业内人士看休闲及免费游戏市场发展空间

作者:Steve Peterson

于旧金山举行的Digital Game Monetization峰会汇聚了许多行业专家和讨论小组,他们不仅发表了各自的观点和分析结果,还列举了准确的数据和案例。因为数字发行情况普遍是不透明的,所以深入了解赢利额和如何赢利是非常重要的。本文归纳了峰会上提出的各种报告中的几个要点。

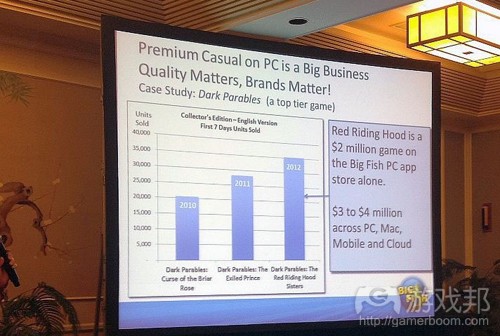

Big Fish首席执行官Paul Thelen探讨了该公司从休闲游戏的经营中吸取的经验教训。Big Fish已经持续赢利11年了,仍然在以两位数的速度成长。Thelen强调,虽然PC并不被认为是一个仍在成长的平台,但Big Fish的PC游戏玩家数量仍然在增加,所以对该公司来说,PC仍有发展空间。根据Thelen所述,公司获利模式很多,包括从19.99美元的付费休闲游戏到免费游戏。Thelen的重要建议是,不断地努力改造自我。他提出:“我们今年以这种模式挣钱了不等于明年也能靠它挣钱。”

“你必须根据游戏机制选择商业模式,而赢利模式又必须与游戏的商业模式相符。如果你的游戏只有6到8小时的线性玩法,当你玩完游戏时,你就完了,因为这款游戏的赢利渠道是非常狭窄的。我们所做的是一个简单的处理:你买一款游戏,就像买一本书。你很难靠一本免费的书挣钱。”Big Fish给游戏标上各种价格,有19.95美元的“收藏版”,也有6.99美元或9.99美元的标准版,有购买版,也有免费版。

Big Fish计划在2013年发布250款游戏。Thelen表示几乎所有游戏都将在PC平台有良好收益。公司现在正将许多游戏移植到手机平台。Thelen指出,对Big Fish来说,一款高产值的游戏的开发成本大约是50万美元,而移植到iPad需要2万美元。Thelen提道:“现在你有一款50万美元的游戏在高速成长的平台上,那款游戏已经给开发商带来回报了。”

Thelen展示了一些令人大开眼界的数字。“免费游戏的市场庞大,开发商的获利非常丰厚。Supercell经过不少失误后,现在仅靠两款iOS游戏就挣到3亿美元了。”Thelen还强调,Big Fish免费游戏的PC玩家达到12亿,每月访问Big Fish游戏的玩家有1400万,所以他们的发展空间还很大。

讨论小组探讨了游戏的运营,他们展示了一些令人吃惊的数据。例如,热门手机游戏《Temple Run》采用免费模式后,其收益增长了5倍。虽然许多开发商专注于通过社交、在线和手机平台为迅速壮大的玩家制作休闲游戏,但有些讨论小组成员认为机遇落在其他地方。

Greg Richardson是Rumble Entertainment首席执行官,他指出:“如果你看看人们怎么靠Facebook和早期的手机游戏成功的,你会发现,大量游戏是通过滥发垃圾邮件(Facebook一度允许这么做)或者借助苹果或谷歌的手机服务来开发廉价玩家。但现在不行了。 去年用户在游戏领域投入500亿美元,其中还不到10%是用于休闲游戏内容。这些公司在分析和挣钱方面非常高明,但不太注重产品和内容的开发。我不肯定这样做能维持多久。游戏的未来在于关注那些自我定位为玩家的人所形成的市场,那才是玩家开发和产生长期价值所在的地方。”

