少,所以它们在免费游戏榜单排名较低(因为免费游戏榜单排名与下载量一般会受到发行商投入营销成本的影响)。

6)据venturebeat报道,游戏市场分析公司Newzoo主管Petr Warman最近指出,游戏行业的收购及投资额度之间的巨大差距表明,投资者对该领域的信心已受到影响。

社交、移动和网络游戏市场规模目前正在赶超PC和主机游戏市场。游戏行业的玩家数量目前已达8.8亿,移动游戏每年增幅为32%,目前市场规模达90亿。有33%的移动应用下载量来自游戏产品,有66%的移动应用收益来自游戏相关产品。

Warman强调游戏行业正出现5种趋势:用户将使用更多种游戏设备,游戏趋于免费模式,游戏在向服务转型,能够实现收支平衡的模式才是优秀的商业模式,游戏正呈现全球化特点。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)App Annie takes an-depth look at the mobile app economy in Japan

Scott Reyburn

App store analytics company App Annie today took an in-depth look at Japan, analyzing the Japanese mobile industry, the state of the platforms in the country and the companies, app genres and apps dominating the Japanese market.

In October 2012, Japan surpassed the U.S. in revenue on Google Play, becoming the most lucrative country for the Android platform, with 29 percent of the app store’s total global revenue.

Before Japan surpassed the U.S. as the leader in terms of revenue on Google Play, the country was actually late to the smartphone party, with smartphones taking only a 23 percent share of the handset market share at the end of 2011.

In Japan, the mobile market is dominated by three wireless carriers — NTT DoCoMo, KDDI and SoftBank. Traditionally, these companies have been the gatekeepers of content, but since the debut of the iOS and Android app store ecosystems, the top three wireless carriers are seeing its control over content change hands to the iOS and Android mobile platforms. This is why feature phones held on for so long in the country while smartphones blossomed in other regions, because the wireless carriers could restrict access to content and have influence over device manufacturers.

The No. 1 wireless carrier, NTT DoCoMo, doesn’t carry Apple products because it can’t control the sale of content from the Apple iTunes Store. Instead, NTT DoCoMo put its chips on Android and also built its own carrier stores to continue to maintain control on content that flows through its wireless network. For example, “dmenu” is a portal for accessing internet-based content, and “dmarket” is a market offering videos, music, books and apps.

On the other hand, the No. 2 and 3 wireless carriers, KDDI and Softbank, offer the iPhone, enabling Japanese consumers to buy content through the Apple iTunes Store instead of through the wireless carrier. The move to carry Apple products in turn has boosted the subscriber rate for both KDDI and Softbank, while NTT DoCoMo is now losing more subscribers than the competition, which leaves hope for KDDI or Softbank to overtake NTT DoCoMo as the wireless carrier leader in Japan.

All the happenings in the Japanese wireless carrier industry led to Android holding two-thirds of the Japanese smartphone market share, while iPhone has the other third. Despite Android’s handset market share, the Apple iTunes Store generates far more revenue than Google Play, although Google Play has been catching up over 2012. A trend seen in other regions as well.

App Annie also analyzed the top 20 iOS publishers in Japan by revenue from January 2012 to September 2012, finding that 18 of the top 20 publishers are gaming companies. The 20 publishers combine for more than half of the total value of all grossing content, with the top five publishers representing nearly one-third of all revenues. Also, Japanese companies dominate the chart, with only South Korean NHN, developer of LINE, French game developer Gameloft and Apple as the lone Western companies in the top 20. Publishers with deep pockets and market dominance in other regions such as Electronic Arts, Zynga, and Rovio, aren’t even in the top 20, which demonstrates the difficulty for Western companies to excel in the Japanese gaming market.

The games genre, to no one’s surprise, crushes the other app genres in revenue, with 77 percent of total revenues across all categories. The gaming category is the leader in revenue in other regions as well — the U.S. at 59 percent — but the category is not as dominate as the category is in Japan. GungHo Online’s Puzzle & Dragons, which recently reached the seven million user mark, is an example of a native mobile game for smartphones that’s leading the way for the gaming genre in Japan, demolishing the competition in terms of revenue.

