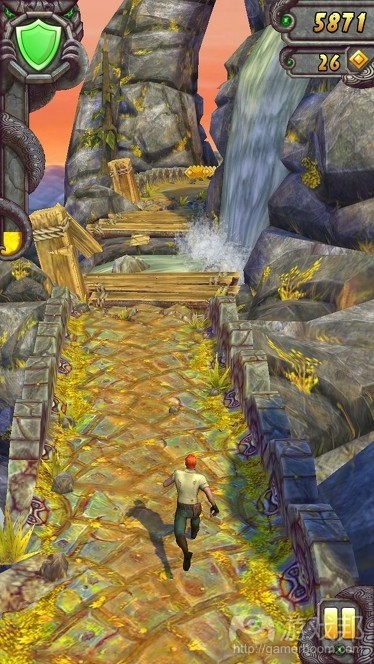

每日观察:关注Imangi继集游戏《Temple Run 2》(1.17)

1)据games.com报道,Imangi日前向新西兰推出热门游戏《Temple Run》续集(即将在美国市场开放下载服务)。《Temple Run 2》并不只是更新了游戏的外观,其玩法也同样出现突破性的变化。游戏为玩家提供了多个可玩角色选项,支持玩家激活特殊能力,以及更多曲折场景。

2)据insidesocialgames报道,真钱游戏平台Betable日前宣布聘请Jonathan Flesher任业务开发执行副总裁,在此之前Flesher曾担任Zynga副总裁及业务开发总经理,并曾在摩根大通、EA(任业务开发高级总监)以及私募股权公司Kohlberg Kravis Roberts & Co就职。

据Flesher的LinkedIn资料显示,他是在2012年11月份才刚离开Zynga。

3)ABI Research最新报告指出,亚马逊每部Kindle Fire每月只需通过其应用或内容创收3美元,就能够实现20%的利润。

亚马逊Kindle Fire自2011年以来就在“亏本”销售,但却通过书籍、电影、应用程序等数字内容成功盈利。

Kindle Fire是目前市场上领先的Android平板电脑,在去年圣诞节销量约600万部,其市场份额远超其他Android平板电脑。观察者认为,亚马逊以低于成本的价格出售Kindle Fire,它采用防御策略意在确保苹果和谷歌不会与其争夺用户并扼制亚马逊的数字电子商务业务。

亚马逊曾表示Kindle Fire在2012年占据了22%的美国平板电脑市场份额,ABI估计截止2012年底该设备安装量为1100万至1250万,一年销售额大约4亿美元。

4)分析公司IHS iSuppli日前预测,屏幕至少为5英寸的智能手机在2013年出货量将达6040万部,同比2012年时的2560万增长136%。预计到2016年,这类智能手机出货量将超过1.4亿部。

5)据venturebeat报道,尽管最近不少人认为iPhone 5市场需求并不理想,但KGI Securities分析师Ming-Chi Kuo却对此持乐观态度,并预测苹果在2013年第一季度的iPhone出货量将达5200万部,比去年同期增长41%,几乎是上一季度的两倍左右。

有苹果产品供给链的消息源指出,苹果在该季度的iPhone 5出货量超过3500万部,而Kuo则预测该时期iPhone 5出货量为3650万部,iPhone 4S出货量为950万部,iPhone 4为730万部。预计iPhone全年出货量将达1.4亿部,远超去年时的7200万部。

他预测iPad在今年出货量将达2300万部,比去年增长49%,其中第四代iPad出货量为930万部,iPad mini则是820万部。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Temple Run 2 hits the New Zealand App Store

by John Bedford

The sequel to Imangi’s incredibly popular endless-runner Temple Run has turned up on the New Zealand App Store, and will be available to download in the US from midnight tonight (thanks, TouchArcade).

Imangi hasn’t just taken the safe route for this sequel by refreshing the game’s cosmetic appearance, there are some radical changes to the gameplay too. There’ll be multiple playable characters to choose from, special powers to activate, zip-lines to ride, and more fluid and curved scenery to negotiate as well.

We’ll bring you a review of this follow-up to the phenomenally successful mobile game as soon as we can.(source:games)

2)Former Zynga GM Jonathan Flesher joins Betable team

Mike Thompson

Real money gaming platform Betable today announced it had hired Jonathan Flesher as its new Executive Vice President of Business Development.

Flesher comes to Betable most recently from Zynga, where he was the company’s Vice President and General Manager of Business Development. Prior to Zynga, Flesher worked at companies like JP Morgan, Electronic Arts (where he served as Senior Director of Business Development) and private equity firm Kohlberg Kravis Roberts & Co. Flesher’s LinkedIn account shows he left Zynga in November 2012, part of the ongoing high-profile series of departures the casual gaming giant’s seen over the past couple of months.

Since Betable came out of stealth in July 2012, the company’s generated a great deal of interest from the development community because of the extra potential revenue stream its API represents. As a result, we’re told several thousand characters have signed up to take part in Betable’s private beta program, but Betable’s announced partnerships with Slingo, Digital Chocolate, SGN, Murka, and Big Fish. Although Betable is based in San Francisco, its servers are in the United Kingdom, which allows the API to add real money gaming to titles in any country that allow online gambling.