一个讨论小组探讨了粘性,也就是留住玩家的游戏机制。Meteor Entertainment首席执行官(《Hawken》的制作人)Mark Long概述了Meteor对游戏作出的几个关键改变。“在我们的封闭测试调查中,我们发现许多玩家玩了一次就离开,这引起了我们的重视。我们想到了一个我们称之为‘新手岛’的点子:在前五次游戏,玩家只作为新玩家玩游戏,新手岛作为他们的安全区,希望他们在玩过一次后还能回来。”Long还提到一款在吸引新玩家方面做得非常好的游戏。“《CSR Racing》我从来没有见过新手培训做得如此完美的游戏。”

另一个讨论小组提出了在线赌博的话题,或更委婉地叫作“金钱游戏”,以及其未来的市场。现在,它已经形成350亿美元的市场,难怪Zynga等公司那么有兴趣地开发它。因为美国将放宽赌博游戏政策,其地位也向合法化转移。据讨论小组所言,美国特拉华州已经允许赌博游戏,而内华达州也将这么做。在线赌博游戏意味着玩家更容易接触到这类游戏。这会不会产生新一类玩家呢?GoPlay首席执行官George Zaloom直言:“必须的。一般赌博运营商都关注他们传统的顾客基础,也就是年龄介于50到75的人群。他们将传统的社交游戏玩家看作有经验、懂技术、爱玩游戏的年轻妈妈。如果他们能将这类人从免费游戏领域转移到金钱游戏领域,那这就是拯救行业的新道路。”Zynga面临的困难很大,资金实力雄厚的赌博运营商IGT正瞄准这个市场,他们不可能不干上一架就把市场转手给Zynga。

Meteor Entertainment的Mark Long又将话题引向《Hawken》的跨媒体式营销战略。Long展示了一张图片,问观众“知道这是什么的请举手?”在场的人大多数举手了。Long表示:“真让我惊喜,因为我们在广告上的花费为0。”接着他继续解释他们如何通过最具病毒性的方法达到如此高的辨识度。“虽然我们已经集资2850万美元,我们仍然是独立游戏界中默默无闻的一员。”

Long表示《Hawken》成功吸睛(和高注册量)是因为跨媒体战略。所谓的跨媒体,即借多种媒体生成游戏的完整形象。《黑客帝国》就是一个典范,这部作品借助漫画、游戏、动画和电影吸引了大量关注,然后又将关注引向作品本身。Long透露,目前已推出2万字的故事书介绍游戏起源、一部改编电影已在制作中,接下来几年还将有一部绘本小说、散文小说和动画陆续面市。最重要的是,这些媒体都充分利用了搜索引擎,通过分析将所有搜索结果导向同一个网站:playhawken.com。

Nick Bhardwaj是负责Natural Motion的运营事务的副总裁,他的论题是《CSR Racing》的玩家获取成本。这款游戏在75个国家/地区的游戏榜单上名列第一,发布首月的利润就达到1200万美元——但却没有耗费任何玩家获取成本。Bhardwaj解释了K因素,也就是维里系数(游戏邦注:即viral coefficient)的重要性,这个指标衡量了每个玩家带来的新玩家数目。Bhardwaj讨论了游戏的基本循环:计划、完成、拓展、重复。例如,参加赛车,胜利得奖,用奖金购买更多赛车配件。他的主要建议是想办法让玩家分享游戏成果、装扮后的赛车图片。比如,在Facebook或Twitter上分享,会吸引更多人来试玩游戏。Bhardwaj认为这种自然而然的用户开发方式是最好的,正如他所说的:

“我的工作是手机广告,我理解用户开发是怎么回事,我明白所有的值点,游戏业的真相就是,游戏业毕竟是游戏业。最残酷的事实是,CPI(每次游戏安装成本)只会越来越高。你觉得现在的CPI有多高?就像油价。目前的平均CPI在周末时超过2美元或3美元。之前几周,我看到有些大型公司的CPI甚至达到10美元。上升的原因有二:新玩家和来自亚洲的资金流。亚洲有许多大公司已经在日本、中国和韩国做大游戏,现在又想进军美国。接着,你们看到金钱游戏的涌入。这些玩家的LTV(寿命期价值)是成百上千美元,甚至超过最热门手机游戏的10倍、20倍。我敢说,到明年的第二个季度末,平均CPI将超过5美元。”