Aside from games, social networking is a genre worth noting. iOS revenues for social networking apps grew 383 percent when App Annie compared its January 2012 versus its September 2012 data.

Messaging app Line, which recently reached 100 million users, was the leading app in the social networking genre by revenue over a 12-month period ending in September 2012.(source:insidemobileapps)

2)Puzzle & Dragons Hits 7 Million Downloads. Maker GungHo Is Now Worth More Than Zynga.

by Dr. Serkan Toto

Japan’s top platform-free smartphone game Puzzle & Dragons is running from one record to the other: the puzzle/RPG hybrid boasts a staggering 7 million registered users across iOS and Android now.

GungHo says the number was actually reached on January 18, just a few days after announcing 6 million users earlier this month.

What helped the game to continue to rack up downloads is, apart from TV advertising, the fact that it became available on Kindle Fire on January 11.

Puzzle & Dragons was launched in Japan for the iPhone in February and on Android in September 2012. An English version landed in the US App Store in November last year.

330 days after the launch in Japan, the title is still not only adding users at a fast clip but also making serious money: it currently occupies the No. 1 spot on the Japanese top grassing ranks on the iPhone, iPad, and Android. It’s actually insane how profitable the title is.

So how does the success of Puzzle & Dragons reflect in the stock price of GungHo (which is listed at the JASDAQ in Tokyo)?

The company’s market cap has reached 195.2 billion yen, which currently translates to a staggering US$2.2 billion. This is more than Zynga’s market cap, which stands at US$1.9 billion today.

GungHo does have a number of fairly popular smartphone games, but what you can see below is essentially all about Puzzle & Dragons.(source:serkantoto)

3)Android captured almost 70% global smartphone market share in 2012, Apple just under 20%

John Koetsier

Apple may be winning the smartphone battle Stateside, but Android is winning the global smartphone war being fought everywhere else.

Smartphone sales grew 38 percent last quarter to reach 217 million units worldwide, and over 700 million units for the entire year, according to a new report from Strategy Analytics. Of those 700 million-plus smartphones, 68.4% smartphones ran Android as the operating system, while only 19.4 percent ran iOS, Apple’s mobile operating system.

“Almost half-a-billion Android smartphones were shipped in total worldwide during 2012,” the firm’s executive director Neil Mawston said in a statement. “Android is clearly the undisputed volume leader of the smartphone industry at the present time.”

In terms of manufacturing, the global smartphone industry is basically two companies: Apple and Samsung. Apple shipped 135.8 phones last year, all smartphones, of course, while Samsung shipped 396.5 million phones, most of them smartphones. Phone shipments in general reached 1.6 billion in 2012, meaning that smartphones still made up slightly less than half of all phones sold. Nokia still ships a lot of units — 335.6 million in 2012 – but most of them are not modern smartphones.

“Apple grew 29 percent annually and shipped 47.8 million smartphones worldwide for 22 percent marketshare in Q4 2012, dipping slightly from 24 percent a year earlier,” Scott Bicheno, a senior analyst at Strategy Analytics, added. “Combined together, Apple and Android accounted for a record 92 percent share of all smartphones shipped globally in the fourth quarter of 2012.”

The massive numbers obscure that growth, while still torrid, is slowing. While 2011 saw 64 percent in smartphone shipments, 2012′s growth rate was a slightly more moderate 43 percent.

But it’s clear that the market has become a tale of two mobile operating systems: Android and iOS.

The challenge in 2013 for Windows Phone, BlackBerry, and even smaller upstart phone operating systems is simple to grow enough to matter.(source:venturebeat)

4)Kabam Enters 2013 With More Than A $200M Runrate Even As The Gaming IPO Window Seems Closed

Kim-Mai Cutler

Kabam, a midcore game developer that staged a stunning new chapter on mobile platforms, is out bragging about its expected revenues for the coming year. The company said it ended 2012 with gross revenue of $180 million, up 70 percent from the year before. Gross revenue is bookings, so it doesn’t account for the 30 percent platform cut that a provider like Apple, Google or Facebook would take.