Betable hasn’t revealed how many games are using its API, but we’re told the early results are exceeding the company’s expectations.(source:insidesocialgames)

3)Kindle Fire: If each Amazon tablet generates $3/month in digital sales, that’s 20% profit

John Koetsier

Amazon needs to make only $3 a month on apps or content from each Kindle Fire it sells in order to generate a 20 percent profit, according to new estimates from ABI Research.

Amazon sells Kindle Fires below cost, and it’s been this since 2011. The razor-and-blades plan seems to be: Give away the device and make it up on digital content, such as books, movies, apps, and more. But positive results of this strategy have not been easy to see in the company’s quarterly reports, with Amazon having losses or just small profits for the last four quarters.

However, the plan may be starting to work, and it has prospects for getting better over time.

“Considering the probable margins of app and content sales, our research shows that Kindle Fire is a credible proposition,” senior ABI analyst Aapo Markkanen said in a statement. “We expect that there will be a certain level of ‘innovation plateauing’ in mobile hardware taking place over the next five years, and that would certainly work in Amazon’s favor. Its future devices are likely to require less cross-subsidy than the ones we’ve seen so far.”

But Amazon like isn’t making money on the Kindle yet, Markkanen told me.

“They need more scale, more revenue, and more margin,” he said. “For example, with Amazon Prime, Netflix only recently got margins to 10-15 percent — and Amazon Prime is still around 5-10 percent.”

There are signs of that happening soon, however, according to ABI, perhaps as early as 2014.

The Kindle Fire is by far the leading Android tablet on the market, having sold perhaps six million units last Christmas and capturing significantly more marketshare than other Android tablet during the holiday. All that hardware sold below cost is part of what is making Amazon’s margins so thin. According to Markkanen, that’s a defensive strategy to ensure that Apple and Google do not own its customers and present a barrier to Amazon’s growing digital commerce.

The question is: How much could all that digital commerce be worth?

Exact sales figures on Kindle are hard to get — mostly since Amazon does not release them. But the company did say Kindle Fires accounted for 22 percent of the U.S. tablet market in 2012, and the Kindle Fire seems to compete well against the iPad Mini. ABI calculates the Kindle Fire installed base as between 11 million and 12.5 million units as of the end of 2012, which could then translate to some $400 million a year in sales. That’s revenue up in the Amazon Web Services area. But it’s not here yet.

And of course, Amazon’s strategy is not just about its own hardware — it’s also on every other platform. In fact, Markkanen estimates that Amazon has amassed about 180 million downloads from the iOS, Windows Phone, and Android app stores for its Kindle, Price Check, and other apps.(source:venturebeat)

4)Analyst: 5-Inch+ Phones Will More Than Double Marketshare In 2013 — 60M Incoming, Up 136%

Natasha Lomas

Smartphones with very large displays are set to take a much bigger chunk of the market this year, according to analyst IHS iSuppli which is predicting so-called phablets will more than double their share this year. iSuppli is forecasting that 60.4 million units will ship in 2013, up “a notable” 136 per cent from 2012′s 25.6 million. The prediction comes from the latest IHS iSuppli Mobile Handset Displays market tracker report.

iSuppli defines a phablet as a smartphone with a display of 5 inches or more. Recent additions to the phablet family include a 6.1 inch whopper made by Huawei and a 5-incher unboxed by Sony – both of which broke cover at CES. iSuppli notes that Chinese mobile makers are taking a lead in launching phablets, with Lenovo and ZTE also showing off huge phones at the tradeshow.

The analyst believes the phablet market will continue to swell after 2013 — with “vigorous double-digit-rate expansion” predicted for the next few years, as availability of large LCD displays ramps up and helps to bring screen prices down. By 2016 the analyst’s forecast indicates annual phablet shipments could exceed 140 million.(source:techcrunch)

5)What weak iPhone demand? Apple shipped 52M iPhones in Q1, analyst estimates

Devindra Hardawar

Amid speculation that iPhone 5 demand has been weak for Apple, which has led to a significant stock hit, KGI Securities analyst Ming-Chi Kuo has a positively rosy view of Apple’s holiday quarter.

Kuo predicts that Apple shipped 52 million iPhones in its fiscal 2013 first quarter, according to a note to investors picked up by AppleInsider. That’s an increase of 41 percent over iPhones sold from the same quarter last year, and almost double the number of iPhone sales from the previous quarter.

Reports of Apple cutting back iPhone 5 component orders have put its demand in question, but Kuo’s own supply chain sources point to Apple shipping more than 35 million iPhone 5 units during the quarter. That’s still about 3.5 percent less than Kuo’s original 36.5 million forecast, but it’s far from disastrous for Apple. Kuo puts iPhone 4S shipments at 9.5 million and iPhone 4 shipments at 7.3 million. (If anything, that shows Apple has a lot of room for a real low-end iPhone.)

We won’t know the full story about Apple’s iPhone shipments until its earnings report next Wednesday, but at this point there seems to be little reason to panic. Kuo’s estimates show we shouldn’t be so quick to count out Apple — even though many are expecting its skyrocketing growth to come crashing down soon. There’s a good chance we’ll see a better explanation for Apple’s reduced iPhone component orders next week.

Overall, Kuo expects Apple to ship 140 million iPhones for 2012, up from around 72 million last year.

When it comes to the iPad, Kuo expects shipments of 23 million units, or a 49 percent jump over last year’s figure. Apple’s new fourth-generation iPad makes up 9.3 million of those units, while the iPad mini accounts for 8.2 million.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号