市场竞争将越来越激烈,Bhardwaj建议谨慎地管理K因素,以便成功占领市场。追踪安装游戏的玩家是哪类人,思考玩家推广你的游戏的原因,然后努力制作最好的游戏,这样玩家自然而然地就会与朋友分享你的游戏。

接下来的讨论小组谈的是新兴领域的经营策略,并展示了一些有意义的数据。根据NPD的Anita Frazier所述,三分之一的美国玩家在玩免费游戏。大约有15%的玩家知道免费游戏但没有玩过,8%左右的玩家在免费游戏中购买道具。第一个月是消费的关键期;如果玩家不能在这个时期内消费,那他之后也不太可能花钱。在不同国家实施本土化策略也很重要;举个例子,在《World of Tanks》中,有一种坦克售价60美元。当这款游戏引入中国时,本土化顾问建议将坦克改成金色的,然后标价为100美元。结果是,这种坦克的销售额甚至比在俄罗斯的还高。一般来说,东欧和拉丁美洲的市场成长比较快,开发商应该想办法利用这个势头。讨论小组认为,与本土化专家合作是很关键的,找到真正了解当地市场的人有助于最大化游戏的潜力。

DFC Intelligence分析师David Cole提出游戏的嵌入式广告,质疑是否是时候利用广告为开发者赢利。许多免费游戏只靠少数玩家赢利;广告有助于多赢利吗?虽然有些成功的视频广告案例,特别是当玩家能够选择进入游戏或取得奖励时,但这毕竟不是通用的解决办法。一方面,没有那么多广告;广告商还没有完全接受游戏这种媒体。手机游戏甚至更成问题。讨论小组仍然觉得游戏中会出现更多广告,特别是Zynga和King.com等公司,它们靠大规模玩家而赢利。Greg Mills是Goko营销副总裁,他表示:“Zynga不久将为不太邀请好友的玩家制作前滚式广告。你会发现广告量非常大。拥有大量玩家的公司将会开始这么做,然后渐渐盛行开来。”

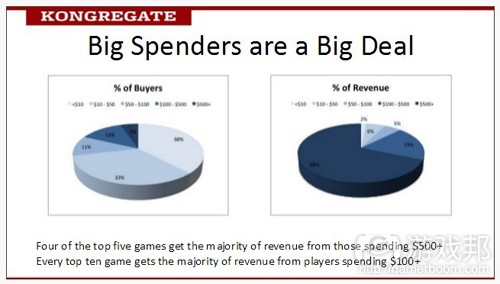

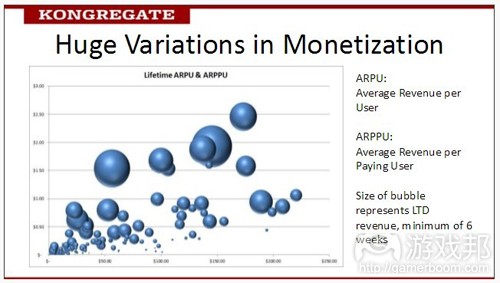

最后,Kongregate首席运营官兼联合创始人Emily Greer展示了几款Kongregate的主要游戏。Greer强调虽然许多开发商认为消耗品是最好的一类病毒式道具,但它们只占销售额的10-30%。从开发者的角度看,最好的道具应该是产生最多利润的东西——具有一定持久性的赢利能力。