Kabam didn’t reveal its margins, except to say that the company was profitable (which I honestly hope should be the case for any mature freemium gaming company).

Kabam was a pioneer in midcore freemium gaming on Facebook. Unlike Zynga, they didn’t focus on reaching the largest audience possible or the stereotypical 35-year-old female casual gamer. Instead, they cultivated a smaller player base (usually more male) that spent more on average to play. As Facebook became a more challenging environment, they pivoted to mobile like many other game developers did. That mobile business, which includes extensions of their Kingdoms of Camelot franchise, is now a more-than $100 million business.

Another tidbit the company shared was that it was valued at at least $500 million during a May 2011 round of funding that raised $75 million for the company. It also said the recent strategic investment from Warner Bros. Entertainment Inc. and Metro-Goldwyn-Mayer Studios Inc. was secondary, with the investors purchasing shares from earlier investors. On top of that, it says it has $45 million in cash in the bank.

So why reveal all this? Kabam says it’s to “establish who’s leading.”

But we occasionally see companies do this from time to time as positioning ahead of a sale or additional investment. Seattle’s PopCap actively talked about a potential IPO for months before EA turned around and bought the company for up to $1.3 billion including earnouts.

The thing is that Kabam has raised at least $125 million. That’s substantially more than what other midcore developers like Kixeye, which has $19 million in funding, have raised. That just means the bar for an exit, whether that’s through a sale or through a public offering, is much higher. Kabam has mentioned an IPO in the past as a possibility, depending on what’s right for the company.

But given how Zynga performed through 2012, it would be hard to imagine that public market investors have the appetite for another freemium gaming IPO. Zynga is valued at 4.5 times the at-least $500 million that Kabam said it was worth in the 2011 round, on at least six times the revenue.

Then there are only a handful of companies in the world, like EA, Zynga, Nexon, DeNA and GREE, that could even make an offer that would clear the bar for investors. Zynga has appeared to shy away from larger acquisitions after its shares were clobbered in the wake of the $180 million OMGPOP deal and CEO Mark Pincus’ April 2012 remarks that the company was looking at more deals of that size.

Many other game developers of similar or slightly smaller size face a conundrum — there is an inhospitable public market, a relatively small number of potential buyers and lower valuations of publicly-traded comparable companies. This has meant that there might still be some misalignment between what game developers and acquirers are expecting to see in M&A discussions. This may be why we haven’t seen any big ticket acquisitions of game developers recently — at least outside of Japan, China and South Korea. (Japan is a completely different story with the Pokelabo and Gloops deals.) (source:techcrunch)

5)Chart of the Week: Which F2P games demonstrate the most dense monetisation?

by Jon Jordan

The top of the US top grossing chart isn’t a very volatile place.

Once a game manages to carve out a position, it maintains a death grip, at least while the developer has cash to run a strong user acquisition program.

Or does it?

According to some research from Tom Aherne, the finance manager at UK developer Kwalee, there’s actually a large spread between the US top grossing free-to-play games and their position in the US free download charts.

Comparative ranking

Looking at 13 titles over a three months period, Aherne points out that games such as CSR Racing, The Simpson: Tapped Out and Candy Crush Saga rank relatively high in both the free and the top grossing charts.

Meanwhile, titles like Kingdoms of Camelot and Rage of Bahamut rank high in the top grossing charts, but low in the free chart.

Granted they have been released longer than the former titles, so now likely to rank lower in terms of pure downloads, but nevertheless, this finding suggests that they are retaining and monetising their players much better.

It also suggests that their publishers – Kabam and DeNA respectively – are spending less money on user acquisition in the US, as this drives downloads and hence would be reflected in a leap in free chart ranking.(source:pocketgamer)

6)Newzoo warns of a gap between investor thinking and game-market opportunities

Dean Takahashi

In the London Underground, the ubiquitous warning is to “mind the gap” between the train platform and the train. Peter Warman, head of game-market analysis firm Newzoo, thinks that’s a good analogy for the growing gap between investors and opportunities in the game market.

During 2012, stocks such as Zynga’s tanked after a big initial public offering. And while mergers and acquisitions hit a record $4 billion ($3.4 billion by our own calculation at GamesBeat), game investments tumbled 57 percent, according to investment bank Digi-Capital (see chart at right).

The big difference between the acquisition values and the value of investments suggests a disconnect, where investors no longer believe they can get out-sized returns. This comes amid headlines bemoaning layoffs at traditional game companies and a fall in retail sales of titles in the U.S. But in an interview with GamesBeat (in a preview of a talk at the [a]list summit in New York on Jan. 29), Warman said the gap comes from a misperception. While traditional console releases are seeing retail sales fall, the overall game industry is still growing fast on a global basis across multiple platforms, he stated.

“There is a lot of worry about the state of the game market, which is changing enormously,” Warman said. “Zynga’s stock fell, and it had such a negative effect on investors. But there is nothing wrong with social gaming and the larger market. We want to put investors back at ease and get them to understand the market that we see.”

Warman says the big trend that has benefited gaming is the increase in the number of screens people play titles on (see picture at left). In addition to the PC and the TV, consumers are playing games on tablets and smartphones, as well as portable gaming systems.

“Five years ago, only two screens mattered, but now, all of the screens form a perfect circle around the consumer,” Warman said.

Social, mobile, and online are now growing on top of the PC and console markets. And markets in emerging territories are growing at faster rates. That is a lot more to get excited about. When you add up those numbers, you get a $68 billion industry growing at a compound-annual-growth rate of 7 percent a year. All told, Warman said gamers now number about 880 million (see chart at bottom).

Mobile titles are growing 32 percent a year and are now a $9 billion market. About 33 percent of all mobile-app downloads are games, and 66 percent of all mobile-app spending is gaming related.

Within this context, Warman acknowledged that some segments of the market are going through hype cycles. Social gaming had hype, followed by the mobile-gaming bubble. Investors touted “mid-core” social games even as Zynga’s casual offerings declined. Social casino games soared in the last year. Hype over the hot categories drives a herd mentality among investors and inevitably leaves them feeling burned when the category fails to live up to expectations.

“We’re confusing investors and giving them no clear outlook on the future,” Warman said. “The result is a decline in investments. But based on what we see, the game market will grow for another 20 years.”

Warman acknowledged that only a few game companies have maximized their value by succeeding in multiple parts of the market. Electronic Arts is beginning to see a payoff from its years of investments in digital efforts, but its stock price doesn’t reflect that yet. THQ, which dismantled in a bankruptcy auction last week, is an example of what happens when you make investments in the new categories too late.

“THQ ran out of time,” he said. “They didn’t have enough time to learn from experiments in gaming as a service. You have to learn your optimal investments in digital content. These days, you have to realize you are not investing in a team that will make a game and move on to something new. You are investing in a team that will run a game, like a service.”

By contrast, he pointed out that Kabam learned from years of experimentation on how to monetize games like Kingdoms of Camelot. When the studio took that property to mobile platforms in the past year, it was a smash hit, becoming the No. 1 grossing hit for the Apple iTunes App Store.

“The good news is that the tablet and smartphone platforms are poised for growth for a long time ahead,” Warman said. “And investing in international markets can pay off now. There is so much opportunity if you localize a game for a region like Russia or Turkey.”

Companies have to realize that their marketing budgets should spread across multiple platforms, not just a single platform, Warman said.

Warman highlighted five trends that matter. Consumers are using more screens. Games are becoming free. Games are becoming services. A good business model is a balanced one. And globalization matters.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号