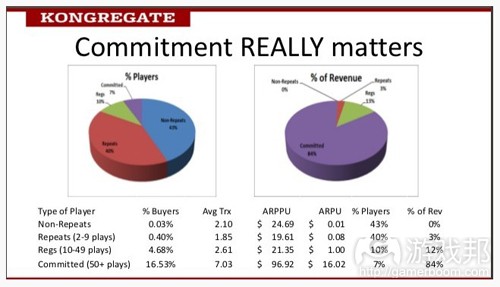

Kongregate的数据说明了稳定型玩家的重要性。“除了出手大方的玩家,另一件很重要的事是忠实度。根据游戏,我们将玩家分为四类:一次性玩家,这类玩家只玩一次就离开了;重复型玩家游戏的次数介于2到9次;常规型玩家则是10到49次;忠实型玩家不少于50次。我们最热门的十款游戏中,只占7%比例的忠实型玩家产生了87%的利润。”

Greer提醒,销售额可能会使收益飙升,但那只是促进赢利,并没有真正地增加赢利。“当游戏出现问题时,有可能是玩家对游戏的沉浸感不够,也可能是没有最大化收益能力。让玩家对游戏忠实是非常重要的,这样玩家才有理由不断地为游戏付钱。”

Greer指出:“大多数鲸鱼型玩家(游戏邦注:指在游戏中消费多的玩家)的游戏消费水平为1000或2000美元,但有些甚至达到上万美元。平均算来,Kongregate的一般玩家会消费3款游戏,而鲸鱼型玩家则更多一点,大约是4.5款,但他们的花费往往集中于最喜欢的一款游戏。大多数鲸鱼玩家有90%的消费额是投入同一款游戏。”(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Gamers rule: Only 10% of the industry’s $50 billion comes from casuals

By Steve Peterson

The Digital Game Monetization Summit in San Francisco had a number of speakers and panels that not only presented opinions and analysis, but also refreshingly presented us with some specific numbers and examples. Since digital distribution is generally opaque, getting some insight into the amount of money being made, and how, is vitally important. The following overview hits some of the high points of the varied array of presentations.

Paul Thelen, CEO of Big Fish, offered a look at the lessons Big Fish has learned from the business of casual games. Big Fish has been profitable all through its 11-year life span, and continues to grow at “healthy” double-digits. Thelen noted that while the PC is not considered a growth platform, Big Fish is still adding audience for its PC games – so it’s a growth platform for them. According to Thelen, Big Fish is making money with a variety of business models, from premium casual games sold for $19.99 to free-to-play games. Thelen’s key advice is to try and continually reinvent yourself. “Just because we made money doing this last year doesn’t mean we will make money doing this again next year,” he noted.

“You need to match the game mechanic to the business model, and the monetization needs to match the business model of the game,” Thelen said. “If you have a game that has 6 to 8 hours of linear gameplay and when you finish it, you’re done, there are very limited ways you can monetize that game. What we’ve done is a simple transaction; you buy it, just like you would buy a book. It’s very hard to monetize a book with free-to-play.” Big Fish provides a variety of price points for its games, ranging from a $19.95 ‘collector’s edition’ to a standard edition at $6.99 or $9.99, as well as subscriptions and free-to-play.

Kongregate’s big spenders

Big Fish is planning to launch some 250 games in 2013, and Thelen said that almost all will have a positive return on the PC. Big Fish now is in the process of bringing many games to mobile; Thelen points out that a high production value game for Big Fish, which would cost about $500,000 to produce, can be ported to the iPad for about $20,000. “Now you have a half-million dollar game on a hyper growth platform, and that game has already returned a profit to the developer,” Thelen said.

Thelen provided some eye-opening numbers about the state of the business. “Free-to-play is a huge market, and there are people making crazy amounts of money,” Thelen said. “Supercell came from nowhere after a lot of mistakes, and they are now making $300 million on two games on iOS alone.” Thelen also noted that free-to-play games reach 1.2 billion PC users, and that 14 million gamers are visiting Big Fish each month, so there’s plenty of room for growth.

The next session featured panelists talking about the business of games, and they noted some astonishing statistics. For example, mobile hit Temple Run quintupled its revenue when it switched to a freemium model. While many have focused on creating casual games for the greatly expanded demographics available through social, online, and mobile platforms, some of the panelists felt the opportunity lies elsewhere.

“If you look at what people successfully did on Facebook or the early days of mobile, a lot of it was about cheap user acquisition through the spammy virality that Facebook allowed for a while, or manipulations of the terms of service from Apple or Google on the mobile side. That’s gone away,” said Greg Richardson, CEO of Rumble Entertainment. “Of the $50 billion that was spent worldwide last year on games, less than 10 percent was spent on casual content. These companies were really smart around analytics and monetization and very light in terms of product and content creation. I’m not sure any of those things are particularly sustainable. The future lies in going into the larger part of the market which is people that self-identify as gamers, and where the user acquisition and long-term value creation comes from making great games.”

The following panel talked about stickiness, or game mechanics that keep players playing, and Mark Long, CEO of Meteor Entertainment (creators of Hawken) outlined how Meteor made some key changes to its game. “In our closed beta exit survey, we saw a lot of players play one session and leave, and this concerned us,” said Long. “We came up with the idea of what we call Newbie Island; your first five sessions you’re only playing new players, so there’s a safe place for them to not get their asses handed to them and hopefully get the them to come back after that first session.” Long also pointed out a game that does a great job of getting new users into the game. “CSR Racing, I’ve never seen onboarding that’s so flawless.”

Another panel took on the subject of online gambling, or “real-money gaming” as it is more politely termed, and what that market will offer in the future. At the moment it’s already a $35 billion market, so it’s no wonder that companies like Zynga are very interested in moving into it. The legal status is changing, as states are moving to allow real-money gaming. Delaware already allows most anything, according to the panelists, and Nevada is next up. Putting the games online means easy access for anyone. Will this open up the demographics to new players? George Zaloom, CEO of GoPlay, was blunt. “They have to. The typical Vegas operator is concerned about their traditional customer base, which ranges between the ages of 50 and 75. They see the traditional social gamer as this young mom who’s sophisticated, who’s technology savvy, and likes to play games. If they can migrate that customer from being a free-to-play player and bring them into their real-money space, that’s a new way to save their business.” The difficulty ahead for Zynga is that large, well-funded casinos and operators like IGT are aiming for this market, and they’re not about to just hand it over to Zynga without a fight.

The next talk saw Mark Long of Meteor Entertainment return to the podium to talk about Hawken’s transmedia approach to marketing. Long showed a picture from Hawken, and asked the audience “How many of you know what that is?” Most of the audience raised their hands. “That’s amazing to me, since we spent zero dollars on advertising,” Long said. He then proceeded to talk about how they had achieved high awareness through a mostly viral approach. “For a company that has raised $28.5 million we are still perceived to be an indie Cinderella story,” said Long.

Hawken has been a success at gathering attention (and signups) because of the transmedia approach, Long said. This means creating a coherent story across multiple media, told out of order; The Matrix is a good example of this, with comics, games, animation as well as the movies driving multiple impressions and connecting the stories in a larger universe. Long discussed the creation of a 20,000 word story bible to seed the game, a feature film now in production, a graphic novel, prose novels, and anime, all being rolled out over the next few years. Crucially, all of the media is optimized for search engines, embedded with analytics, and driving all traffic to one web site: playhawken.com.

Nick Bhardwaj, the VP of monetization for Natural Motion, took to the stage to talk about the acquisition costs for CSR Racing. The title is the #1 app in 75 countries, and brought in $12 million in revenue during its first month – while spending precisely nothing on acquisition costs. Bhardwaj explained the importance of K-factor, the viral coefficient; that’s the number of new users brought in by each user. Bhardwaj discussed the basic loop for games: Do a thing, get a thing, and expand your things, then repeat. For instance, that might be running a race, getting an award for that race, and using that award to purchase more components for your car. His basic advice was to look for ways to get people to share content; pictures of their tricked out car, for instance, shared on Facebook or Twitter will lead to more people trying out the game. Such natural customer acquisition is best, Bhardwaj said, because as he put it:

“I was in mobile advertising, I understood user acquisition, I understand all the price points, and the truth is, it’s a shitty industry,” Bhardwaj said. “It really is. The first harsh reality is: CPIs [Cost Per Install] are only going to go up. You think they’re high now? It’s going to be just like gas prices. Right now, average CPIs in the industry on the weekends are over $2, $3. There have been previous weekends where I’ve seen major players bid upwards of $10 per install. This will only go up for two reasons: new entrants, and cash influx from Asia. There are a lot of great companies in Asia who’ve been doing great games in Japan, China, and Korea, who now want entry into the US. Next you’re going to see the influx of real-money gambling apps. The LTVs [Life Time Value} of those customers are hundreds and hundreds of dollars, 10x, 20x higher than anything you see in even the greatest mobile games. I would assume by the end of Q2 next year you’re going to see average CPIs above $5.”

It’s going to be a tougher market, and Bhardwaj advises careful management of K-factor to help succeed in it. Track where your game installs come from, figure out what gets people to recommend your game, and strive to build the best game you can that naturally encourages people to share it with their friends.

The next panelists talked about monetization strategies for emerging regions, and had some interesting data to present. According to NPD’s Anita Frazier, one-third of gamers in the US have played free-to-play games. About 15 percent are aware of free-to-play games but have never played, and about 8 percent of the players have paid for items in free-to-play games. The first month is crucial to paying; if a player hasn’t paid in that time, they are unlikely to spend money later on. Localizing your strategies for different countries is important; one example given was the $60 tank in World of Tanks. When the game was brought to China, local advisers suggested making the tank gold, and charging $100 for it; the result was that sales were even higher for that tank than in Russia. Generally, there seems to be strong growth in Eastern Europe and Latin America, and developers are looking for ways to take advantage of that. Working with local experts is crucial to success, the panelists advised, so find people who really understand local markets to help maximize your game’s potential.

DFC Intelligence analyst David Cole moderated a panel on in-game advertising, wondering if the time is right for advertising to make serious inroads into providing revenue for developers. Many free-to-play games monetize just a few percent of their players; can ads help monetize the rest? While there has been some success with video ads, especially when players are given a choice to opt-in in order to gain access to a game or rewards, it’s not a universal solution. For one thing, there’s not a huge inventory of ads available; advertisers have yet to fully embrace the medium of games. Mobile games are even more problematic. Still, panelists felt that we’re likely to see more ads in and around games, especially as companies like Zynga and King.com work to generate more revenue from the huge numbers of players. Greg Mills, VP of marketing for Goko, said “I do think Zynga will soon start doing pre-roll ads for users who virally don’t invite a lot of new people,” Mills said. “If you look at the number of impressions that would generate, it would be huge. It’s going to start with the large companies that have a massive audience, then it will trickle down.”

Finally, Emily Greer, COO and co-founder of Kongregate, provided a look at some of Kongregate’s top games. Greer noted that while many developers think of consumables as being the best type of virtual item, consumables only account for some 10-30 percent of sales. The best items from a developer’s standpoint – that is, the ones that generate the most revenue – offer some permanent capability, Greer said.

Kongregate’s data shows the importance of the steady player. “The other thing that’s really important, besides big spenders, is commitment really matters,” Greer said. “We divide our player base on a game into four categories: Non-repeats, players who come into a game once and bail; repeats who play a game between 2 and 9 times; regulars who play between 10 and 49 times, and the committed players who play 50 or more times. For the top ten games, the 7 percent who are committed are 87 percent of the revenue.”

Sales may spike revenue, but Greer cautions that it’s just moving the revenue forward, not actually increasing it. “When games have problems, they are either not getting players deep enough into the game or they don’t maximize what they can get from players,” said Greer. It’s important to get players committed to a game, and when you do, to make sure there are good reasons for them to continue to spend money later in the game.

Most whales spend less than $1,000 or $2,000 in a game, but there are some who have spent “in the tens of thousands,” according to Greer. “The average buyer on Kongregate has spent on about 3 games, but the whales are a little higher at about 4.5, but their spending tends to be extremely concentrated on one favorite game. Most of the big spenders have about 90 percent of their spend on one individual game.”(source:gamesindustry)

闽公网安备35020302001549号

闽公网安备35020302001549号